The Federal Reserve chief put some more hair on his chest and bolstered his inflation-fighting manhood today with some tough talk at the CATO Institute. “We need to keep at it until the job is done,” Chairman Jerome Powell said, adding that “history cautions strongly against prematurely loosening policy.”

Actually, the most important Fed spokesman is a Wall Street Journal reporter, Nick Timiraos, who announced on this morning’s front page that the Fed will raise its target rate 75 basis points, taking it to 3 percent to 3.25 percent from its current 2.25 percent to 2.50 percent.

It’s quite true that some forward-looking inflation indicators, such as falling M2 growth, slumping commodity prices, a very strong king dollar, and let’s add declining oil to that list, all suggest that the worst of the inflation may be over. But — and it’s a big but — as Art Laffer tells us, there’s an enormous volume of excess cash still sloshing around the banking system and the economy.

What’s more, all these federal subsidy programs — think student loans, food stamps, housing assistance, child allowances — have an inflationary impact. The income effect puts more demand-side money in their hands. And the lack of work requirements generates disincentives to get back into the labor force and produce.

Hence, more demand coupled with less supply equals higher prices. Or, inflation will remain sticky for quite some time, as it has become embedded throughout the economy — not only in prices, but also in wages.

For example, the inflation tracker from the Cleveland Fed anticipates that the year-over-year CPI for the next two months will remain around 8.2 percent.

Remember the Fed’s target is 2 percent. Also, even if the Fed target rate gets to 4 percent or slightly higher by the end of the year, that will still be a negative rate, which is almost always consistent with higher, not lower, inflation.

Compounding our economic difficulties, the GDP tracker from the Atlanta Fed has just downshifted their Q3 estimate to 1.4 percent from 2.6 percent. That’s a bad sign.

We seem mired in an inflationary slump. Two years ago, President Biden inherited a non-inflationary boom. Shows you how damaging big-government socialism can be.

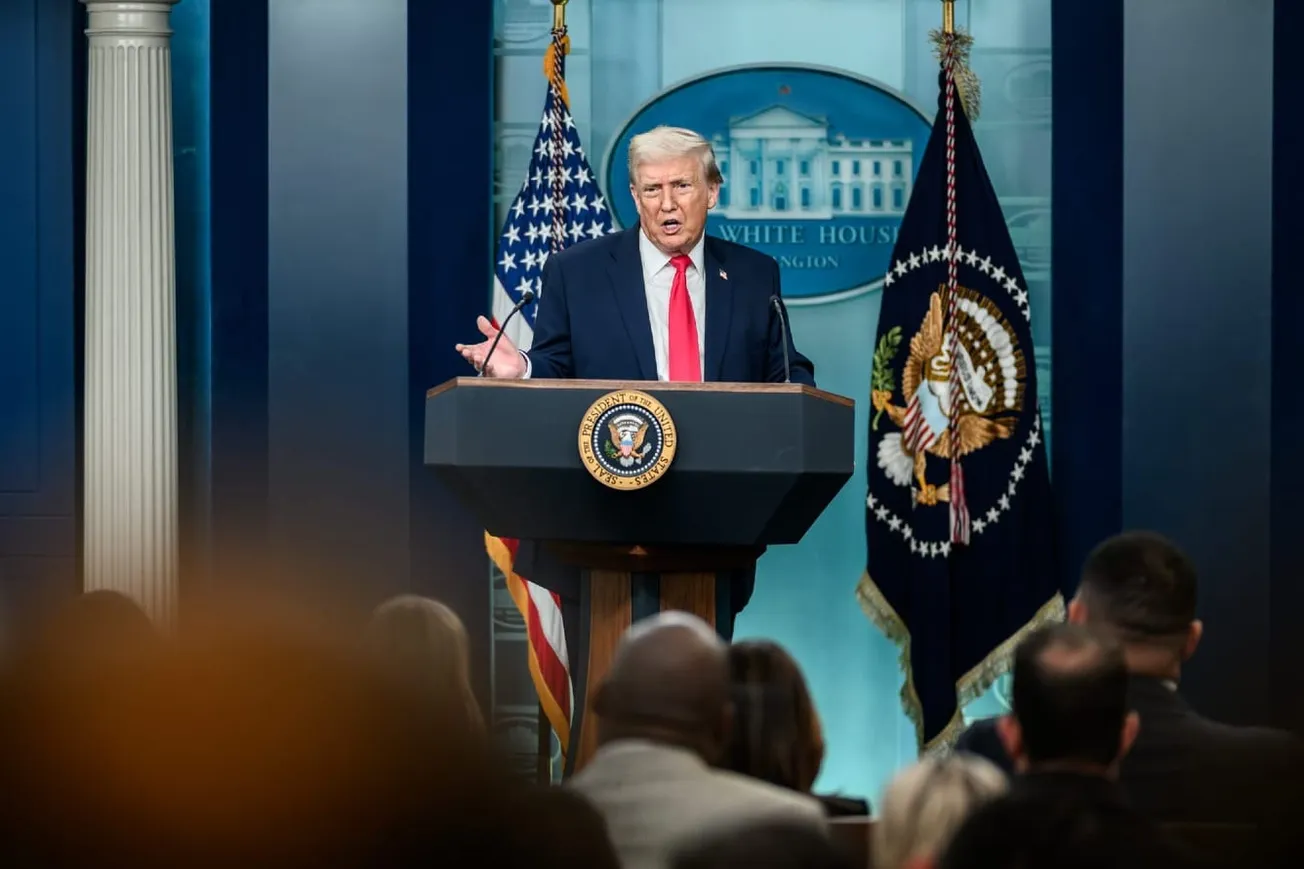

Larry Kudlow was the Director of the National Economic Council under President Trump 2018-2021. His Fox Business show "Kudlow" airs at 4 p.m &. radio show airs on 770 ABC from 10:00 a.m. to 1:00 p.m.