- China wants to control the export of graphite, which is used in EVs

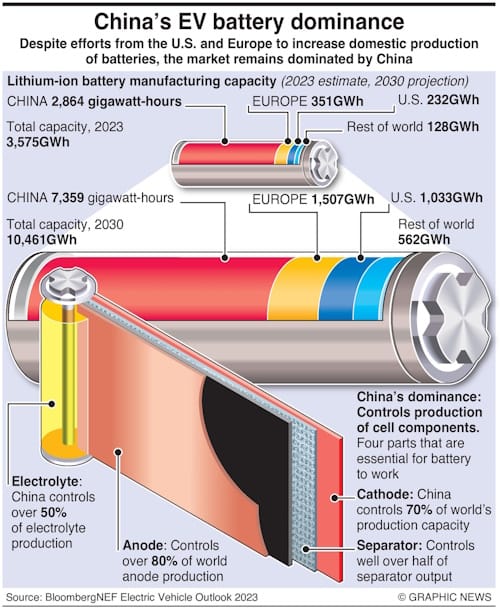

- China has a 60% market share of the EV battery market and is expanding production overseas to bypass regulations and restrictions

- The U.S. introduced rules to promote domestic raw materials and EV fuel cell production

- Washington's rules limit subsidies for EVs connected to certain countries, impacting China's plans

- New rules could stimulate a U.S. EV supply chain, benefiting the global EV industry

America has dealt another blow to Chinese ambitions to dominate the world's electric vehicle (EV) market. Washington recently put forward new rules that would encourage the use of domestic raw materials and shift the production of EV fuel cells stateside.

Thanks to innovative technologies and concerns about climate change, a relatively new technology - an electric-charged, battery-operated vehicle - has pushed up the demand for critical minerals. These hard-to-mine and process minerals are vital raw materials for everything from semiconductor chips to automobile batteries. Due to their limited availability and heightened demand, critical minerals have become potent bargaining tools in international relations.

Last week, Beijing started mandating governmental approval for the export of graphite, one of only two natural polymers of carbon. The significance of China's actions can be grasped only when one understands how crucial this mineral is to modern industry. Once dubbed a "boring" mineral used in pencils, graphite is now extensively used for its heat and electricity-conductive properties.

According to the European Carbon and Graphite Association (ECGA) website, "Graphite also has a myriad of other industrial uses in lubricants, carbon brushes for electric motors, fire retardants, and insulation and reinforcement products. Graphite is a very important part of everyday life but is rarely seen or heard of."

For instance, an electric vehicle needs between 50-100 kg (110-220 pounds) of graphite for its battery pack's anodes (negative electrodes). That is roughly twice the volume of lithium needed for an efficient battery system. By controlling graphite exports, China, the world's leading producer with the third-largest reserves, hopes to play a pivotal role in electric vehicle manufacturing.

The new norms on export are seen as another countermove against curbs imposed on the transfer of semiconductor technology and advanced chipmaking equipment to China by the U.S. Beijing had imposed oversight on the export of gallium, a raw material used in chipmaking, to discourage other countries from joining with America. Exporters are expected to report transaction details to the government and obtain approval, raising fears that the Chinese government will favor their firms over foreign establishments.

China continues to dominate the EV battery segment with a 60% global market share. Chinese firms have set up factories in countries like Finland, Sweden, and Germany to move production out of the country and circumvent restrictions and regulations. Media reports suggest that 17 domestic firms will set up 22 overseas manufacturing units at a cost of over 100 billion yuan ($14 billion).

Washington's proposed rules will severely restrain Beijing's elaborate plans to dominate the EV fuel cell market. EVs involving supply chains or manufacturing facilities "incorporated or headquartered in China, Russia, North Korea, and Iran" and companies where those countries "control 25% or more of the equity interest or board seats" will no longer be eligible for a subsidy of up to $7,500 given under President Joe Biden's Inflation Reduction Act. The hefty tax credits were offered as incentives to power the shift from fossil-fuel-based vehicles to low-pollution electric ones.

Even before the regulations were made as stringent, only 20 EV brands in the U.S. market qualified for the tax credit. Those numbers will shrink further when the new rule comes into effect. The restrictions will become much tighter in 2025 when EVs with components made with critical minerals, such as lithium, nickel, and cobalt, mined or processed by any "foreign entity of concern" will also be exempt from U.S. subsidies.

Questions are being raised about how manufacturers will source critical minerals and components currently not produced in the U.S. Stringent sourcing codes could also drive up the cost of EVs. The new rules could spur the growth of a U.S. supply chain for electric vehicles. That would bode well for the future of EVs worldwide.

We could use your help. Support our independent journalism with your paid subscription to keep our mission going.