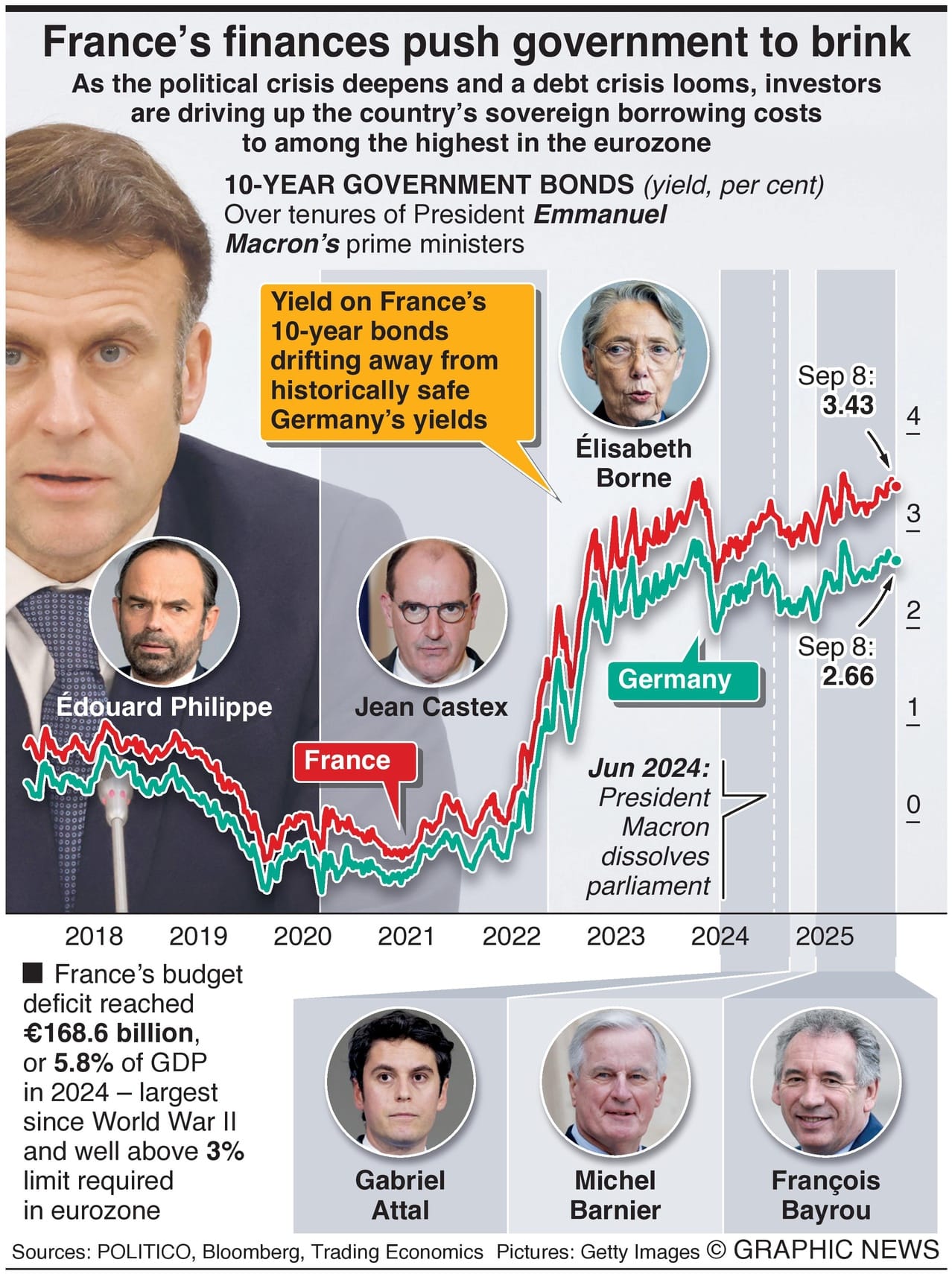

As France’s political crisis deepens and a debt crisis looms, investors are driving up the country’s sovereign borrowing costs to among the highest in the eurozone.

Prime Minister François Bayrou faces a crucial confidence vote over his deficit-cutting measures, a move that could topple him from office and intensify pressure on President Emmanuel Macron to resolve a worsening parliamentary deadlock.

Bayrou, Macron’s fourth prime minister in under two years, called the vote as France grapples with mounting fiscal challenges. The country’s budget deficit reached €168.6 billion in 2024 – equal to 5.8% of economic output – its largest shortfall since World War II and nearly double the eurozone’s 3% ceiling.

Investor unease has already pushed yields on France’s benchmark 10-year bonds above 3% over the past year, underscoring the toll that political instability and fiscal strain are taking on the country’s finances.