- Bidenflation annualized at 5.4%, squeezes Americans’ wallet

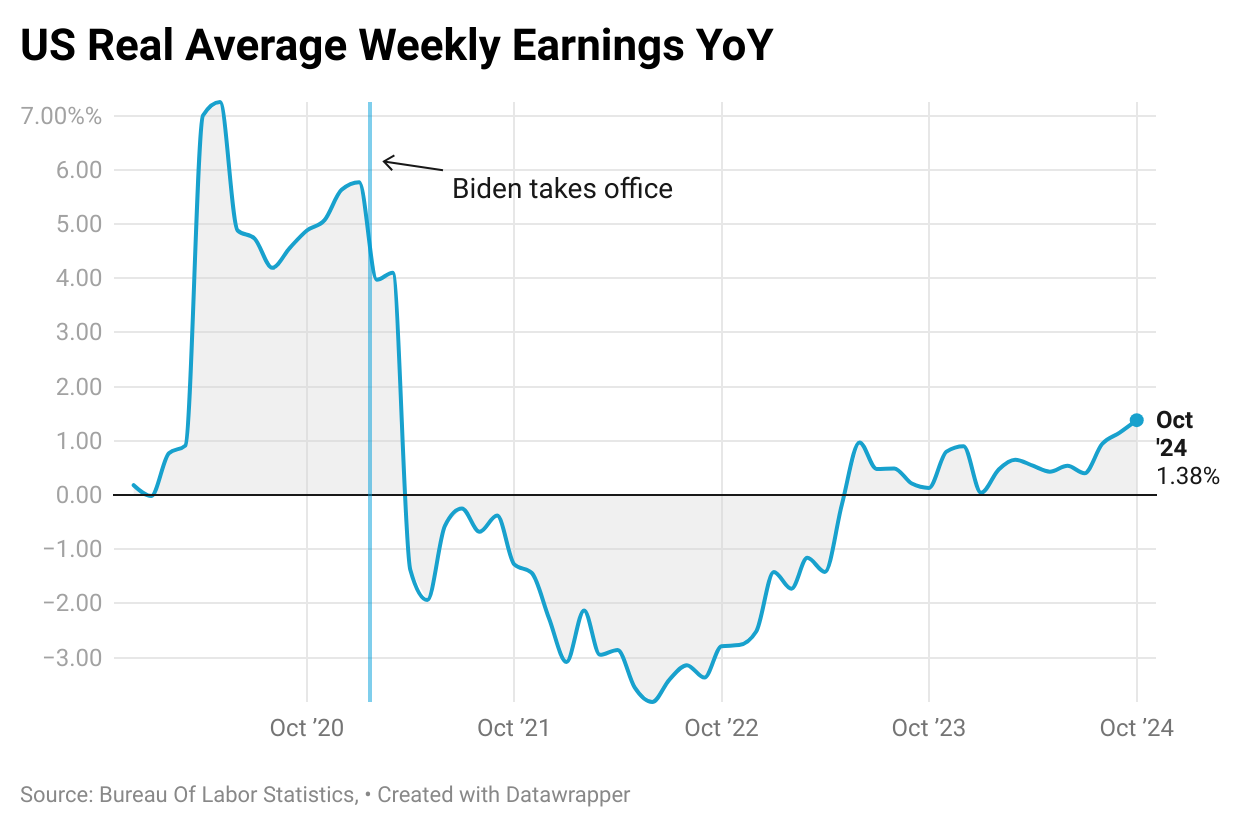

- Average weekly earnings have dropped 3.1% under Biden

- Core inflation remains stubborn at 3.3%

- One-half rate food prices as the top economic concern

- Trump’s election drops "very concerned" about inflation below 50% for the first time since March 2022.

Bidenflation is alive and well—and it just handed the GOP a decisive victory. With an annualized rate of 5.4%, this singular statistic is poised to define President Biden's legacy.

Corporate media has decided inflation is "over" and moved on, but we still get calls and emails from loyal readers asking if we've fallen for that spin. Now they're obsessing over the President-elect and how his policies might worsen inflation. It's just sad—wealthy media elites are completely out of touch. The recent election proved they were the biggest losers, and honestly, we doubt they’ll ever get their credibility back. Meanwhile, this is the only article out there that truly captures the pain of Bidenflation. What a pity.

When Biden-Harris took office, inflation was at just 1.4%. Since March 2021, inflation has consistently remained above the Federal Reserve's 2% target (45 consecutive months).

Under Biden-Harris, the federal debt has increased by $8.2 trillion. To finance the President’s spending spree, the Federal Reserve printed money from nothing. The increased money supply, without a corresponding increase in goods and services, reduced the value of each dollar, causing prices to rise quickly and leading to high inflation, effectively acting as a hidden tax on everyone.

Prices have increased by 20%, while real wages have declined by 3.1%. Average weekly earnings for all employees dropped 3.1% to $385.56 in October 2024 from $397.9 in January 2021, when Biden-Harris took office.

Think of it as the 20% hidden tax Americans pay yearly.

According to the government’s CPI inflation calculator, an American now needs an additional $206.75 to cover the same $1,000 in family expenses as in January 2021. A household with $50,000 in expenses back then adds up to $60,338 today. The problem? Wages aren’t keeping pace.

A recent MarketWatch survey found that 48.6% of Americans consider themselves to be “broke,” and 66.2% feel they are “living paycheck to paycheck.”

So, how do you make ends meet? Many Americans are taking on second jobs, borrowing, or cutting back on essentials—and that’s the reality for millions.

American household debt has increased significantly amid challenging economic conditions. U.S. credit card debt hit a record $1.17 trillion in Q3 2024, up $24 billion from the previous quarter and 8.1% higher than a year ago. The average credit card balance per consumer is $6,329, rising 4.8% year-over-year. 28% of Americans reported increased debt over the last three months, often due to persistent inflation and high interest rates, which have strained household finances. Credit card interest rates remain above 20%, near an all-time high, disproportionately affecting lower-income households.

Housing affordability has also collapsed due to skyrocketing home prices and high mortgage rates. Buying a home in America now requires an income of $107,700—nearly double the $56,800 needed in 2019. Just 36% of households can afford a new home today, compared to 59% five years ago. Soaring home prices, fueled by the pandemic, along with mortgage rates that nearly doubled to 7.3% at their peak, have made homeownership out of reach for many. Even with rates easing slightly, affordability remains a major casualty of inflation.

Nearly half of all renters spend more than 30% of their income on rent, with a quarter spending over 50%, making it difficult to save for a down payment.

Inflation is hitting wallets hard. The LendingTree survey found that 78% of consumers view fast food as a luxury purchase because of rising costs, with 62% eating it less frequently. Americans adopt various strategies in their struggle to adjust to higher food costs. Some concerning trends include 31% eating less (reducing portion sizes) and 24% skipping meals.

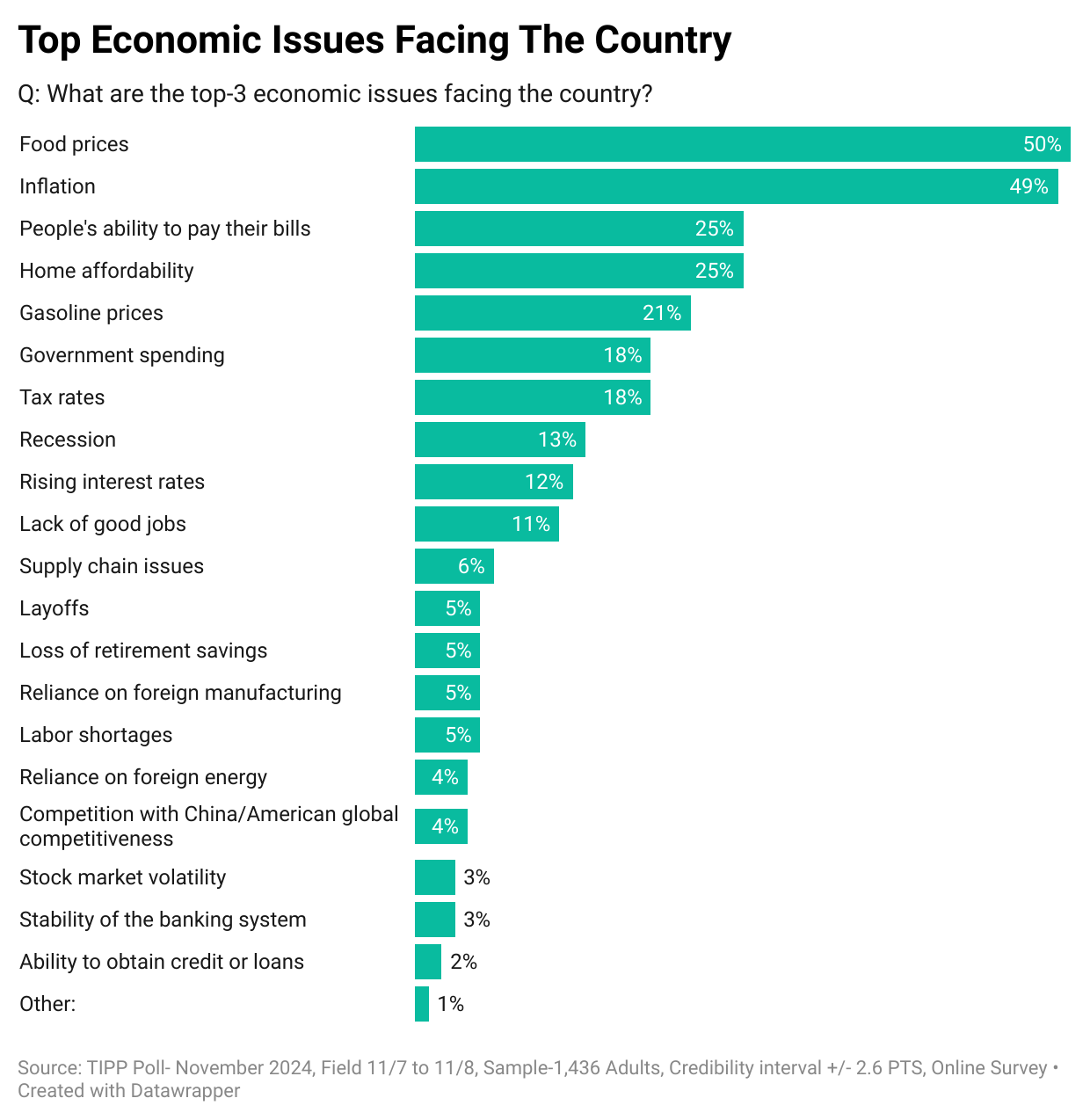

Therefore, it is unsurprising that inflation and food prices emerged as the top economic issues among Americans in the November TIPP Poll conducted after the presidential election.

CPI Report

The government's Consumer Price Index (CPI), released on Wednesday, showed a 2.6% year-over-year price increase from October 2023 to October 2024.

The CPI rate declined steadily for 12 consecutive months, dropping from a 40-year high of 9.1% in June 2022 to 3.0% in June 2023. This trend was interrupted by an increase to 3.2% in July 2023. From July 2023 to June 2024, the rate fluctuated within the 3.0%–3.9% range before decreasing to 2.9% in July 2024, then further declining to 2.5% in August and 2.4% in September.

After adjusting for seasonality, the Consumer Price Index (CPI) increased by 0.2% between September 2023 and September 2024. During the same period, food prices increased by 0.2%, energy prices stayed steady with no change, and core prices (all items except food and energy) increased by 0.3%.

TIPP CPI

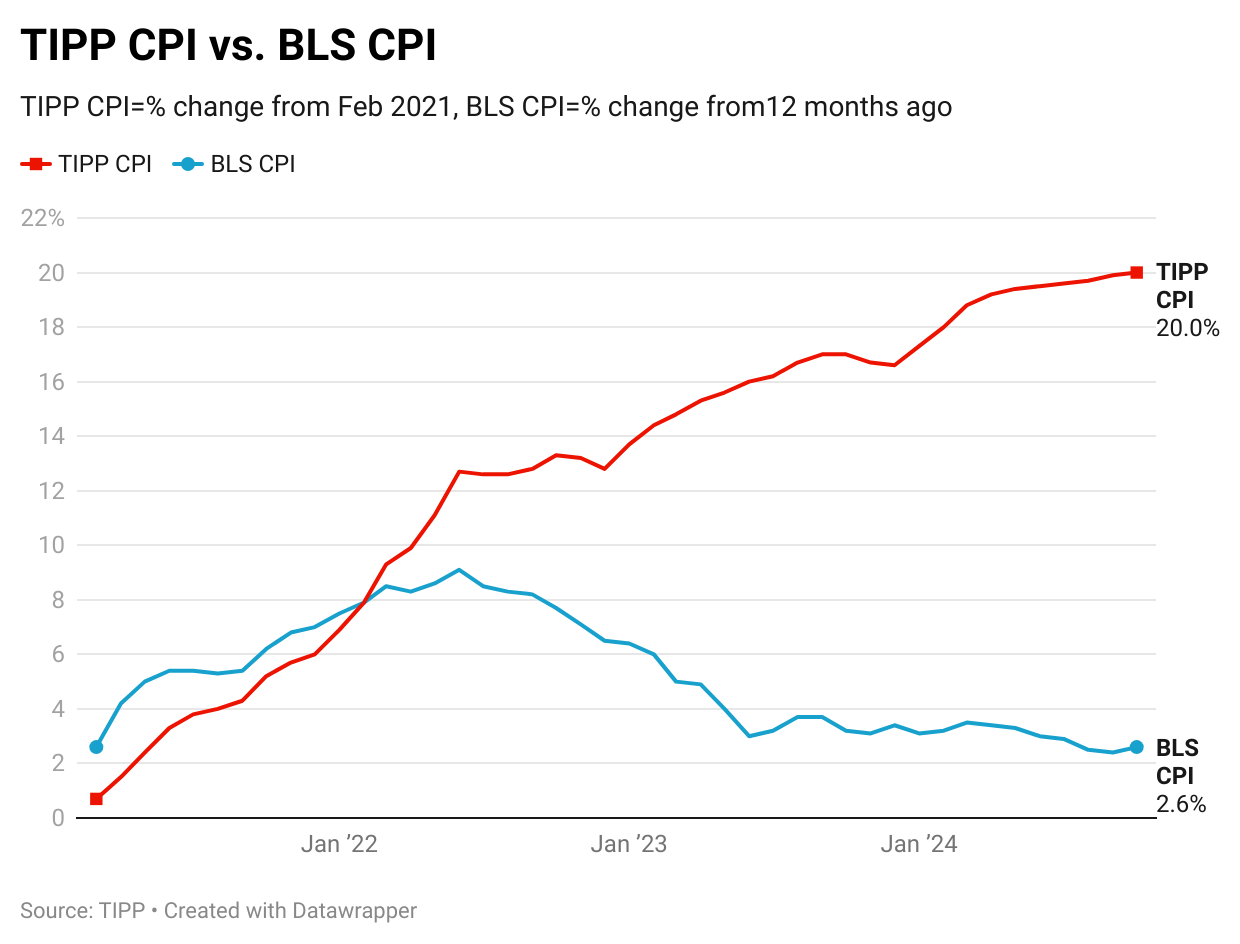

We developed the TIPP CPI, a metric that measures the rate of change using February 2021, the month after President Biden's inauguration, as the base. All TIPP CPI measures are anchored to this month, making them exclusive to the economy under Biden-Harris.

What is the motivation behind the TIPP CPI?

The official BLS CPI year-over-year calculations compare prices to already inflated bases, and these statistics could mask the full impact. Further, the media and some economists frequently use the low CPI rate to present a rosy economic outlook supporting Biden-Harris policies.

In contrast, the TIPP CPI rate offers a clearer understanding of Americans’ economic challenges under Biden-Harris. We use the relevant data from the Bureau of Labor Statistics (BLS) to calculate the TIPP CPI, but we adjust the period to Biden-Harris tenure. When discussing the TIPP CPI and the BLS CPI, we convert the index numbers into percentage changes to better understand and compare them. CPIs are like index numbers that show how prices affect people's lives, similar to how the Dow Jones Industrial Average reflects the stock market.

Bidenflation, as measured by the TIPP CPI using the same underlying data, surged to 20.0% in October 2024. Starting at 17.3% in January, it steadily climbed throughout the year, reaching 19.2% by April and incrementally rising month by month to hit 20.0% in October.

TIPP CPI vs. BLS CPI

The following two charts present details about the new metric.

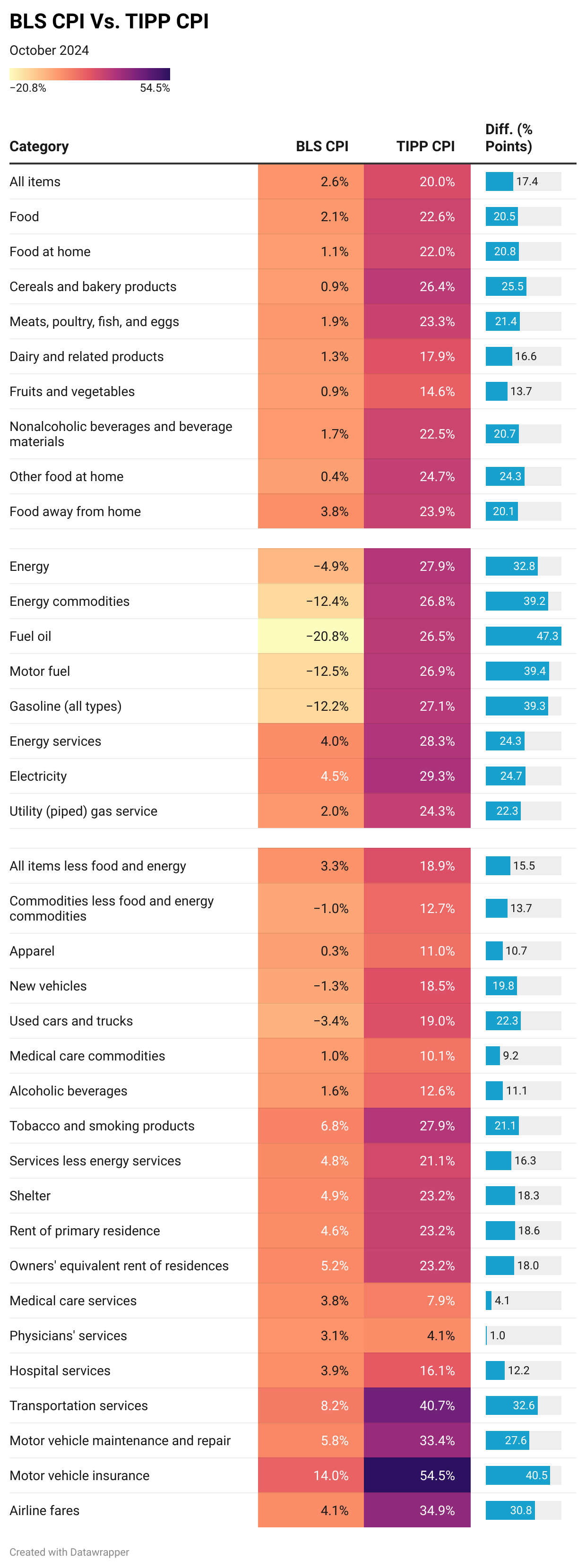

For October 2024, the BLS reported a 2.6% annual CPI increase. Compare this to the TIPP CPI of 20.0% - a 17.4-point difference. Prices have increased by 20.0% since Biden-Harris took office. On an annual basis, the TIPP CPI rate is 5.4%.

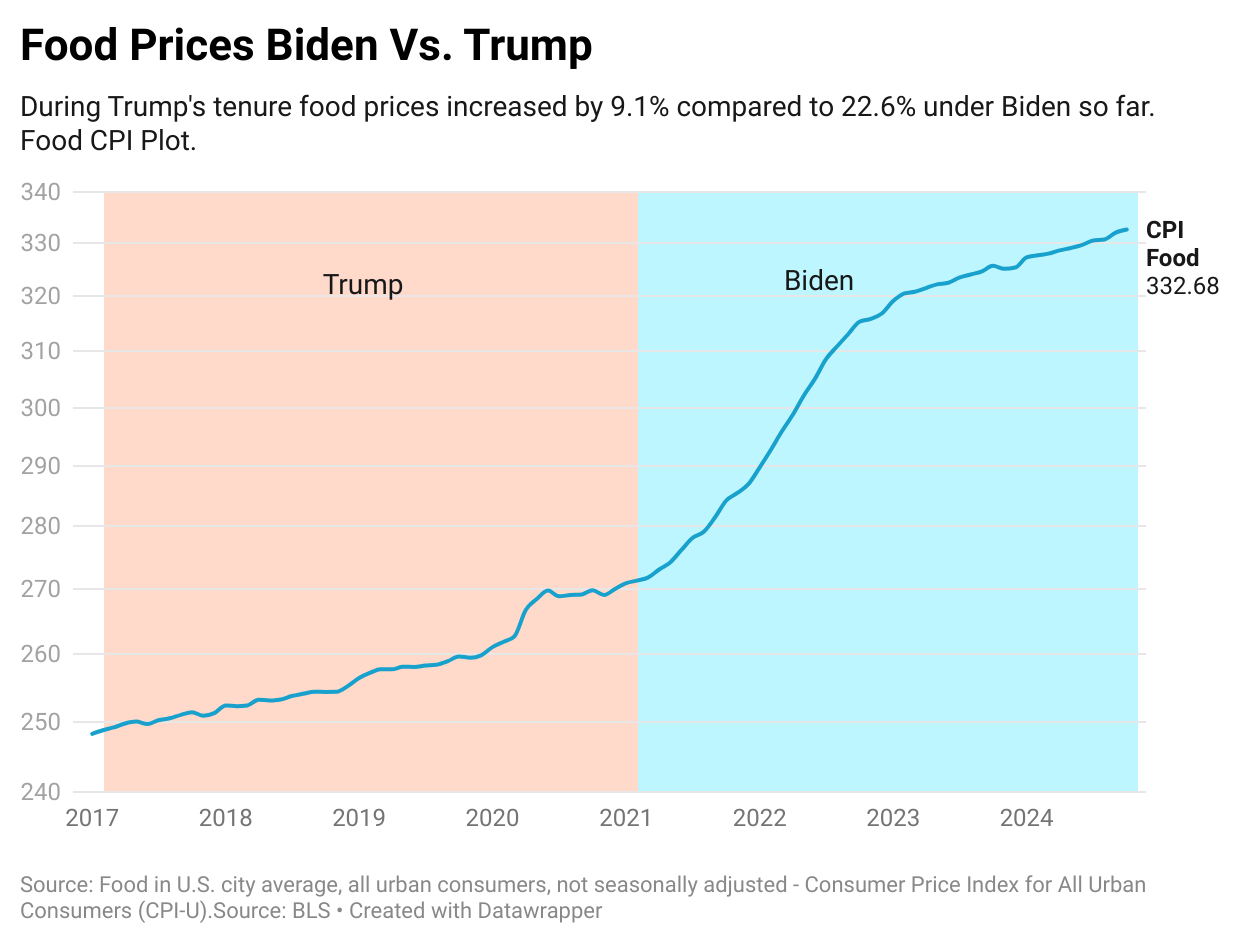

Food prices increased by 22.6% under Biden-Harris per TIPP CPI, compared to only 2.1% as per BLS CPI, a difference of 20.5 points.

TIPP CPI data show that Energy prices increased by 27.9%. But, according to the BLS CPI, energy prices dropped by 4.9%. The difference between the two is a whopping 32.8 points.

The Core CPI measures the price increase for all items, excluding food and energy. The Core TIPP CPI is 18.9% compared to 3.3% BLS CPI, a 15.5-point difference.

Gasoline prices have increased by 27.1% since Biden-Harris took office, whereas the BLS CPI shows that they have declined by 12.2%, a difference of 39.3 points.

Shelter costs rose by 23.2% under Biden-Harris’s watch, compared to the BLS reading of 4.9%, a difference of 18.3 points.

TIPP CPI finds that Used car prices have risen by 19.0% during the current administration. Meanwhile, the BLS CPI reports that the prices have dropped 3.4%, a difference of 22.3 points.

Air ticket inflation is 34.9% compared to the BLS CPI’s finding of an improvement of 4.1%, a difference of 30.8 points.

Motor vehicle insurance increased by 54.5% compared to the BLS CPI’s increase of 14.0%, a difference of 40.5 points.

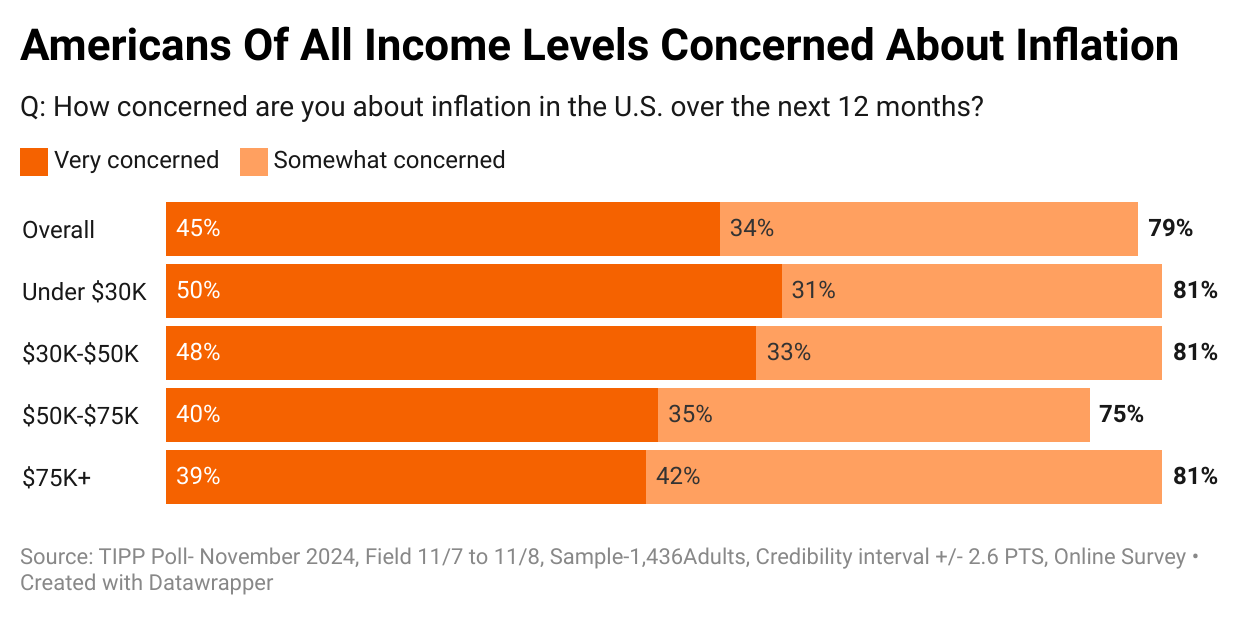

The latest TIPP Poll, completed in early November after the election, shows that nearly eight in ten (79%) survey respondents are concerned about inflation. As the chart below shows, this concern is shared across income levels. The share of those “very concerned” is highest among the Under $30K household and tapers as household income increases, with 39% for the $75K+ group.

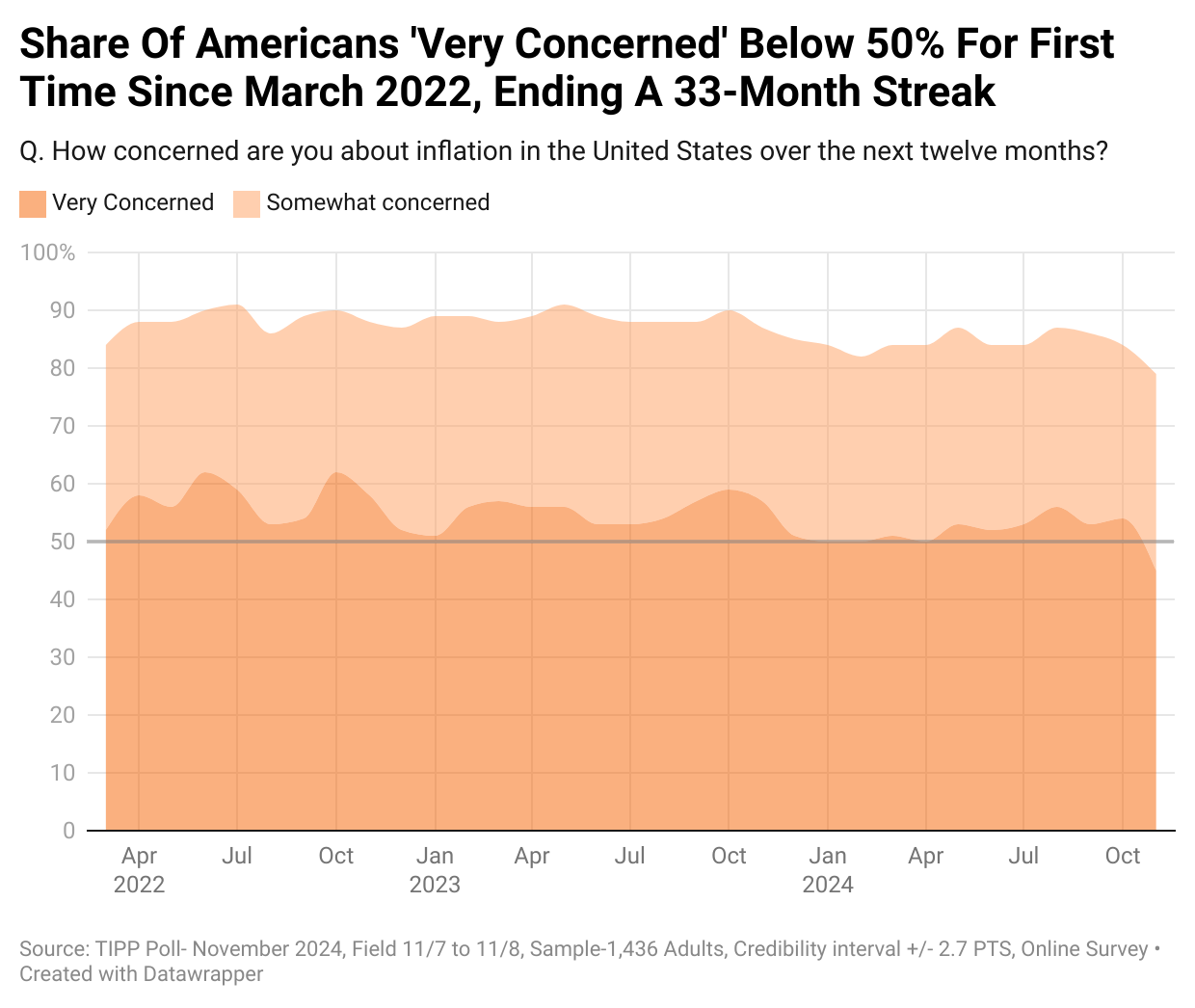

Since January 2022, inflation concerns have consistently remained above 80%. It’s welcome news that in November, the share of Americans who are "very concerned" dipped below 50% for the first time in 33 months.

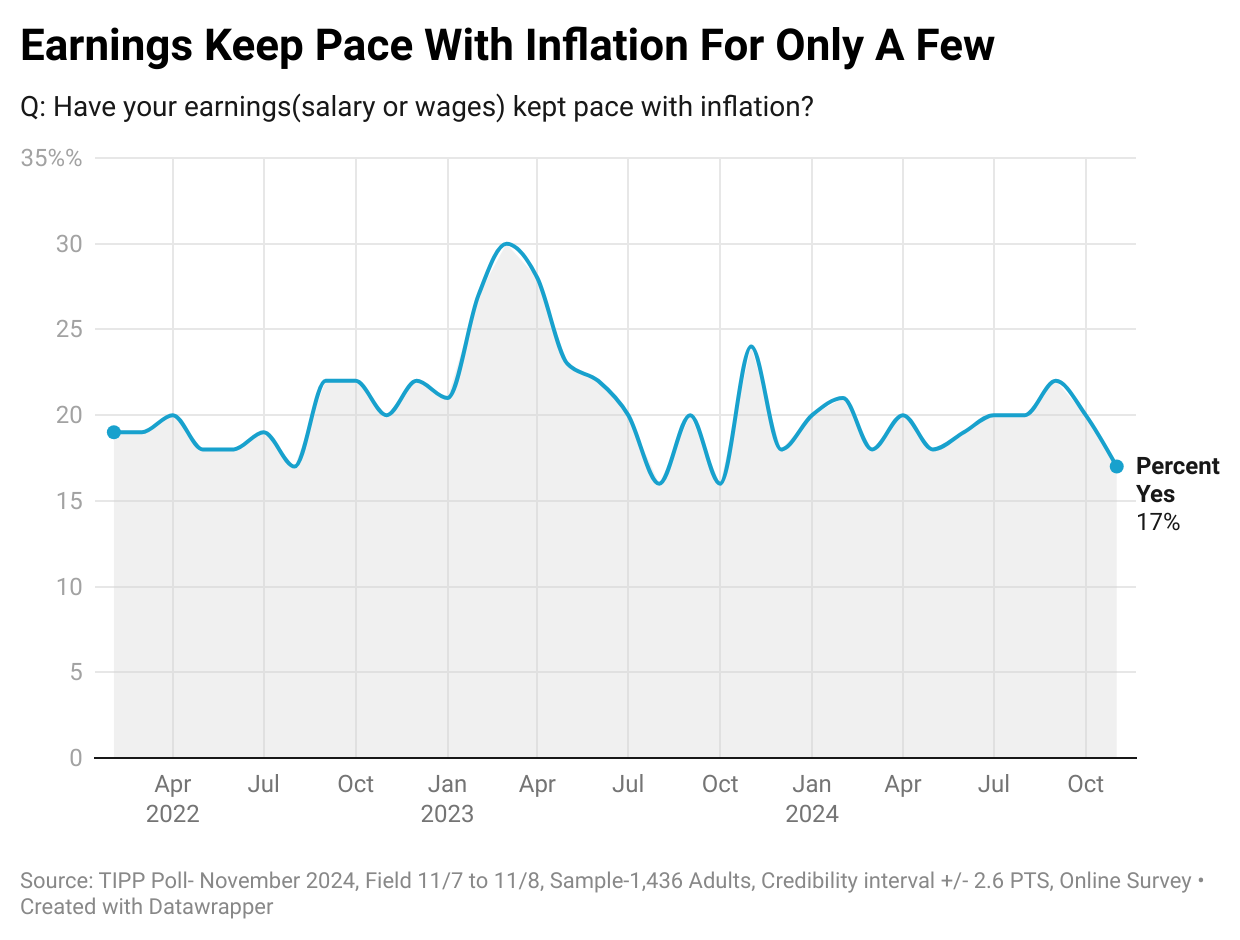

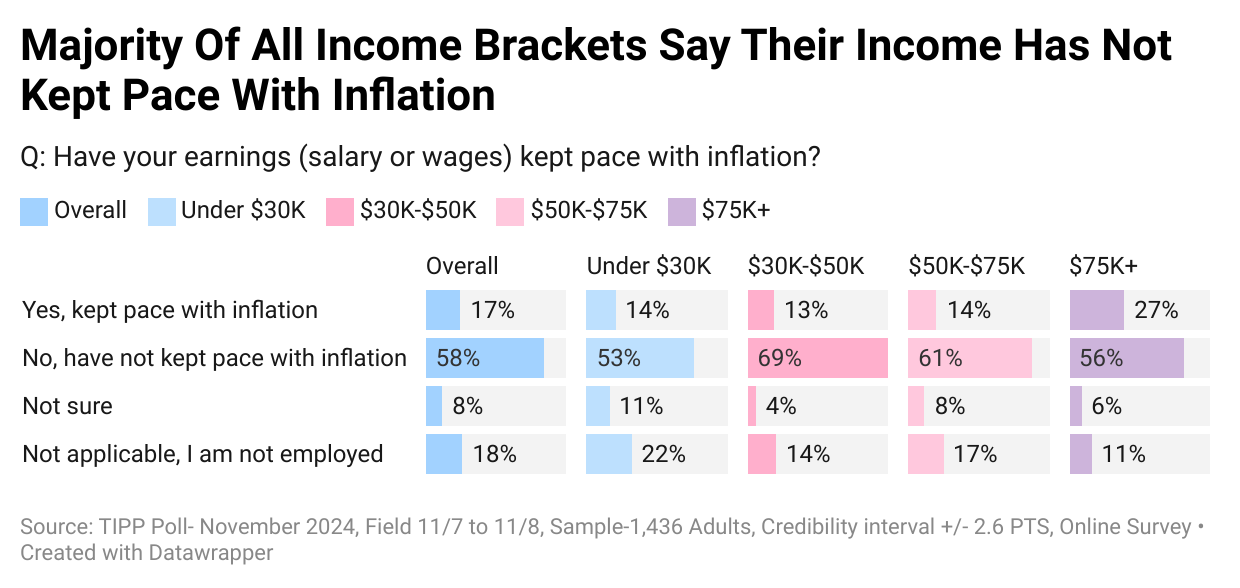

Over half (58%) say their wages have not kept up with inflation, while only one in six (17%) say their income has. Since December 2023, this statistic has moved in a tight 18% to 21% range.

Our data shows that the majority of households in all income brackets find that their earnings have not kept pace with inflation: 53% for households under $30K, 69% for households $30K to $50K, 61% for households $50K to $75K, and 56% for households $75K+.

Nominal wages represent the amount of money one earns without considering changes in the cost of living. On the other hand, real wages consider inflation and measure the purchasing power of wages. Real wages provide a more accurate reflection of what is affordable with the income earned by factoring in the changes in the cost of living.

Real weekly wages, measured year-over-year, showed negative readings for 26 out of the 42 months during the Biden presidency from February 2021 to June 2024. The 26-month negative streak was broken in June 2023. Since then, the measure has posted positive readings.

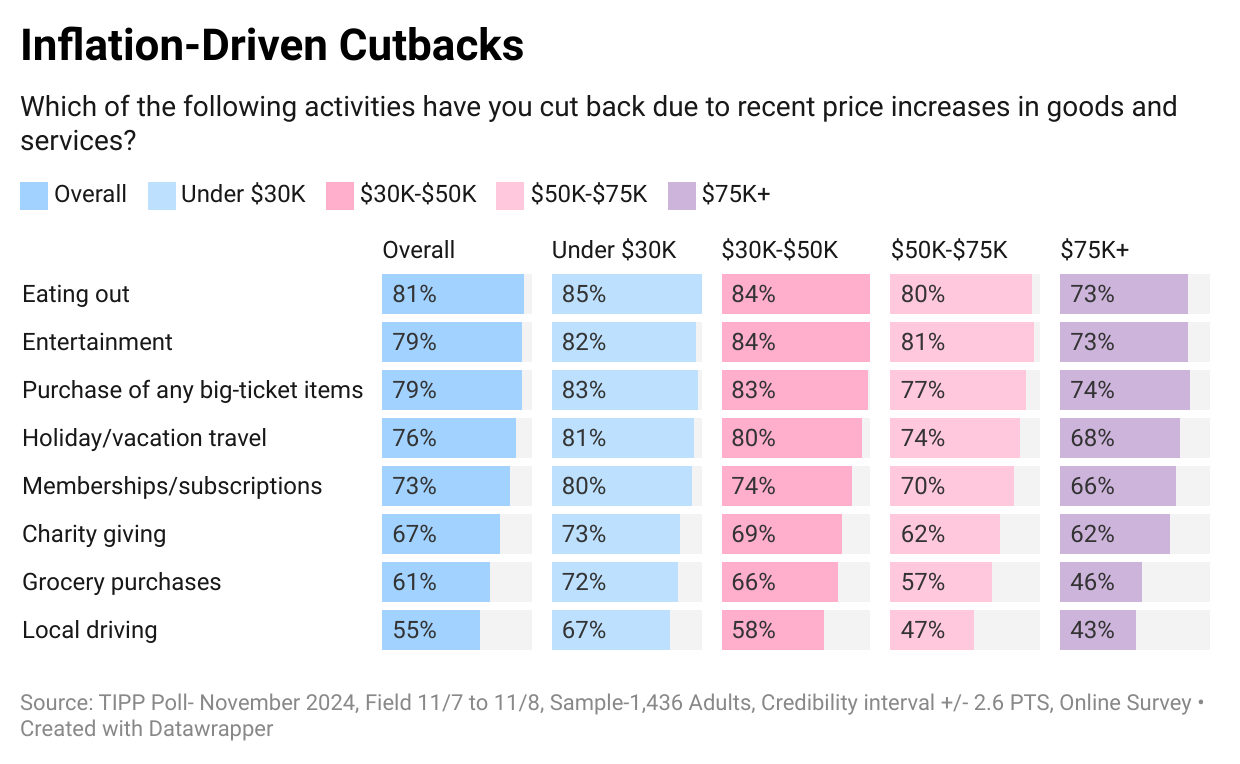

As a result of inflation, Americans are cutting back on household spending.

They are cutting back on eating out (81%), entertainment (79%), purchasing big-ticket items (79%), holiday/vacation travel (76%), and memberships/subscriptions (73%).

Over two-thirds (67%) are cutting back on charity giving. Over half (61%) spend less on groceries, and the high gasoline prices forced 55% to cut back on local driving.

The cutbacks are more prevalent among lower-income households than their higher-income counterparts.

Inflation Direction (Mixed)

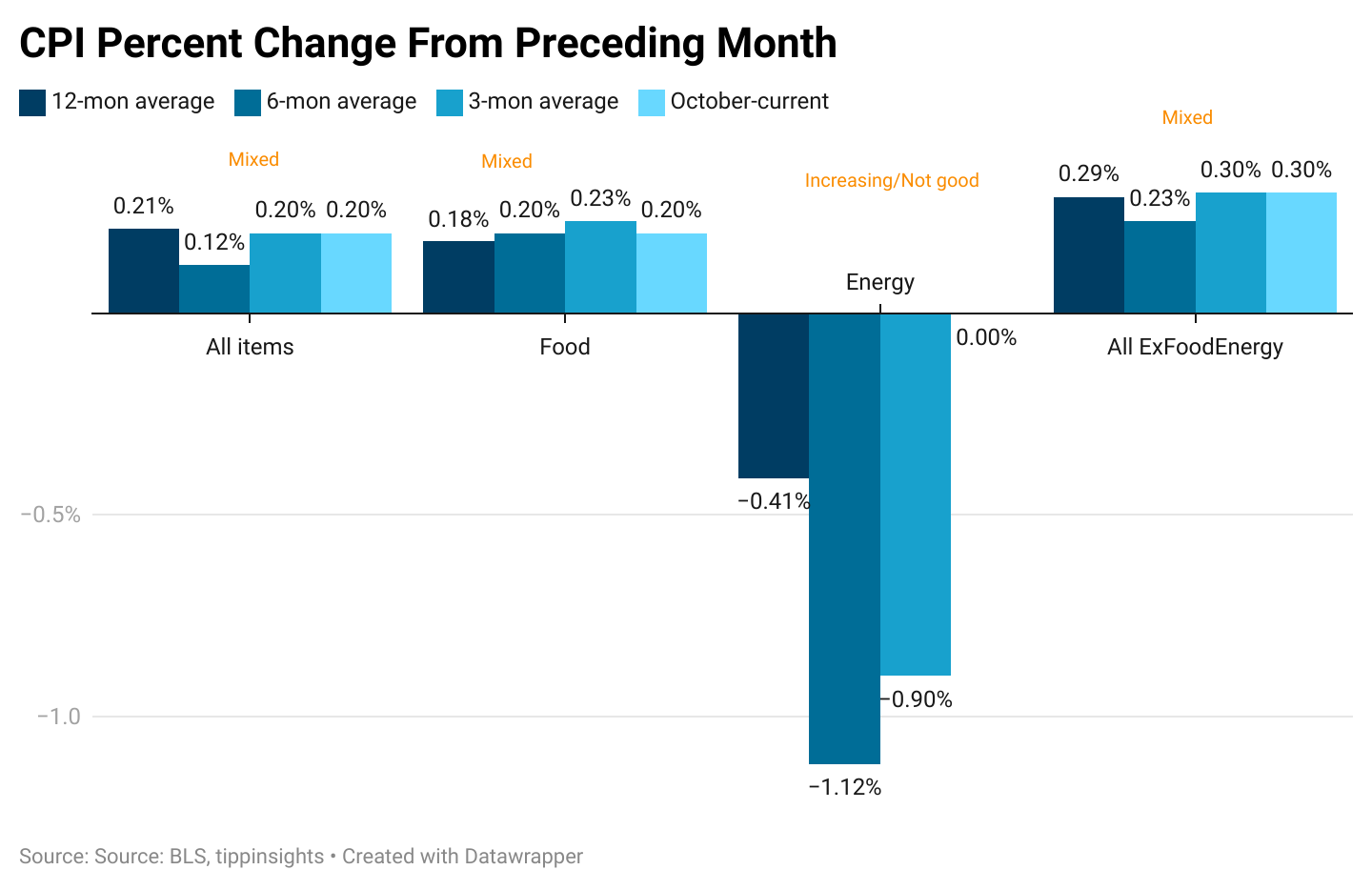

The chart below compares the 12-month, 6-month, and 3-month averages with the latest reading for October 2024.

- All Items: The October increase of 0.20% aligns with the 3-month average of 0.20% and is higher than the 6-month average of 0.12%, indicating a slight uptick in recent months. However, it remains below the 12-month average of 0.21%, reflecting some long-term moderation.

- Food Prices: October's increase of 0.20% is lower than the 3-month average of 0.23% but equal to the 6-month average of 0.20%. This shows a slight easing in October, though food prices remain elevated compared to the 12-month average of 0.18%.

- Energy Prices: In October, energy prices flatlined at 0.00%, ending the steady declines we've been seeing. Over the past few months, energy costs had dropped—averaging -0.90% over the last three months and -1.12% over six months. But now, with prices no longer falling, the relief that lower energy costs had been providing might be drying up, which isn’t great news if energy prices start holding steady or even ticking up from here.

- Core Inflation (All Items Less Food and Energy): October’s core inflation held steady at 0.30%, matching the 3-month average. This is above the 6-month average of 0.23% and the 12-month average of 0.29%, indicating persistent underlying price pressures outside food and energy.

Summary

The October data paints a mixed picture. Food prices show some easing, but energy prices have stopped falling after months of steady declines. Meanwhile, core inflation is still running high. This suggests that while a few inflation pressures are cooling off, underlying costs across the broader economy continue to climb.

Monetary Policy

In September 2024, the Fed cut interest rates by 50 basis points, bringing its benchmark interest rate to 4.75% after raising 11 consecutive times to 5.25%, the highest level in 22 years.

With the core CPI entrenched at 3.2% and geopolitical tensions that could lead to volatility in the energy markets, we are unsure of what lies ahead. We believe it won't be easy to bring CPI inflation down to the Fed's target of 2.0%.

On Thursday, Federal Reserve Chair Jerome Powell signaled a cautious approach to cutting interest rates, citing persistent inflation pressures and the need to monitor its trajectory. While inflation is edging closer to the Fed’s 2% target, Powell emphasized that it hasn’t reached that level yet, and the economy remains strong enough to allow deliberate policymaking.

Economists expect a quarter-point rate cut in December, but Powell’s remarks have tempered expectations for further cuts in the near term. Other Fed officials echoed concerns about inflation’s “stickiness” and warned that aggressive rate cuts could risk reigniting inflation.

Fiscal Policy

According to the Debt to the Penny dataset, which the Treasury updates daily, the national debt is now at $35.97 trillion and will cross the $36 trillion milestone within the next few days.

Most Americans are concerned about the sustainability of this trajectory. The high interest rates are also hurting Americans and sapping their confidence.

Monetary policy alone can’t fix inflation without fiscal austerity.

Inflation is here to stay. Can the business-friendly new president fix it?

To access the TIPP CPI readings each month, you can visit tippinsights.com. We'll publish the TIPP CPI and our analysis in the days following the Bureau of Labor Statistics (BLS) report. The upcoming release of TIPP CPI is on December 11, 2024. We'll also post a spreadsheet in our store for download.

Hey, want to dig deeper? Download data from our store for a small fee!