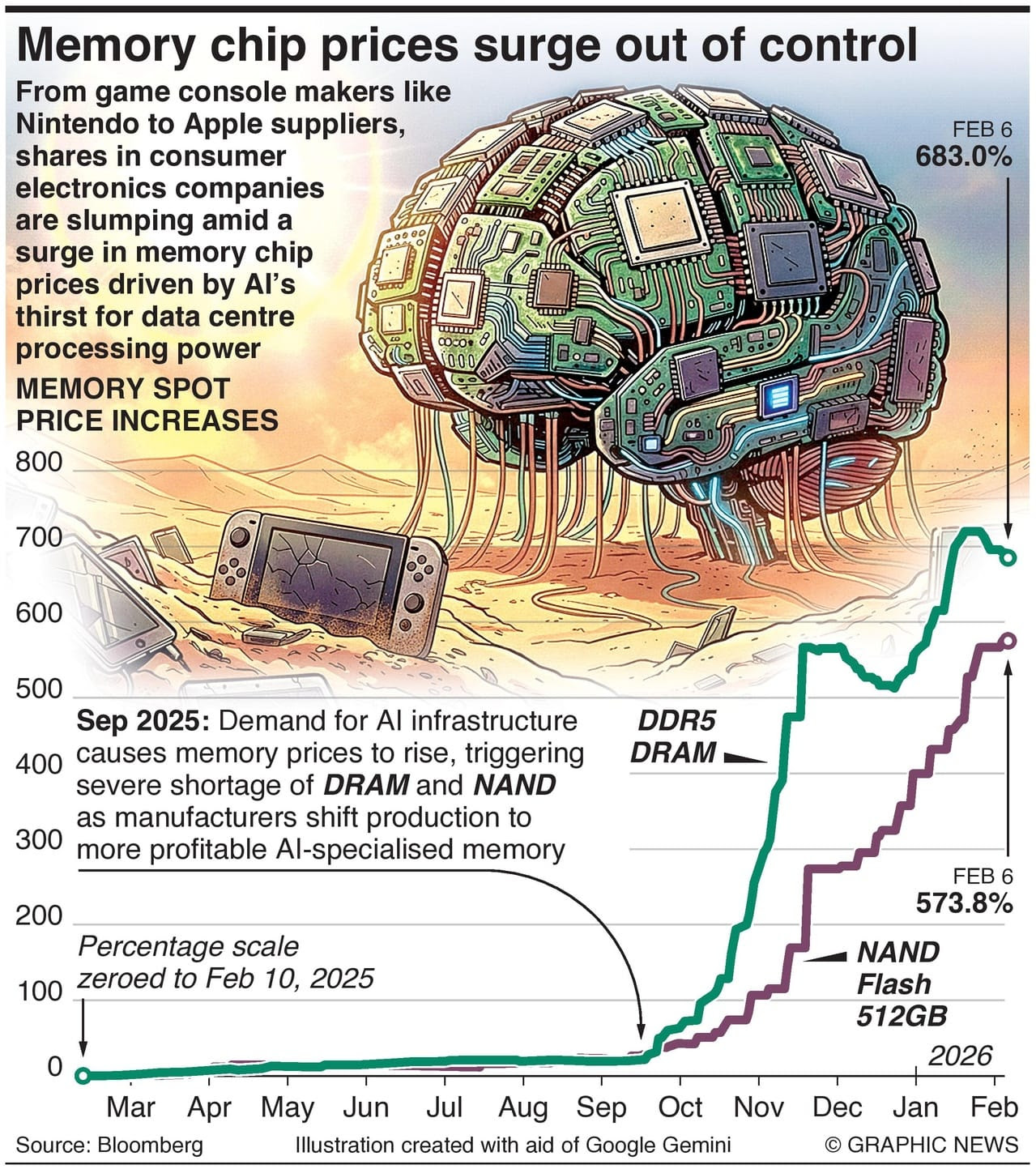

From game console makers like Nintendo to Apple suppliers, shares in consumer electronics companies are slumping amid a surge in memory chip prices driven by AI’s thirst for data center processing power.

Investors are becoming alarmed as electronics companies struggle to cope with the rise – shares in Qualcomm fell more than 8% in February, and Nintendo saw its largest decline in 18 months after warning of margin pressures from chip shortages.

Of course, for every loser there is a winner – and so memory chip makers are seeing their shares rocket. SK Hynix, a key supplier of high-bandwidth memory to Nvidia, has seen its stock go up 150%. Kioxia Holdings and Nanya Technology have risen 270%, and Sandisk is up an astonishing 400%.

Also Read: