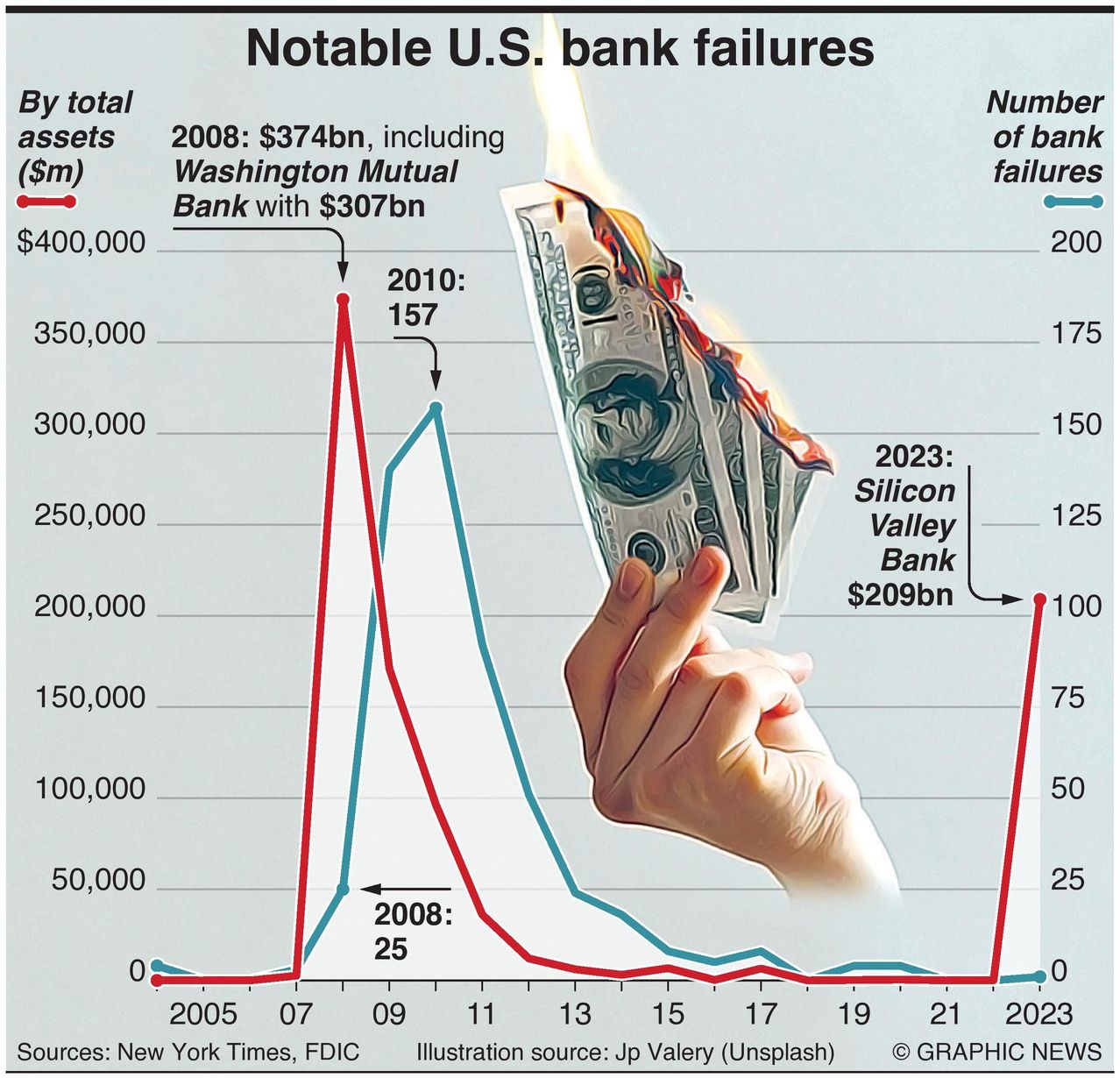

Silicon Valley Bank has become the biggest U.S. bank to fail since the global financial crisis in 2008 and the collapse of Washington Mutual.

On March 10, 2023, Silicon Valley Bank (SVB) became the biggest U.S. bank to fail since the global financial crisis in 2008, when 25 banks collapsed, including Washington Mutual, with assets worth $307 billion.

After its collapse, Washington Mutual was bought by JPMorgan Chase. From 2008 to 2015, more than 500 federally insured U.S. banks failed, often resulting in them being absorbed into other institutions.

In the case of SVB, the Federal Deposit Insurance Corporation (FDIC) created the Deposit Insurance National Bank of Santa Clara (DINB), allowing depositors access to their insured funds and time to open accounts at other insured institutions.