The government narrowly avoided closing after Congress came to a last-minute, short-term political deal to keep it open for another 45 days. With soaring spending and exploding federal debt, the latest partisan dispute was inevitable. But Americans have a clear retort, according to the latest I&I/TIPP Poll: Regardless of party, they want cuts in federal spending, and blame our dangerously soaring debt on Congress’s failure to do so.

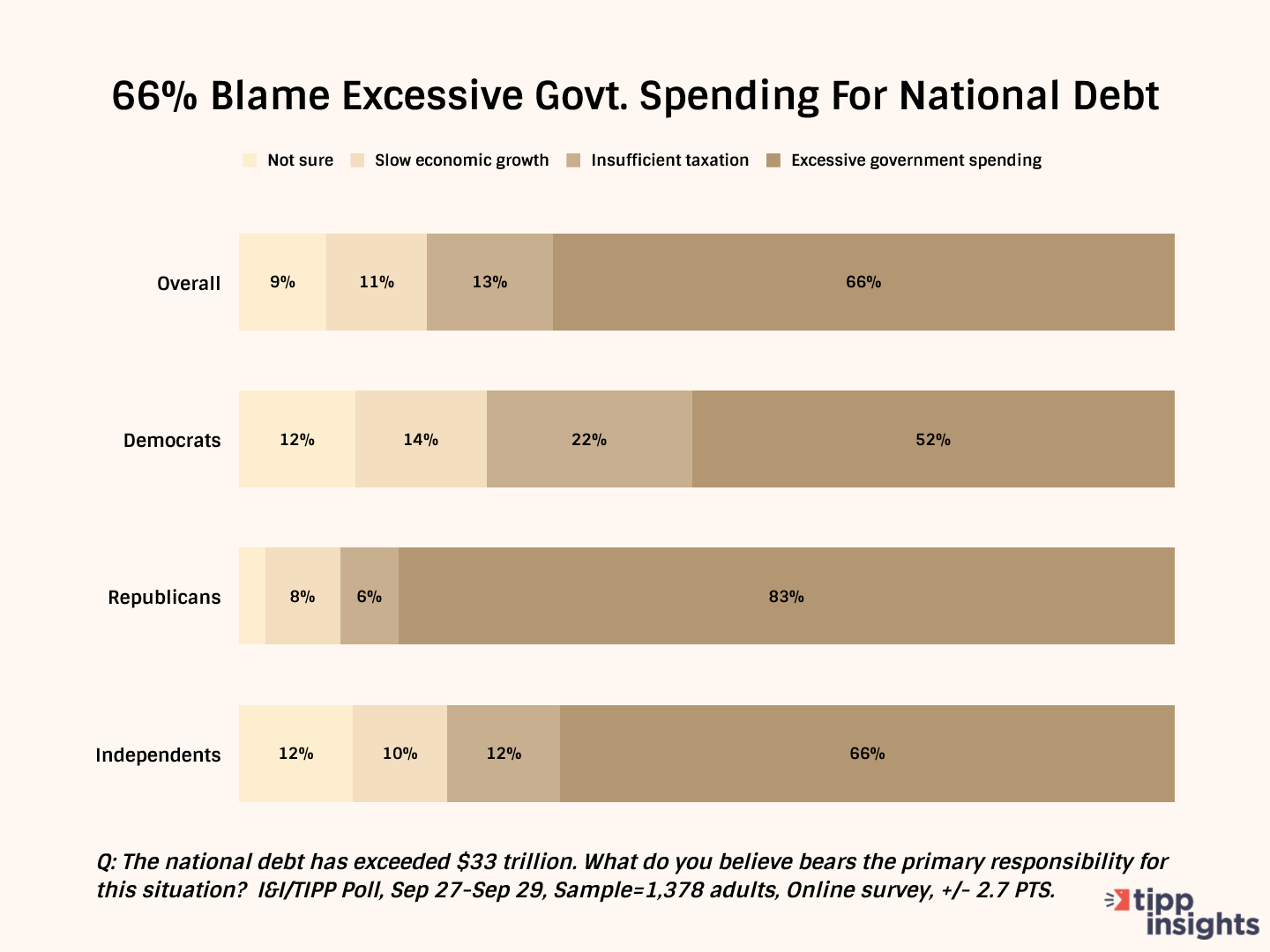

The national online poll of 1,378 Americans, taken from Sept. 27-29, asked respondents two questions related to the current budget impasse. The first: “The national debt has exceeded $33 trillion. What do you believe bears the primary responsibility for this situation?”

The message from the poll, which has a margin of error of +/-2.7 percentage points, was clear: Overall, 66% blamed surging debt on “excessive government spending,” followed by “insufficient taxation” (13%), “slow economic growth” (11%) and “unsure” (9%).

In short, two-thirds of Americans see too much spending as fueling our record debt. And perhaps the most surprising thing is that a majority in each major political group agrees.

Even among Democrats, 52% faulted spending for the debt buildup, while 22% said not enough taxes and 14% blamed slow economic growth. Another 12% weren’t sure.

For Republicans, no great shock, a hefty 83% fingered too much spending as the culprit, while 6% claimed insufficient taxes and 8% said not enough economic growth were to blame.

As usual, independents, many of whom are political refugees from the two parties, split the difference: 66% blamed too much spending for our debt woes, while only 12% faulted not enough taxes and 10% pointed to insufficient economic growth.

Among all the demographic groups tracked by the I&I/TIPP Poll, only two fell below 50% on blaming too much spending for our national debt surge: Hispanic voters (48%) and self-described liberals (47%). A majority of black voters, at 51%, pointed at too much spending as the cause of our rising debt.

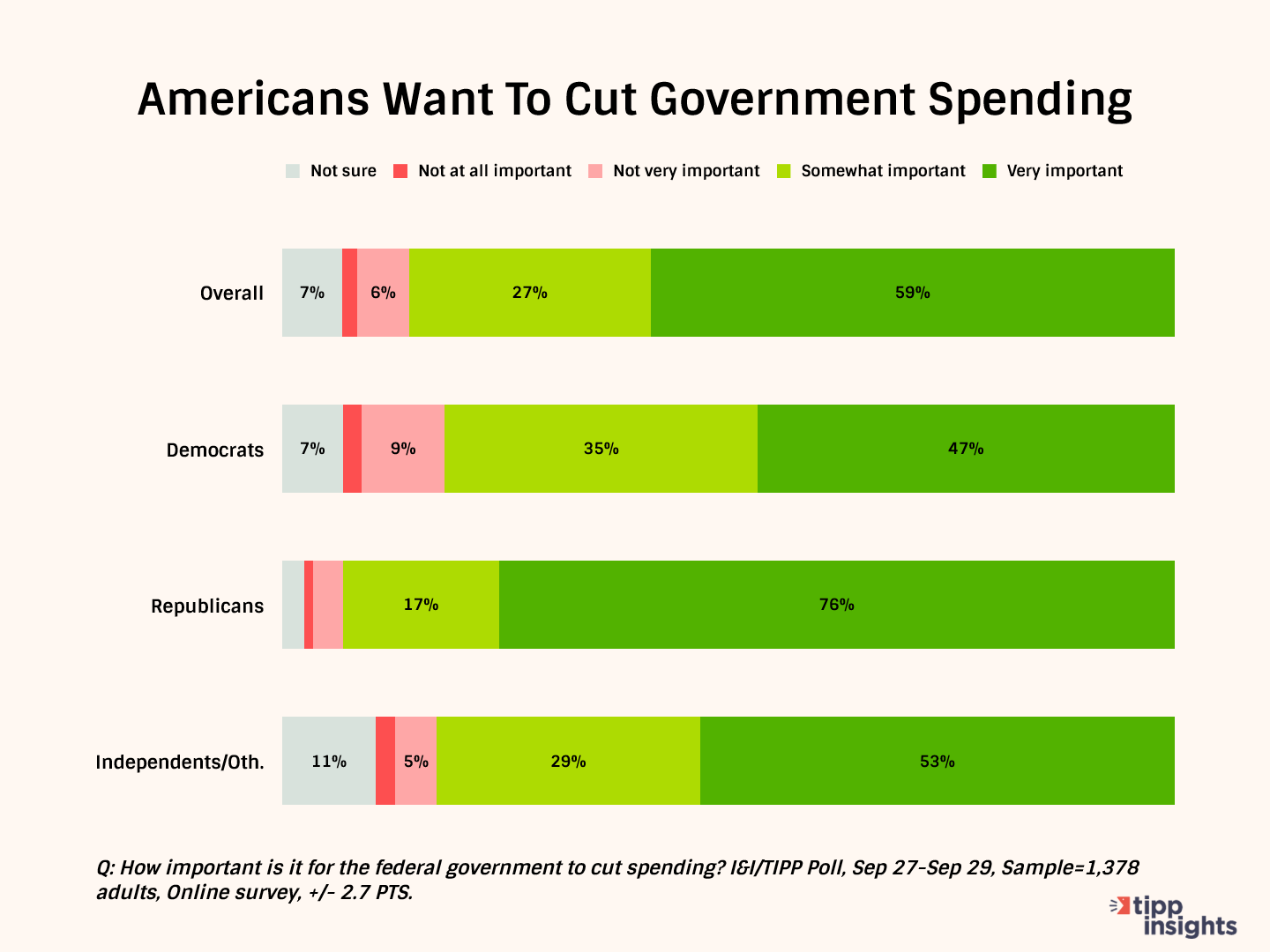

A follow-on question was asked: “How important is it for the federal government to cut spending?” Turns out, it’s consequential to almost all Americans. Among those answering, 86% called it either “very important” (59%) or “somewhat important” (27%).

Only about 7% (numbers don’t add up due to rounding) said cutting spending was either “not very important” (6%) or “not at all important” (2%). Another 7% weren’t sure.

And once again, the importance of cutting spending was overwhelmingly tri-partisan, with 82% of Democrats, 93% of Republicans and 82% of independents in clear agreement.

So it’s logical to ask: Will spending ever be cut? And when will the debt stop growing so fast? The just concluded budget negotiations, which narrowly avoided a shutdown, show why the gloomy answer to those questions likely is “no” and “never.”

Saturday’s last-minute agreement to keep the government open for another 45 days largely hinged on debates over funding for Ukraine’s war with Russia (Democrats), border security (Republicans), and disaster aid.

No doubt, eventually a final deal will be hammered out, and triumphant politicians will appear on the steps of the Capitol to hail their great budgetary statesmanship. As always, news outlets will laud the great compromise.

Lost amid all the back-patting, however, will be the fact that federal spending will remain swollen at pandemic levels and grow further in coming years, without the revenues to support them.

And there will be no cuts of any significance in government spending, even though fiscal conservatives had hoped to use the budget fight to reduce outlays and win concessions from Democrats on key policy issues. It didn’t happen.

“They lost that fight miserably,” The Hill observed, describing fiscal conservatives as among the biggest “losers” of the budget battle.

“After 21 conservatives sunk a GOP-only stopgap bill, (House Speaker Kevin) McCarthy ditched partisan strategies and rolled out a stopgap bill that continues funding at current levels, turning longtime conservative worries into reality. It cleared the chamber with more support from Democrats than Republicans,” the Hill wrote.

More spending means more debt. It’s inescapable.

Total federal debt today stands at $33 trillion, up from $21.5 trillion just five years ago. Put another way, one of every three dollars the U.S. owes has been borrowed in the last five years, a shocking level of debt growth that is now starting to pinch.

In short, government is spending way too much.

From August 2022 to this July, federal spending was roughly $6.7 trillion, an increase of 16%, while revenue came in at just $4.5 trillion. a 7% decrease, according to the nonpartisan Committee for a Responsible Federal Budget. This has pushed interest rates to 20-year highs.

It won’t get any better. This year, the deficit will hit $2 trillion again, on its way even higher, after briefly dropping last year to just $1 trillion in what was then hailed as a turnaround for the economy. More deficits equal more debt.

“The federal budget deficit in the first 10 months of the 2023 fiscal year has more than doubled compared to the same period last year, increasing by 122%,” according to a Washington Examiner analysis. “On Aug. 1, one of the three major credit rating agencies, Fitch, downgraded U.S. debt from a AAA rating to AA+ specifically because of that soaring debt.”

Now the deficit for the just-ended fiscal year is expected to hit $2 trillion, twice the level predicted, after briefly dropping in 2022 to “just” $1 trillion in what was then hailed as a fiscal turnaround for the economy.

The new debt issued to cover the federal government’s incessant spending growth will push up net federal interest payments to nearly $1 trillion a year by 2026, more than we will spend on either entitlements or defense and up from around $350 billion in 2021, as Issues & Insights showed recently.

But didn’t we need all that spending to save the economy? Hardly, as the Center for Budget Priorities points out, only 12% of spending today is “discretionary.” Everything else, all 88% of it, is spending that is almost impossible to cut without broad agreement in Congress.

Voters desperately want spending cut and less debt at the federal level, as the I&I/TIPP Poll clearly indicates. But as long as Americans vote for politicians who want more spending, more regulation and more debt, they’re likely to remain deeply disappointed.

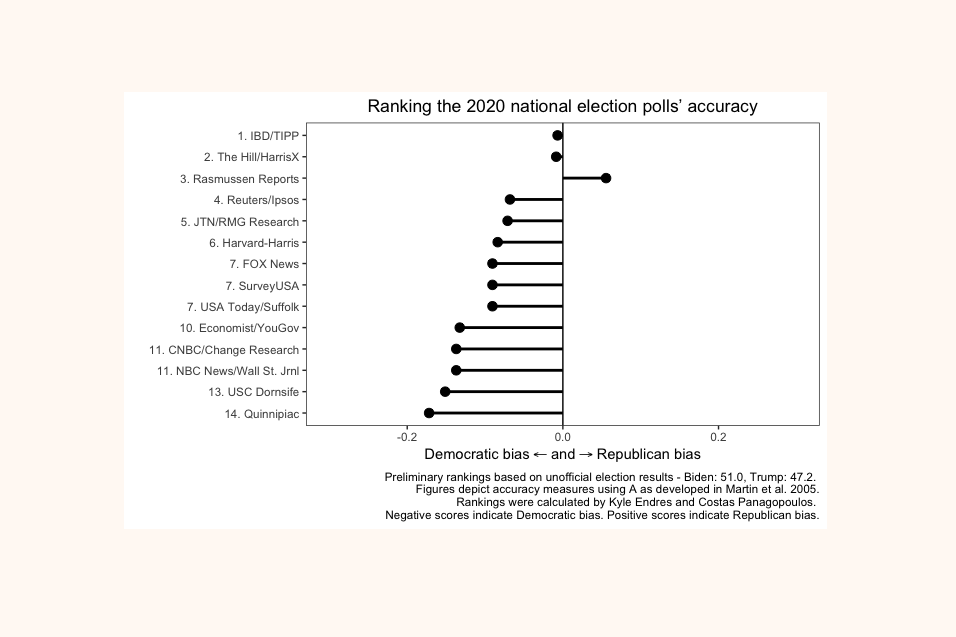

I&I/TIPP publishes timely, unique, and informative data each month on topics of public interest. TIPP’s reputation for polling excellence comes from being the most accurate pollster for the past five presidential elections.

Terry Jones is an editor of Issues & Insights. His four decades of journalism experience include serving as national issues editor, economics editor, and editorial page editor for Investor’s Business Daily.

Want to dig deeper? Download crosstabs from our store for a small fee!

Our performance in 2020 for accuracy as rated by Washington Post: