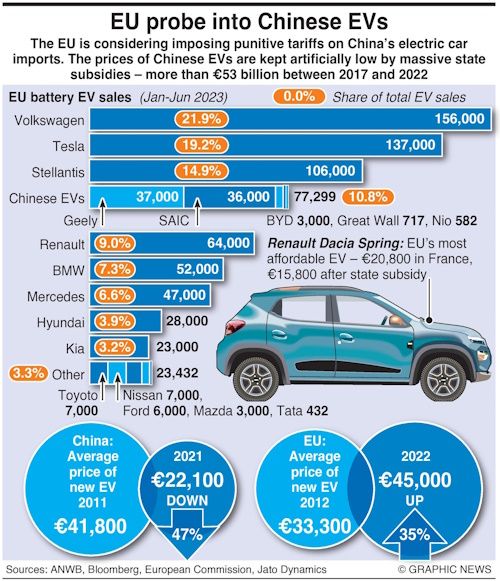

- China dominates Europe's fossil-fuel-free vehicle market, with Chinese EVs being popular due to their lower cost, typically 20% less than European competitors

- China supports the EV sector with substantial subsidies and incentives

- EU officials are considering punitive tariffs to protect domestic manufacturers from cheaper Chinese EV imports

The European Commission in 2020 proposed to "raise the 2030 greenhouse gas emission reduction target, including emissions and removals, to at least 55% compared to 1990."

The ambitious goal necessitated an accelerated shift to electric vehicles (EVs), opening the doors even wider for Chinese-made electric and hybrid vehicles. Today, China holds a lion's share of Europe's fossil-fuel-free vehicle market. The import of Chinese zero- or low-emission vehicles to the EU jumped 112 percent in the first seven months of 2023.

One of the primary reasons for the popularity of China-made vehicles is their price point. Costing about 20% less than their European competitors, these new-gen automobiles have many takers. Industry experts opine that China's dominance of the supply chain and the country's vast resources contribute to the low prices.

Besides, Beijing has been promoting the sector with government subsidies and incentives to boost exports. The country is nurturing the industry with increasing tax breaks and exemptions and has continued to do so for over a decade. China is estimated to have spent around $57 billion between EV and hybrid incentives in the last six years. The latest announcement in June stated that $72 billion will be disbursed over the next four years for EVs and green cars.

The country has steadily invested in setting up state-of-the-art manufacturing facilities that are used to make sought-after brands such as Tesla and BMW. China is the world leader in battery production and an indispensable cog in the global supply chain.

The Chinese economy is shrinking, and the automobile sector reflects the slowdown. It is estimated that the country's present manufacturing capacity produces 10 million vehicles a year over domestic demand.

But, the EU officials have taken note of "artificially low" prices made possible "by huge state subsidies." European Commission President Ursula von der Leyen appointed a commission to investigate whether to impose punitive tariffs above the standard 10% EU rate to protect domestic manufacturers from cheaper Chinese EVs flooding the Continent.

Beijing has, and will likely continue to respond belligerently to the EU's move. China's Ministry of Commerce termed the investigation a "naked protectionist act" and warned that such measures would disrupt the global automotive industry, including Europe's.

China's position as a linchpin in the global automobile sector cannot be discounted. Not only is it the world's largest producer of electric car batteries and a manufacturing hub, but the country is also a considerable market for European car makers. In 2022, Mercedes-Benz, BMW, Bentley, and Rolls-Royce combined sold 3.09 million premium vehicles to the Chinese.

To stay competitive, auto manufacturers have resorted to slashing prices and adopting measures to cut production costs. Companies are calling for better and friendlier policies to boost production and cut overheads, like lowering electricity prices and reducing bureaucratic hurdles.

While punitive tariffs will somewhat level the playing field, manufacturers are focusing on catching up with China, reducing their reliance on its supply chain, and looking for alternate factory locations.

The EU plans to ban the sale of new passenger cars and vans using internal combustion engines (ICE) from 2035. With demand certain to rise, EU automakers have much catching up to do before they can edge Chinese vehicles off European streets.

Like our insights? Show your support by becoming a paid subscriber!