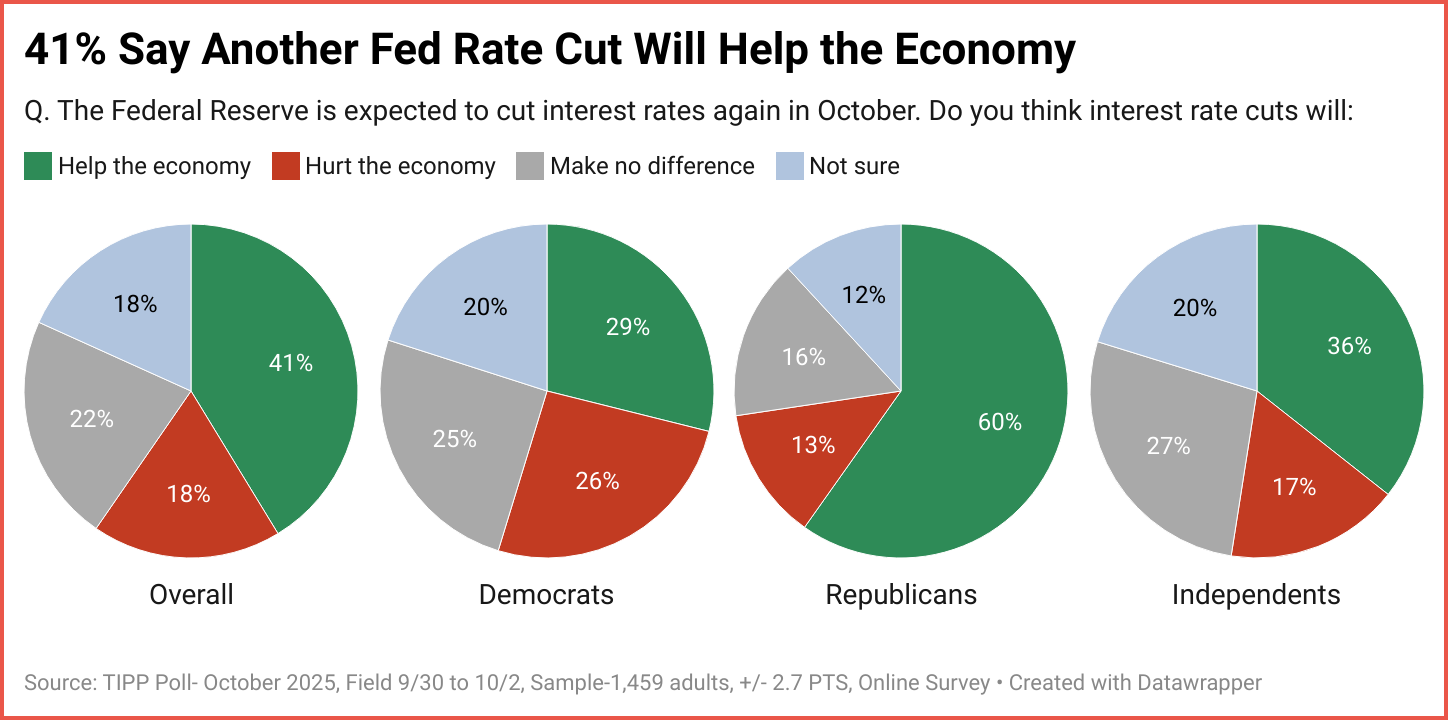

As the Federal Reserve prepares to meet this week, Americans have made their needs/demand clear: it is time to cut. Four in ten say another rate reduction would help the economy, while only 18 percent believe it would harm. Support crosses party lines. Sixty percent of Republicans and 36 percent of independents say cuts would boost growth. The verdict is clear. Monetary restraint has gone far enough.

The Weight of Inflation

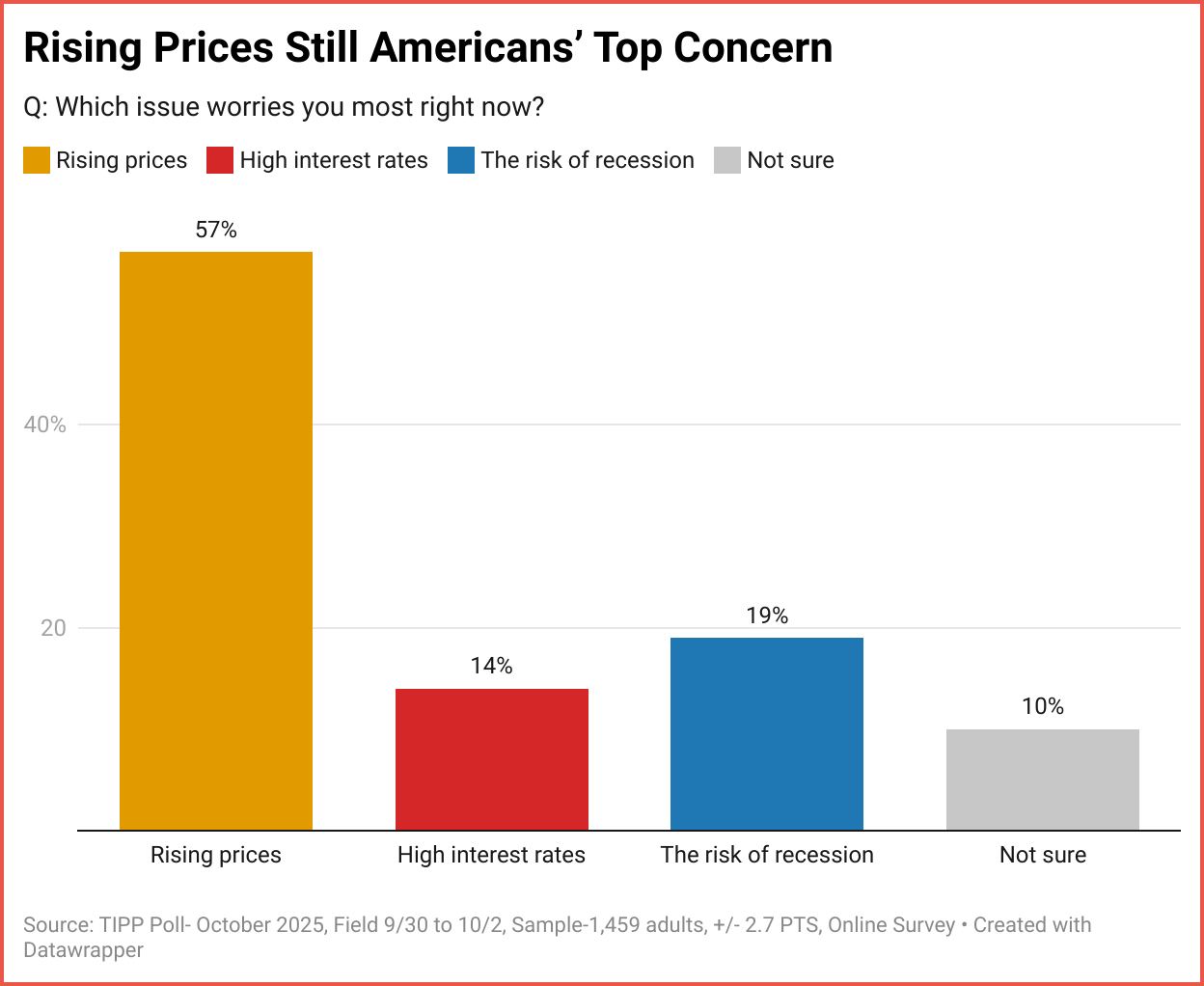

Inflation remains the nation’s top worry, not in theory but in everyday bills.

57% cite rising prices as their chief concern, compared with only 14% who name high interest rates. That gap tells the story. The Fed raised rates to fight inflation, succeeded partly, and now risks overkill.

Prices have steadied, but they still feel high, and the cost of credit has become a burden in its own right.

Housing Tells the Real Story

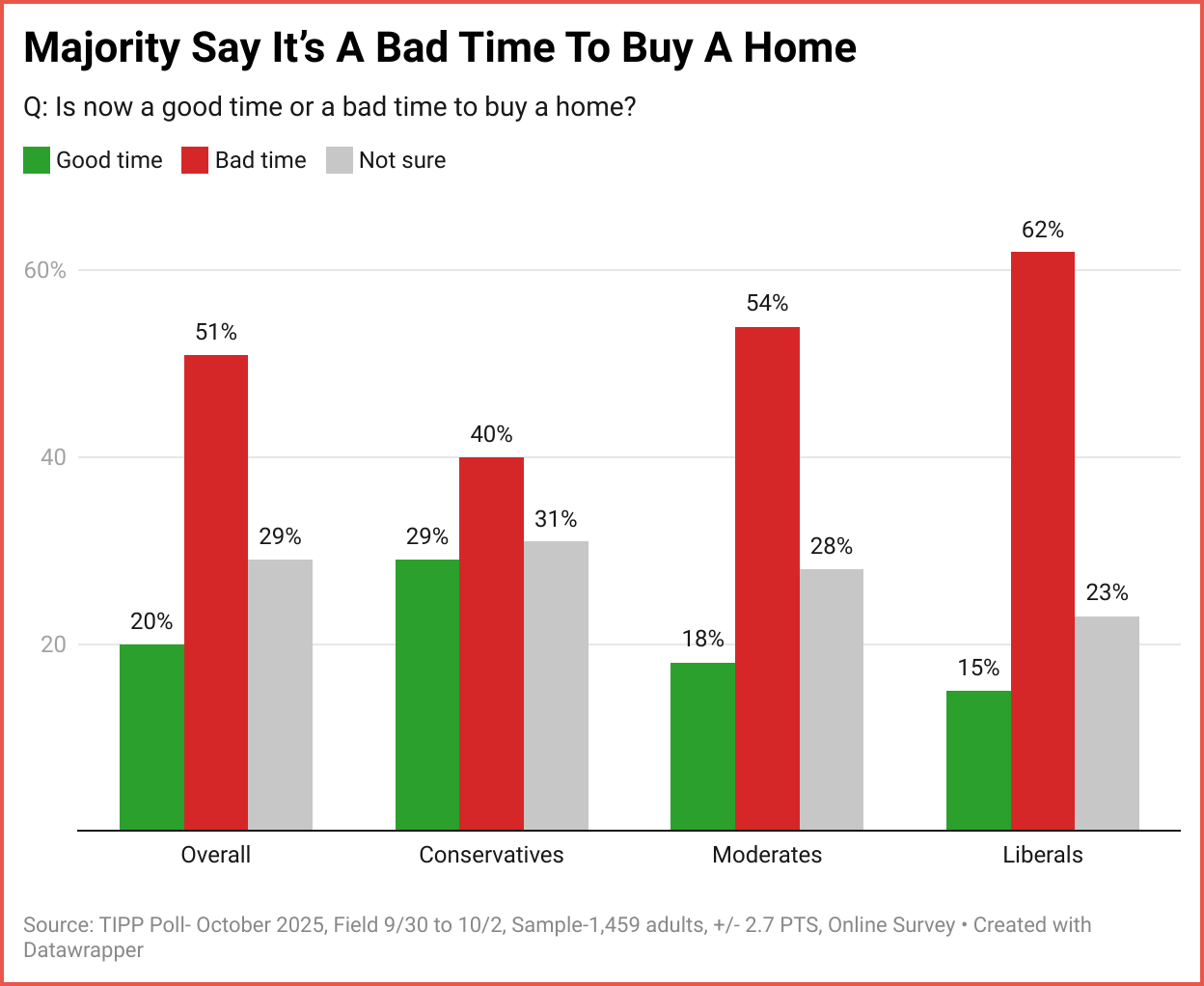

Nowhere is the danger more apparent than in the housing sector.

A majority of Americans (51%) say it is a bad time to buy, with pessimism strongest among liberals (62%) and moderates (54%).

Mortgage rates above six percent have frozen both buyers and sellers, putting the housing market in a stalemate.

When homes do not move, neither does confidence.

The Shelter Squeeze

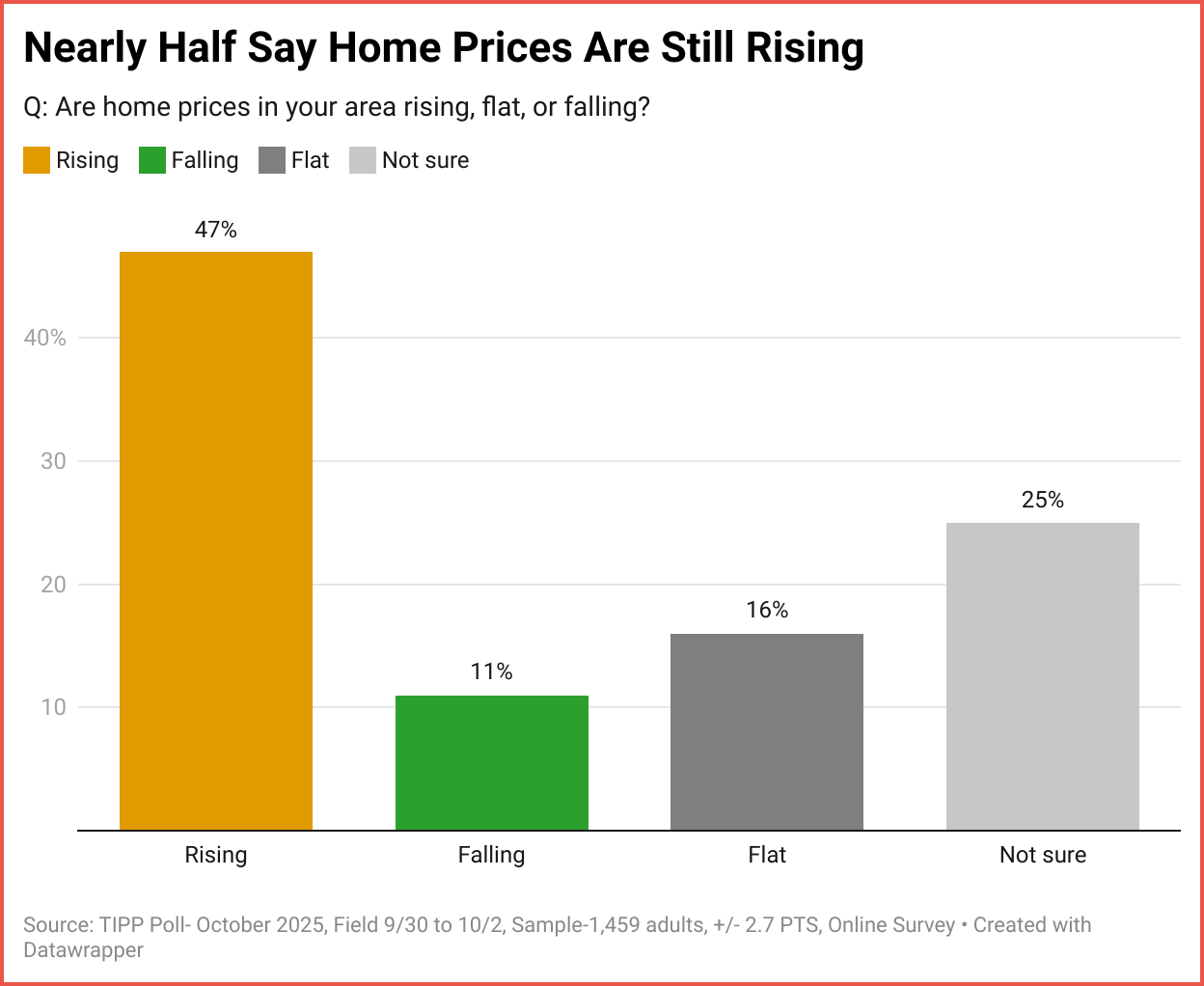

Even as demand collapses, 47% still expect prices to climb.

That paradox of falling affordability without falling prices shows how distorted the market has become. Few Americans feel relief; most feel trapped.

Housing, once the engine of optimism, has turned into a symbol of economic strain.

Cutting rates now would work through several channels that reach ordinary Americans quickly. A half-point move would ease mortgage and auto-loan rates, helping unfreeze the housing market and reviving durable-goods demand. Lower financing costs would give small firms room to hire and invest again instead of hoarding cash. Cheaper credit would also calm markets, lift consumer confidence, and support asset values that influence household spending. Inflation expectations are already stable, so a bolder cut would not reignite price pressures. It would simply reduce the financial strain that is dampening growth. The economy does not need shock therapy; only breathing room, and a 50-basis-point cut would provide it.

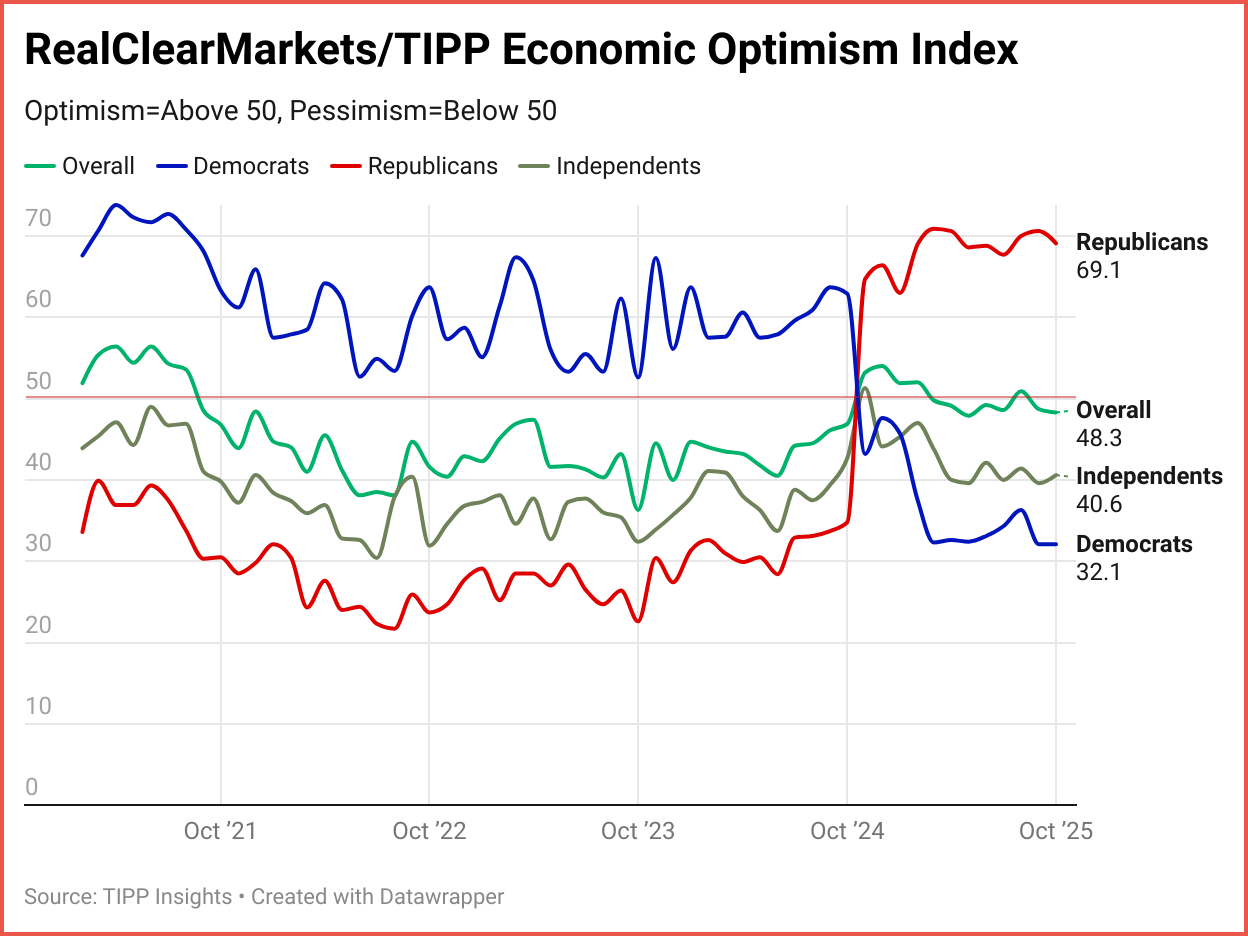

Public confidence is already fraying. The latest RealClearMarkets/TIPP Economic Optimism Index shows that Americans remain more pessimistic than optimistic about the economy. Overall sentiment is stuck below the 50-point line that marks optimism, with sharp partisan divides. Confidence has become the missing piece in the recovery puzzle. The Fed’s hesitation is making it worse.

Test Ride the Economic Optimism Tracker

Numbers tell the story. Our interactive RCM/TIPP Index brings sentiment to life month by month and party by party. Watch confidence rise and fall in real time and see what Americans really think about the economy, their wallets, and Washington.

Time to Ease Before Confidence Breaks

The Fed’s mission is to balance price stability with growth. On the first, it has largely succeeded; on the second, it is now falling behind.

A token 25-basis-point move this week would only nibble at the edges. The economy is crying out for a 50-basis-point cut. Such a step would not reignite inflation. It would restore faith. It would show that the central bank still leads rather than lags behind reality. Confidence, not caution, is what the moment demands.

The Fed raised rates to fight inflation, succeeded partly, and now risks overkill. It should ease before confidence breaks.

📊 Market Mood — Monday, October 27, 2025

🟢 Stocks Extend Rally

U.S. futures climbed as optimism built ahead of this week’s Federal Reserve policy meeting and encouraging progress in U.S.–China trade talks. Investors are also preparing for a packed week of Big Tech earnings.

🟡 Fed in Focus

Wall Street hit record highs Friday, powered by cooler-than-expected inflation data that reinforced expectations of a 25-basis-point rate cut on Wednesday. Traders now see additional easing through early 2026.

🔵 Trade Breakthrough Lifts Sentiment

Treasury Secretary Scott Bessent said the U.S. and China reached a “framework understanding” to pause new tariffs and defer export curbs, setting up a potential Trump–Xi summit later this week.

🟣 Big Tech Earnings Ahead

Five of the “Magnificent Seven” report this week, with investors watching AI spending, cloud demand, and consumer trends. Coca-Cola kicks off earnings before the tech results midweek.

🟤 Oil Slips on Trade Optimism

Crude eased as supply fears faded. Brent fell 0.8% to $64.69, and WTI dropped 0.8% to $61.02 a barrel, giving back some of last week’s gains.

🟠 Gold Retreats Further

Gold slid 2% to $4,031/oz, extending its pullback as easing tensions and profit-taking reduced safe-haven demand.

Market round-up in 5 minutes. We bring you up to speed. Subscribe to TIPP Insights for $99/year.

📅 Key Events Today

🟧 Monday, October 27

🟨 Durable Goods Orders (Sep)

Tracks new orders for long-lasting manufactured goods — a leading indicator of industrial demand and business investment.

🟧 New Home Sales (Sep)

Measures the number of newly built homes sold during the month, offering insight into housing market strength and consumer confidence.

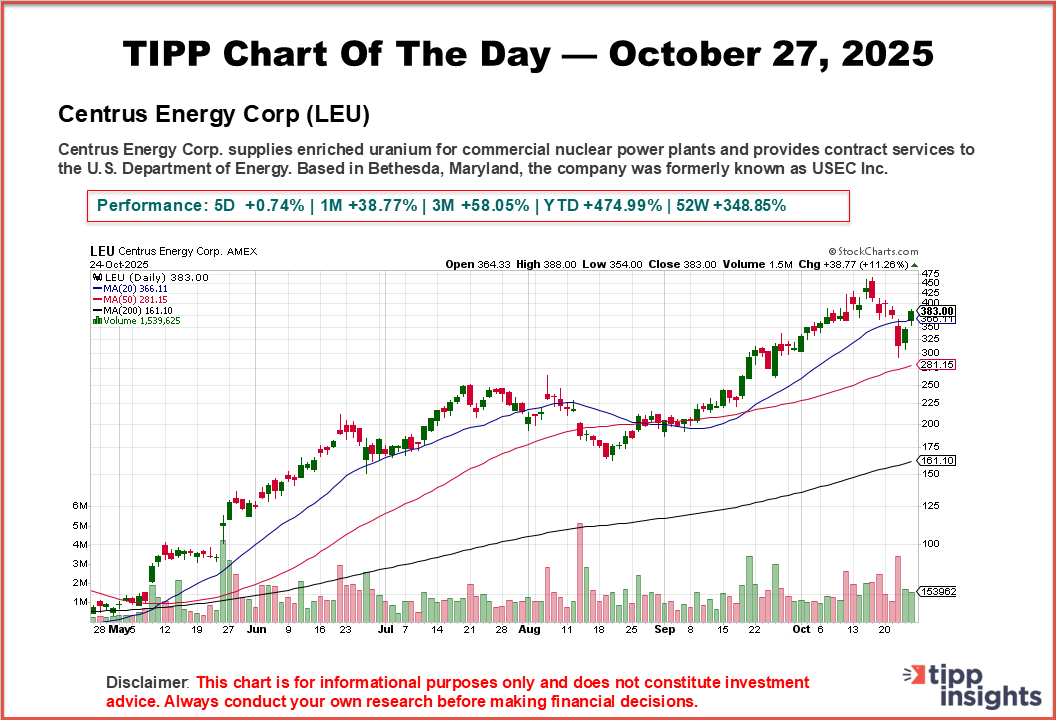

Access our Featured Stocks and TIPP Top-20 archives — exclusive to paid subscribers. Subscribe now → $99/year.