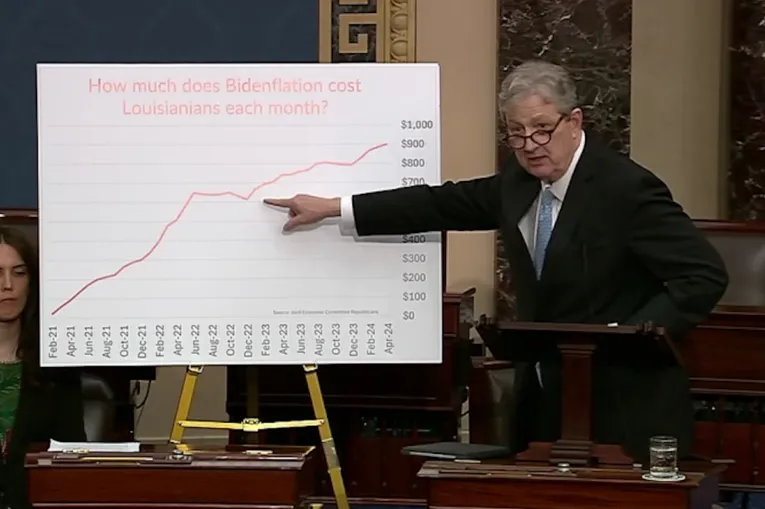

The latest Social Security annual report, projecting that the Trust Fund will be exhausted in 2033, a year sooner than previously thought, politely explains that the Trustees “reassessed their expectations for the economy in light of recent developments.”

What recent developments, you ask? Rising inflation, declining output, weakened GDP forecast, and worsening labor productivity.

In other words, this is another bitter fruit from President Joe Biden’s poisoned economic tree.

Treasury Secretary Janet Yellen responded to the news about Social Security that “the Biden-Harris administration is committed to ensuring the long-term viability of these critical programs so that retirees can receive the hard-earned benefits they’re owed.”

But in his latest budget proposal, Biden offered no proposals whatsoever to shore up Social Security or prevent a looming 23% cut in retirement benefits that current law will require once the Trust Fund is emptied.

As bad as this seems, Social Security’s financial picture is actually far more dire. It’s likely that the Trust Fund won’t even make it to 2033.

The Social Security trustees have had to downgrade the Trust Fund repeatedly for the past 40 years when their economic and demographic assumptions turned out to be too optimistic. Back in 1983, for example, the trustees promised that the Trust Fund would remain solvent through 2058. By 2003, they were saying it would only be solvent until 2044.

It gets worse, because the Trust Fund itself is just an accounting fiction designed to mask the massive deficits the program is already running.

When payroll taxes raise more money than Social Security pays out in benefits, the leftover funds are “deposited” in the Trust Fund, which then earns “interest.” But the money isn’t sitting in a bank somewhere. The federal government spends it, and then promises to pay the money back, with interest. When Social Security benefits exceed payroll taxes, it “draws down” the Trust Fund.

All that really matters is how much Social Security brings in each year through payroll taxes, and how much it pays out in benefits.

By this measure, Social Security has been running annual deficits since 2010, when it had a shortfall of $49 billion. Since then, the program’s annual deficits have totaled more than $1 trillion. This year alone, the shortfall will top $100 billion. By 2033, annual deficits will be more than $400 billion. And the deficits will continue to grow, reaching $1 trillion by 2049 and more than $8 trillion in 76 years. (See the chart below.)

Incredibly, while Biden ignores this calamity, Democrats are pushing to expand Social Security benefits, paid for by an economy-killing $33.8 trillion tax hike.

Even with additional benefits, this will only make Social Security an even bigger rip-off for future retirees.

A Heritage Foundation analysis found that, based on current contribution rates, workers born in 1995 will end up paying an average of $404,337 into Social Security. What can they expect to get back when they retire? If they live to be 80, they’ll receive just $227,513 in pension benefits – an effective rate of return of -2.31%. Even if they were to live to 90, they still wouldn’t get all their money back.

If that same $404,337 had instead been invested in a private account with an annual rate of return of just 4.79% a year, these workers would retire with nest egg valued at more than $1.2 million, Heritage found. And unlike with Social Security benefits, they can pass any money they don’t spend in retirement to their heirs.

Giving young workers the option to shift their payroll taxes to private accounts would not only provide better retirement benefits, it would also relieve Social Security’s massive long-term deficit problem.

But who wants to talk about privatizing Social Security? The last politician to propose anything along these lines was George W. Bush in 2005, whose plan vanished after getting mercilessly pilloried.

Kilolo Kijakazi, acting commissioner of Social Security, says that “The trustees continue to recommend that Congress address the projected trust fund shortfalls in a timely fashion to phase in necessary changes gradually. With informed discussion, creative thinking, and timely legislative action, Social Security can continue to protect future generations.”

Good luck with that. At his last State of the Union, Biden accused Republicans of wanting to cut Social Security and Medicare, to which Republicans responded by calling him a liar.

Biden’s retort: “So, folks, as we all apparently agree, Social Security and Medicare is off the books now, right? They’re not to be touched?”

One way or another, Social Security has to be touched. The only question is: Who gets burned?

— Written by the I&I Editorial Board