Inflation – it's on everyone's mind. Everyone is talking about how inflation is the highest it has been in forty years. With the slowing economy, what was said to be a "transitory" phase has turned into "stagflation."

Some are blaming the government. The government is blaming the war. Republicans are blaming the Democrats, and the left is blaming greedy corporations. As the blame game and alarm rage, it remains a fact that most of us don't know what inflation is. Few know what causes it. Fewer know how it can be curbed.

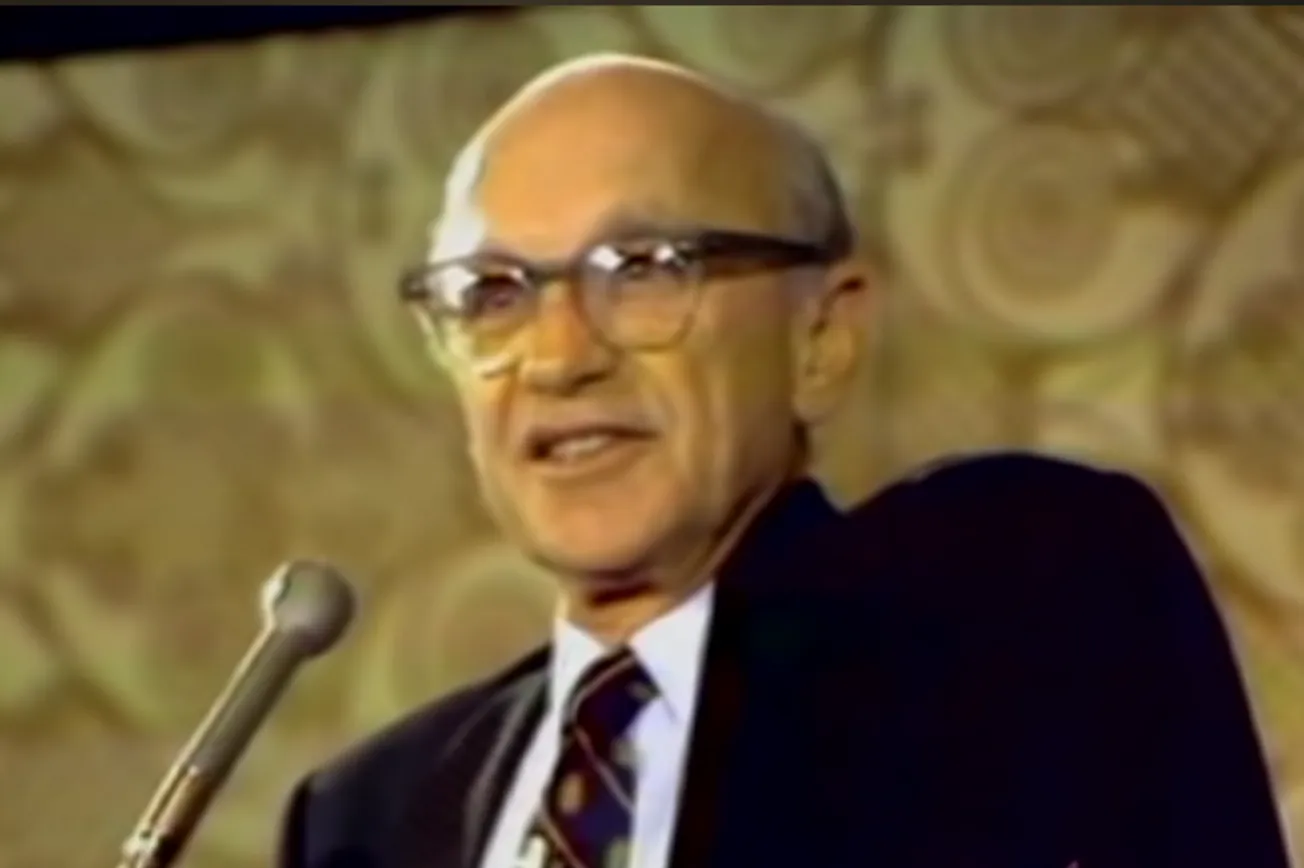

Under the circumstances, it pays to listen to the respected American economist Milton Friedman as he deconstructs this "alarming" phenomenon. The Nobel Laureate, speaking at the University of San Diego and the San Diego Chamber of Commerce in 1978, busted some well-established myths and shed light on the causes and cures.

Friedman describes inflation as a "social," "dangerous disease" of society. It is a deeply divisive phenomenon. Some people do very well, achieving great prosperity, while others even struggle to make ends meet. He points out how skyrocketing inflation has brought down governments and led to revolutions worldwide.

Inflation, he stated, is a monetary phenomenon. It is a problem of too much money buying too little goods in the market. A "rapid increase in the quantity of money than in output" leads to the state of affairs.

Every time money has flooded the market and production has not kept pace, it has resulted in such an economic situation. In the mid-1800s, the Gold Rush created a scarcity of goods, sending prices soaring. But, since money was decoupled from gold and silver, such scenarios no longer play a role in price rises.

Busting Myths

As modern governments control the amount of money in circulation at any given time, he lays the blame for inflation squarely on them.

Friedman points out that the country's government ultimately has control over the printing of currency and, thus, the amount of cash reaching the people, absolving often-blamed greedy businessmen and crippling trade unions.

Busting the myth that inflation is a consequence of capitalism, he cites examples of communist countries that have dealt with similar situations despite their diametrically opposite economic system. In the same way, a strong trade union may successfully demand higher wages. Still, military-run countries, where such unions have no role to play, have not remained immune to the monetary phenomenon.

Governments often blame "worldwide inflation" for the country's economic situation. Friedman explains that such an argument no longer holds. He says, "That was a valid explanation before 1971 when we had a worldwide system of fixed exchange rates. In that case, inflation in one country would indeed tend to spill over into another because it would influence the quantity of money." He goes on to say, "But today, that explanation is not valid. As long as countries have variable floating, flexible exchange rates between their currencies, inflation is a national phenomenon and not an international phenomenon." The reasoning is easy to understand, considering that different countries are experiencing varying percentages of inflation. The current inflation rate in the U.S. is 7.7%, while in the U.K., it is 11.1%.

Reasons For Inflation

Friedman explains that large amounts of money come into the economy due to government spending and is the primary reason for inflation. National governments create large quantities of money to fund their expenditures. Most people are against taxes, so the administration must find money to fund its programs and initiatives. He explains, "There is no way you can do the one without the other. The real tax on the American people is what the government spends. If the federal government spends $450 billion and only raises $400 billion in taxes, who do you suppose pays that other 50 billion dollars? Do you suppose the tooth fairy does? You pay it, and I pay it, and one of the ways we pay it is by the tax, which we call inflation."

More money is often printed or borrowed from the public to meet the budget deficit. The excess money reaching the people gives rise to inflation. Friedman says that inflation is a tax imposed without representation and that nobody has to vote for it. And, of course, it's a marvelous tax from the point of view of a congressman trying to meet the demands of his constituents for more spending.

Moreover, efforts to create full or high employment rates also contribute to the situation. The stimulus flooding the market to create employment has a short-term positive impact. After that, the stimulus becomes the excess money chasing the same amount of goods, leading to higher prices. Friedman also makes it clear that unemployment or low wages are not ways to stop inflation.

Friedman also blames the faulty fiscal policies promoted by the Federal Reserve Bank. "Their mistake has almost always been caused by confusing their function, by thinking that they had something to do with interest rates instead of recognizing that their real function was to control the quantity of money."

Even as he acknowledges the role of productivity in the equation, Friedman explains that "from the point of view of inflation, it's the wrong order of magnitude." He says, "the possible variations in the quantity of money are much greater than the variations in output and productivity."

Inflation Pays The Government

The economist points out that the "inflation tax" is a source of revenue for the government. Besides the direct payment, wages gradually catch up with the increase in prices. This automatically pushes Americans into higher tax brackets, making the exchequer richer. He minces no words when he says, "These much-publicized tax cuts... have not been tax cuts at all. Inflation has raised taxes, and the so-called tax cuts have given back a small part of that to the taxpayer, but the actual taxes that taxpayers have paid have gone up as a result of the automatic effects of inflation."

Further, high rates of inflation aid the government in repudiating its debts. In Friedman's words, "Anybody who has bought a long-term government bond and then redeemed it has gotten back an amount of money which has less purchasing power, less ability to buy goods and services, than the sum he initially paid for the bond. And to add insult to injury, he has had to pay taxes on what they call interest, and as a result, the debt has gone down in meaningful terms."

Curing The Social Disease

The respected economist also provides simple solutions to curb the "social disease" that could pose a threat to societies. And herein lies the rub.

He opines, "That's the easiest thing in the world to say: in order to stop inflation, you have to have the government spend less and print less." He points out that the political will to do the needful is lacking. He also notes that "slowing down inflation slows down the economy temporarily," and there will initially be "some very difficult times," and that the collective will of the citizens to put up with such conditions is not guaranteed.

"There has been about a two-year interval between a more rapid increase in the quantity of money on the one hand and the inflationary effects of it on the other. But the same thing happens the other way. If the government slows down its spending, in the first instance, people simply experience that as slower demand for their products, and they (citizens) tend to retrench." As he succinctly says, "Everybody wants to stop inflation at somebody else's expense."

Elaborating on the role of the citizen in this unfortunate cyclical phenomenon that successive governments have not been able to break, he states, "And as I say, I don't really blame the people (government) who are doing it. The real blame has to be put on us, the citizens, the voters of this country, for not telling our government what we want them to do. And I am afraid that we shall have to go through several more of these swings in the roller coaster before the American people decide that they have had enough of it and that it's time to bring it to an end, that it's time to send an unmistakable message to Washington, "We want you to stop the roller coaster."

The noted economist's words from more than four decades ago still ring true. The question is, faced with record-high inflation numbers, are we, the citizens, ready to learn from him? Will the newly-elected Republican House listen to Friedman and tighten government spending? Only time will tell.

Dear Reader,

We thank you for your committed readership and would like to present you with a special holiday offer of a 50% discount on our annual membership. A subscription to our services will:

- Provide access to all of our articles at a lower price ($49.50 vs. $99) for the first year.

- Bring you thought-provoking editorials and explainers.

- Help us to keep you on top of Geopolitics and Geoeconomics.

- Help us fund timely polling to bring you critical data.

- Support independent, data-driven journalism.

- Qualify you for a 25% discount on all public opinion research conducted with the gold standard TIPP Poll.

This offer is only valid from 11/24/22 - 11/29/22. Click here to grab it now!

Happy Holidays!

Best wishes,

tippinsights team

Please email editor-tippinsights@technometrica.com

Please share with anyone who would benefit from the tippinsights newsletter. Please direct them to the sign-up page at:

https://tippinsights.com/newsletter-sign-up/