So there’s been a lot of talk recently about the potential demise of King Dollar. That, by the way, is a phrase I conjured up in 1990, a little more than 30 years ago, and it stuck.

What I meant by that phrase is two-fold. First, it’s incumbent on the U.S. government, no matter who’s in power, to maintain the reserve currency status of the dollar. The world’s most powerful country should be represented by the globe’s premier medium of exchange.

Second, to enhance U.S. economic growth, the currency should be a reliable store of value to attract investment. We have enjoyed that King Dollar status since the Bretton Woods agreement reached in 1945 at Mount Washington, New Hampshire, following World War II.

The arrangement was crafted by John Maynard Keynes, who, through the force of his personality and brilliance, got consensus agreement to peg the dollar to gold at an exchange rate of $35 an ounce. The rest of the world’s currencies were expected to peg their exchange rates to the dollar.

Hence, gold became the North Star of the world’s monetary system. It was the fixed standard of value, which is an old-fashioned virtue that I wish had continued to this very day.

Unfortunately, President Nixon broke the Bretton Woods system and moved us to a system of floating exchange rates, which is how the world monetary system operates today, for better or worse. The dollar continues as the central unit of account for world trading of goods, services, and financial markets.

Quite simply, America is the world’s most powerful economy and, therefore, it is appropriate that the American currency be the center of the world’s financial system. We don’t want to lose this privilege.

Now, many people are suggesting that the dollar will be overturned as the center of the world economy, and somehow replaced by the Chinese yuan, or remnibi, or some other currency consortium. That is most fanciful. Ain’t gonna happen, at least not any time soon.

The Bank for International Settlements reports that there is a roughly 6.6 trillion daily average transaction volume of U.S. dollars. In other words, about 90 percent of all goods, services, and financial transactions are based on the dollar. No other currency is even remotely close.

The euro is second. Japan is third. The British pound fourth. China is a very distant fifth, probably only about 1 percent.

It’s true that central bank foreign exchange reserves denominated in dollars have gradually declined, to just under 60 percent today from around 70 percent 20 years ago. But central bank reserve currencies are really a theoretical notion, and there’s nothing wrong with diversifying the crown jewels of various economies.

The point is, transactionally, King Dollar is still sitting on her throne. The Chinese yuan, or remnibi, is hardly used internationally. The Chinese constantly manipulate their currency.

The communist government still uses capital controls, which prevents reliable investment, and there are very few international investment funds or other intermediaries in China — because the CCP doesn’t want them in its state-run economy.

No, China’s not really the problem in the currency world today. But here’s another thought: We have met the enemy, and the enemy is us.

So, if the U.S. government keeps overspending, overborrowing, over-deficits, over-debt, over-money printing, over-taxing, over-regulating — then King Dollar will keel over and fall off her throne with a loud-sounding thud. Unfortunately, that seems to be the direction we’re going in.

Regrettably, since last October, the dollar exchange rate against other major currencies has fallen about 15 percent and the price of gold — remember that old-fashioned standard of value — has spiked almost 20 percent, moving to more than $2,000 from $1,600.

This, despite assurances from President Biden that he’s really cutting the budget deficit, or similar assurances from the Fed chairman that he’s really tightening monetary policy. Part of the problem is that both of them are speaking with forked tongues. Another part of the problem is that there’s no confidence in Mr. Biden’s economic policies.

Leftist progressive policies of Modern Monetary Theory have failed. They have left us in stagflation. Outright recession is a huge threat. Yet Mr. Biden wants more of this — despite his failure. So people don’t want to hold dollars.

The solution? It’s time to curb spending and borrowing.

Speaker McCarthy is crafting a solid Republican plan for debt-ceiling-related spending restraint and other pro-growth policies, including the H.R. 1 “Lower Energy Costs Act.” That’s just the beginning.

How about a return to a reliable standard of value, to anchor the worth of the dollar? Did someone say gold? Did somebody say a commodity price rule?

My final point is this: The best thing Congress could do is to take measures that would give us a steady, sound, reliable greenback. Put that in the same basket of economic reforms as budget restraint, lower taxes, and limited regulations.

In other words, a true economic prosperity agenda for the future.

From Mr. Kudlow’s broadcast on Fox Business News.

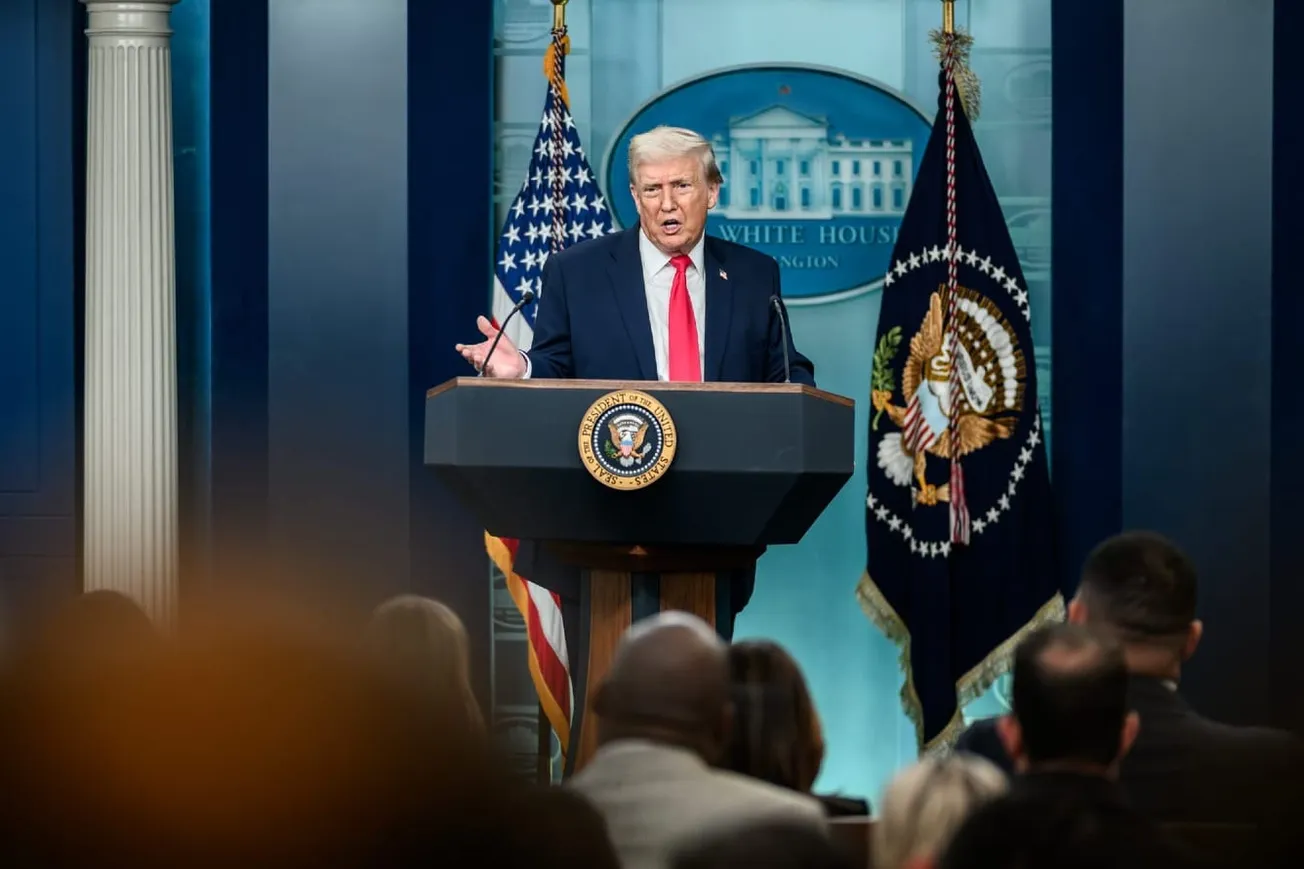

Larry Kudlow was the Director of the National Economic Council under President Trump from 2018-2021. His Fox Business show "Kudlow" airs at 4 p.m &. and his radio show airs on 770 ABC from 10:00 a.m. to 1:00 p.m.