Although the crippling inflation in the wake of the pandemic, exacerbated by Bidenomics, has begun to ease, the prices of essential goods remain high, and many households are still watching their budgets closely. Furthermore, in recent months, Trump’s economic and trade policies have caused the markets to react sharply, often in a bearish manner.

The economic climate has had a significant impact on how and how much Americans are able to save and invest. The cocktail of factors has also influenced people’s idea of safe and preferred investments.

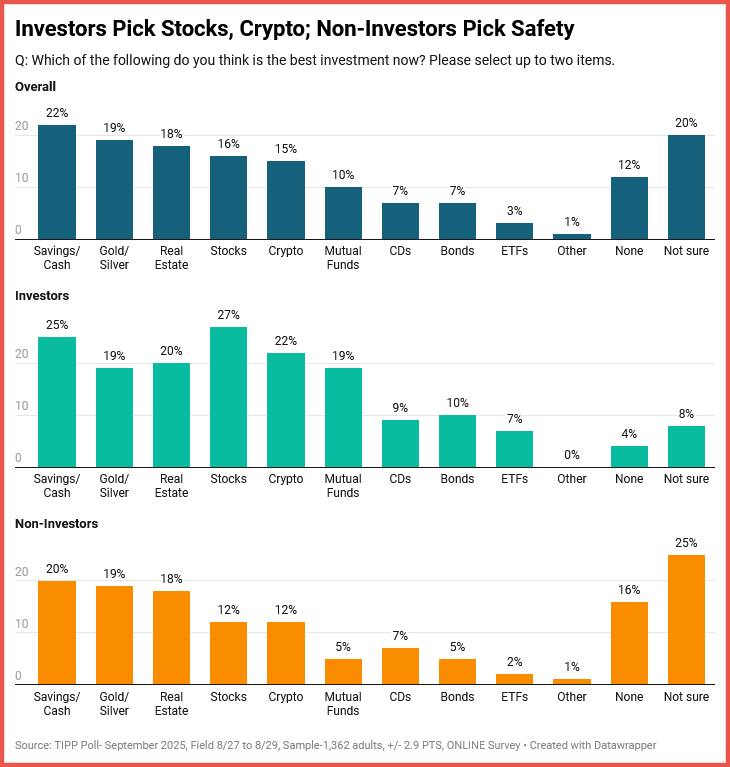

TIPP Poll conducted a nationwide survey in early September to understand which investment avenues are being used by Americans. The numbers paint a clear picture of the general sentiment and economic optimism.

Overall, more than a fifth preferred to keep their money in savings accounts or as cash, highlighting the prevailing uncertainty. Metals, like gold and silver, are the next choice, with real estate following just a point behind. Given the current conditions, it is not surprising that though 16% consider stocks a good option, only a fraction, 7%, deem bonds preferable. However, 20% were unsure of the best investment option, and another 12% considered none of the avenues satisfactory, reflecting the hardships and cash crunches facing many.

Interestingly, investors’ - those who currently have at least $10,000 invested in the stock market, either personally or jointly with a spouse, either directly or through a retirement plan - choices reflect optimism despite recent market volatility. More than a quarter, 27%, chose stocks as their first pick, followed closely by savings accounts or cash at 25%. Crypto also finds favor with this group, with 22% deeming it’s the best investment at present. Real estate at 20%, and mutual funds and metals at 19% each, are the next favorites.

Among non-investors, time-tested options such as savings accounts/ cash, precious metals, and real estate were the top picks. Surprisingly, crypto – a relatively new entrant on the scene – found more favor than mutual funds and bonds. But a quarter were undecided, and another 16% did not have faith in any of the listed options.

While investors’ faith in the stock market is a clear indicator of optimism, the preference for crypto, even among non-investors, suggests a shifting attitude toward personal finances.

Access our Featured Stocks and TIPP Top-20 archives — exclusive to paid subscribers. Subscribe now → $99/year.