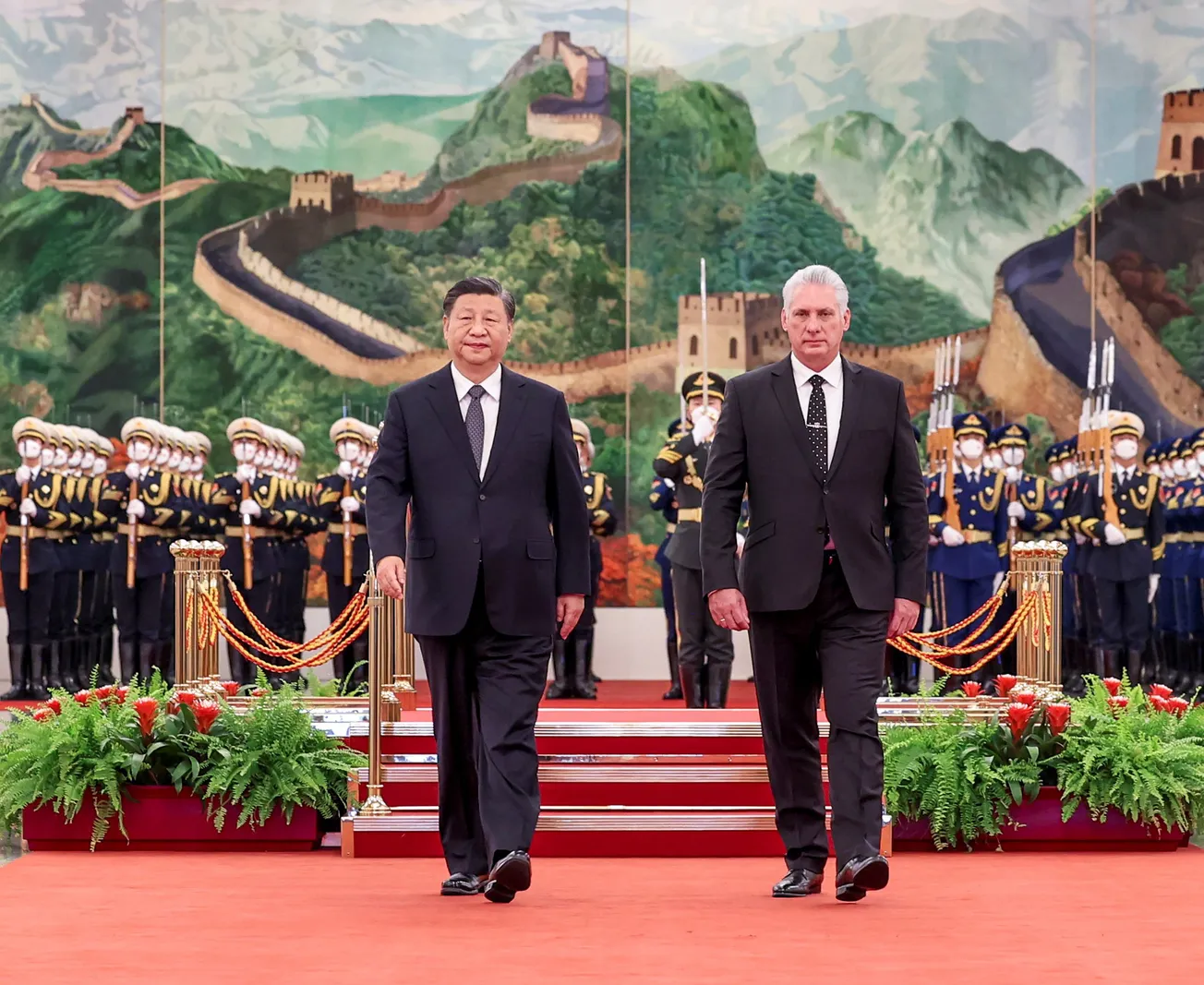

The world recently learned that China is secretive about everything, from the origin of the coronavirus to the number of cases in the country. The same holds for its inter-country lending.

China is the world's largest lender to developing countries. China's international development assistance averages $87 billion per year, compared to $37 billion for the United States, most of it in high-risk loans from Chinese state banks.

However, there's nothing altruistic about it. The country's lending process takes advantage of poor countries and leads them into debt traps. Forty-two low-to-middle-income countries (LMICs) have debts to China that exceed 10% of their GDP.

The lending schemes achieve three of Beijing's objectives: employing its people on infrastructure projects, spending its foreign currency surplus, and helping to stake its claims on strategic resources on foreign soil.

Many transactions between China and others are unknown to gold standard bookkeepers, such as the World Bank and IMF, who track lending between countries.