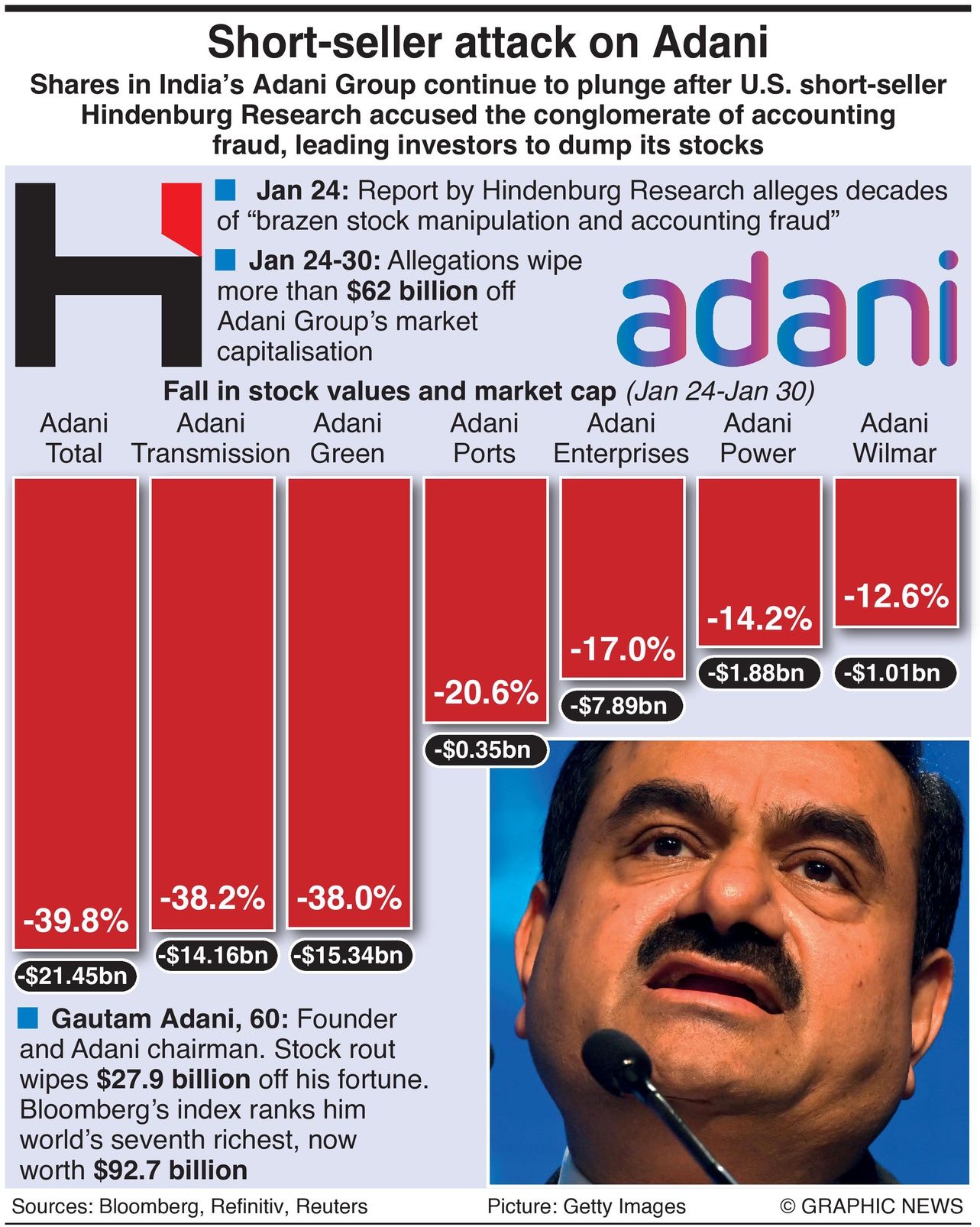

Shares in India’s Adani Group continue to plunge after U.S. short-seller Hindenburg Research accused the conglomerate of accounting fraud, leading investors to dump its stocks.

Gautam Adani and his family have suffered massive losses since Hindenburg issued its report on January 24.

By Monday morning, the stock rout had wiped more than $62 billion off the market cap of the seven listed companies and almost $30 billion off Gautam Adani’s family fortune.

Businesses in the conglomerate span industries including construction, data transmission, media, renewable energy, defense manufacturing, and agriculture.

Most of the allegations by Hindenburg involved concerns about the group’s debt levels, activities of its top executives, use of offshore shell companies, and past fraud investigations.

Following the report’s release, Jatin Jalundhwala, head of the Adani group’s legal department, said the group “was evaluating the relevant provisions under U.S. and Indian laws for remedial action against Hindenburg Research.”

“Hindenburg Research, by their own admission, is positioned to benefit from a slide in Adani shares,” Jalundhwala said.

In Monday trading, the company’s Adani Enterprises gained 4.8% to trade at 2,892.85 rupees ($35.50), but shares in other Adani listed companies fell between 5% and 20%.