The headline the White House wants everyone to write would say that President Joe Biden’s budget plan will cut projected deficits by $2.9 trillion. That number isn’t impressive at all, given the context. Worse is the way he gets there.

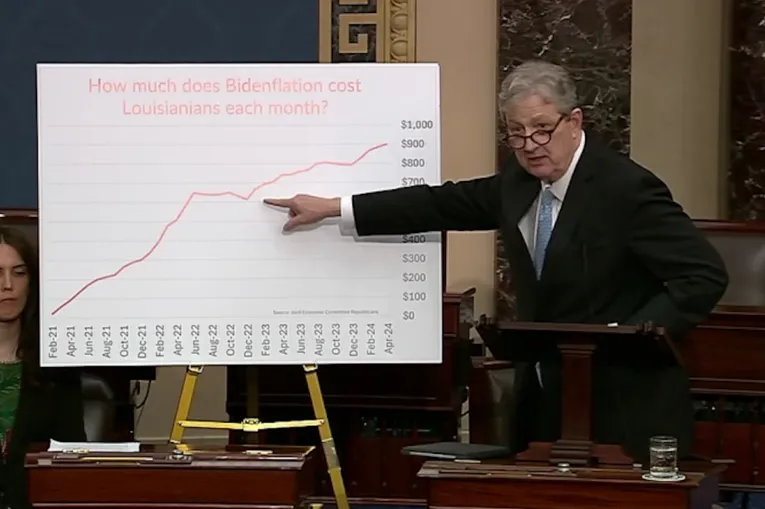

Start with the fact that the $2.9 trillion amounts to just a haircut in the projected $20 trillion deficits over the next decade, deficits that Biden and his fellow Democrats vastly inflated with their two-year spending spree. The chart below shows how little difference Biden’s budget would make.

Next is the fact that Biden’s budget would increase spending by $1.8 trillion over the next decade. And all of it comes through increases in “mandatory spending” – also known as “entitlement” programs.

Among the items on Biden’s shopping list:

- New childcare and preschool benefits: $600 billion

- Expanded Obamacare and Medicaid subsidies: $534 billion

- More college aid, including free community college: $217 billion

- Paid family and medical leave: $325 billion

- Expanded child care tax credit: $429 billion

- Earned Income Tax Credit changes: $156 billion

This list alone adds up to $2.3 trillion in new entitlement spending.

Part of this massive increase in entitlement spending is offset by cuts in projected “discretionary” spending – money that goes for things such as national defense, education, the environment, etc. Biden also employs other gimmicks to mask the size of his gargantuan spending plans.

As anyone who has paid any attention to federal entitlement programs knows, each of these new or expanded entitlements will cost far more than expected, while the spending cuts will never materialize, which means the true spending increase Biden is proposing is magnitudes higher.

So where does Biden get his $2.9 trillion in deficit reduction? It all comes from tax hikes.

Biden’s budget would boost taxes by $4.7 trillion. The biggest hikes:

- Income taxes, including an increase in the top rate: $581 billion

- Corporate taxes, including a rate hike from 21% to 28%: $2.7 trillion

- Medicare payroll tax: $1.2 trillion

We also know from decades of records that these tax hikes will never raise as much money as Biden projects because, for one thing, they will crush economic growth and encourage tax evasion.

What Biden is proposing is so reckless it should constitute an impeachable offense.

Even if everything worked according to plan, Biden’s vision would vastly increase the federal government’s claim on the economy. He projects spending that averages 24.8% of GDP, and taxes that consume 19.6% of GDP.

For comparison, federal spending over the past 70 years has averaged less than 20% of GDP, while taxes averaged 17%. And at best, deficits would never get below $1 trillion over the next decade.

Thankfully, Biden’s budget plan has no chance of being enacted with Republicans in control of the House.

But that’s not the point of it. The only reason to offer something this extravagant is to score political points.

Biden wants to go around the country promising voters free everything while pretending to cut the deficit, and with all the costs paid for by undeserving billionaires and evil corporate giants.

When he ran for president, Biden promised to restore honesty in government. This budget is arguably the most dishonest one that any president has ever offered up.

— Written by the I&I Editorial Board

Original article link