The arrest of narco-dictator Nicolas Maduro, the quarantine imposed on Venezuela's oil industry and the collapse of the European Union's "renewable energy" strategy all have raised a big question in the minds of many Americans: What role should foreign energy play in our policy efforts?

This month's I&I/TIPP Poll's online national survey of 1,478 adults, taken from Jan. 6 to Jan 9, provides a very clear answer: Access to foreign crude oil and other energy sources is very important to a majority of Americans. The poll's margin of error is +/-2.9 percentage points.

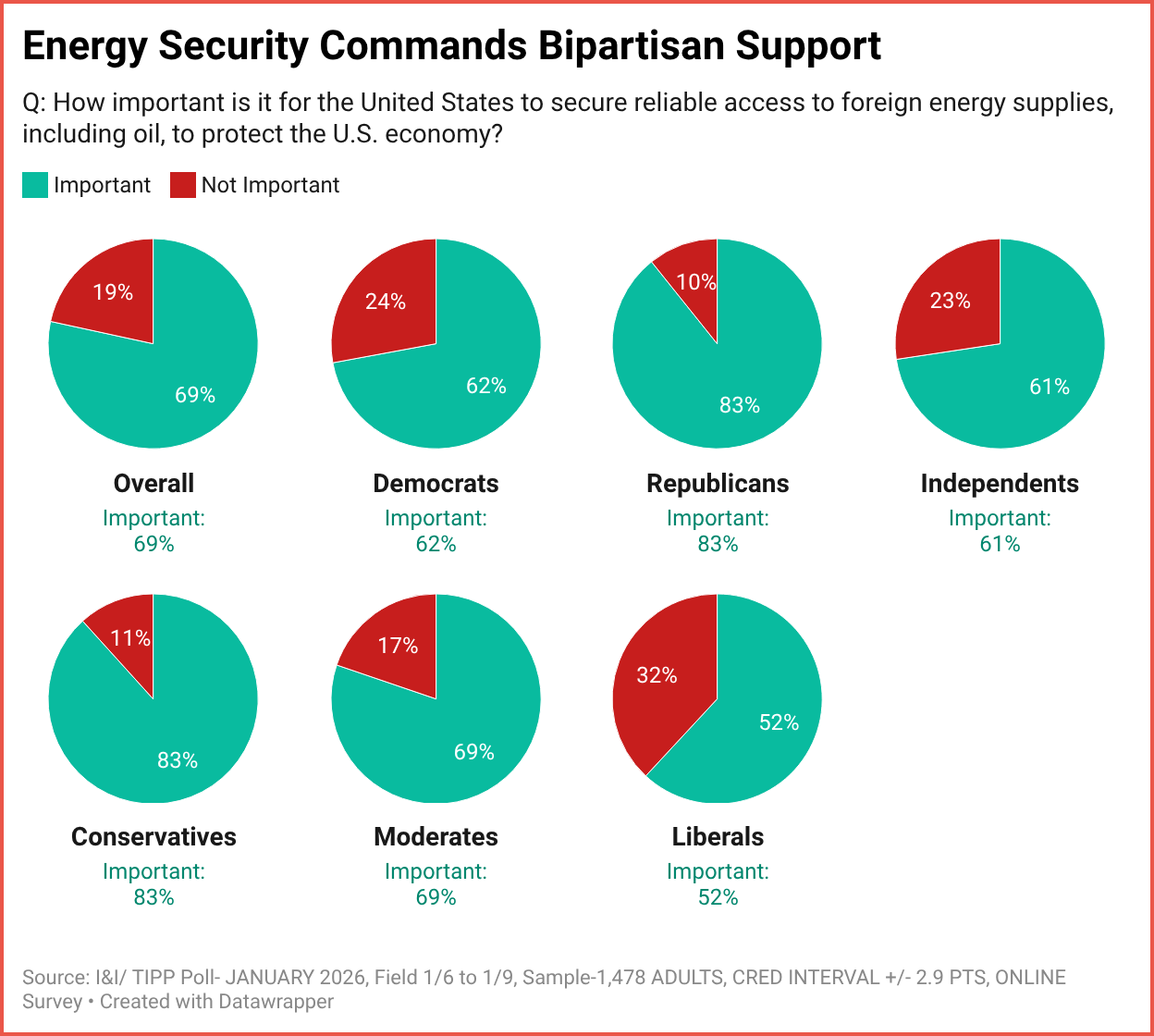

Specifically, I&I/TIPP asked the following question: "How important is it for the United States to secure reliable access to foreign energy supplies, including oil, to protect the U.S. economy?"

Overall, 69% said it was either "very important" (36%) or "somewhat important" (33%). The "not important" category gathered just 19% backing, with 12% saying it was "not too important" and 7% saying it was "not at all important." Another 12% said they weren't sure.

So, by a rough ratio of 7-to-2, American voters want to maintain access to foreign energy, including oil, and see it as critical for protecting the U.S. economy.

Moreover, there appears to be extraordinary unity about maintaining access to oil supplies among all 36 major demographic groups. A hefty majority in all groups described access as "important": That includes men (71%) and women (67%), white (69%) and black/Hispanic (70%), and urban dwellers (75%), suburbanites (63%) and rural Americans (74%).

Solid majorities of Democrats (62%), Republicans (83%), and independents (61%) also agree, making it a politically popular policy path. Americans disagree on many things, but seem to draw the line at policies that will starve the U.S. economy of the energy it needs to thrive.

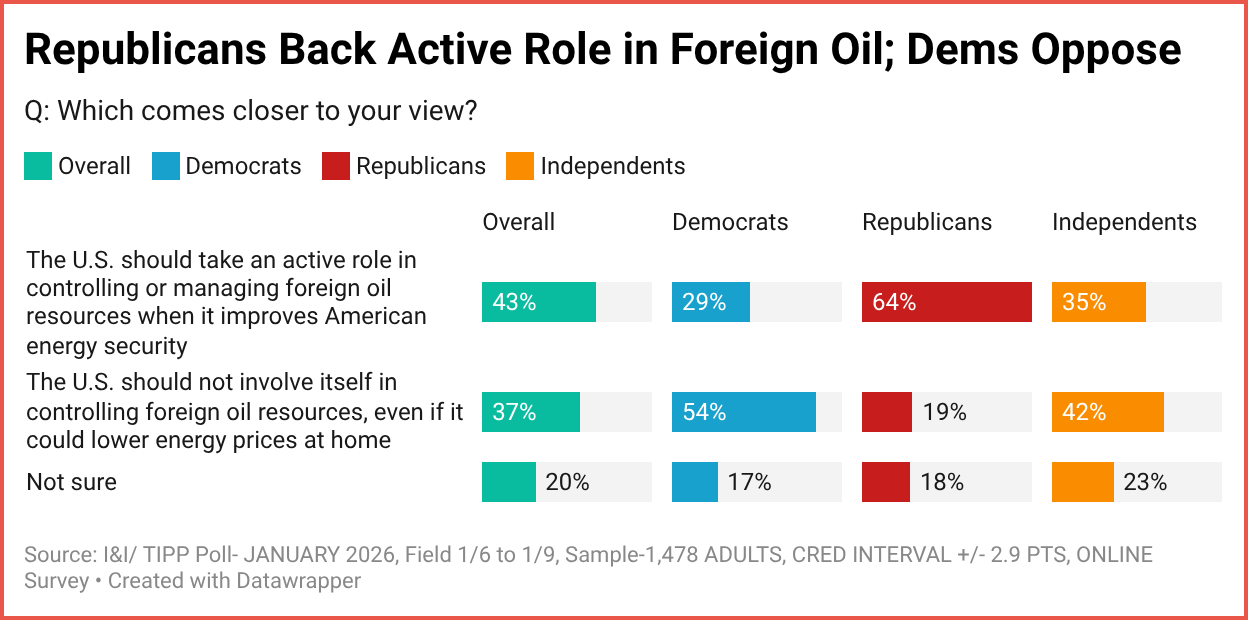

I&I/TIPP followed with a second, narrower question that asked respondents to choose which phrase best described their feelings about the issue.

Some 43% selected "The U.S. should take an active role in controlling or managing foreign oil resources when it improves American energy security," while 37% picked "The U.S. should not involve itself in controlling foreign oil resources, even if it could lower energy prices at home." A significant 20% said they were "not sure."

But on this question, political differences showed: Only 29% of Democrats agreed the U.S. should "take an active role," versus 64% of Republicans and 35% of independents.

The second offered response, "the U.S. should not involve itself in controlling foreign oil reserves" garnered a majority 54% of Dems and a 42% plurality of indie voters, but only 19% of Republicans.

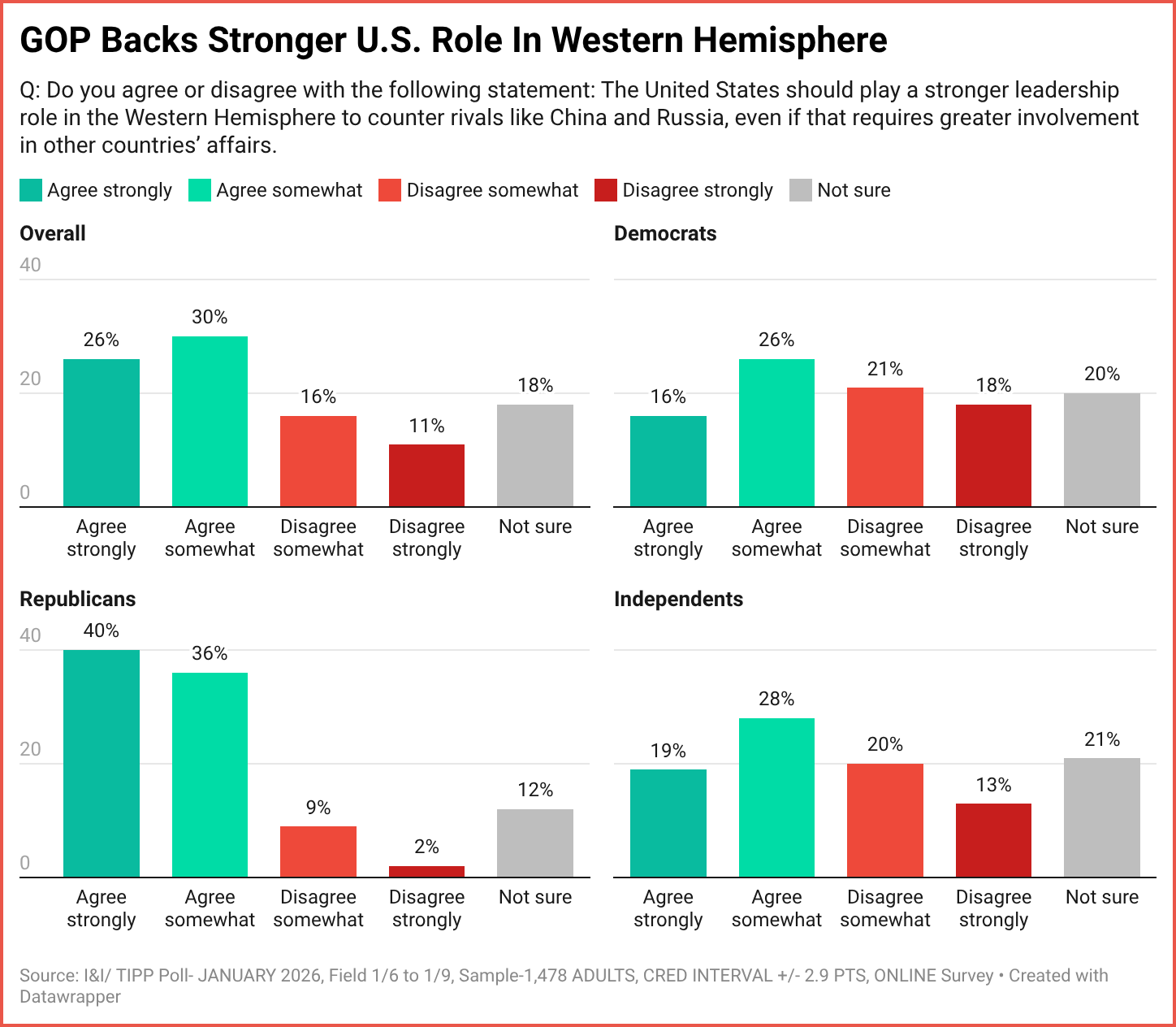

One final question indirectly gauged Americans' reaction to what has jokingly been dubbed the "Donroe Doctrine," President Donald Trump's muscular new foreign policy initiative in the Western Hemisphere, loosely modeled on President James Monroe's 1823 "Monroe Doctrine."

Without mentioning Trump's name, I&I/TIPP asked voters whether they agreed or disagreed with this statement: "The United States should play a stronger leadership role in the Western Hemisphere to counter rivals like China and Russia, even if that requires greater involvement in other countries’ affairs."

And again, overall, "agree" (56%) far outweighed the "disagree" responses (27%). All major demographic categories show either a plurality or outright majority agreeing. But, also again, differences in enthusiasm emerged among Democrats (42% agree), Republicans (76% agree) and independents (47% agree).

So whether Americans know it or not, the I&I/TIPP Poll shows they do support Trump's "Donroe Doctrine." But instead of trying to keep today's waning European powers from meddling in Latin America, Trump's hemispheric policy aims at two other superpower interlopers: China and Russia.

Why is this significant? America's entering a new golden age of cheaper energy, which will ultimately make all citizens better off by using all the energy assets the U.S. has at its disposal: oil, gas, nuclear, coal, and even solar and wind (but only when economically feasible).

Meanwhile, European governments, which once sneered at Trump's criticisms of the region's energy-austerity policies, have been forced to admit: Trump was right about the EU's radical turn towards non-economical "green" energy technologies.

As German Chancellor Friedrich Merz admits, it was a "serious strategic mistake to phase out nuclear energy." Across the EU, others also recognize the same truth: Energy poverty equals economic poverty.

Unsustainable green policies are a major reason why EU economic output has stagnated, with EU GDP growing just 13.5% from 2008 to 2023, while U.S. GDP soared 87% over the same time.

Against this backdrop, both Russia and China have muscled into the energy-rich Western Hemisphere, corrupting governments (including Canada's) and using Latin America's energy riches as an economic weapon against the U.S.

Trump's aggressive policies in Latin America are intended to restore non-authoritarian elected governments to that region, and to keep corrupt regimes from handing control of the region's energy wealth to Russia and China.

Meanwhile, the U.S. continues to find out that its own energy reserves are even bigger than once thought. A recent U.S. geological survey report discovered that, thanks to technology, there are "massive" recoverable reserves of 1.6 billion barrels of oil and more than 28 trillion cubic feet of natural gas in Texas' energy-rich Permian Oil Basin alone.

That's happening all over, as Trump pushes to expand exploration and drilling within our own borders, including energy-rich Alaska.

However, outside U.S. borders, as the I&I/TIPP Poll shows, energy and foreign relations are intimately connected, a fact increasingly recognized by average Americans of all political persuasions.

I&I/TIPP publishes timely, unique, and informative data each month on topics of public interest. TIPP’s reputation for polling excellence comes from being the most accurate pollster for the past six presidential elections.

Terry Jones is an editor of Issues & Insights. His four decades of journalism experience include serving as national issues editor, economics editor, and editorial page editor for Investor’s Business Daily.

👉 Show & Tell 🔥 The Signals

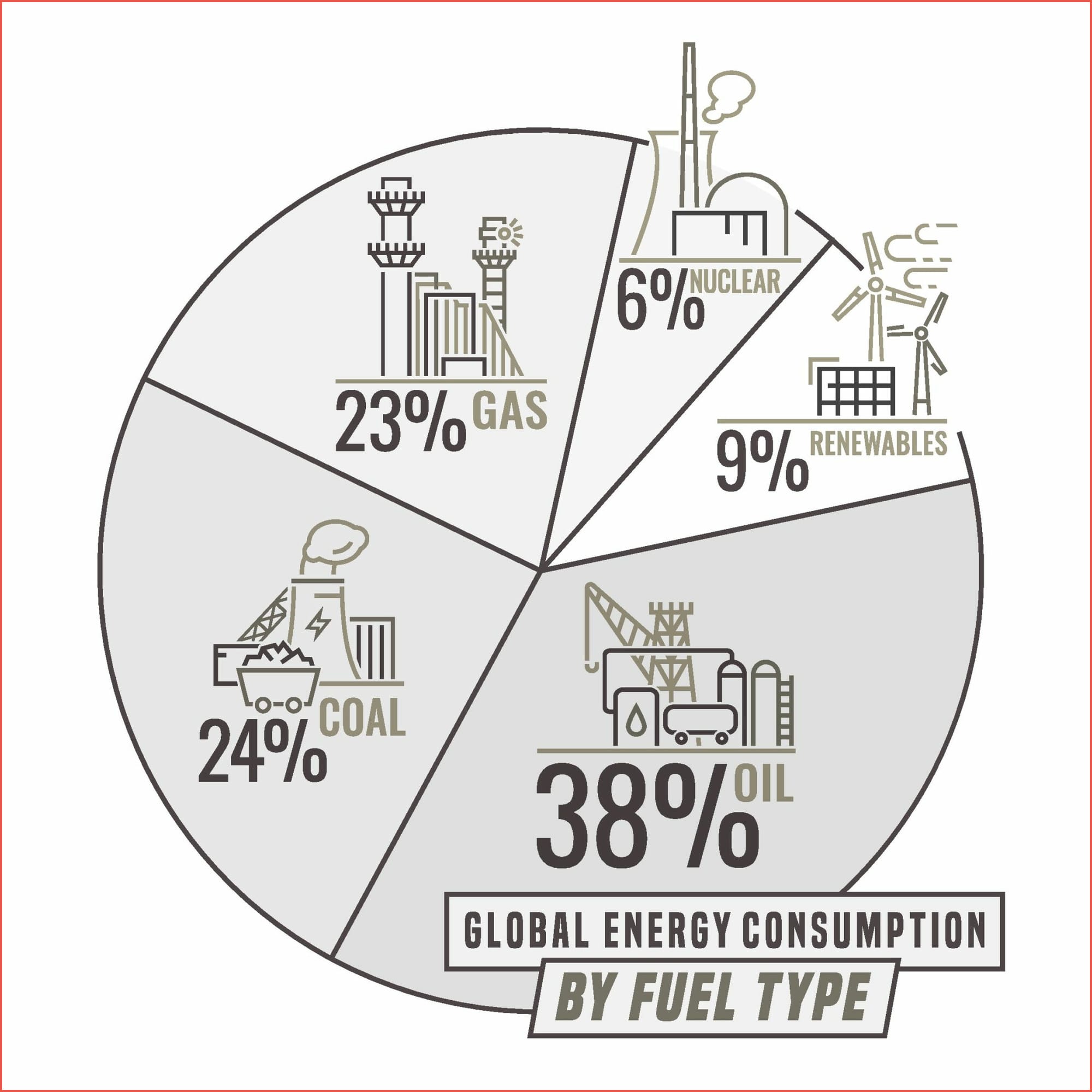

I. Fossil Fuels Still Power Most Of The World

The chart shows how global energy use is split by source. Oil, coal, and natural gas together account for roughly 85% of world energy, underscoring how dependent the global economy remains on fossil fuels. Nuclear, hydro, and renewables are growing but still make up a relatively small share, highlighting why energy transitions tend to be slow and incremental rather than rapid shifts.

II. Global Oil Reserves Are Highly Concentrated

The chart shows that the world’s oil reserves are dominated by a small group of countries. Venezuela and Saudi Arabia lead by a wide margin, followed by Iran and Canada. The U.S. ranks lower on reserves despite being a top producer, highlighting the difference between how much oil a country has underground and how much it produces each day.

III. Gas Prices Have Come Down And Are More Manageable

After years of sharp swings, U.S. gas prices have eased significantly from their 2022 peak and are now closer to recent historical averages. While prices remain higher than the ultra-cheap levels of the 1990s, the trend shows greater stability and relief for consumers, even amid global energy uncertainty.

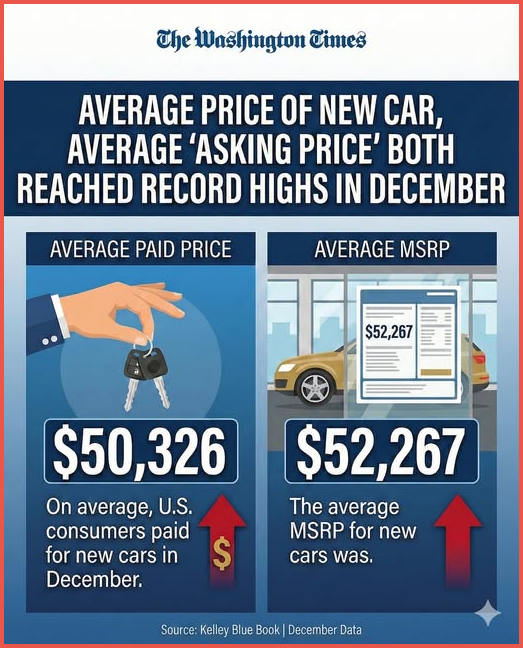

IV. New Car Prices Hit Fresh Record Highs

Both what buyers paid and what dealers asked for new cars reached record levels in December. The average transaction price climbed to $50,326, while the average MSRP rose to $52,267, highlighting how tight supply and higher costs continue to keep car prices elevated despite softer demand.

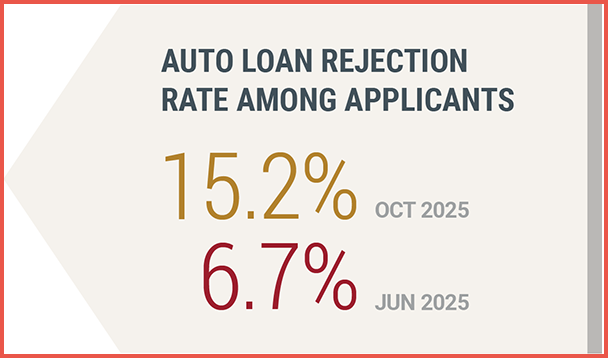

V. Auto Loan Rejections Are Rising Fast

According to the New York Fed, 15.2% of auto loan applicants were rejected in October, more than double the rate seen earlier this year. The sharp increase points to tighter lending standards and growing strain on household finances, making it harder for buyers to secure car loans even before factoring in high interest rates and vehicle prices.

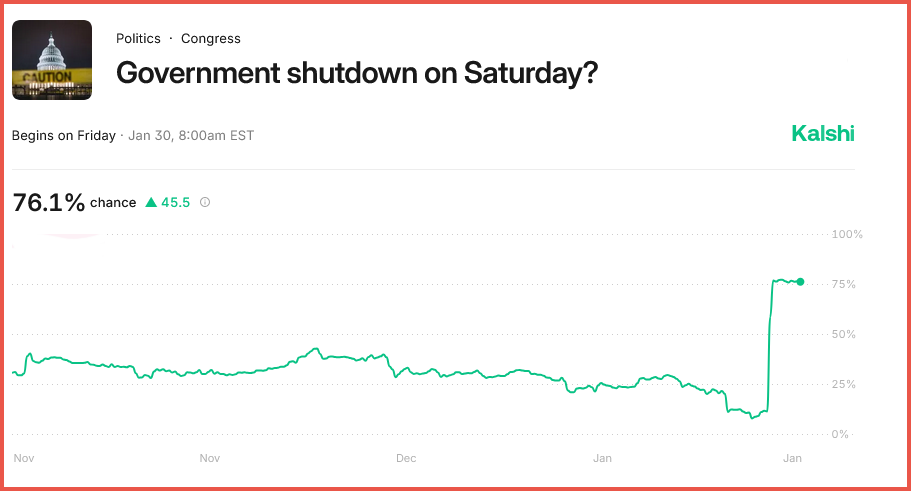

VI. Time For A Shutdown? Prediction Markets Say Odds 76%

Prediction markets have sharply raised the odds of a U.S. government shutdown this weekend, with probabilities jumping to around three-in-four. The sudden move suggests traders see negotiations breaking down late in the process, a pattern typical of past shutdown standoffs as deadlines approach.

📊 Market Mood — Monday, January 26, 2026

🟨 Futures Tread Water Ahead of Fed Week

U.S. futures are muted as markets brace for a pivotal Fed rate decision and a heavy slate of earnings, after a volatile, geopolitics-driven week.

🟧 Fed Chair Succession Adds Unease

With rates expected to stay put, attention is shifting to President Trump’s looming pick to replace Chair Powell—reviving concerns about Fed independence.

🟥 Tariff Threats Return, This Time Canada

Trump’s warning of a potential 100% tariff on Canadian goods if Ottawa deepens ties with China is weighing on sentiment, even if markets doubt it materializes.

🟪 Shutdown Risks Re-Emerge After Minneapolis Protests

Fresh unrest and a deadly shooting in Minneapolis have raised the odds of another U.S. government shutdown, adding political risk to an already crowded week.

🟨 Gold Breaks $5,100 as Safe-Haven Rush Continues

Gold surges to new record highs as investors hedge geopolitical risk, tariff uncertainty, and expectations of easier policy later in 2026.

🗓️ Key Economic Events — Monday, January 26, 2026

🟩 08:30 AM — Durable Goods Orders (MoM)

Tracks new orders for long-lasting manufactured goods, offering an early read on business investment and overall economic momentum.

editor-tippinsights@technometrica.com