- Economic challenges during the Biden administration may lead 18-24-year-olds to consider switching allegiance to former President Trump

- Economic difficulties, such as student loan payments, rising housing costs, and car payment delinquencies, are impacting this age group

- These challenges might make the Trump presidency seem more appealing to 18-24-year-olds, despite their previous reservations

If there's one voting bloc that the Biden administration has vigorously pursued since Bernie Sanders announced his candidacy in 2019, it has been college students and recent graduates.

But talk is one thing; actions are another. The Biden economy has been so disastrous to 18-24-year-olds that they may switch their allegiance to former President Trump in 2024 if he clinches the GOP nomination. James Carville's famous political axiom, "It's the economy, stupid!" applies just as well today as it did in 1991 when Carville forced the Bill Clinton war room to focus on Bush 41's handling of the economy and helped Clinton win the presidency. Coming out of the first Gulf War successfully, Bush was enjoying an approval rating of over 90% and was considered unbeatable.

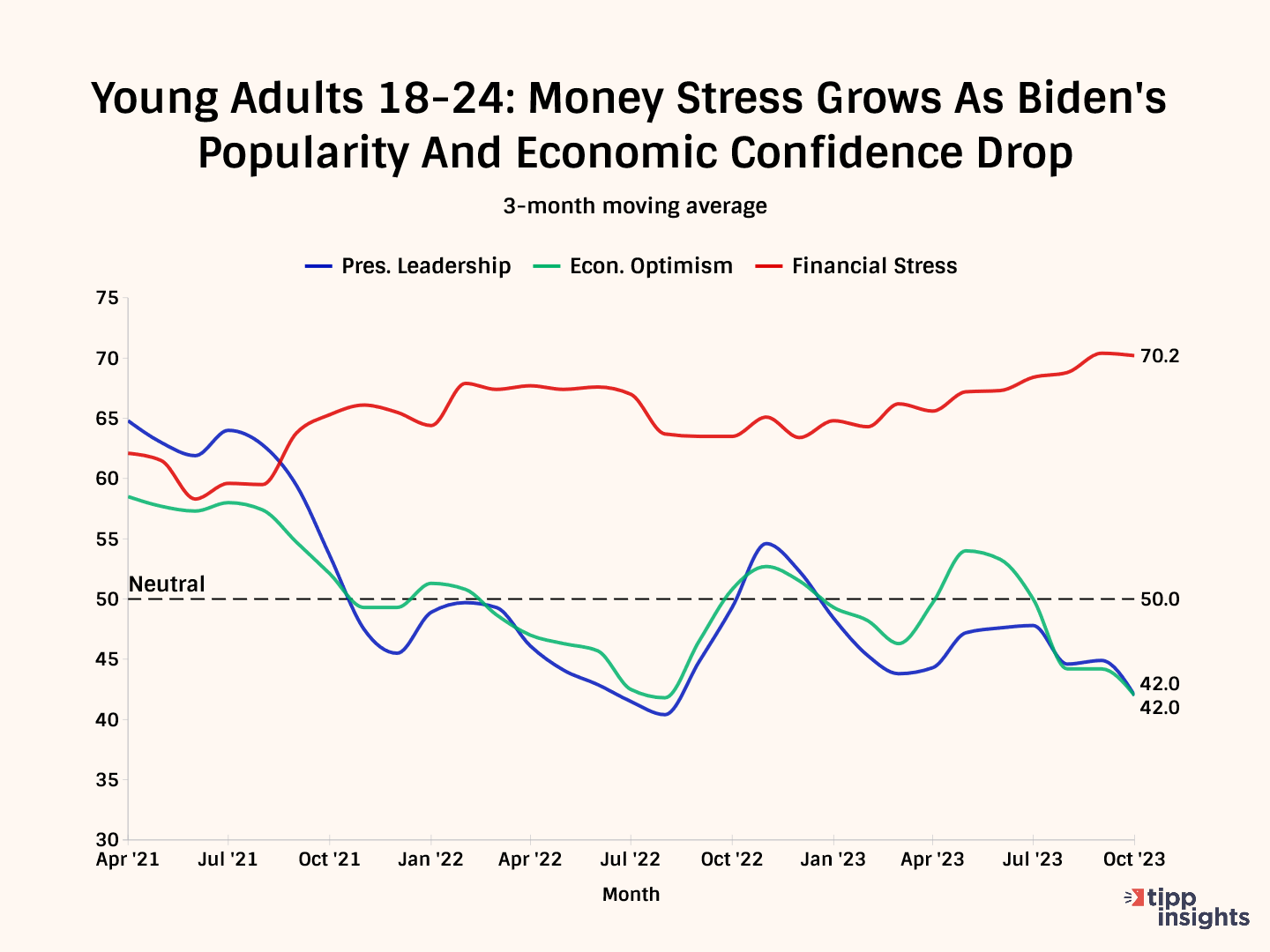

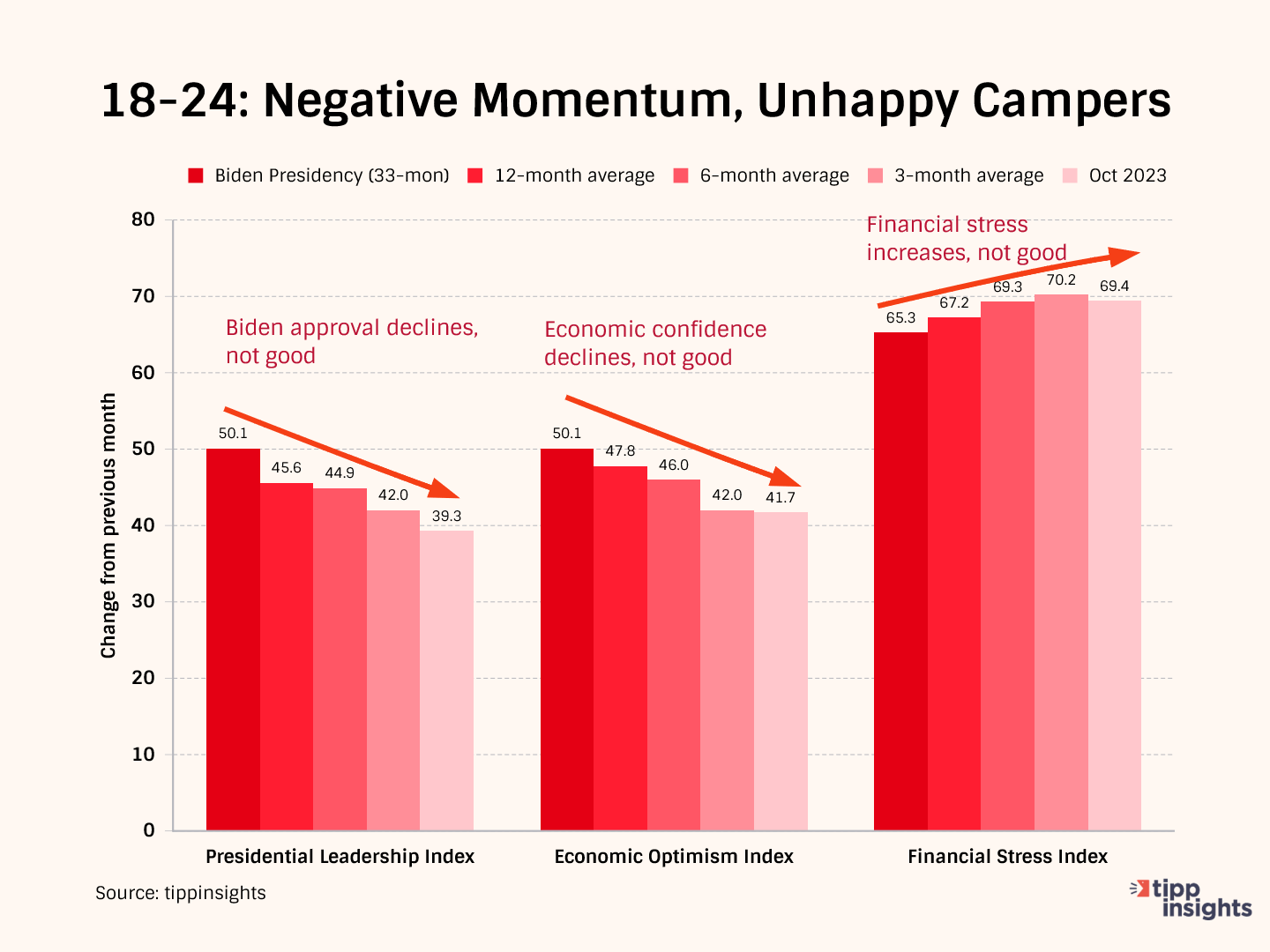

It is time to dive into the nitty-gritty of how the economy's been treating 18-24-year-olds during the Biden administration. The following charts tell the story.

18-24-year-olds are away from home, are independent thinkers, and are no longer under the influence of elders. Many get their worldviews developed on college campuses, which are vast enclaves of liberalism. Because colleges essentially prohibit conservative speakers' access, having declared safe zones for students who feel they could become "victims of microaggressions," few students are interested in understanding the other side of the argument or engaging in rigorous policy debates.

Until, of course, things hit their pocketbook.

The administration knows the pocketbook factor well, which is why it has tried numerous times to bribe students by offering to waive up to $10,000 in student debt. We argued in June 2022 that forgiving student loans was a terrible policy and unfair to youth who had never borrowed. The Supreme Court agreed a year later when it prohibited the Department of Education from implementing the Biden-Harris Administration's one-time debt relief program.

Student loan payments resume. Using the pandemic as an excuse, the Biden administration had kept postponing student payments on education loans. But this concession ended when the first payments resumed in October. Millions of borrowers have begun seeing a bill with the payment amount and due date in their mailboxes, something they had not seen for years when the administration had paused debt repayments. Defaulting on the payment or paying just the minimum balance are not options, so borrowers must immediately budget about $500 extra each month.

Housing costs are through the roof, although they have moderated somewhat. For many 18-24-year-olds, housing costs often form the most prominent single element of their monthly budgets. The Washington Post reported in July that rents are stabilizing or calming down, but that is little relief to renters who experienced monthly asking price increases of up to 15% between 2020 and 2022, marking the fastest run-up in rents in nearly a century. Owning a home is almost impossible, with mortgage rates on a 30-year loan reaching a recent record of 8% and inventories low as homeowners stay put in their homes, locked into their lower rates.

Car payment delinquencies are rising. Many 18-24-year-olds, not having held jobs for long and not having built sound credit profiles, are grouped into the so-called subprime class of borrowers. The credit rating agency Experian defines subprime as consumers with FICO® scores of less than 670 —or those in the "poor" and "fair" range. Nearly 1 in 3 U.S. consumers had a credit score in the subprime range, according to Experian data from Q1 2021.

Experian says that for subprime borrowers, rates for new cars average 11.5% and 18.5% for used autos (14.08% and 21.32%, respectively, for deep subprime borrowers with FICO scores of 579 or below). A Yahoo! News story said that a record number of new car buyers took out loans with monthly payments of $1,000 or more in the three months to June. Car payments have become the highest expense for some Gen Zers and millennials, even exceeding their rent.

Entry-level jobs are scarce. We pointed out in late August how the Biden economy has been terrible for college seniors, juniors looking for internships, and recent graduates. Wired Magazine said two weeks ago that Tech companies have laid off more than 400,000 people in the past two years. Competition for the jobs that remain is getting more and more intense.

Trump suddenly looks attractive. The 18-24-year-olds may not have liked former President Trump's mean tweets and boastful comments when he was in the White House. But this crucial demographic understands what a mess the Biden administration has been - inflation, never-ending wars, now a new conflict in the Middle East which could spread, a disastrous southern border, crime in the inner cities - and could switch its electoral support to the relative prosperity during Trump's presidency. It is a terrifying prospect for the Biden campaign.

We could use your help. Support our independent journalism with your paid subscription to keep our mission going.