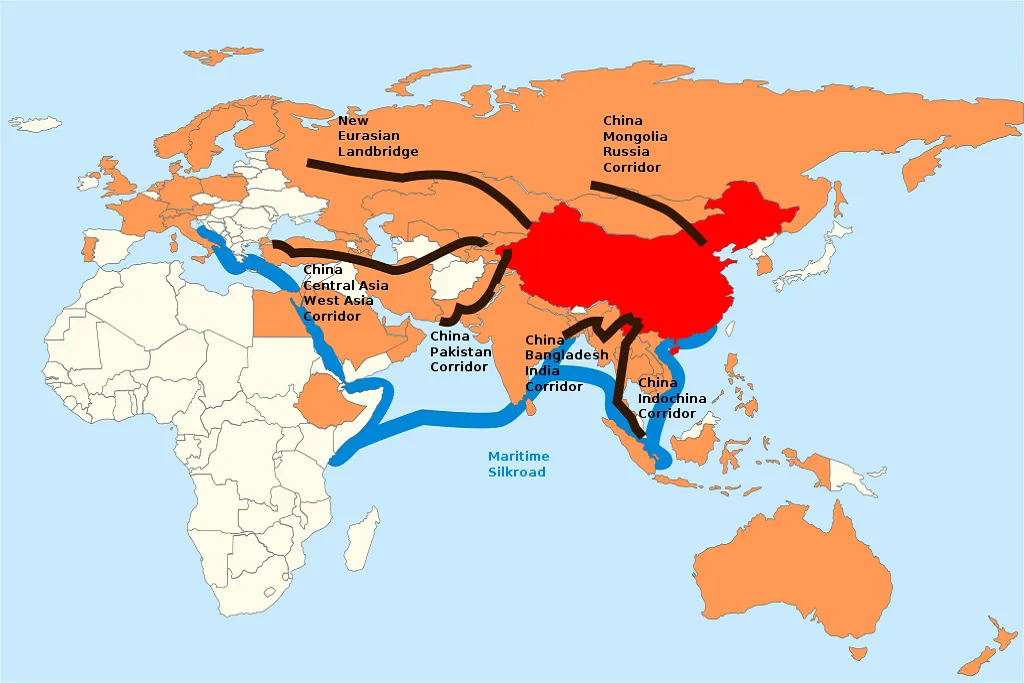

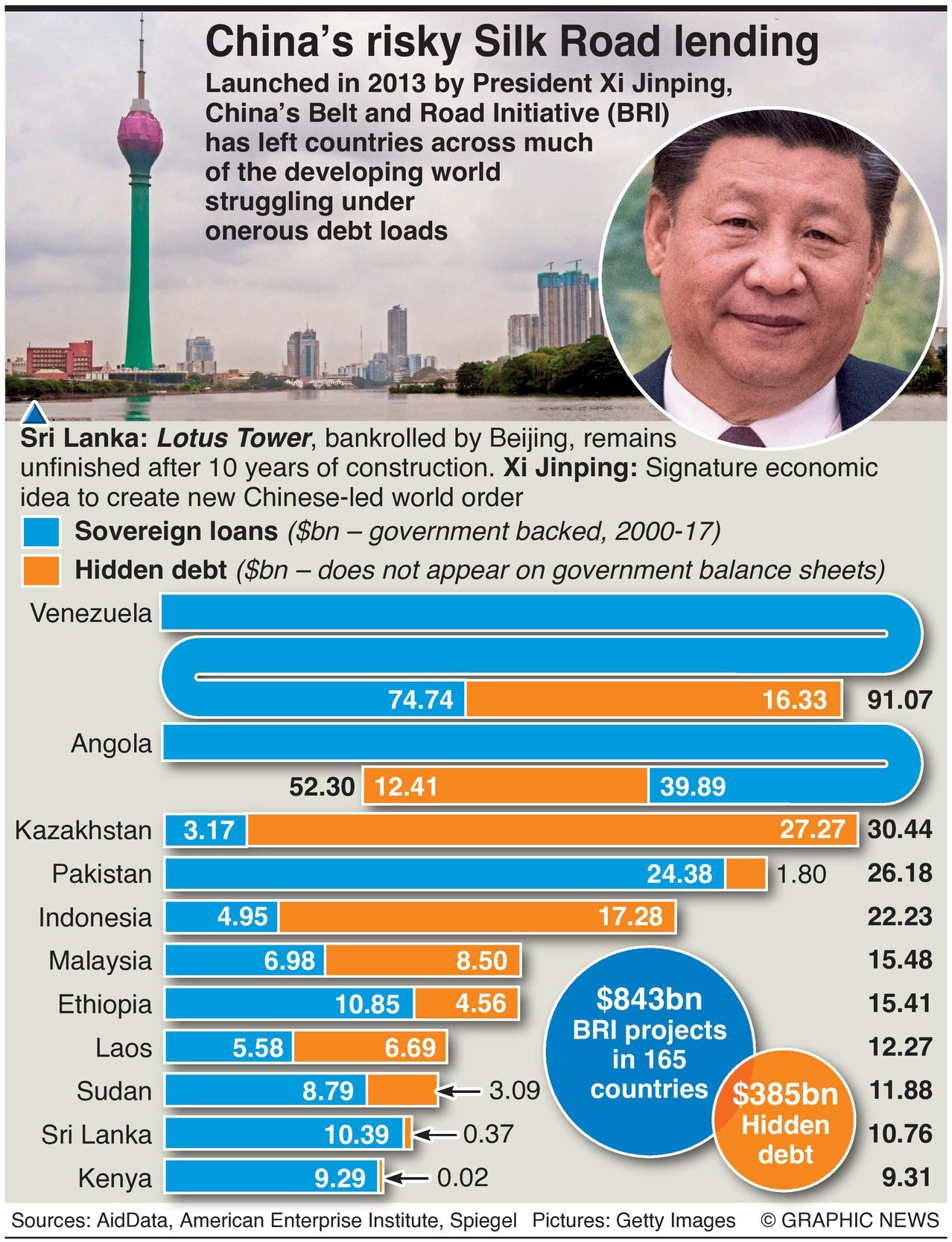

Completing the BRI has been part of the constitution of the governing Chinese Communist Party since 2017. Xi’s signature economic idea aims to reshape the global economy and create a new Chinese-led world order.

During the first five years of the initiative, China spent about $85 billion annually financing overseas development, according to a 2021 report by U.S.-based research lab AidData.

AidData examined more than 13,000 BRI projects worth at least $843bn in 165 countries. Of these projects, AidData reported that “hidden debts” -- those that do not appear on government balance sheets -- accumulated by lower- and middle-income countries totaled around $385 billion.

Venezuela has $91.1bn of loans, including $16.3bn in hidden debt, followed by Angola with loans of $52.3bn and hidden debt of $12.4bn.

Sri Lanka owes around $10.8bn for transportation, energy, and telecommunications projects. Its Mattala International Airport is not generating enough revenue to pay back the $190 million in loans that the Exim Bank of China provided to build it. Often, only two flights a day land at Mattala. China leased Sri Lanka’s $1.3bn container port at Hambantota in 2017 when Colombo failed to repay its debts.

The concern is mounting that Beijing will seize more assets from countries pushed into “debt traps.”

According to a survey by the American Enterprise Institute, projects valued at $838bn were underway by the end of 2021. However, the nature of the projects is now changing -- instead of building railroads or airports, loans are now more often used for natural gas or oil extraction.