Americans expecting a better economy to emerge three years after the COVID shutdowns will no doubt be disappointed by the first quarter’s GDP gain of just 1.1% with higher inflation. And it’s even worse than it looks.

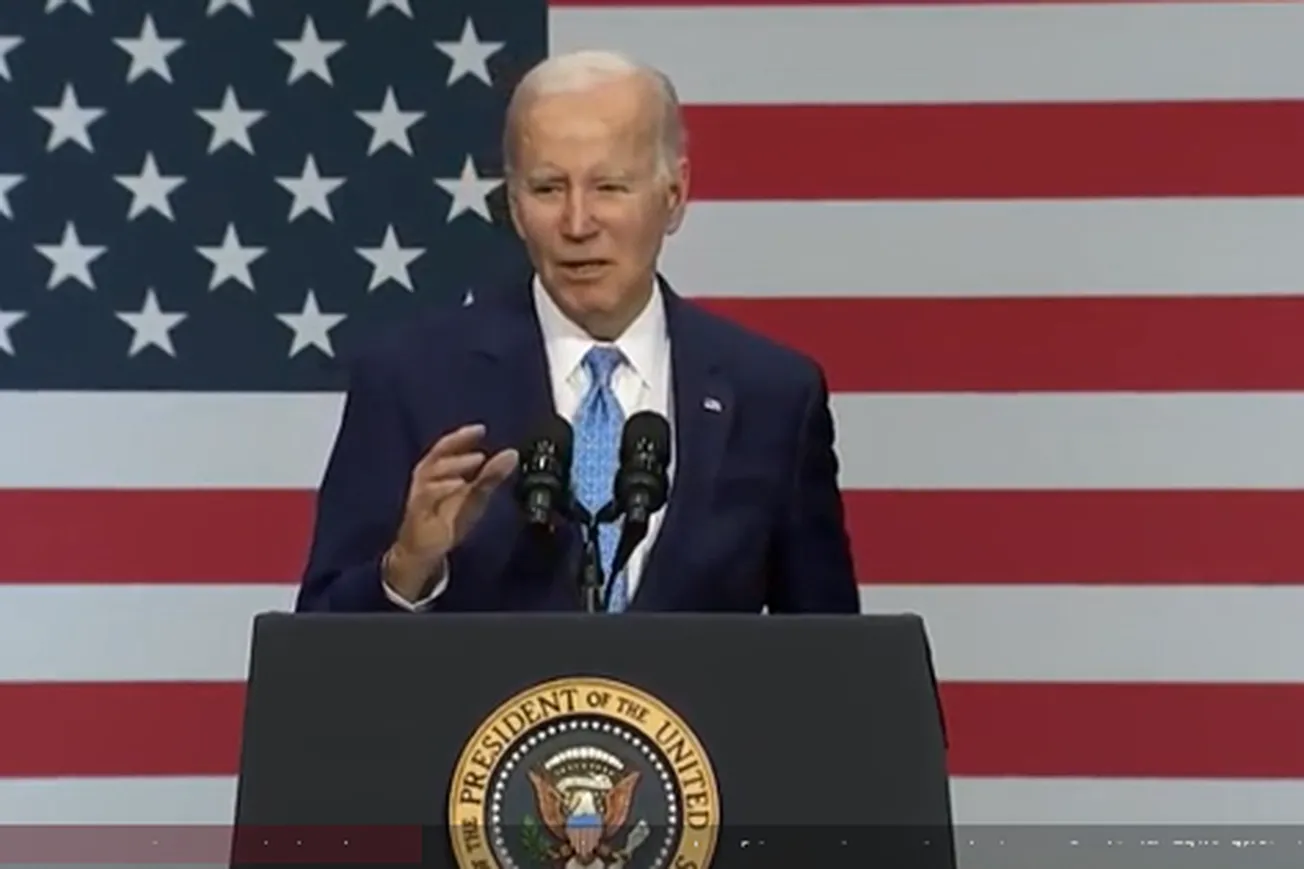

Of course, President Joe Biden denied the worsening news, saying, “Today, we learned that the American economy remains strong, as it transitions to steady and stable growth.”

“Strong”? Really? No one believes that. As recently as late March, economists were looking for a first-quarter GDP growth number exceeding 3%. Instead, they got 1.1%, down from 2.6% in the fourth quarter and 3.2% in last year’s third quarter.

See the trend?

It’s no accident. The Fed, responding to 9%-plus inflation during the COVID “emergency,” has jacked up interest rates to 5% from near zero, and is expected to add another quarter point in early May during its meeting.

More ominously, a big part of the Q1 GDP slowdown came from businesses reducing their inventories and, for the fourth quarter in a row, their capital investments. Typically, businesses do that only when they expect really rough times ahead.

The first quarter’s 3.7% jump in consumer spending won’t last, either. Struggling consumers have turned to credit cards to maintain their living standards, waiting desperately for inflation to abate.

Currently, Americans have more than $1 trillion in credit card debt, almost all of it carrying double-digit interest rates. As soaring credit-card bills squeeze other spending, something will have to give. That something is U.S. economic growth.

Biden and his Democratic supporters like to boast about the current 3.5% unemployment rate, equal to the 3.5% rate in February of 2020, the month before the COVID epidemic slammed the U.S. But that number is deceiving on a number of counts.

As we wrote earlier this month:

Over those same three years, the working-age population grew by 6.6 million. For unemployment to be back down to 3.5%, you’d think there’d be 6.6 million new jobs created.

But the number of people employed went up by only 2.1 million over the past three years.

So where did the other 4.5 million people go? Most of them simply dropped out of the labor force. They don’t have a job, and they aren’t looking for one.

So millions of people left the economy during COVID, encouraged to walk away from their jobs by generous cash benefits that in many cases made it more lucrative to stay home than to work. Many left their jobs and haven’t gone back, retiring early or taking part-time “gig” jobs, leaving an economy now starved for workers and unable to get them.

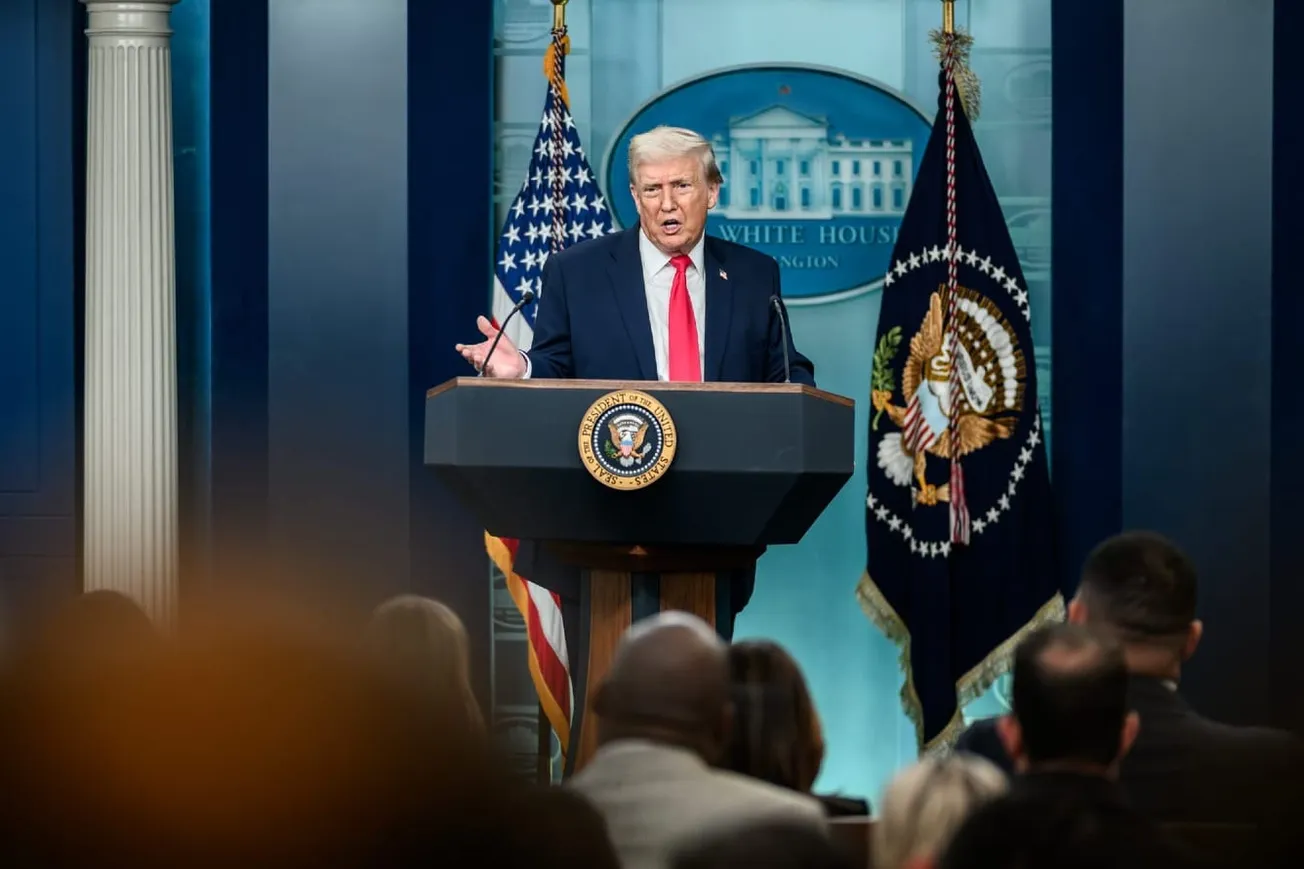

Last summer, we made the bold but not unwarranted statement in a headline that “The Biden Recession Has Arrived,” noting that during the first and second quarters of 2020 the economy shrank by 1.6% and 0.6%, the traditional definition of a recession.

Now, another looks to be on the way. Using its own recession probability model, the Conference Board, a national business group, now gives a 99% chance for a recession over the next year.

“This is consistent with our view that economic weakness will intensify and spread more widely throughout the US economy over the coming months, leading to a recession starting in mid-2023,” the group said in an online release.

In the interim, we now pretty much have a consensus building among economists of all stripes that the U.S. economy is about to take a dive, weighed down by high interest, soaring debt and growing uncertainty about Biden’s erratic presidency.

“The economy’s slowdown reflects the impact of the Federal Reserve’s aggressive drive to tame inflation, with nine interest rate hikes over the past year,” reported AP. “The surge in borrowing costs is expected to send the economy into a recession sometime this year.”

This has been made worse by the failure of two major banks, part of the biggest financial sector meltdown since the 2008 Great Recession, and the ongoing difficulties experienced by the housing market as interest rates shoot skyward.

But despite the Fed’s aggressive efforts and a growing wave of layoffs at major corporations, the Fed’s favorite inflation gauge, the Personal Consumption Expenditures price index, rose at a higher-than-expected 4% in the first quarter, double the Fed’s 2% target.

“I think we’re going to have difficulty getting near a 2% inflation target until and unless the economy slows down substantially,” predicted former Treasury Secretary and Obama adviser Larry Summers earlier this week.

Due to a “contractionary monetary shock” in 2022, wrote President Barack Obama’s former top economic adviser Christina Romer and co-author David Romer in a new paper, “one would expect substantial negative impacts on real GDP and inflation in 2023 and 2024.”

In short, in addition to stagflation, it’s highly likely we’ll soon be in another recession, the second of Biden’s first term. Even Democrats think so.

But you can’t just blame the Fed’s rate hikes.

Things have been bad for some time, thanks to Biden’s more than $5 trillion in pandemic “stimulus” that, along with shutdowns of the economy, caused inflation to surge and severely distorted our nation’s economy.

The damage Biden and his Democratic allies in Congress have done in just two short years is significant: A war on made-in-America energy to achieve “net zero” emissions; trillions of dollars in wasteful added spending on Biden’s “American Rescue Plan”; a massive 45% increase in costly regulations in just his first two years in office. The list goes on and on.

And that abbreviated reckoning doesn’t include our open border, a declining military and the dollar’s shrinking role in the world economy.

The result of all this is that the average family has lost more than $7,000 in income during Biden’s mere two years in office. While average weekly earnings have risen 9% since Biden took over, inflation has climbed 14.9% over that time. So Americans’ standard of living actually has shrunk 5.1% under Biden, a disaster in the making.

The point is, we’re likely to have another recession. But the damage done by Biden’s abysmal economic policies will linger. This week’s “surprisingly bad” GDP report will become just another data point among dozens illustrating the economic ineptitude of our worst-ever president.

— Written by the I&I Editorial Board