On Friday, a Houthi missile fired from the Gulf of Aden struck an oil tanker with connections to the United Kingdom, engulfing it in flames for several hours. The Houthis claimed that their attack on the tanker was in retaliation for perceived American-British aggression.

Such attacks are heightening tensions in the Red Sea and could have a significant impact on the American economy, which is already grappling with inflation. If they continue, it could potentially affect the global economy.

With Bidenflation persisting at 16.6%, Americans are struggling to make ends meet. Any further deterioration of the situation will become an Achilles' heel for the President, whose approval rating stands at only 36% in the January TIPP Poll. Furthermore, if the Red Sea situation spins out of control, energy prices could increase, drawing attention to Biden's squandering away of the Strategic Petroleum Reserve before the 2022 midterm election.

It's like déjà vu from 1970 when the U.S. economy experienced extended stagflation, and the Arab oil embargo that began in 1973 was a significant factor. Fifty years later, in 2024, as we anticipate the U.S. may enter a prolonged stagflation, the Middle East could become a catalyst.

Approximately 50 container ships transit the Suez Canal daily, transporting goods valued at $1 trillion annually from Asia to Europe and North America. Estimates indicate that this transit represents about one-eighth, or 12%, of global trade.

The number of weekly Suez Canal and Red Sea transits has declined by 42% over the past two months.

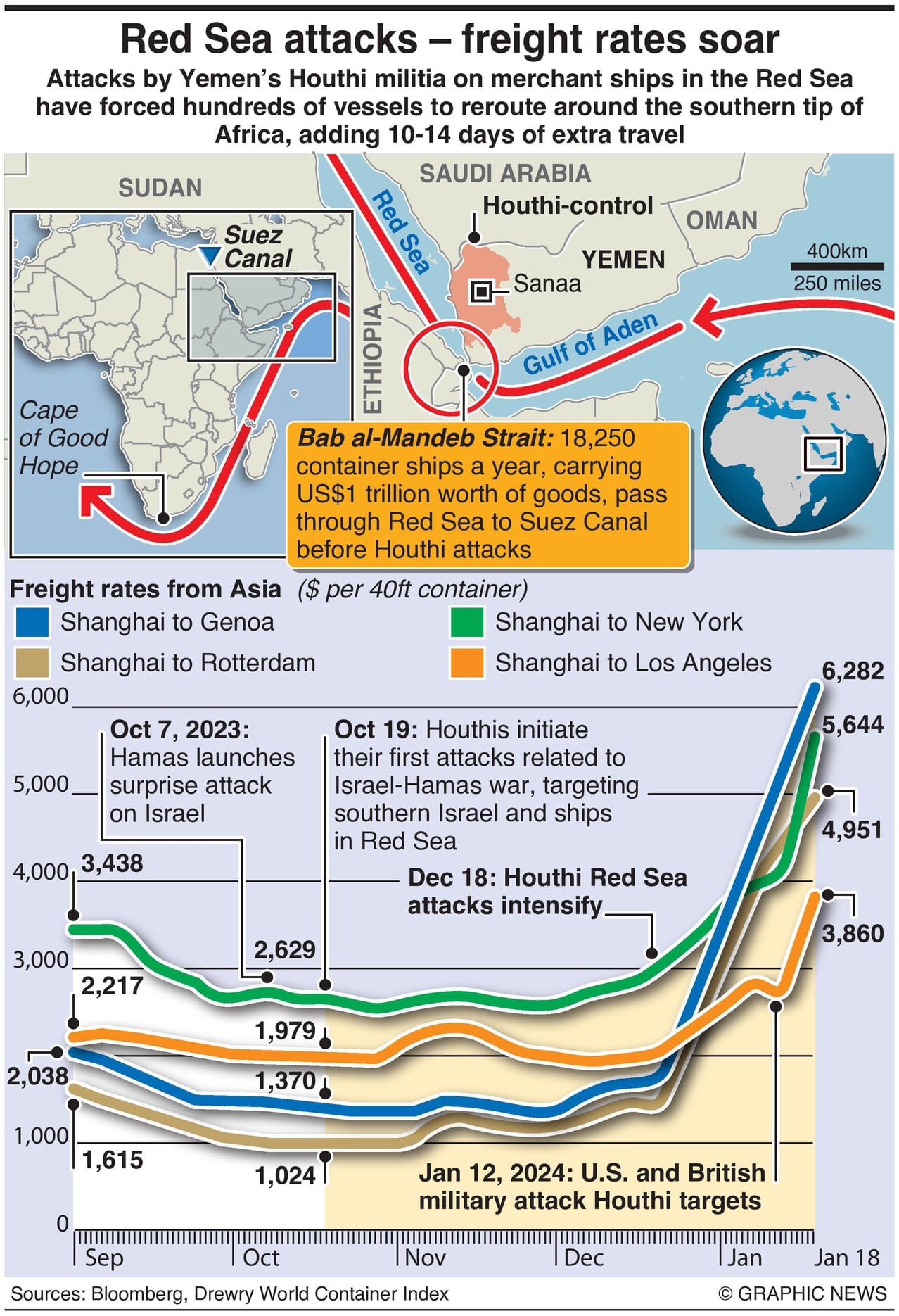

The Houthi attacks, which started on October 19, have forced ships to take alternate routes around the Cape of Good Hope at the southern tip of Africa, adding another 3,000–3,500 nautical miles and extending their voyages by another 10 to 14 days.

The increased traffic has created congestion in ports around Africa with significant infrastructure demands.

Further, more days mean more cost. The longer trip costs $1 million extra for every round trip between Asia and Northern Europe.

Shipping companies using the Red Sea take out war risk insurance for ships that cost fiftyfold more.

According to Drewry’s World Container Index, the cost of shipping a 40-foot container increased by 23% to $3,777 this week. It has increased by 82% compared to the same week last year.

Since the Houthi attacks began, freight rates for a single 40-foot container have surged. The rates from Shanghai to New York increased by 115%, rising from $2,629 to $5,644, while the rates from Shanghai to Los Angeles increased by 95%, going from $1,979 to $3,860.

Meanwhile, rates for shipping a single 40-foot container from Shanghai to Rotterdam have skyrocketed by 384%, soaring from $1,024 to $4,951, and the rates for Shanghai to Genoa have risen by 359%, climbing from $1,370 to $6,282.

All imports to America by ship will incur increased shipping costs, which will ultimately be passed on to American consumers, leading to higher prices and inflation. Furthermore, the Red Sea attacks have the potential to disrupt supply chains. For instance, Tesla and Volvo temporarily halted some of their European production due to delays in the arrival of crucial parts at their factories. If these attacks persist, they could exacerbate supply and demand imbalances, increasing prices.

The higher shipping costs could also have an impact on global food prices. About seven million metric tons of grain pass through the Suez Canal into the Red Sea each month. Reuters reports that nearly four million tons of grains have been diverted from the Suez Canal since the attacks started.

Public Opinion

A recent TIPP Poll from early January showed that only 46% of Americans follow the story. By party, 52% of Democrats, 49% of Republicans, and 43% of independents are aware of the issue.

Among those aware, nearly nine in ten (89%) said that they were very or somewhat concerned about the Red Sea situation, while only 9% said they were not.

Overall, 52% of respondents said they were confident that Biden’s Operation Prosperity Guardian to secure commercial shipping in the Red Sea would be successful, compared with 41% who said they weren’t confident and 8% who said they were not sure.

Victoria Coates, a national security expert, discussing the TIPP Poll results, warned in her recent article:

If the Houthi threat isn’t neutralized and this type of stoppage spreads in the coming weeks, supply chain disruptions will start to compound in a fashion that may grip the American electorate more broadly as primary voters head to the polls.

Strategic Petroleum Reserve

The ongoing Red Sea attacks threaten the stability of the Middle East and can impact the global oil supply.

Fifty years ago, in 1973, OPEC imposed an embargo on the U.S. due to its support for Israel during the Yom Kippur War. In response to this event, the U.S. established the Strategic Petroleum Reserve (SPR) in 1975 to enhance America's national energy security during supply disruptions.

The SPR stores oil in salt caverns thousands of feet below ground and has a storage capacity of 727 million barrels of oil. The U.S. consumes 20 million gallons of oil a day. On average, the SPR has held 33 days of supply.

However, President Biden has converted the Strategic Petroleum Reserve into a Strategic Political Reserve.

We have warned numerous times that this day would come to pass, and the President’s actions lacked foresight when Biden authorized significant releases as a political move ahead of the 2022 midterm elections. Now, the Strategic Petroleum Reserve (SPR) has only 355 million barrels of oil, with only 49% of its storage capacity filled—that can fulfill just 18 days of America’s needs.

To conclude on a positive note, China is unhappy with the Red Sea situation and has asked Iran to rein in Houthi attacks on ships or risk harming business relations with Beijing. Also, the United States urged China to exert pressure on Iran to rein in the Houthis. The appeal was made during two days of meetings this week between Chinese Foreign Minister Wang Yi and U.S. National Security Adviser Jake Sullivan in Bangkok.

We hope the Red Sea situation gets better for the global economy.