During the last couple of weeks, all eyes have been focused on a potential banking crisis, the Fed’s interest rate hikes, and the wobbly stock market — and, of course, when it comes to politics, the potential Donald Trump indictment.

The latter, by the way, looks to be dead in the water, believe it or not. So far: No handcuffs, no perp walk, no nothing. In fact, the grand jury’s not even meeting. That’s what I call a big nothing-burger.

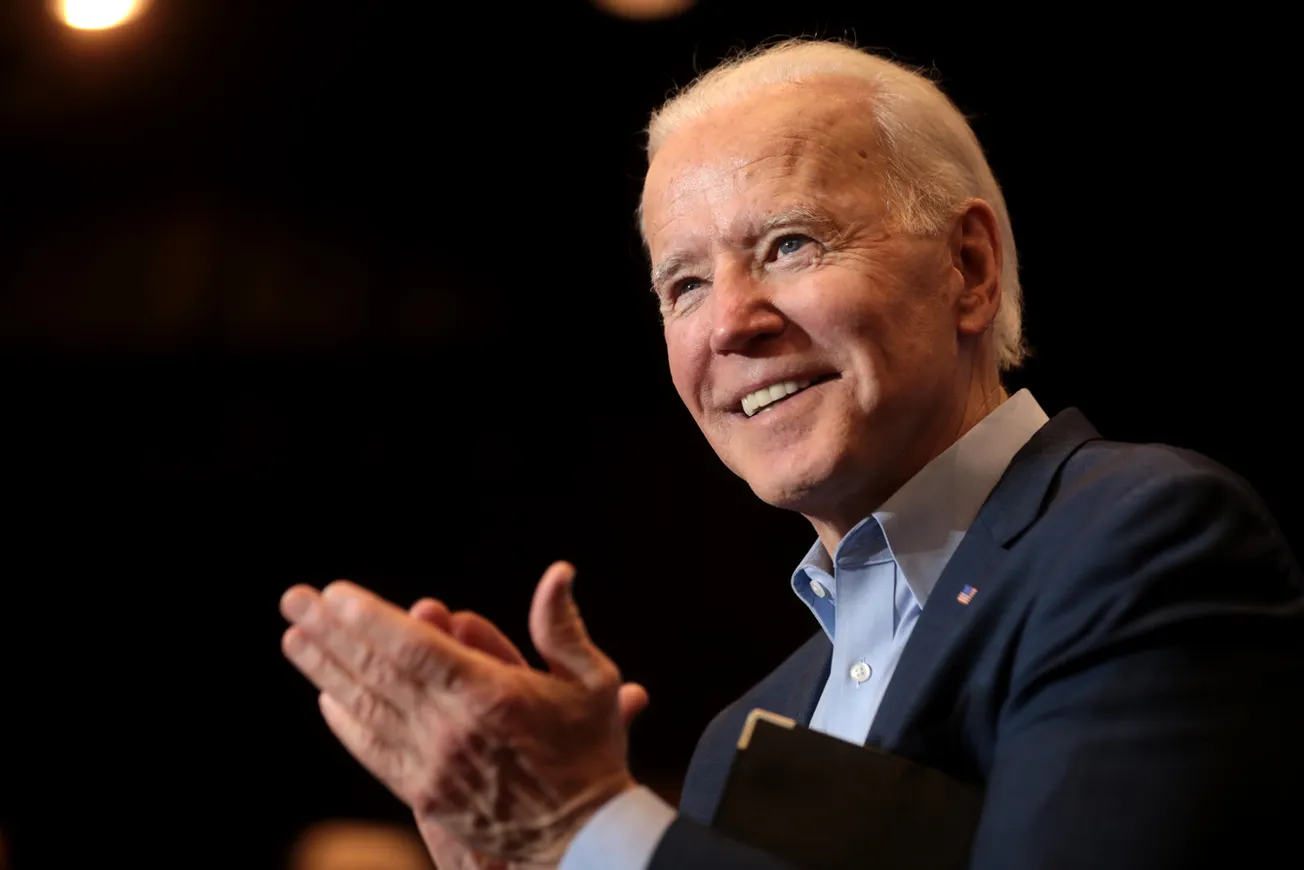

I also want to put something else on the table: President Biden’s poll numbers are crumbling. The AP-NORC poll had Mr. Biden at a 45 percent approval rating in February; suddenly, it has dropped to 38 percent in March. His all-time low, by the way, was 36 percent.

On the flipside, his disapproval number in February was 54 percent; by March, 61 percent. For whatever it’s worth, this is just a tracking poll, but, at the heart of it, his big problem is failing stewardship of the national economy.

In February, this measure was at 36 percent approval. Not much, I’ll grant you, but in March it dropped to 31 percent. A stock looking for a bottom.

The flip side: His disapproval on this score in February was 61 percent. That’s bad enough, but in March it jumped all the way to 68 percent — even worse.

Now, the poll was taken between March 16 and March 20. What happened just before that poll on Sunday, March 12? Mr. Biden okayed a bailout of Silicon Valley Bank. He also okayed the bailout of Signature Bank.

Since then, his Treasury secretary has been running around Washington saying things that don’t make any sense to anybody, contradicting herself, changing her story. Reminds me of her inflation-denial period two years ago.

Most of all, the Biden administration decided on an FDIC guarantee of uninsured bank deposits. This infuriated people.

In effect, this was a de facto policy statement by the administration that it’d be prepared to guarantee all uninsured deposits, all across the country. That’s about $7 trillion worth.

Of course, this puts taxpayers on the hook, right, because the banks have to pony up to cover the FDIC, but it’s individual customers, who are also taxpayers, who are also hard-working families having trouble making ends meet. They don’t like this either, and they know they’re going to pay for it.

Now, we don’t know how the bank problems are going to work out yet, but Mr. Biden is heading in the direction of nationalizing the banking system. More big-government socialism — just like the administration’s policies on student loans, climate projects, social welfare benefits, health care, ESG.

In other words, big-government socialism reigns. The Wall Street Journal’s Dan Henninger calls it “no-limits” government.

By the way, none of it is working. Interest rates keep rising, stocks keep falling, and the economy looks shaky. The Bidens can’t get it together.

Yesterday, the Fed chairman, Jerome Powell, said yes to bailouts of uninsured deposits. But Secretary Yellen, who said she would cover the uninsured deposits the day before — well, she comes back and says, I didn’t say that. I really didn’t say that.

Yes, she did. So the market went down 600 points. This is called moral hazard. What does “moral hazard” mean? That means when the government guarantees something, it encourages the worst behavior, or no discipline. No one fails.

Capitalism without failure is like religion without sin. It doesn’t work. (Thanks to the late Allan Meltzer.)

None of this is working for Joe Biden’s economy. That is why Mr. Biden’s polls are in freefall.

From Mr. Kudlow’s broadcast on Fox Business News.

Larry Kudlow was the Director of the National Economic Council under President Trump from 2018-2021. His Fox Business show "Kudlow" airs at 4 p.m &. and his radio show airs on 770 ABC from 10:00 a.m. to 1:00 p.m.