By David Ditch, The Daily Signal | October 22, 2024

President Joe Biden will leave office on Jan. 20, 2025. Although the Biden-Harris administration has been riddled with flawed and failed policies, perhaps the most lasting damage will be from its reckless approach to the federal budget.

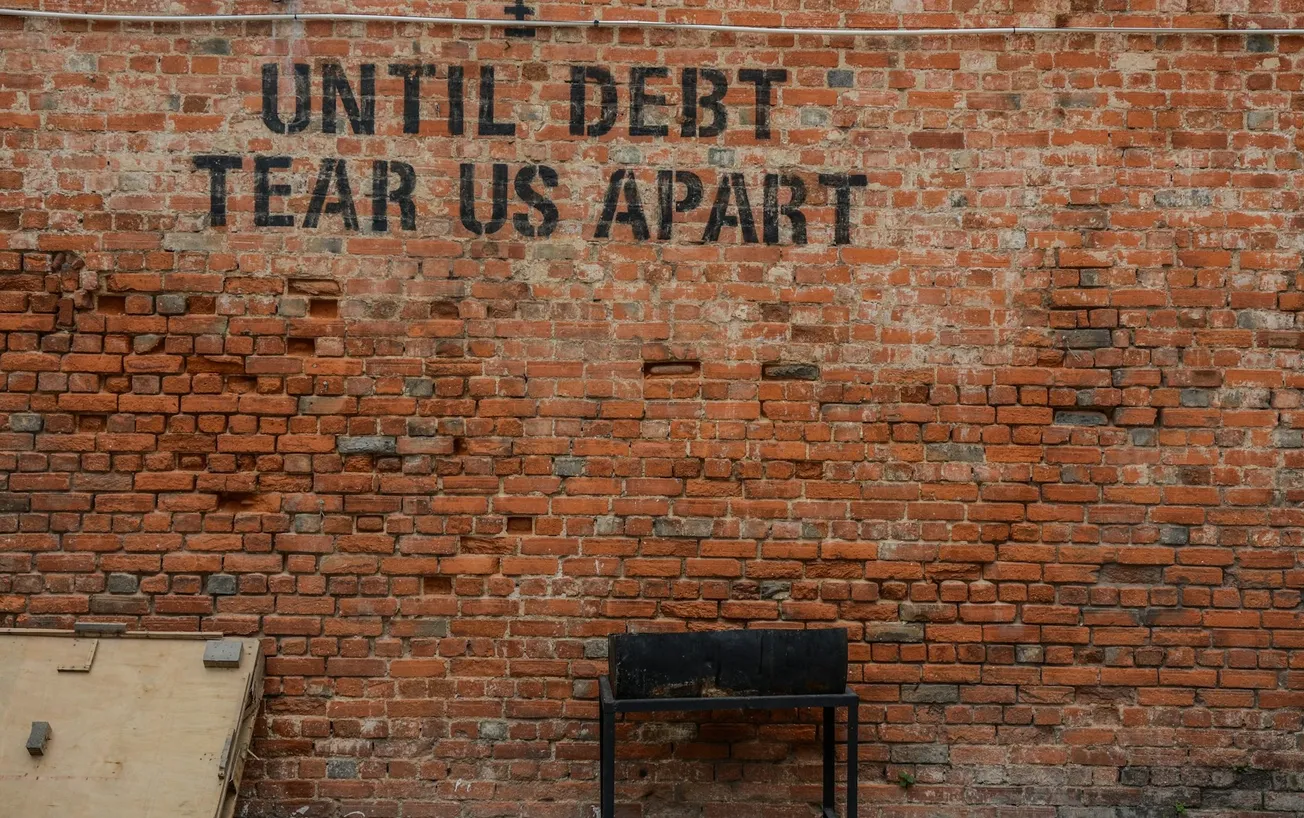

When Biden and Harris took office on Jan. 20, 2021, the gross national debt was $27.8 trillion. It’s now $35.8 trillion.

Such enormous numbers are nearly impossible to comprehend. However, if one were to spread out the debt evenly, every U.S. household would have roughly $273,000 of red ink.

Of that, just over $61,000 per household came during less than four years of the Biden-Harris administration.

Although the administration’s defenders argue that this was an inherited mess, the reality is that Biden and Harris made a bad situation much worse.

Although government spending related to COVID-19 drove up budget deficits in 2020 and 2021, the Biden-Harris administration and its allies in Congress saw the pandemic as an opportunity to blow out spending and tax subsidies for unrelated issues.

This opportunity included:

- A $1.9 trillion stimulus package containing a multitude of handouts for left-wing political groups.

- An infrastructure package funding a variety of boondoggles.

- Several rounds of student loan write-offs costing taxpayers hundreds of billions of dollars, despite most of the schemes being struck down in court as illegal power grabs.

- Democrats’ misleadingly named Inflation Reduction Act, which set up a gigantic corporate welfare system on behalf of “green” energy producers.

Through poor legislative choices and deliberate administrative decisions, Biden and Harris have increased 10-year deficits by $7 trillion relative to when they took office.

Needlessly increasing the government’s deficit spending even after the economy recovered from the damage caused by COVID-19 lockdowns was a major factor behind the wave of inflation that began in 2021.

Even today, inflation rates remain elevated relative to the pre-pandemic trend as tens of millions of families struggle to deal with high prices.

Once it became clear that inflation was not a short-term problem, the Federal Reserve took the step of raising interest rates to regulate the money supply. This increased the cost of borrowing for households, businesses, and even Uncle Sam.

Although federal interest payments also increased from 2014 to 2020, primarily due to rising debt, higher interest rates caused these payments to explode under the Biden-Harris administration.

In fact, interest on the national debt cost almost three times as much in fiscal year 2024 as in fiscal year 2020.

Although it’s possible that the Federal Reserve’s recent move to lower interest rates might provide some relief on this front, the federal government is still in the process of rolling over old low-interest debt at today’s relatively higher level.

This makes it likely that Washington will need over $1 trillion to finance the national debt in fiscal 2025. Coupled with chronic deficits that grow the total debt every year, interest payments possibly could grow with no end in sight.

From an economic perspective, that represents $1 trillion of dead weight, which will drag down growth and reduce the amount of job-creating private investment.

This could lead the U.S. down the same path as Japan, which went from an economic powerhouse in the 1980s to a near afterthought today, in part because of overloading on government debt.

Fortunately, it’s not too late for America to change course. We have hundreds of ways to cut wasteful spending and corrupt handouts across the federal government.

From defunding the academic Left, to curbing pork barrel earmarks, to reforming Medicare’s payment system, a variety of fixes not only would improve budgetary health but remove harmful favoritism.

It seems unlikely that the swamp is going to willingly drain itself.

That means the first step will be for American citizens to hold their leaders accountable and demand a return to fiscal sanity in the wake of the Biden-Harris administration.

David Ditch is a senior policy analyst in budget policy in the Grover M. Hermann Center for the Federal Budget at The Heritage Foundation.

Original article link