Our editorials and TIPP polls have constantly reminded readers of the threat of judicial activism. Idealogues with hatred in their hearts have cleverly been exploiting America's vaunted criminal and civil justice system to destroy the reputations of individuals or harm their finances. And, too often, judges bring their personal biases to the bench to help.

If courtroom decisions stand, former President Trump is expected to pay Jean Carroll more than $100 million in damages for allegedly sexually assaulting her over 30 years ago and defaming her afterward. Never mind that TDS activists in the State of New York's legislature passed a law that was valid only for one year, which allowed Carroll to resuscitate the charge and bring the lawsuit against Trump. This generous law excluded plaintiffs from the statute of limitations that would have prevented her from suing because the accusation was a long time ago - so long ago that Carroll could not even recall the year the abuse supposedly happened. Funded by Reid Hoffmann, the billionaire co-founder of LinkedIn, Carroll sued and won.

The latest to fall victim to lawfare is Tesla co-founder Elon Musk. An activist lawsuit by a shareholder who owns just eight shares claimed that Musk's compensation "was excessive." A Delaware judge agreed and reversed Musk's pay.

The legal wrangling resulted from how Musk, a billionaire many times over, negotiated his pay package with Tesla's board.

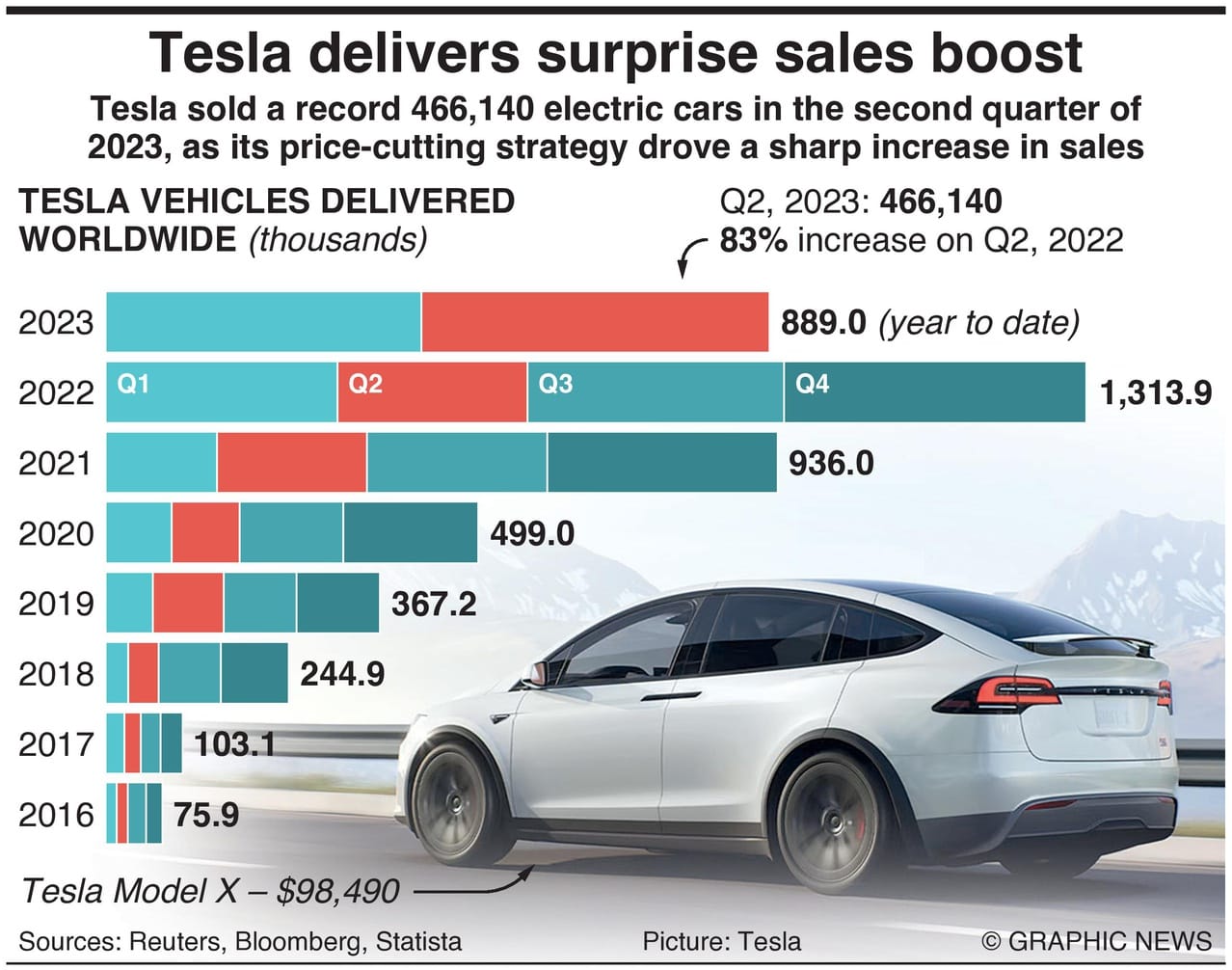

In 2018, Tesla faced severe production problems, and the markets were unsure if it could be a viable company. At the time, Tesla ($TSLA) had a market capitalization of just $59 billion. It had not made any profits since its founding 15 years prior.

The EV industry then was very different from today. Consumer Reports magazine, a respected American publication that rates automobile reliability and ownership costs, ranked Tesla low on both attributes. The pick-up truck or SUV had become so popular that both GM and Ford said they would stop car production altogether - a decision to which they have stuck. Electric vehicle range was an issue, with driver anxiety that their cars would run out of charge being paramount. Of the more than 270 million registered vehicles in America, only about 1.1 million were electric, representing a 0.4% share of the market. Nearly half of EV sales were in California.

Today, according to CarEdge, fully electric vehicles (BEVs) have an 8.1% market share (Q4 2023), a new record. Much of this stellar growth can be traced to Tesla's success, led by Musk. Globally, Tesla's position is so dominant that it controls 17% of the market, leaving every other Western manufacturer far behind, including GM, Ford, BMW, Mercedes, and Nissan.

Musk negotiated with the Tesla board to make his compensation entirely performance-based - no annual salary, no annual bonuses, no annual stock options, nothing. The deal was that if he could increase Tesla's market cap from $59 billion in 2018 to $650 billion in five years - that was the only metric - he would be granted options to buy 304 million shares at a predetermined price far less than what $TSLA would trade on the New York Stock Exchange. If Musk were to exercise his options today - indications are that he has not yet done so - he would make over $50 billion.

Musk's genius was bringing so many innovations to every aspect of Tesla's value chain - from design to manufacturing, technology, and global marketing - that Tesla reached the $650 billion market cap in just three years. In 2021, Tesla crossed the $1 trillion mark in market cap. Even an elementary school student would conclude that Musk not only met the goals in his compensation package but exceeded them by at least 50%.

A fundamental tenet of American law is that a deal is a deal. That is why we painstakingly write/read contracts for everything we do, whether renting an apartment, leasing a car, or buying a home. Once both parties sign on the dotted line, that piece of paper carries the full force of the law if either party refuses to abide by its terms. Disagreements between parties are taken to court.

The remarkable thing about this case was that there was no disagreement. The board agreed to the compensation plan, as did Musk. The package was put up to shareholders for a vote in 2018. 73% of the shareholders agreed.

Yet one shareholder with only eight shares brought a suit, alleging the compensation was excessive. Chancellor Kathleen St. J. McCormick of the Delaware Court of Chancery agreed, ordering Tesla to cancel stock options awarded to Musk. The judge concluded that "Tesla paid him much more than was needed to motivate him to do a good job."

It is the most atrocious civil suit and decision in memory. Coupled with Trump's lawfare cases, the Tesla decision reinforces the average American's uncomfortable sense that the country's judicial system has lost its appeal as the global gold standard it once was. As the 2024 general election approaches, expect both sides to litigate every aspect of polling - before, during, and after Americans vote. The last vestige of Americans' trust in institutions has been the courts - and with this trust in trouble, expect America to become even more divided than it already is.