Comparative advantage is a fundamental economic principle that explains how and why countries engage in international trade. Embedded in it is the eminently elegant idea of opportunity cost that even a fifth grader can understand.

Imagine two countries, Country A and Country B. Country A is very efficient at producing wine and can produce ten bottles of wine in the time it takes to produce 15 fifteen loaves of bread. On the other hand, Country B can produce only five bottles of wine at the same time it takes to produce 20 twenty loaves of bread.

Country A has a comparative advantage in producing wine because it has a lower opportunity cost for wine compared to bread. For every bottle of wine Country A produces, it gives up 1.5 loaves of bread. Meanwhile, Country B has a comparative advantage in making bread because, for every loaf of bread it produces, it gives up only 0.25 bottles of wine.

If both countries specialize in their comparative advantages and trade with each other, they can both benefit. Country A can trade wine for bread with Country B, and vice versa. The opportunity cost for Country A is the bread it could have produced instead of wine, and for Country B, it’s the wine it could have produced instead of bread.

When it comes to making green energy products, China has a clear comparative advantage over America, which, for the last three decades, gave up its manufacturing heft in favor of higher-end services like finance and consulting. Yet, President Biden, with his misnamed Inflation Reduction Act, seeks to pick winners and losers in the American economy and challenge the theory of comparative advantage.

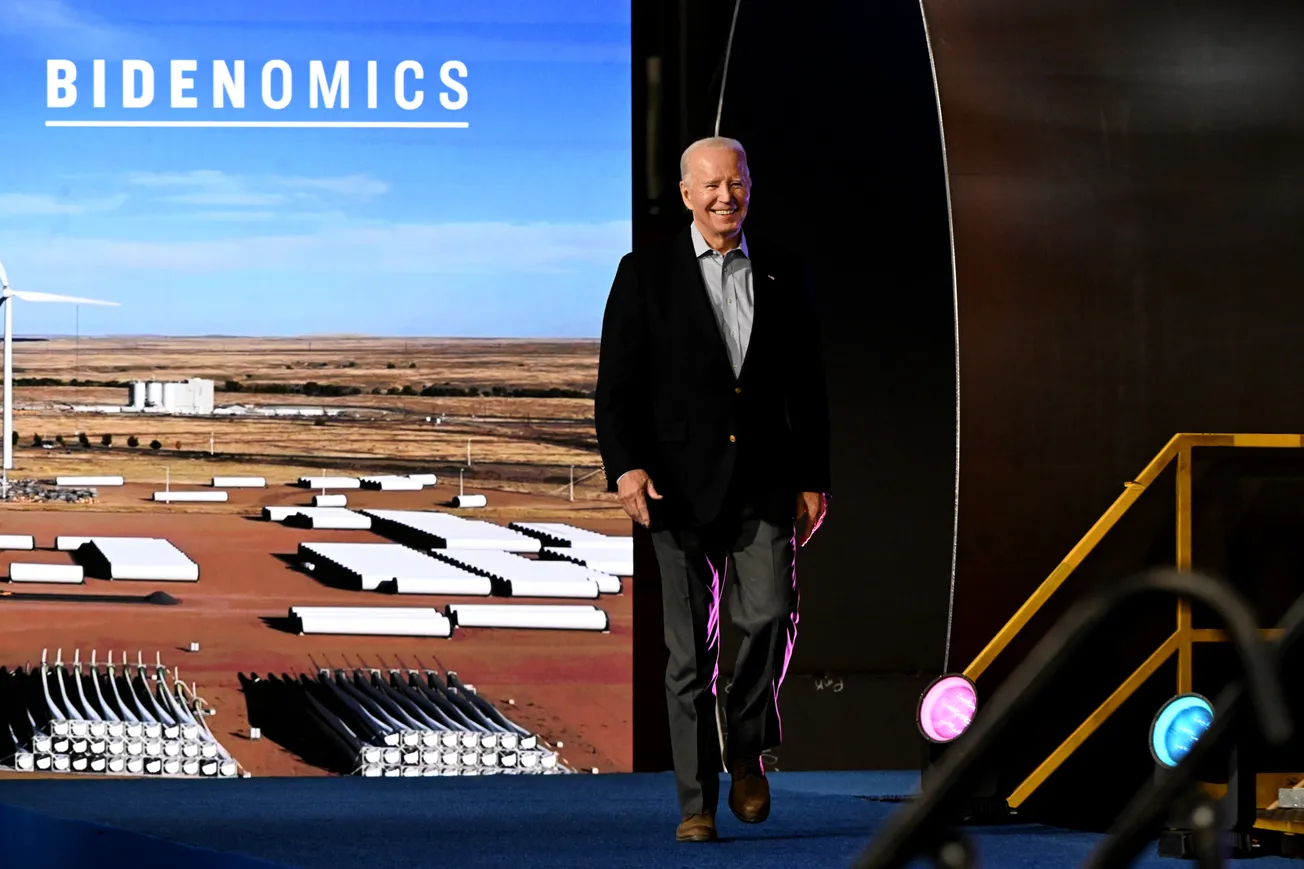

In a throwback to a Soviet-style, centrally-planned boondoggle, Biden's key industrial policy raised $738 billion in new taxes and borrowed the rest of an $891 billion package "to invest" in American manufacturing and infrastructure, promote clean energy and electric vehicles, expand access to broadband internet, and increase funding for research and development in emerging technologies. Anything that was environmentally sound (green) would get sizable government assistance. Industries that were dirty (coal, oil) would get penalized. The law, sold as Washington's solution to climate change, is proving to be a dud.

The New York Times reported that CubicPV, a Massachusetts-based company that announced with much fanfare a plan to build solar panels in Texas as a "direct result of the long-term industrial policy contained within the Inflation Reduction Act," threw in the towel and gave up. As CubicPV was gearing up to make wafers in the United States, prices of those components were dropping by 70 percent because China's green energy companies were "flooding U.S. markets with cheap solar panels."

Last year, Royal Dutch Shell, which had a joint venture with Atlantic Shores Offshore Wind and the rights to provide offshore wind energy to New Jersey, abandoned the project altogether and walked away. The project faced supply chain issues, rising interest rates, and insufficient state financial subsidies. It aimed to provide 1.5 gigawatts of offshore wind energy, enough to power over 700,000 homes in New Jersey. The expected start-up of the wind farm was initially set for 2027 - and now, the wind farm sector faces an uncertain future.

In a classic case of America's industrial policy fighting China's industrial policy, it is clear that China is winning hands down. To keep its vast factories humming and meeting aggressive GDP growth targets, China is producing massive quantities of every possible green energy product - from EVs to batteries to wind farm components to solar panels - and selling them abroad after meeting significant demand from its domestic economy.

Over 60 percent of the world’s solar panels are produced in China and mainly used domestically for energy generation. With a substantial installed capacity and continuous investments in solar technology, China leads the world in solar energy production, including rooftop installations. So dominant is China's positioning in the green sector that the country holds more than 80 percent of the world’s polysilicon, wafer, cell, and module manufacturing capacity. China invested $130 billion into the solar industry in 2023 alone.

In EVs, China's auto exports, particularly new energy vehicles (NEVs), including all-electric and plug-in hybrids, saw exports rocketing 57.9 percent to a record of 4.9 million units in 2023. China made up more than 60 percent of global NEV sales last year. In battery production, China’s lithium-ion battery sector output surged 25 percent in 2023. The country accounted for approximately 57 percent of global demand for lithium-ion batteries in 2022.

When it comes to the green industry, China, the world's factory, clearly has a comparative advantage over every other country, including the United States. If the Biden administration was concerned about addressing climate change - a goal Biden officials say is the cornerstone of every government policy - it should have accepted China's comparative advantage in green energy manufacturing and welcomed China's exports without any tariffs.

Rooftop solar contributed only about 1.5% of all the electricity used in the U.S. in 2022. But experts say that vast areas of the country blessed with perennial solar energy - such as the Plains and the desert Southwest - could help America generate up to 45% of the electricity the U.S. uses. With far fewer federal dollars and by hewing to the theory of comparative advantage, the administration could have imported China's excess capacity, helped transform America, and reached its climate change goals faster.

Instead, the Biden administration is firing on all cylinders to set up manufacturing in America and compete against China despite the complex market structures that American companies face with varying regulations at the state level. Securing financing for green energy projects can be difficult, particularly for new or unproven technologies that investors may see as risky. Some purchasing models for renewable energy can lead to price premiums, making it more expensive for companies to switch to green energy compared to traditional energy sources.

And now, after failing on the factory floor and being egged on by Treasury Secretary Janet Yellen, America is threatening tariffs on Chinese exports of green energy products, increasing their cost to the average American household in an already high-inflation economy. According to the Times, ahead of talks with Chinese officials at the Treasury Department on Tuesday, Yellen said that China was not operating on a “level playing field” and warned that by producing more green energy products than the world can absorb, it was putting American firms and workers at risk.

Yellen, a distinguished economist, should perhaps brush up on the chapter on comparative advantage. Countries with a comparative advantage do not have an obligation to serve other countries that don't have an advantage by leveling the playing field. It is like asking a baseball pitcher to go easy on an opponent batter so that the latter can score. That is just not the way the world works.

Rajkamal Rao is a columnist and a member of the tippinsights editorial board. He is an American entrepreneur and wrote the WorldView column for the Hindu BusinessLine, India's second-largest financial newspaper, on the economy, politics, immigration, foreign affairs, and sports.