Editor’s Note

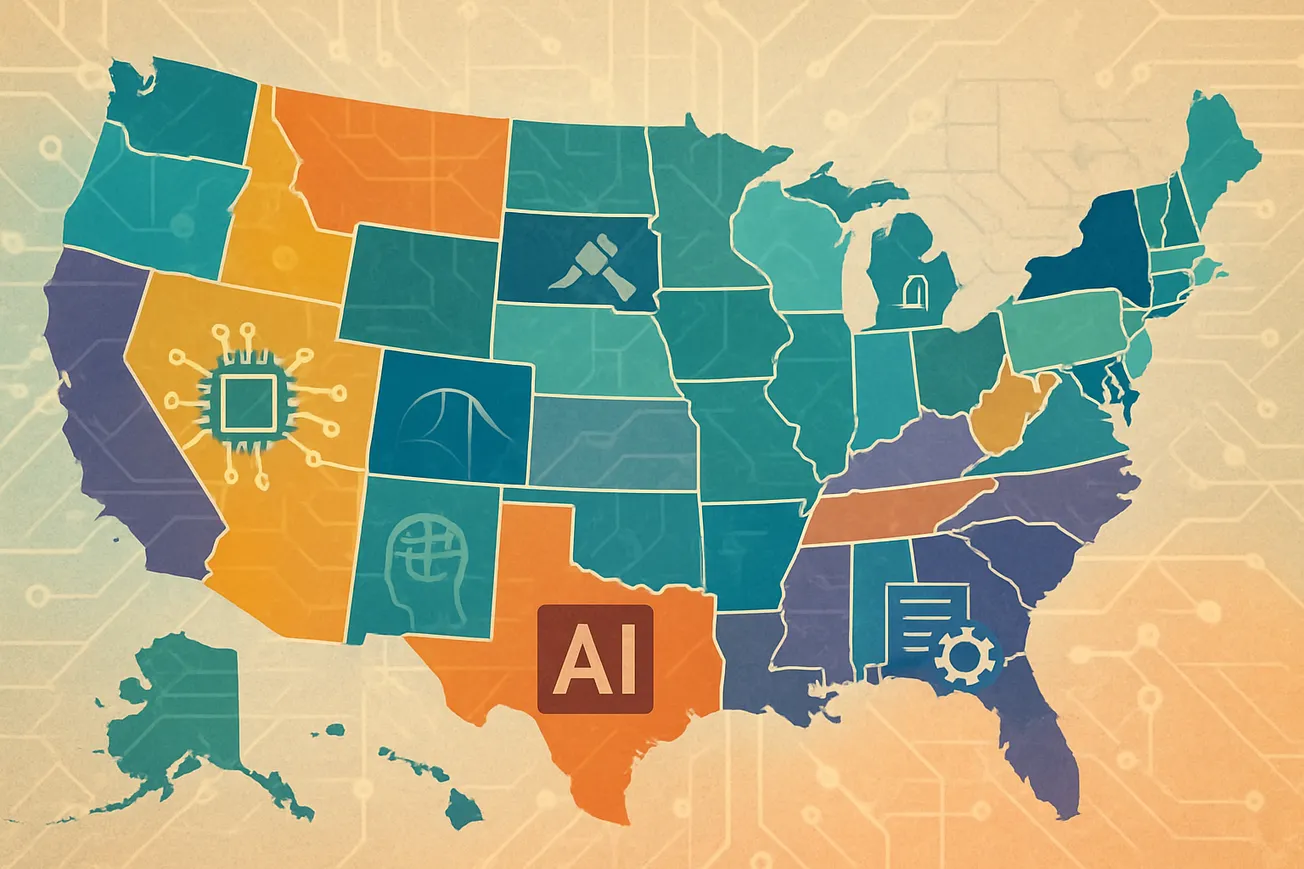

America is often accused of “deregulating” AI, but that storyline misses how our system actually works. With 50 states and a strong legal culture, the country is not stepping back. It is regulating through many hands at once. That may look messy to outsiders, but it is part of our constitutional DNA. In a fast-moving field like AI, this decentralized, trial and error approach may turn out to be one of America’s quiet advantages.

By Angela Huyue Zhang, Project Syndicate | November 19, 2025

While critics of decentralized technology regulation warn of higher compliance costs for businesses, Chinese-style centralization is hardly preferable. In fact, not only do regulatory patchworks tend to converge, but they also provide the flexibility that rapid technological change demands.