65% support higher capital gains tax rate for couples earning more than $1 million annually. Another 54% favor raising the corporate tax from 21% to 28%. However, 50% oppose increasing the estate taxes on a person's assets after death.

The Investor's Business Daily/TIPP poll in early April included the three proposals that the Biden administration was considering at the time.

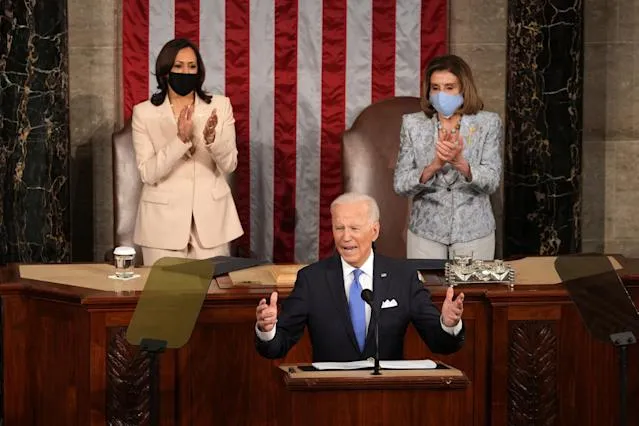

IBD released the findings on Wednesday, April 28, to coincide with President Biden's State of the Union address to Congress.

President Biden's tax proposal includes increases in corporate and capital gains taxes to help finance his $1.8 trillion American Families Plan.