Commercial Real Estate (CRE) includes, among others, office buildings, data centers, hotels, apartment complexes, warehouses, industrial properties, retail spaces, and malls.

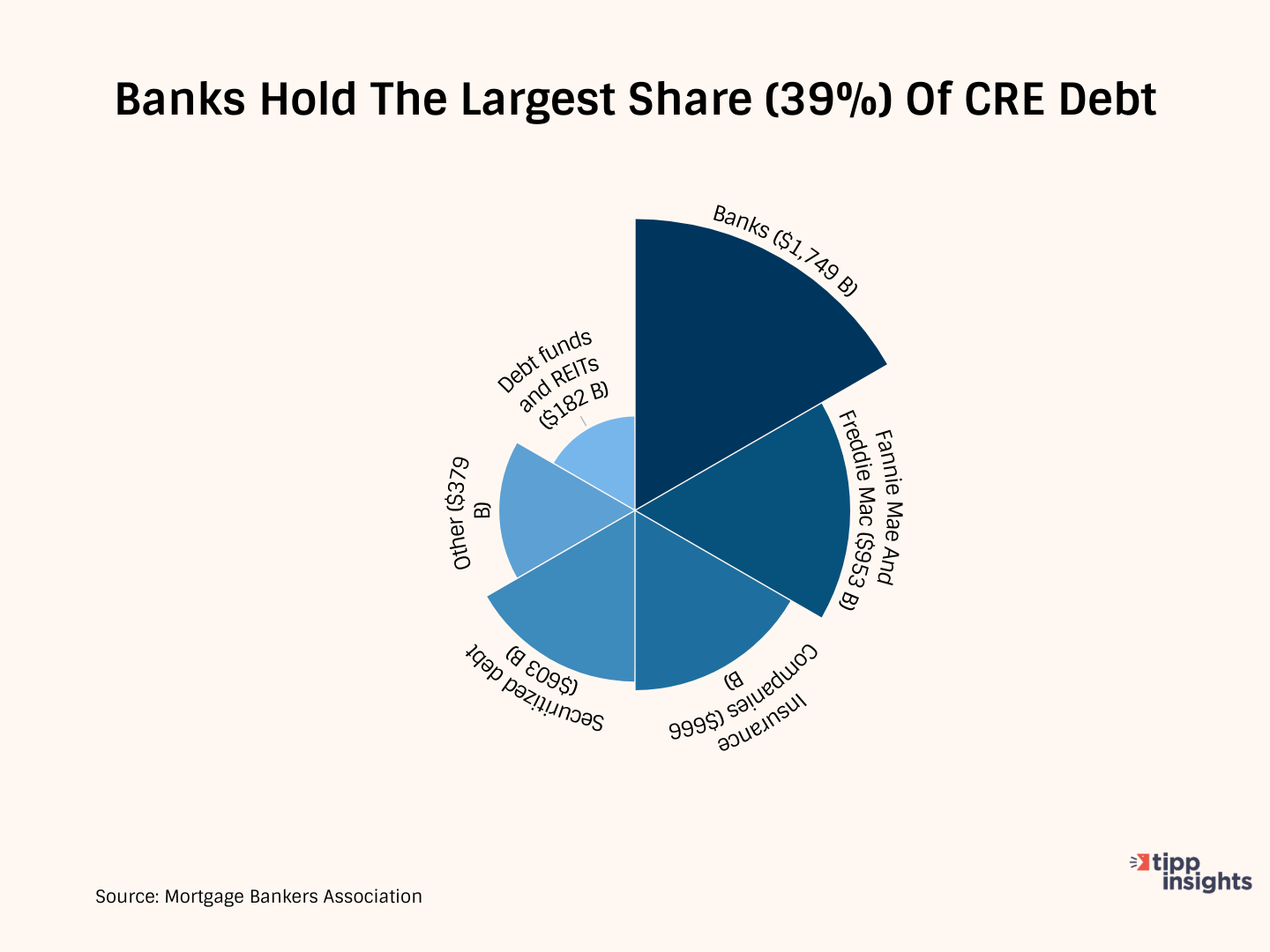

The U.S. commercial real estate sector is valued at $20 trillion. The total amount of commercial real estate loans outstanding is approximately $4.5 trillion, with a loan-to-value ratio of 25%. Mortgage Bankers Association data shows that banks hold the largest share of the debt, accounting for 39%.

CRE faces a perfect storm because of a combination of factors, including the rise of work-from-home jobs, rising interest rates, and the weakness of the banking system. There is a real fear that some of the iconic buildings that have become synonymous with cities and the face of commercial hubs may face changing fortunes.

Work From Home/Hybrid

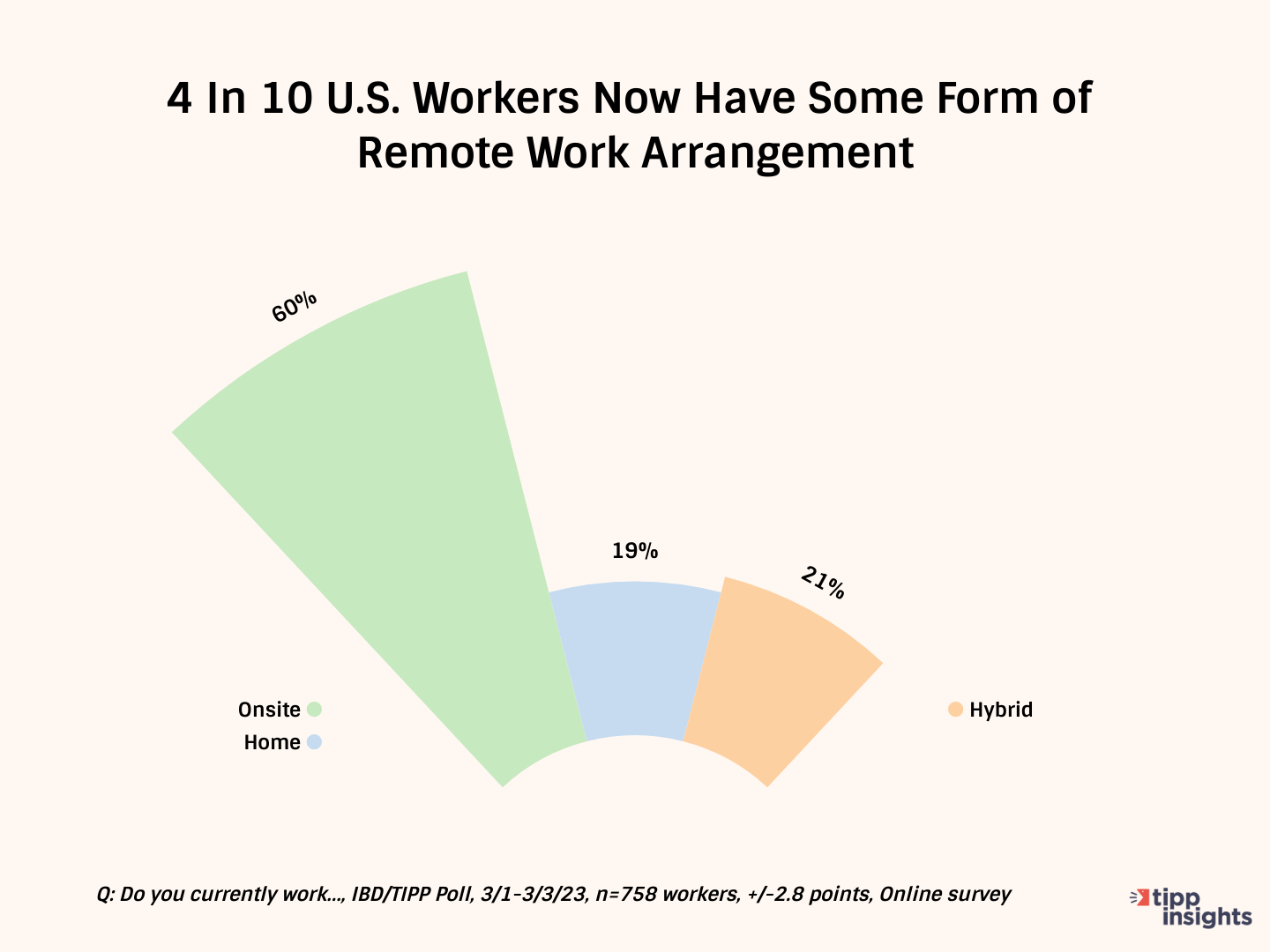

A recent IBD/TIPP Poll found that 60% of American workers only work on-site, 19% only work from home (WFH), and 21% do a combination of both.

As the WFH and hybrid work trends continue, many companies are finding that they need less office space. To cut costs amid high-interest rates, some businesses are resorting to layoffs and expense reductions such as giving up office space or downsizing. Remote work option also allows companies to move to less expensive or volatile real estate markets. Many have shifted to Tier 2 cities, less costly states, or even the suburbs to cut down on overheads.

Before the pandemic, the national office vacancy rate was around 12% in 2019. According to Cushman & Wakefield, it will increase to approximately 18% by 2030, roughly equal to one billion square feet of unused office space.

Small Banks Exposure

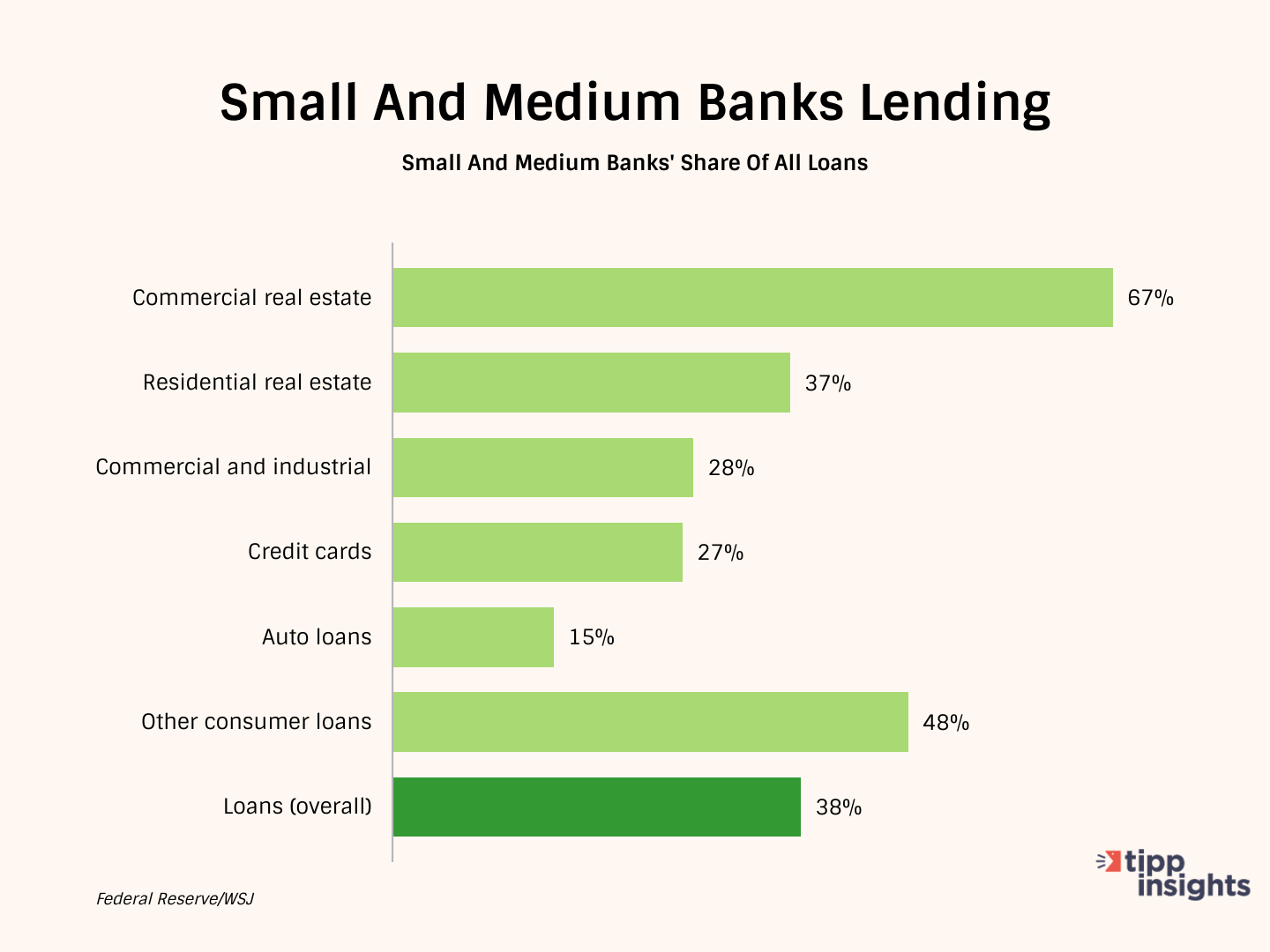

Federal Reserve data, as reported by the Wall Street Journal, shows that banks smaller than the top 25 hold 68% of commercial real estate lending.

During the pandemic, consumer deposits in banks ballooned. As we came off the pandemic, consumers started withdrawing savings to fund activities.

Small banks facing declining deposits began tightening lending standards even before Silicon Valley Bank and Signature Bank collapsed. The collapse of the banks further boosted withdrawals from small banks.

Interest Rates

A large portion of CRE, $1.5 trillion, initially financed at low-interest rates, is due for refinancing over the next two years, with prevailing rates higher by 350 to 450 basis points.

As business owners decide to shift their workers to WFH, downsize, or opt for coworking solutions such as WeWork, property owners are forced to raise rentals for their commercial properties to meet higher interest payments or have to hand over the keys if payments can’t be made.

Further, landlords are squeezed by falling property prices, a fallout of rising vacancy rates.

Cracks are already appearing in the CRE market. Recently, Columbia Property Trust, a large office landlord controlled by PIMCO, defaulted on $1.7 billion in loans tied to seven buildings across the country, marking one of the largest office defaults since the start of the pandemic. Elevated interest rates that pushed monthly payments higher was the reason for default.

It's impossible to know what the future holds, but it's clear that the commercial real estate sector is facing some ominous challenges.

Like our insights? Show your support by becoming a paid subscriber!

Want to show your appreciation? Donate