On the heels of record-high inflation, Americans now have to deal with a credit crunch that will put borrowing out of the reach of many.

According to a note by the Morgan Stanley CIO, "The data suggest a credit crunch has started." A credit crunch refers to a situation where there is a shortage of credit in the financial system, typically due to a lack of liquidity, as banks become more risk-averse and tighten their lending standards. The past fortnight recorded the steepest decline in lending in the United States as banks do their best to surmount the "deposit flight" set off by recent bank failures.

Bank deposit flight refers to the situation when depositors withdraw their money/deposits from a bank or banks, either due to a lack of confidence in the country's financial system or a particular institution. Depositors may also withdraw funds when changes in monetary policies or interest rates are instituted.

Concerns about a bank's financial stability, ability to meet obligations, or fear of bank failures are all grounds that trigger deposit flights.

When account holders withdraw their funds, it can create a liquidity problem for banks. Then, the financial institutions are forced to respond by either selling assets to meet their obligations or curtailing lending activities, often leading to a credit crunch.

A credit crunch makes it harder for individuals and businesses to obtain loans and access funding. Business investment and consumer spending will decrease, leading to a slowdown in economic activity. This, in turn, may lead to job losses and lower wages. The high-interest rates make it difficult for borrowers to manage their debt.

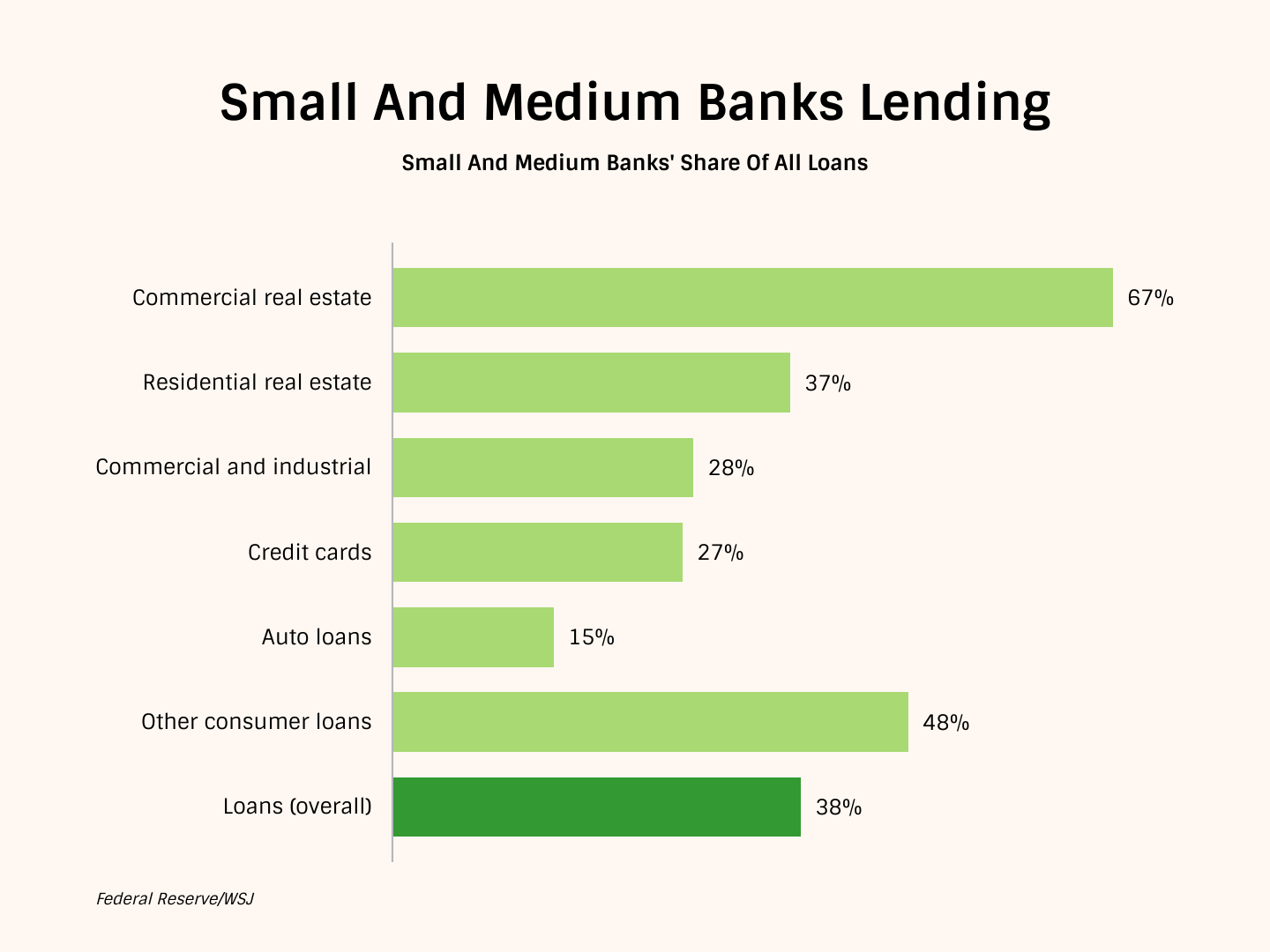

Often the first to suffer are small and medium enterprises. According to Federal Reserve data reported by the Wall Street Journal, smaller banks outside of the top 25 are significant contributors to community lending.

During the pandemic, many consumers deposited large sums of money into banks. As the pandemic eased, people started withdrawing their savings to fund their activities, resulting in declining deposits for small banks. According to Morgan Stanley, $1 trillion in deposits has been withdrawn from US banks after the Federal Reserve started raising rates a year ago.

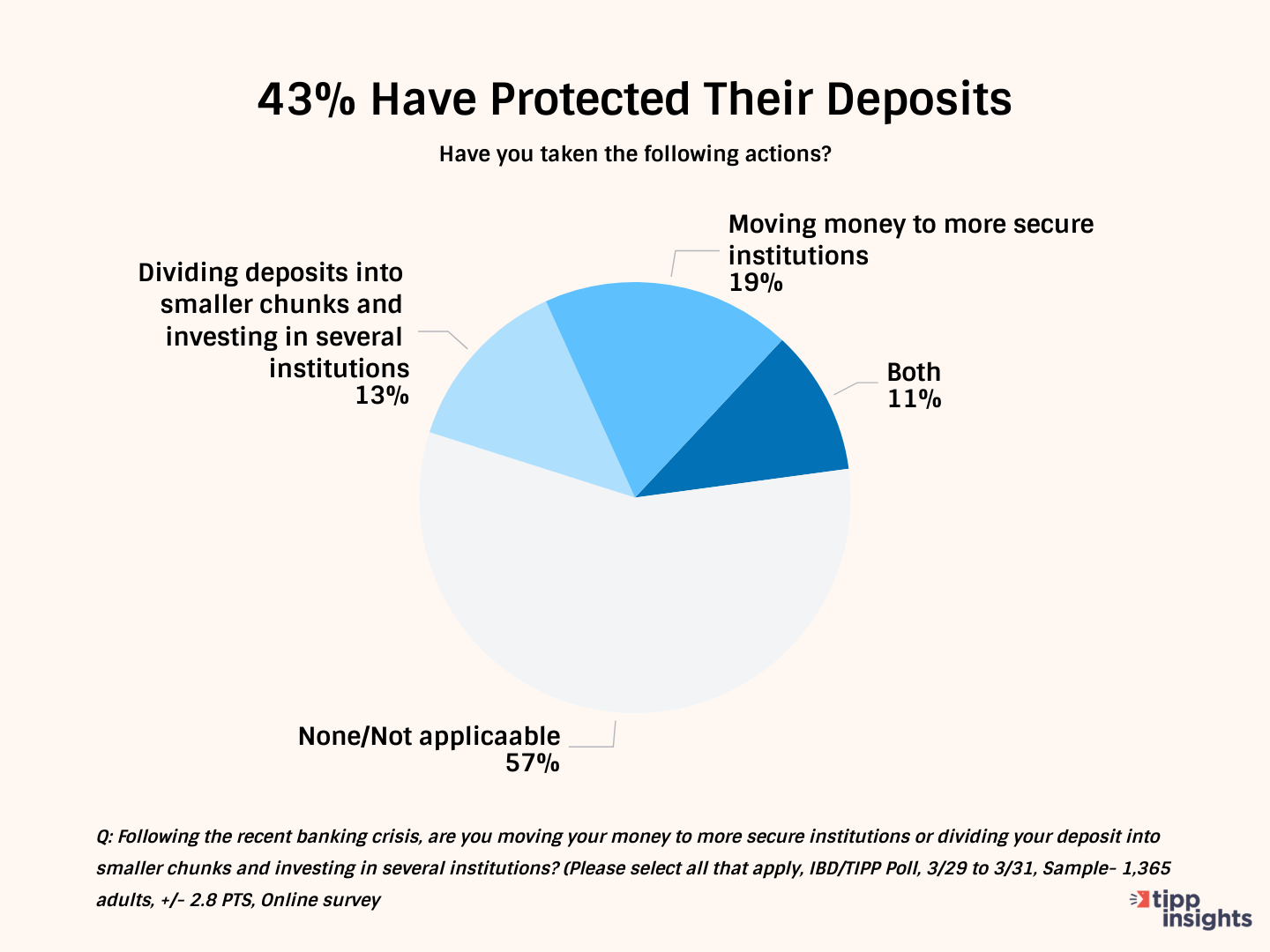

To compensate for the shortfall, small banks had begun tightening their lending standards even before the collapse of Silicon Valley Bank and Signature Bank. The failure of these banks further contributed to a flight to safety, with some people moving their money to larger banks or spreading their savings across multiple banks.

A recent IBD/TIPP poll found that 19% of Americans moved their money to larger banks, 13% divided their deposits into smaller amounts across different banks, and 11% did both.

As banks tighten lending, it can become more difficult for individuals and businesses to obtain loans and access funding, decreasing business investment and consumer spending. This can, in turn, lead to a slowdown in economic activity and job losses, which can further exacerbate the credit crunch by reducing savings and deposits. The negative feedback loop can be difficult to break.

With the government’s help and some of the largest financial institutions stepping in, a credit crisis has been averted. Still, the economic headwinds are far from over. The Federal Reserve is warning of a “mild recession” due to bank failures later this year. The only good news is that the Federal Reserve may choose fewer interest-rate hikes this year to prevent exacerbating the credit crunch.

Related Contrast: YELLEN: The U.S. Economy Is Doing Extremely Well - Video

Like our insights? Show your support by becoming a paid subscriber!

Want to show your appreciation? Donate