So far in 2023, economic policy in Washington is all about the debt ceiling. You know this, but I want to set the table.

The statutory debt ceiling of $31.4 trillion was reached last Thursday — but the Janet Yellen Treasury can finagle, so the federal government will continue to borrow for another six months or so, thereby postponing the truly fun, high-drama moments until the summer.

We have, as you might guess, two political points of view on this debt question. President Biden and Democratic leaders want a clean debt bill without any spending cuts. In fact, the president doesn’t want to negotiate at all.

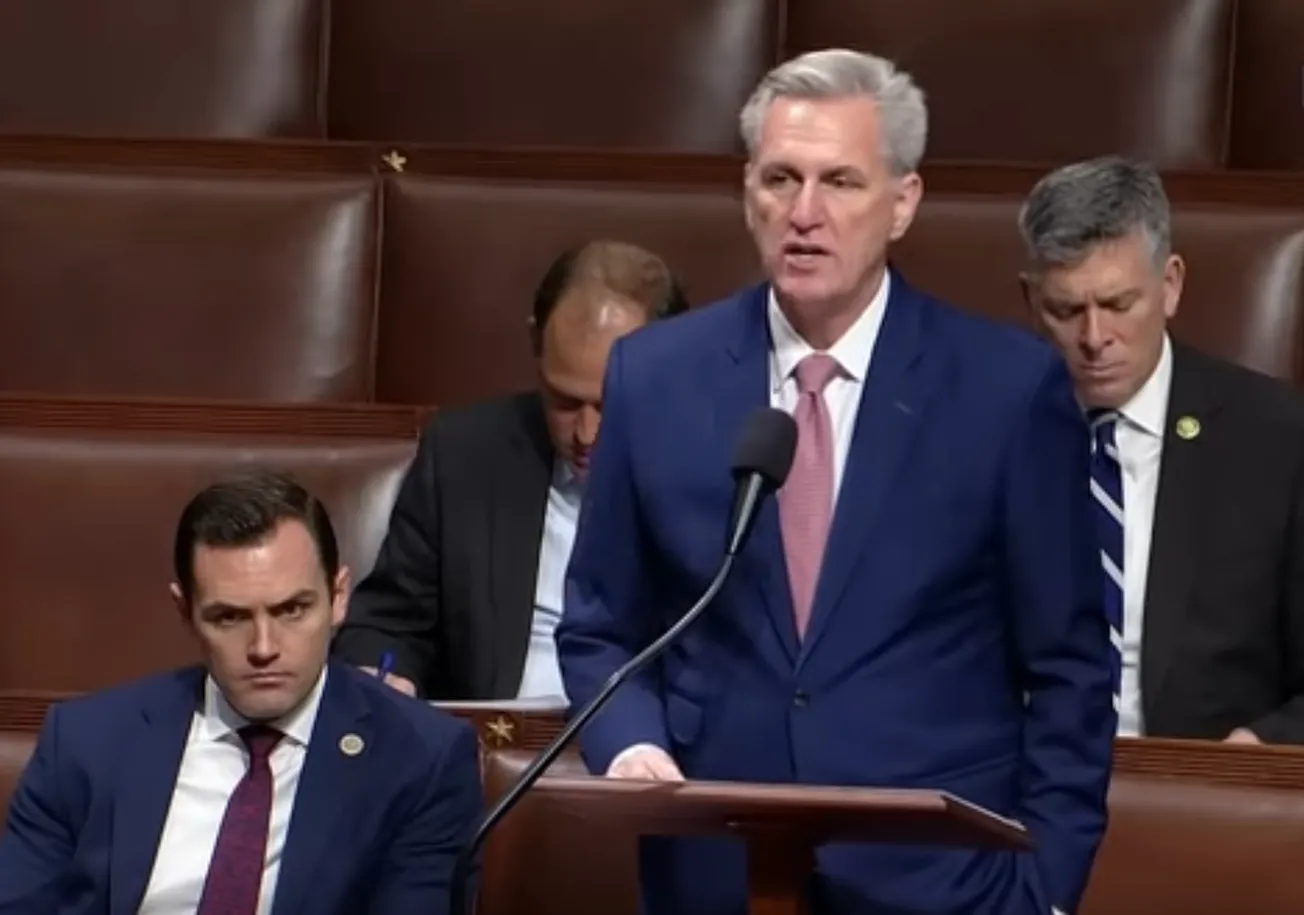

It’s kind of like the fiscal version of “I have no regrets” and “there’s no there, there,” but there is someone there: His name is Speaker McCarthy, and he and his Republican House are insisting that any increase in the debt ceiling be accompanied by significant budget cuts, new spending caps, and new sequestration penalties in the form of automatic spending cuts — should the caps be breached.

My view is that Mr. McCarthy is right. Both the economy and the country are clamoring for more limits on government, spending, and borrowing in order to promote economic growth and reduce inflation. In short: Save America. Stop spending.

For what it’s worth, by the way, a recent Rasmussen poll shows 56 percent of Americans would rather see a partial government shutdown until Congress can agree to cut spending or keep it the same, while just 34 percent would rather avoid a partial shutdown by authorizing more spending.

The issue isn’t really a partial government shutdown so much as some sort of a debt default on the interest payment on U.S. treasury bonds, but a government shutdown could come into play.

Yet most Americans are mindful of the fact that the Biden Democrats have legislated nearly $5 trillion of new borrowing scheduled over the next 10 years. It’s a gigantic number.

My key point is: Yes, over-borrowing is a problem, but the root cause of the debt binge is over-spending.

Over-spending by an ever-expansive government is one of the chief causes of the stagnation of economic growth and prosperity over the past three decades. As I’ve said before, for more than 50 years after World War II, the U.S. economy adjusted for inflation increased 3.5 percent per year — making it the envy of the world. Since the year 2000, though, that number has slumped to less than 2 percent yearly.

This has robbed us of an incredible $9 trillion of economic output, and, if it continues another 10 years, it will diminish prosperity by another $8.5 trillion.

As a free-market capitalist, I believe government spends too much, taxes too much, regulates too much, and inflates the currency too much. Massive social welfare spending without any work requirements is another huge problem.

Remember, all these new government programs, especially in the last couple of years, come with enormous regulatory strings attached, which have literally strangled growth. Entire industries, from energy on down, have been blunted by government-created obstacles.

Punishing success rather than rewarding it. Redistribution rather than growth.

In the high-growth post-war period, federal spending as a share of the economy averaged 18.9 percent. Over the past 20 years, that grew to 21 percent. The most recent tally is 24 percent of GDP.

In the year ending in February 2020, pre-Covid, Uncle Sam was spending $4.6 trillion on his budget. Two years later, that number jumped to $6.3 trillion and rising — not even including $600 billion in student loan cancellations. This can’t continue.

The rapid rise in the size and scope of the federal government is undoubtedly the single biggest prosperity killer, and recent policy is going in the wrong direction. That’s why it is time for another showdown.

The U.S. government will never default on its debt. Ever. There’s more than enough revenues to cover those interest payments, which themselves are getting way too high.

Debt showdowns occurred in 1986, 1997, and 2011. They were debt and government shutdown showdowns. In each case, the showdowns were finally concluded with sizable deductions in federal spending and borrowing.

How about the idea from a former Council of Economic Advisers chairman, Kevin Hassett: $3 of spending cuts for every $1 of increased debt? A little bit of D.C. swamp suffering pain? Yup. It takes what it takes to right the ship.

All the blather about debt default is a canard. It’s a red herring. It’ll never happen. What will happen is that Speaker McCarthy and Republicans and maybe Democrats too decide it’s time to limit government and turn prosperity killers into prosperity creators for the good of the country.

Save America. Stop spending.

From Mr. Kudlow’s broadcast on Fox Business News.

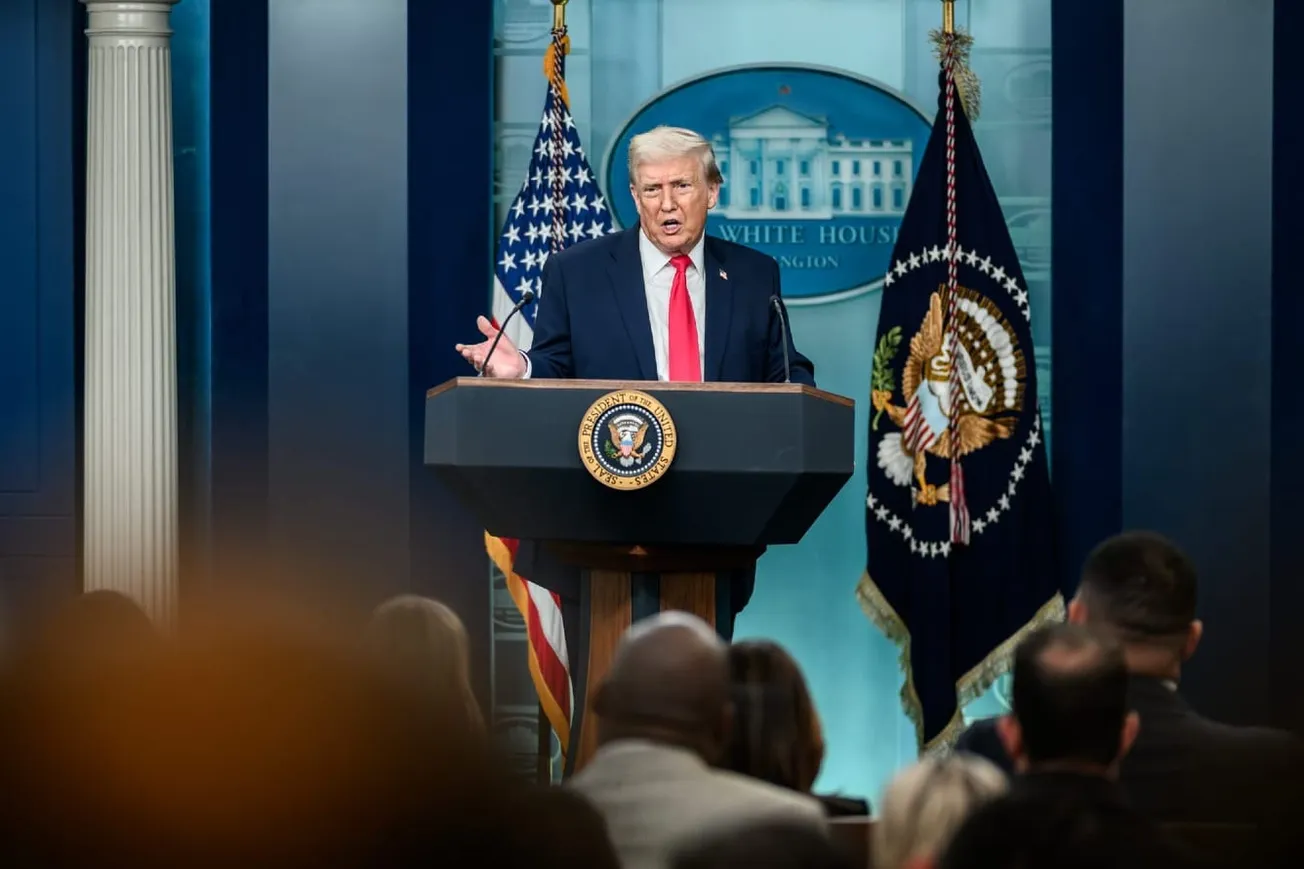

Larry Kudlow was the Director of the National Economic Council under President Trump from 2018-2021. His Fox Business show "Kudlow" airs at 4 p.m &. and his radio show airs on 770 ABC from 10:00 a.m. to 1:00 p.m.