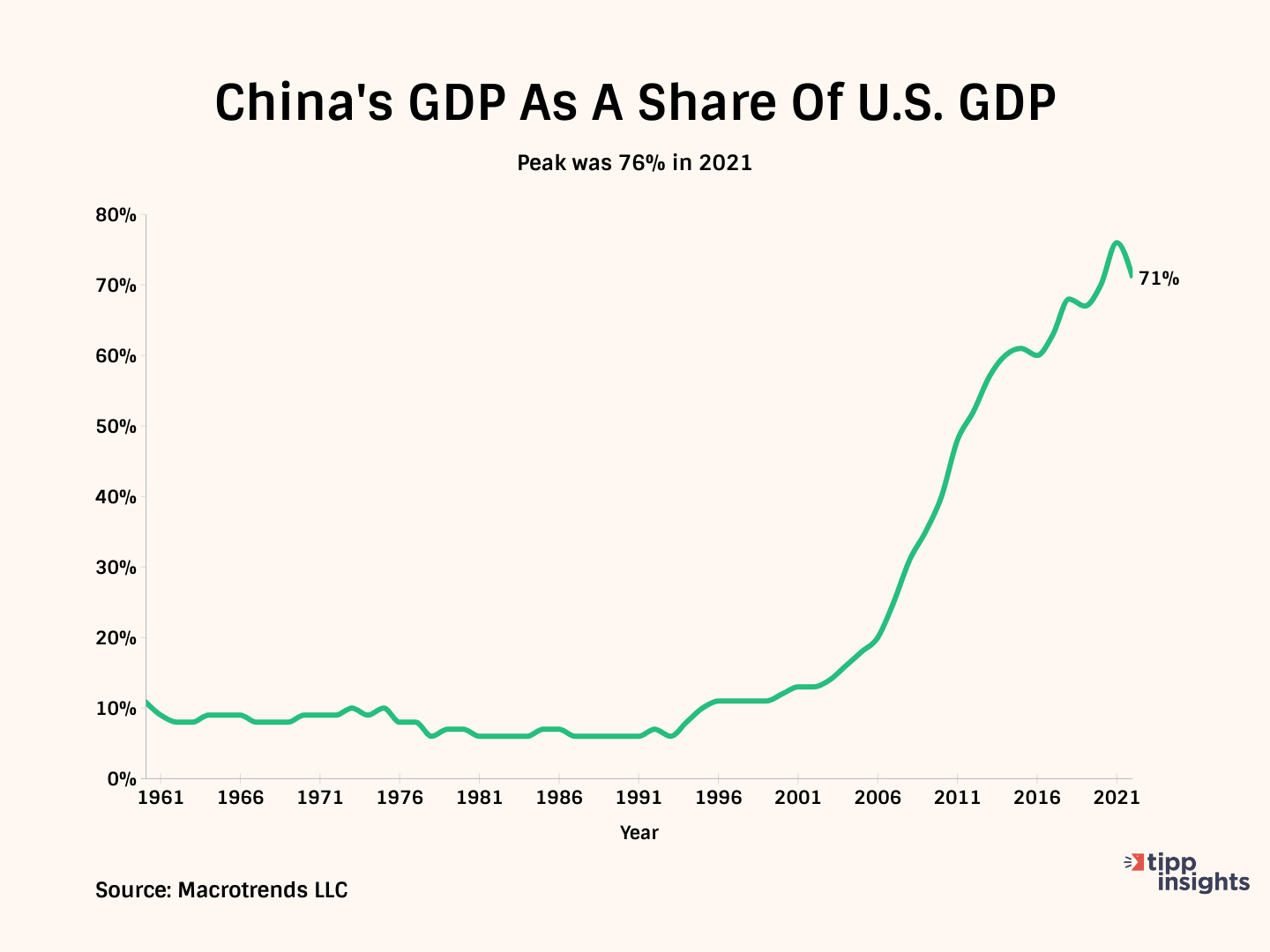

The world's second-largest economy is facing multiple headwinds and is in peril. Statistics and numbers released by various Chinese state departments have pointed to a complex crisis long in the making.

Though it has been known for some time that the Chinese economy is shrinking, the scale of the predicament is slowly emerging. A few key factors are dragging the Chinese economy into the doldrums.

The debt cycle that China entered into to tide over the 2008 financial crisis has contributed significantly to the present state of affairs. Beijing pumped money into the economy and fuelled the property sector to drive growth, making it one of the largest contributors to the country's GDP.

"After years of building housing and offices at breakneck speed, the bloated property sector – which accounts for 23% of the country's GDP (26% counting imports) – is now yielding diminishing returns." opined renowned economist Kenneth Rogoff.

Over the past few months, multiple behemoth property developers have sent shockwaves through the Chinese economy. The collapse of Evergrande and Country Garden created panic in China, where real estate is considered a 'safe investment.'

President Xi Jinping's authoritarian rule and increasing bureaucratic interference in multinational companies have prompted many large firms to leave the country. This is bad news for "the world's manufacturing hub," which provides cheap labor to some of the world's biggest brands. The search for alternate production sites to shore up the supply chains will also drive more multinational companies out of China in the coming months.

Chinese official data shows that foreign investment dropped more than 80 percent in the second quarter year-on-year. The foreign direct investment (FDI) outflow could negatively affect the Chinese economy in the long term. FDIs played a significant role in creating jobs, enhancing productivity, and supporting China's robust export sector.

News from the trade sector is dismal, too. Struggling to recover from the harsh Zero-Covid policy, Chinese exports have fallen steadily over the months. Data show that exports fell by 14.5 percent in July YOY. It is the biggest drop since the beginning of the Covid-19 pandemic in February 2020.

Prolonged supply chain disruptions and worsening relations with its trade partners, including the U.S., have caused a drop in the demand for Chinese goods. With inflation inflicting most developed countries, demand will likely remain muted for the near future, further imperiling Chinese factories.

Beijing has been trying to boost domestic consumption to counter the fall in international demand. However, the declining population has hindered such efforts. Incentives and propaganda to boost the birth rate have not taken off. Even if it does, it will take decades to notice a marked shift in the labor market. For now, the demographic imbalance and the resulting shrinking workforce is another headwind challenging the Chinese economy.

The latest National Bureau of Statistics pegged the unemployment rate among the country's youth at a record high of 21.3% in June. In typical Chinese fashion, Beijing has decided to cease calculating unemployment rates amongst the youth.

While many of these factors result from deeply flawed policies, some factors outside human control worsen the situation. Torrential rains just before the harvest flooded large portions of wheat fields, putting a question mark on China's wheat supply and food security. In the past year, heat waves and drought conditions are estimated to have negatively affected 2.2 million hectares of farmland. The country's rice production is said to have fallen by 8% in the past twenty years.

With President Xi Jinping's aggressive foreign policies raising geopolitical tensions from the South China Sea to the Pacific islands, China can ill afford to be in such a difficult situation. Beijing's militaristic aims have raised its defense budget for eight consecutive years. In March, the Chinese government approved a budget allocation of 1.55 trillion yuan (about USD 225 billion), a 7.2 percent increase from the previous year.

China has officially slipped into deflation over the last quarter and could be facing a prolonged stagnation. This is bad news for the world markets, as China is a producer and a giant consumer of goods and energy.

Beijing's total debt has skyrocketed. At nearly 300 percent of the country's GDP and surpassing the U.S., Chinese banks are walking a fine line in efforts to balance profitability while spurring domestic consumption and stimulating the sagging economy.Beijing has promised many measures to address the critical condition, including a good working environment for businesses and boosting private enterprise. So far, no concrete plans or policies have been put forth suggesting much of these "measures" would remain mere rhetoric.

Beijing is also employing a strident rhetoric to deflect attention from the crisis that will likely have a lasting impact on the Chinese. President Xi has consistently overplayed and amplified geopolitical tensions, often instigated by Beijing's actions, as "threats" to China from other nations. He has been stoking nationalism, building up Chinese navy might, and developing sophisticated defense systems.

According to the IMF, an economic crisis in China, which accounts for over 22 percent of the global gross domestic product (GDP), will have repercussions globally. The situation could present an opportunity to extract some developing countries from China's sphere of influence. The slowdown could also provide a much-needed shakedown in the world's supply chains and allow other countries to level the playing field against Beijing.

TIPP Clips

Must Watch - Selected by tippinsights Editorial Board

Kamala Harris Praises ‘Bidenomics’: It Is ‘Working’

Yellen: ‘Most Americans Feel Good About Their Own Economic Situation’

Sen. John Kennedy: ‘I’m Sorry that the American People Are Going Through Bidenomics’

NBC News: ‘More Americans Are Turning to Loans to Help Pay for Everyday Expenses’

Please email editor-tippinsights@technometrica.com