Beijing has retaliated after raising protests and issuing warnings against U.S.-led efforts to curb the Chinese semiconductor chip manufacturing sector. China announced plans to curb the export of two metals - gallium and germanium.

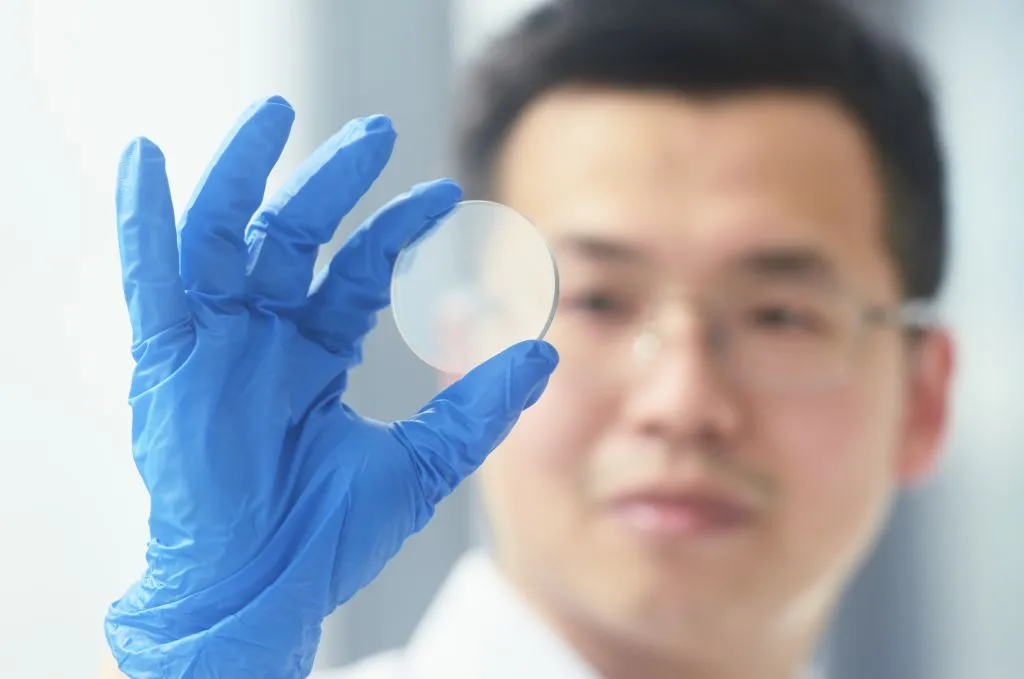

The export of these rare earth metals, used in computer chips and solar plans, has not been banned. But, restrictions or additional regulations could spell trouble for chipmakers everywhere as China holds more than half (60%) of the world's germanium. The country possesses 80% of the world's gallium. This is over and above its vast resources of other critical minerals used in semiconductor chip and lithium-ion battery manufacturing. With the new statutes taking effect on August 1 (less than a month from now), the global supply chain of these vital components is likely to be disrupted.

The move comes days after the Dutch government announced new exports rule limiting the sale of ASML chip-making machines to China. As per the new law, starting September 1, the company will need an export license issued by the Netherlands government to sell its most advanced immersion DUV lithography systems to Chinese firms.

Advanced Semiconductor Materials Lithography (ASML), the Dutch company, is Europe's most valuable technology firm. The company designs and builds machines that make the most advanced computer chips. Being the only company in the world with that kind of know-how makes it an effective monopoly.

Manufacturers like Taiwan Semiconductor Manufacturing Co, Samsung Electronics, and Intel use extreme ultraviolet (EUV) lithography machines made by ASML. As export bans were already in place for the most advanced machines, the latest development is unlikely to affect Chinese manufacturing capabilities immediately.

China's sudden "export control" is seen as a direct retaliation to The Hague's move. Though in the short term, it may drive up the price of semiconductor chips and affect industries such as data centers, 5G services, radar, and wireless communication sectors, in the long run, Beijing's move may prove to be a boon.

The two metals, gallium and germanium, are not considered to be rare. Industry experts believe that China's new regulations could speed up the diversification of the supply chain of these metals. China has been the dominant player mainly by keeping extraction costs low. The cost advantage is responsible for pushing out other suppliers like Germany, Kazakhstan, and Russia from the market. It is also estimated that America may hold the world's largest germanium stores, though it does not extract it now.

The U.S. has led efforts to rein in the Chinese chip industry, primarily by restricting the sale of advanced machinery and technology to Chinese manufacturing firms. Citing national and international security concerns, America has diligently tried to delay China from advancing its artificial intelligence and quantum computing capabilities. The technology blockade speared headed by the Biden administration is slowly gaining ground.

China has used the same tactic as the U.S., claiming its move is necessary to protect "national security." For the same reason, Washington has been pushing stringent export curbs on Chinese firms. Beijing has been accusing Washington of coercing others to join its tech embargo. Many see these moves as the end of the "globalization" era.

With both sides claiming "national security" concerns, the chip war is far from over. The tit-for-tat measures will likely raise prices and impact the technology development and transfer rate. For the layperson, it could mean higher prices and fewer free services.

Like our insights? Show your support by becoming a paid subscriber!