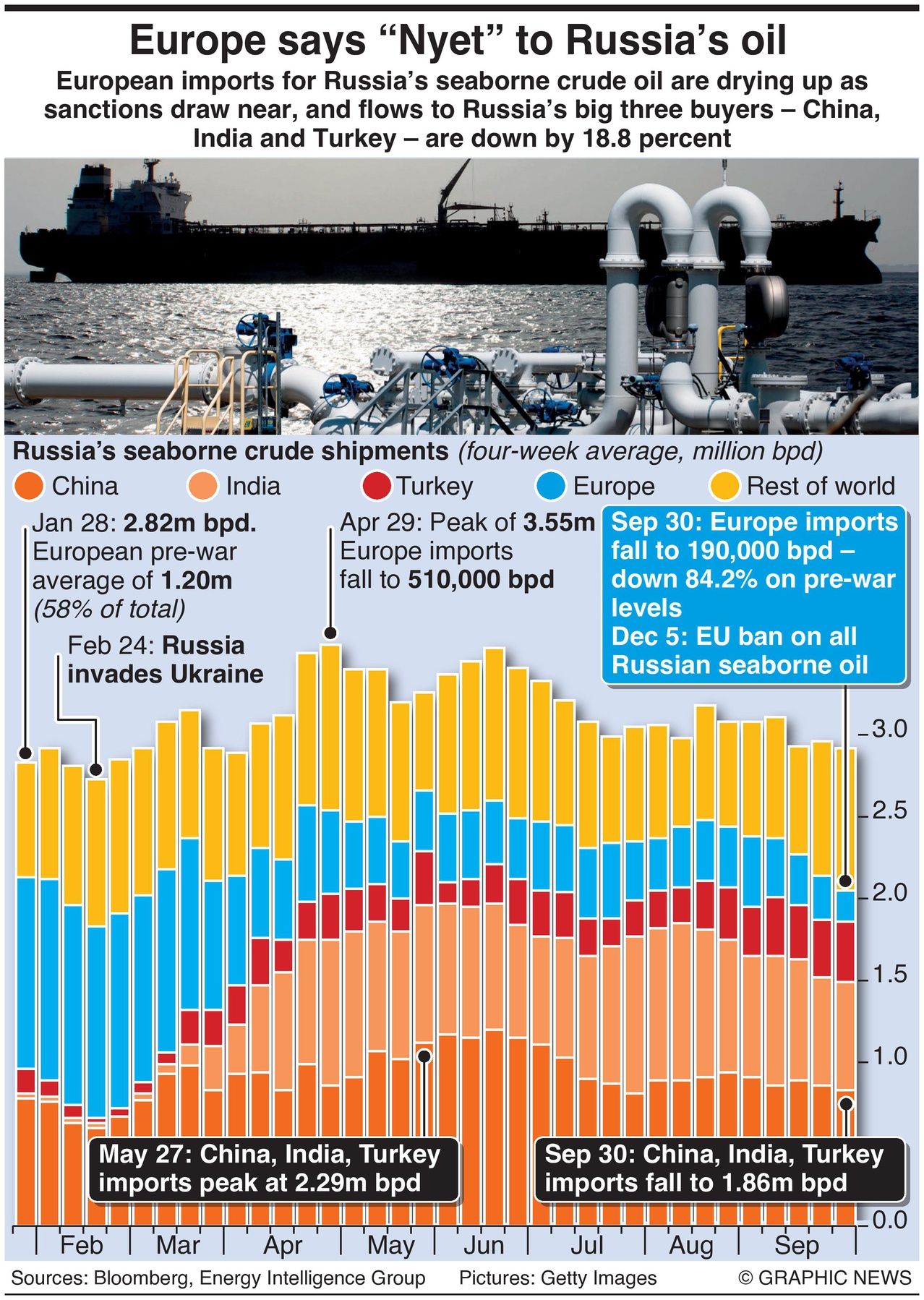

With just weeks until a European Union ban on seaborne crude imports comes into effect on December 5, shipments to the bloc are down by about 84 percent from where they were before Moscow’s troops invaded Ukraine.

In the weeks before the invasion, Europe imported an average of 1.2 million barrels per day (bpd) of Russian oil -- about 58 percent of Russia’s total seaborne exports. As of September 30, the four-week average had fallen to just 190,000 bpd.

Meanwhile, flows to China, India, and Turkey peaked in late May at 2.29 million bpd. In the four weeks to September 30, that figure was down by about 430,000 bpd to 1.86 million bpd.

Vessel tracking data monitored by Bloomberg shows that overall exports remained below three million bpd for a third week -- the most prolonged period since early March, driven by lower European flows.

The Group of Seven approved a plan to cap the price of Russian oil exports last month to cut revenue for the Kremlin to wage war in Ukraine.

From December, the proposal would allow western companies to service and insure Russian oil cargoes worldwide, exempting them from EU and other western embargoes as long as sales are below the price cap.