As families around the country take their last road trip of the summer to drop their college seniors back to campus, the job prospects for these youngsters are frighteningly grim.

Many companies are holding out on making returning offers to interns who slogged through the summer trying to impress. The reason? An uncertain economy.

The worst offenders are companies in industries that rely heavily on a steady supply of young and talented knowledge workers - tech, financial services, and consulting.

For several weeks, McKinsey partners have been calling rising seniors to say that while the elite strategy firm will visit campuses for recruiting events, hiring will be limited to enlisting interns for next summer. Current seniors will never get a chance to appear for full-time interviews. The same applies to other consulting firms, including BCG, Bain, and the technology-based Big-4 consulting firms, such as EY, PwC, Deloitte, and KPMG. These firms are just not hiring; if they are, the hiring numbers are way down from prior years.

The big banks are doing the same - and college seniors are seeing doors shut in various banking sectors, including commercial, housing, dealmaking, and M&A. Credit the situation to the anxiety in banks' corner offices, what with the Fitch downgrade of US debt and the Moody's downgrade of the banking sector (including banks that are too big to fail).

A recent NY Times report showed that many Commercial Real Estate (CRE) loans are coming due before 2025 and can't be refinanced because landlords find the interest rates too high and occupancy rates too low. Although companies are tightening Work From Home policies and requiring employees to return, the model is more hybrid than full-time at the office.

Meanwhile, residential mortgage rates hit 7% last week, the highest in over 20 years. So, thanks to leaders at the Treasury who refused even to acknowledge that inflation was raging (remember transitory inflation?) and helped pass trillion-dollar deficit bills, the Fed has had to tighten the money supply significantly. With money so dear and expected to be tight through December 2024, the big builders are scaling back on developing new housing projects when America faces an acute housing shortage. And why wouldn't they scale back? They wouldn't want to risk having unsold homes in inventory when the average American can't afford a mortgage. According to the Mortgage Professor, a 30-year $500,000 loan at 7% will cost a household $3,362 a month in mortgage payments (not including taxes, insurance, and maintenance) thanks to the Biden economy.

The immediate casualties are young college seniors who have had their experiences bookended by two terrible disasters over which they had little control. Many in the Class of 2024 began their first year at home due to college lockdowns from the pandemic. And now, they face an uncertain future, with many forced to accept temporary jobs or even consider graduate school to ride out the market. Going to graduate school has its own set of difficulties: assuming more debt on top of existing undergrad loans that have reset to higher interest rates.

In an economy that is not growing as fast, the best hope for the average college senior is that existing company employees resign or retire so that new openings are created. But with inflation so high, many in the labor force cannot afford to resign or retire, preferring to hold on to each paycheck as though it could be their last.

Reuters made this point in a Breakingview article earlier this month.

When interest rates are going up, and workers demand higher pay, attrition (the number of workers expected to quit) feels like a painless way to bring down wage bills. That's not so easy anymore since the so-called quit rate – the percentage of the workforce leaving their employer – has sunk back to its low levels from before the pandemic. One response is for companies to hire less, and the financial sector's ratio of job openings to current employees has fallen to its lowest since September. If that doesn't work, layoffs do. The rate of those is edging higher. Companies have an incentive to defer the moment of wielding the ax though, for fear of seeming more troubled than their rivals.

If it is bad enough for seniors who just completed an internship, it is much worse for those who tried for an internship and never got one this summer. Forbes considered their plight and concluded thus:

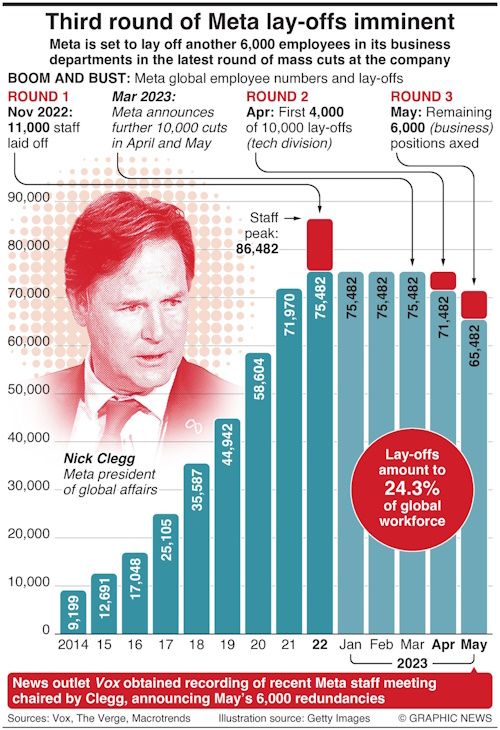

As layoffs plague companies from technology and banking to entertainment and healthcare, hiring is being halted and scaled back, affecting summer internships for students, too. In Silicon Valley, Meta and Google hired fewer interns this summer; the decreased numbers are part of larger efforts to trim the size of their workforces and slow hiring, the tech giants told Forbes.

The Biden economy has been a complete disaster for college students. Gen Zers are generally a liberal, righteous bunch, but they should help throw Washington insiders out of office the next time they go to the polling booth.

Related Infographics