America's sanctions regime is killing the dollar's viability as countries worldwide see firsthand the ability of the United States government to inflict pain on Russia.

It's just not Russia. Earlier this week, Treasury Secretary Janet Yellen warned China not to deviate from the sanctions regime that she has personally supervised.

"It is essential that China and other countries do not provide Russia with material support or assistance with sanctions evasion. We will continue to make the position of the United States extremely clear to Beijing and companies in its jurisdiction. The consequences of any violations would be severe."

If America could target the world's mightiest powers, what would happen to smaller countries that attracted America's ire?

Administrations of both parties are guilty of weaponizing the dollar to further America's foreign policy goals. An international entity sanctioned by America is entirely at the mercy of America's bureaucrats since no judicial review is allowed.

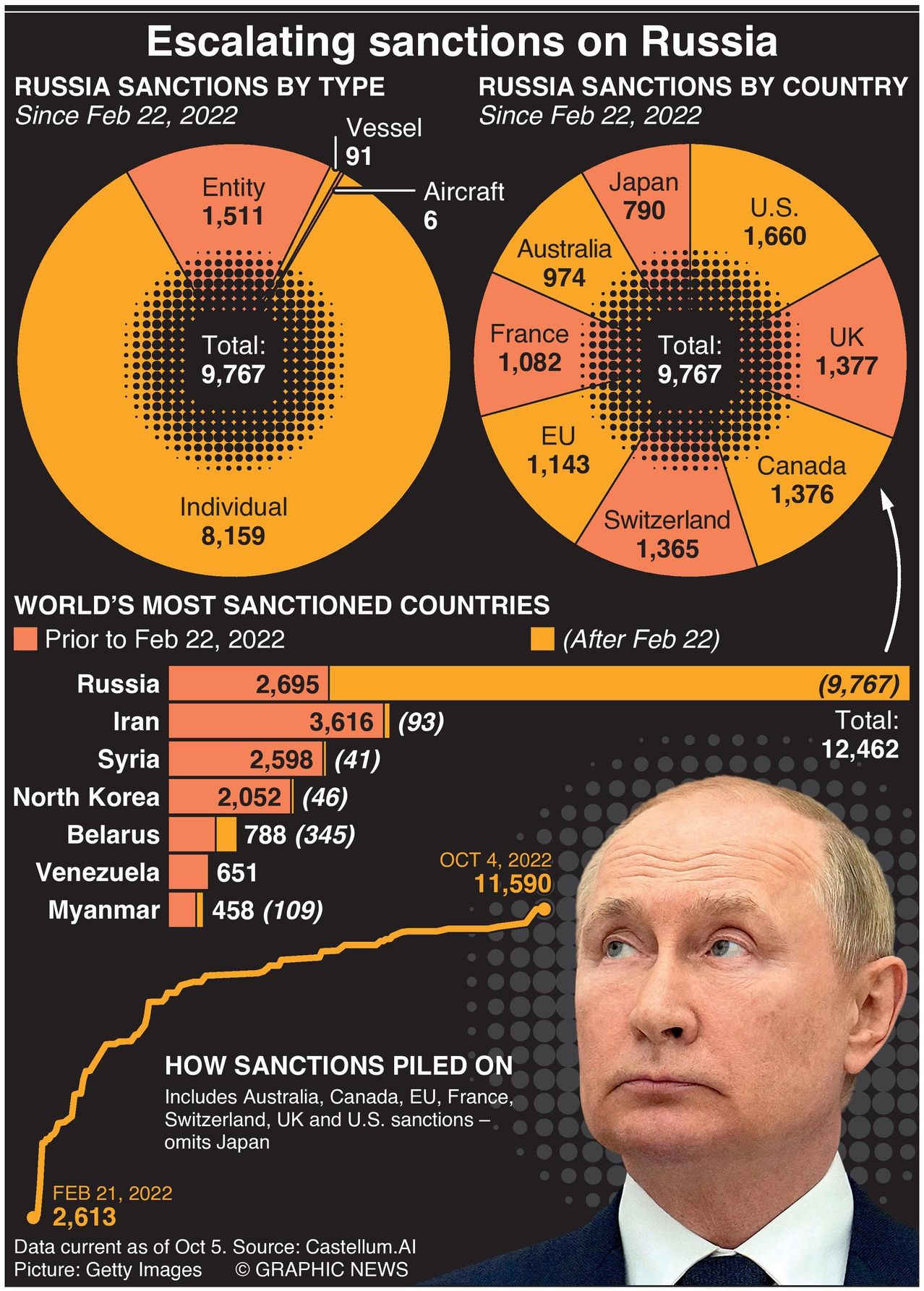

The Treasury Department's Office of Foreign Assets Controls (OFAC) wields enormous power to block fund transfers to countries, groups, or individuals subject to American sanctions. In a 2021 paper, the Treasury reported that 9,421 sanctions designations were active, a 933% increase since 9/11, as American administrations have used dollarization as a primary diplomatic weapon.

President Biden in the Russia-Ukraine conflict has unleashed weapons usually reserved if America were attacked. That Treasury has gone after one party in a dispute between two nations is sending shock waves through the capitals of the Global South.

Since February 2022, Treasury alone has implemented over 2,500 sanctions on Russia, nearly a quarter of all sanctions against all countries in the last 21 years. They encompass numerous Russian banks, wealth management-related entities, individuals that play key roles in Russia's financial services sector, and any companies involved in Russia's military-industrial complex.

Over $300 billion of the Russian Central Bank's reserves at the Fed in New York and other Western financial institutions have been frozen. There's now talk that the West wants to seize Russia's dollar and gold assets to pay for Ukraine's reconstruction.

Treasury is also after companies that assist Russia's supply chain, targeting global companies that may even sell technologies classified as dual-use - such as a chip that could be used in a civilian air conditioner that may be repurposed for a drone.

Leaders of the Global South have been taken aback by the extraordinarily swift and intense nature of America's Russia sanctions. Brazil, India, China, South Africa, Malaysia, and Turkey have billions of dollars parked in U.S. Treasurys and other liquid assets because of the dollar's status as a "safe haven." But is the dollar really a safe haven? If any of these countries cross American ideals regarding rules maintaining the liberal international order, even in a third-party dispute, could America use its regime authority to cripple it?

The Chinese Yuan is becoming attractive to countries of the Global South because China, for nearly 70 years, has made it a foreign policy cornerstone to hew to the idea of "non-interference." China believes that countries should cooperate but not make judgments about each other regarding internal matters, preferring a more transactional approach instead. It is the exact opposite of America's foreign policy goals which are designed to change the behavior of sovereign nations to one that suits Western tastes, such as protecting human rights and territorial integrity.

Larry Summers, the former Treasury Secretary, tweeted recently about a comment he had heard from somebody in a developing country: "Look, I like your values better than I like China's. But the truth is, when we're engaged with the Chinese, we get an airport. And when we're engaged with you guys, we get a lecture."

The "non-interference" nations appreciate that it is easier to become friends when others don't judge you. The five BRICS countries - Brazil, Russia, India, China, and South Africa - are a potent global force to counterbalance the West. They collectively represent 40% of the world's population and a combined GDP based on Purchasing Power Parity (PPP) greater than the G-7.

The BRICS Development Bank, founded in 2015 to aid infrastructure and sustainable development projects in member countries, has added three new countries - Bangladesh, UAE, and recently, Egypt, in February. Two countries with among the world's worst human rights records - Saudi Arabia and Iran - recently joined hands with China to bolster trade and establish diplomatic relations. Although they are not yet part of the BRICS combine, their move into the China fold should be worrisome to the United States.

When Brazil's President Lula met Chinese President Xi this week, he may have summarized the collective ideas of the Global South when he remarked: "Every night, I ask myself why all countries have to base their trades on the dollar."

Like our insights? Show your support by becoming a paid subscriber!

Want to show your appreciation? Donate