Sanctions And Price Cap Crush Russia's Seaborne Crude Exports To Europe - Infographics

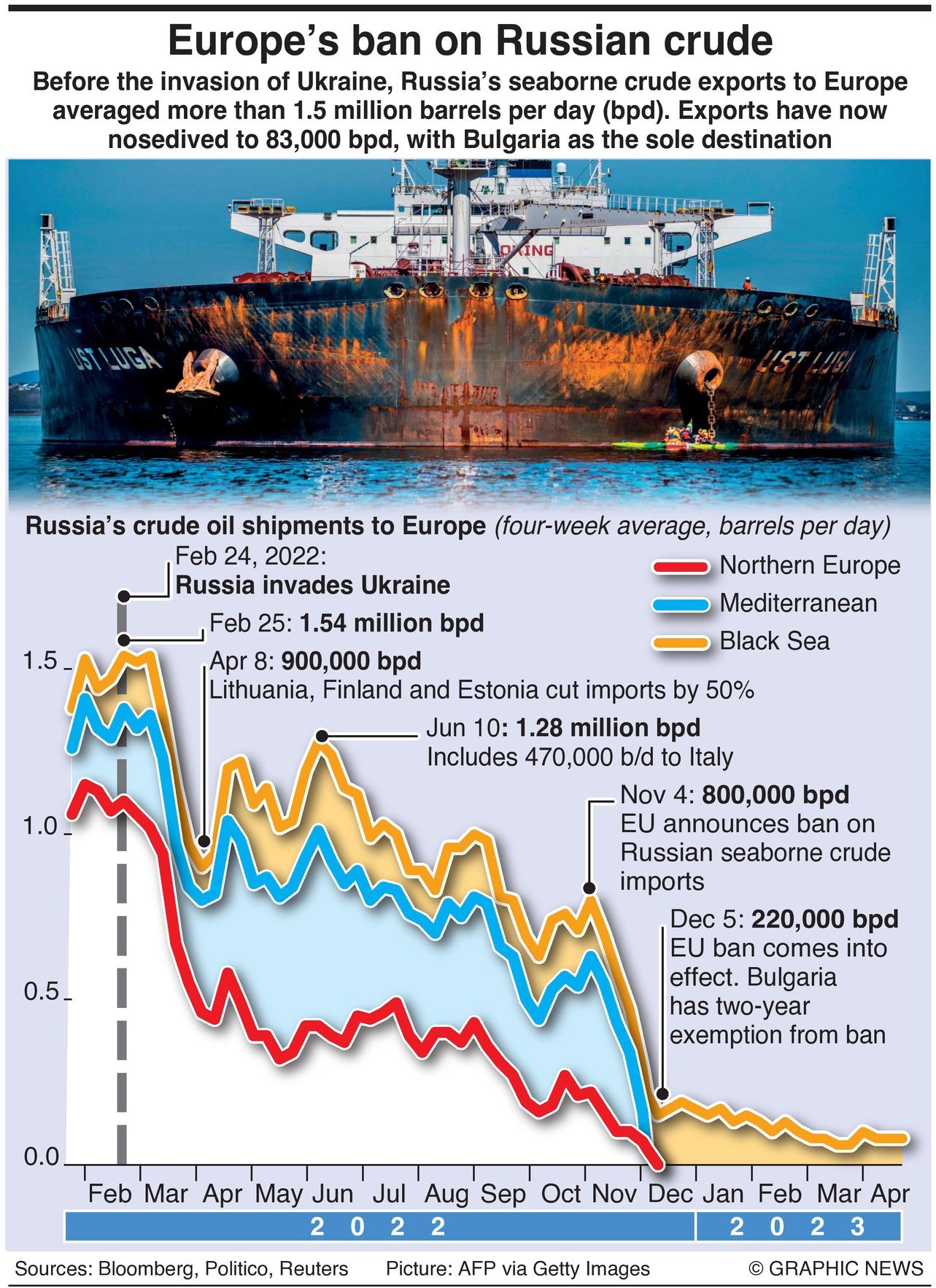

Before the invasion of Ukraine, Russia’s seaborne crude exports to Europe averaged more than 1.5 million barrels per day (bpd). Exports have now nosedived to 83,000 bpd, with Bulgaria as the sole destination.

The European market for Russia’s short-haul crude, which shipped from export terminals in the Baltic, Black Sea, and the Arctic, has been lost almost entirely, to be replaced by long-haul destinations in Asia that are much more costly and time-consuming to serve.

Western nations agreed upon sanctions on Russia’s oil exports in mid-2022 and implemented them in late 2022. First, a maritime oil embargo by European Union countries came into force, further affected by damage to the Nord Stream pipeline by unknown assailants.

Second, by the end of the year, the G7 nations agreed to an oil price cap of $60 per barrel on Russian oil. The EU oil ban and price cap cost Russia an estimated €160 million per day.

Writing in the Economics Observatory, Richard Disney, Professor of Economics at the University of Sussex, estimates Russia makes €640 million per day from exporting fossil fuels -- down from a high of €1,000 million in March-May 2022. The EU’s ban on refined oil imports, the extension of the price cap to refined oil, and reductions in pipeline oil imports to Poland are estimated to have reduced this by a further €120 million per day.