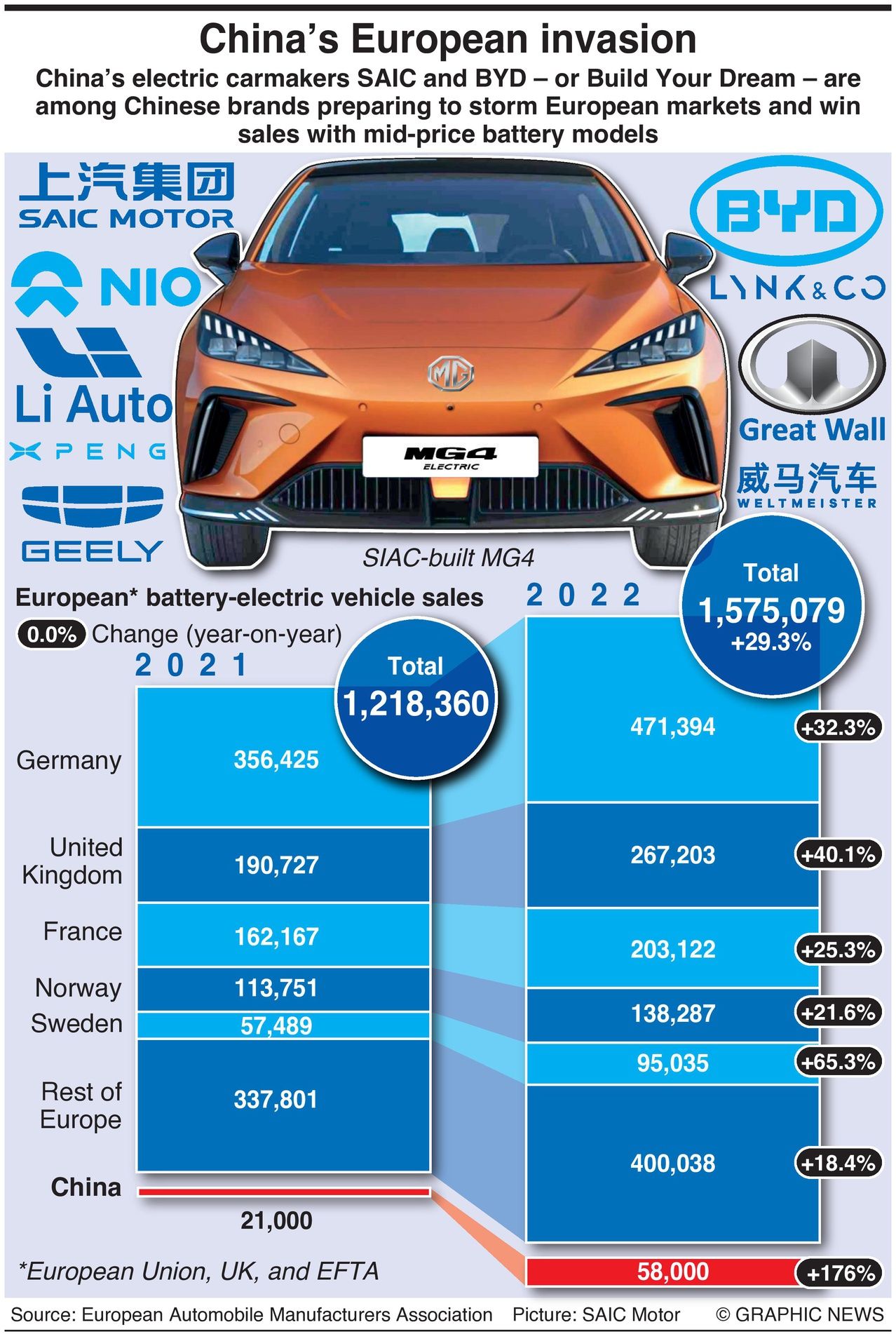

China’s electric carmakers SAIC and BYD – or Build Your Dream – are among Chinese brands preparing to storm European markets and win sales with mid-price battery models.

Industry analysts warn that China’s ascendance will reshape the continent’s automotive landscape for a decade, especially the €30,000-plus ($33,000-plus) mass-market segment.

Great Wall’s Ora brand aims to enter the market with its €34,000 ($37,250) Ora Funky Cat model. Shanghai-based SAIC’s MG4, with sophisticated driver assistance software, is selling at €30,600 ($33,540) -- about 35% below its competition, the Tesla Model 3, at €48,700 ($53,370).

BYD, the Warren Buffett-backed group, and China’s biggest EV maker, has launched new mass-market models, including one of its smallest and cheapest electric cars yet. BYD’s Seagull hatchback offers a range of 300km from its lithium-ion blade battery for just €10,350 ($11,360).

Stellantis chief executive Carlos Tavares warned that Chinese state-backed companies would sell their vehicles at a loss to undercut European brands and grow market share.

“The market is wide open to the Chinese,” Tavares said.

The advent of electric vehicles has given Chinese brands their first shot at dominance on the international stage. China’s tech giants have plowed more than €17 billion ($19bn) into car-related technologies since 2021.

“If Europe wants to maintain the competitiveness of its car industry, the EU must introduce a strong industrial policy of its own to match the Chinese and Americans’ muscular support for EVs,” said Julia Poliscanova, director of green lobby group Transport and Environment.