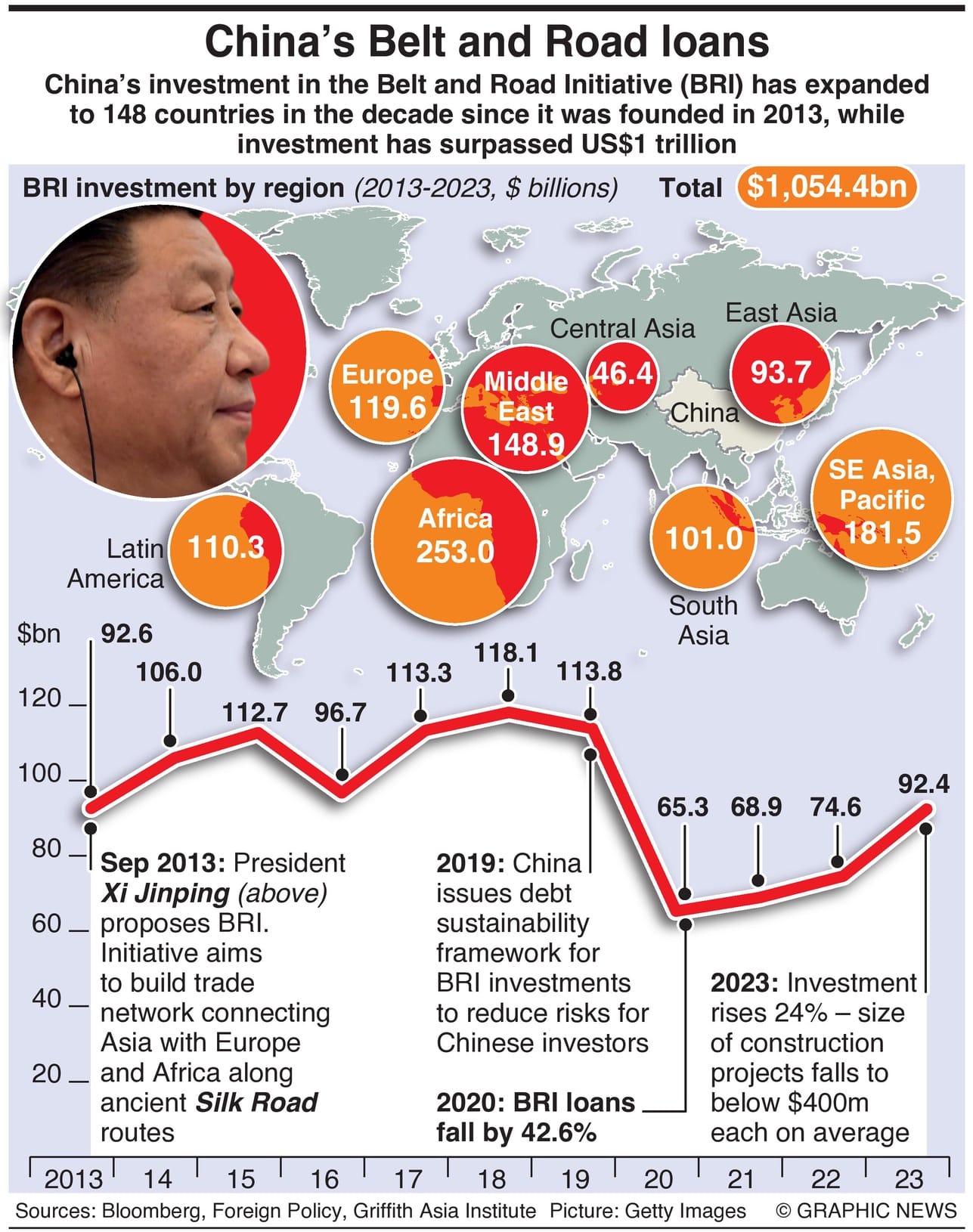

The report from Griffith University in Australia and Fudan University in Shanghai confirms recent data showing China’s outbound investment surged by 24% in last year.

The surge followed a 42.6% plunge in 2020 following introducing a BRI “Debt Sustainability Framework” in April 2019.

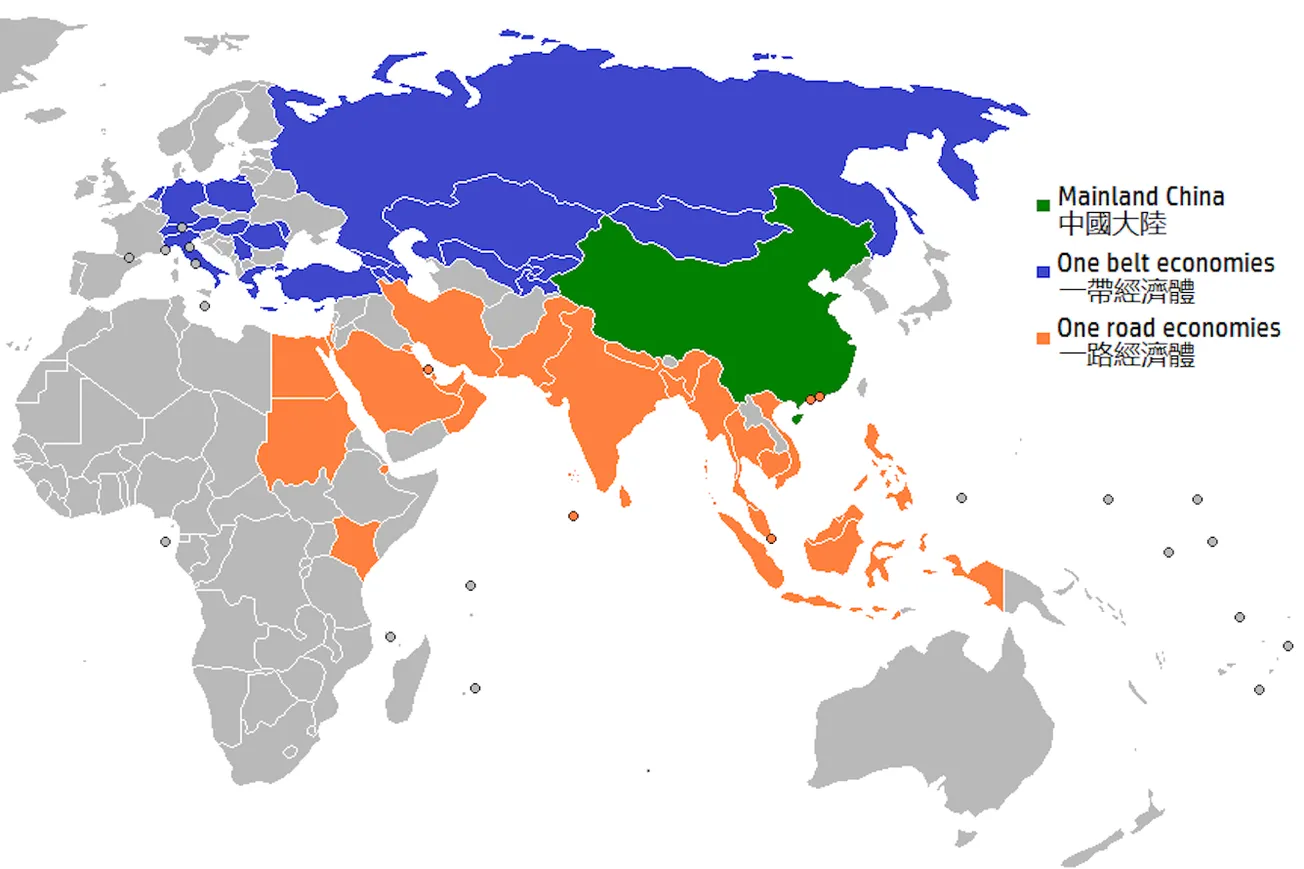

According to a study by the International Monetary Fund, from 2013 to 2016 -- the first three years of President Xi Jinping’s BRI project -- Beijing’s contribution to the public debt of low-income countries nearly doubled from 6.2% to 11.6% and has been labelled “debt trap diplomacy.”

Critics of the BRI project claim that the initiative is partly motivated by Xi’s desire to stimulate his economy and obtain strategic assets of recipient countries.

For example, unable to repay China for a loan used to build a new port in Hambantota, Sri Lanka signed over to China a 99-year lease for its use -- a strategic base for China’s navy.

In Djibouti, public debt rose to 47% of the country’s Gross Domestic Product in 2022, placing the country at high risk of debt distress.

It’s no coincidence that China’s first official overseas naval base has been established in Djibouti’s northern Obock region, eclipsing a smaller U.S. military installations there.

Beijing has refuted debt trap charges.