President Trump is, without question, the most transformational occupant of the White House in recent memory. From his aggressive policies on immigration and trade to challenging the Deep State and the courts, and asserting the unitary power of the Executive, Trump has changed America more than any president since LBJ’s War on Poverty in the 1960s.

With Trump asking the Supreme Court to intervene in his fight with federal courts regarding Birthright Citizenship, under the 14th Amendment, which was ratified in 1868, following the Civil War, America could witness a major constitutional shift soon.

Forbidden by the Constitution to run a third term, Trump is technically a "lame duck." However, there's nothing lame about what Trump has accomplished in fewer than nine months since he assumed office for the second time.

Furthermore, there is one issue on which Americans want President Trump to take bold action. They want him to use all of his expansive political capital to solve the one intractable budget issue that has crippled the government since 1935: keeping Social Security and Medicare solvent.

Social Security is often referred to as the "third rail" of American politics because, like the electrified rail on a subway track, touching it can be politically perilous. The term implies that any politician who proposes cutting or significantly altering Social Security risks a massive backlash from voters, especially seniors who rely on it as their primary source of income. Since nearly every American pays into and benefits from the program, it has broad bipartisan support. Proposals to raise the retirement age, reduce benefits, or privatize the system have historically led to strong public opposition and electoral consequences.

Therefore, I suggest that Trump adopt a different path: raise Social Security taxes on the current workforce. But in so doing, he should stipulate that all payroll taxes collected will be truly held within the Trust Fund, with no monies lent to the United States Treasury to meet government obligations unrelated to Social Security. If Congress cannot pass this stipulation, Trump should back off the proposal.

Each month, Social Security collects revenues primarily from payroll taxes, supplemented by interest on its trust-fund investments. In 2025, there are approximately 68–69 million beneficiaries, and annual benefit payments total roughly $1.6 trillion, implying benefit distributions of over $130 billion per month. According to Kiplinger, the average monthly benefit for a retired worker in mid-2025 is approximately $2,005.

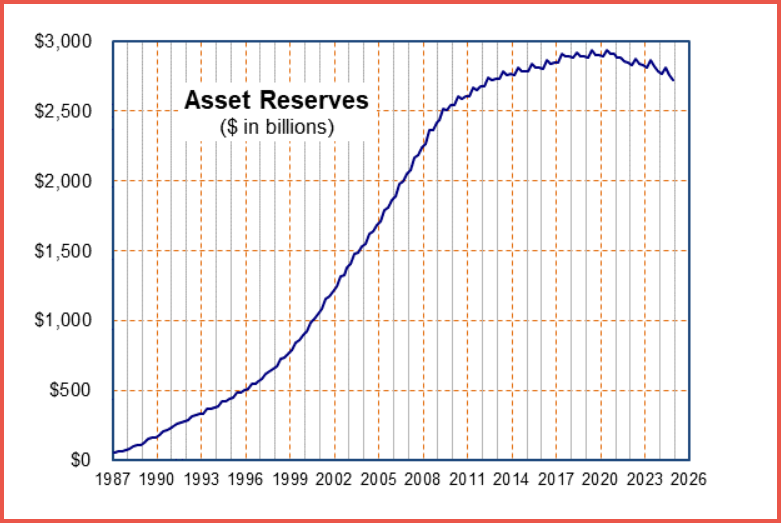

Still, the Social Security Trust Fund has continued to enjoy a surplus, and has done so since its inception. A "surplus" in the Social Security context means that in a given year, total revenues (payroll taxes + taxation of benefits + interest income) exceed total expenditures (benefits paid + administrative costs).

When that happens, the excess is invested in special U.S. Treasury securities held by the Social Security trust funds, thereby building up reserves over time. These reserves accrue interest, which becomes additional revenue credited to the trust funds.

In 2022, the trust fund holdings totaled approximately $2.83 trillion in U.S. Treasury securities, the accumulated result of past surpluses and reinvested interest. That year, interest earnings alone were about $66.4 billion, accounting for roughly 5.4% of the program’s total income.

The problem is that Congress has appropriated, and successive White Houses have spent, all of the $2.83 trillion away on domestic and international priorities. Given how badly in debt Washington is ($37 trillion and counting), it is impossible for the United States government to "pay off" the $2.83 trillion and reimburse the Social Security Trust Fund.

Because Social Security is a "pay as you go" scheme, current payroll tax revenue is more than adequate to pay benefits to retirees, as of today.

That rosy scenario goes away in 2033. According to the Social Security Trustees' Report, incoming revenues will only cover about 77% of scheduled benefits from that year onward.

It is here that Trump has a fabulous opportunity to be transformational.

From their income, current employees pay 6.20% towards Social Security (OASDI) and 1.45% for Medicare (HI). Employers pay identical amounts.

Not all of an employee's wages are subject to Social Security taxes. Once an employee exceeds $176,100, the government stops collecting taxes to fund Social Security. For Medicare (HI), however, there is no income cap because all covered wages are subject to the Medicare payroll tax.

The Trust Fund, therefore, collects a total of 12.40% for Social Security and 2.90% for Medicare. High earners pay an extra 0.9% Medicare surtax on wages above the statutory threshold.

📈 Check out today’s TIPP Zeitgeist below on the Direction of Country for a data pulse that gives you an edge on the national discourse.

So, what should Trump propose? He should suggest that Congress should pass legislation to make the Trust Fund solvent until at least 2060 by raising payroll taxes on current employees.

A lot will depend upon unknowns such as wage growth, fertility, and health spending related to Medicare. However, the trustees have said that increasing payroll taxes from the current 12.4% to approximately 15.9–16.1% would close the actuarial shortfall and make the program solvent for the next 75 years. This would amount to an increase of roughly 3.5–3.7%.

Trump, the classic dealmaker, could cut this in about half, to a total increase of about 2.0-2.4%, split equally between employees and employers, thereby keeping the system solvent until 2060. Since all the funds will remain within the Trust Fund and not be loaned out to the Treasury, Americans are likely to support the proposal, as the fear that many have today—that Social Security will not be around for them—is alleviated.

Additionally, Americans are likely to support Trump since Social Security is a future benefit that will directly benefit them, as opposed to federal spending that may not.

Entitlement spending is the most significant slice of the federal budget and the most challenging to cut. Trump has made waves with DOGE cuts and victories in the court regarding cutting discretionary items. Reforming Social Security would enshrine his legacy just like FDR’s and LBJ’s, the creators of America’s pension system.

Rajkamal Rao is a columnist and a member of the tippinsights editorial board. He is an American entrepreneur and wrote the WorldView column for the Hindu BusinessLine, India's second-largest financial newspaper, on the economy, politics, immigration, foreign affairs, and sports.

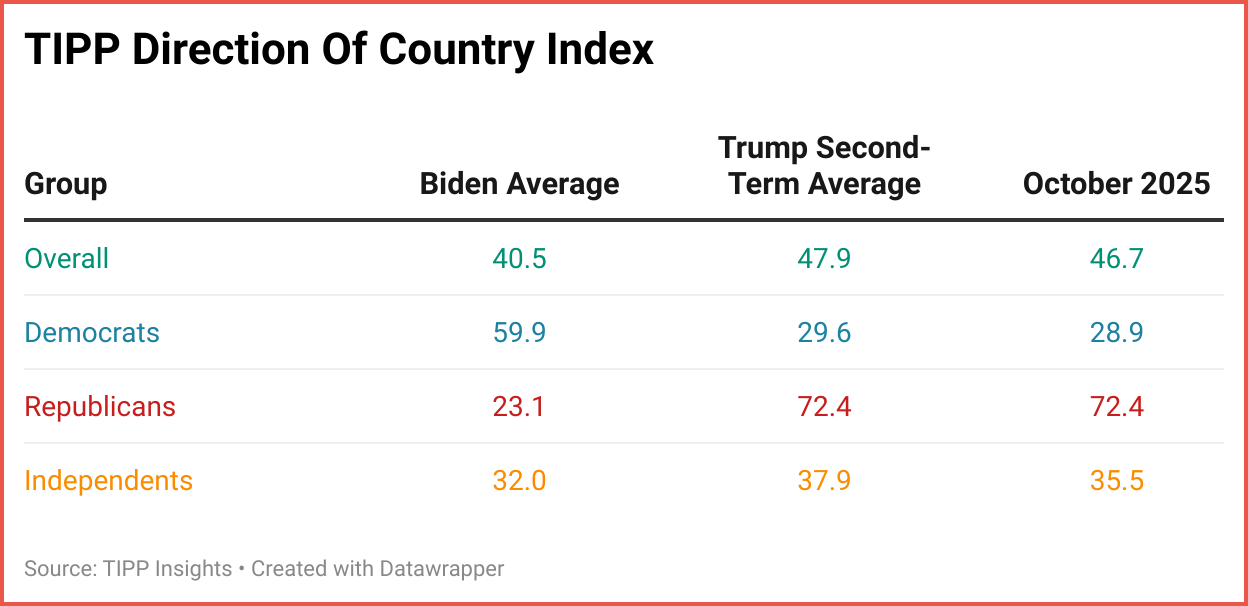

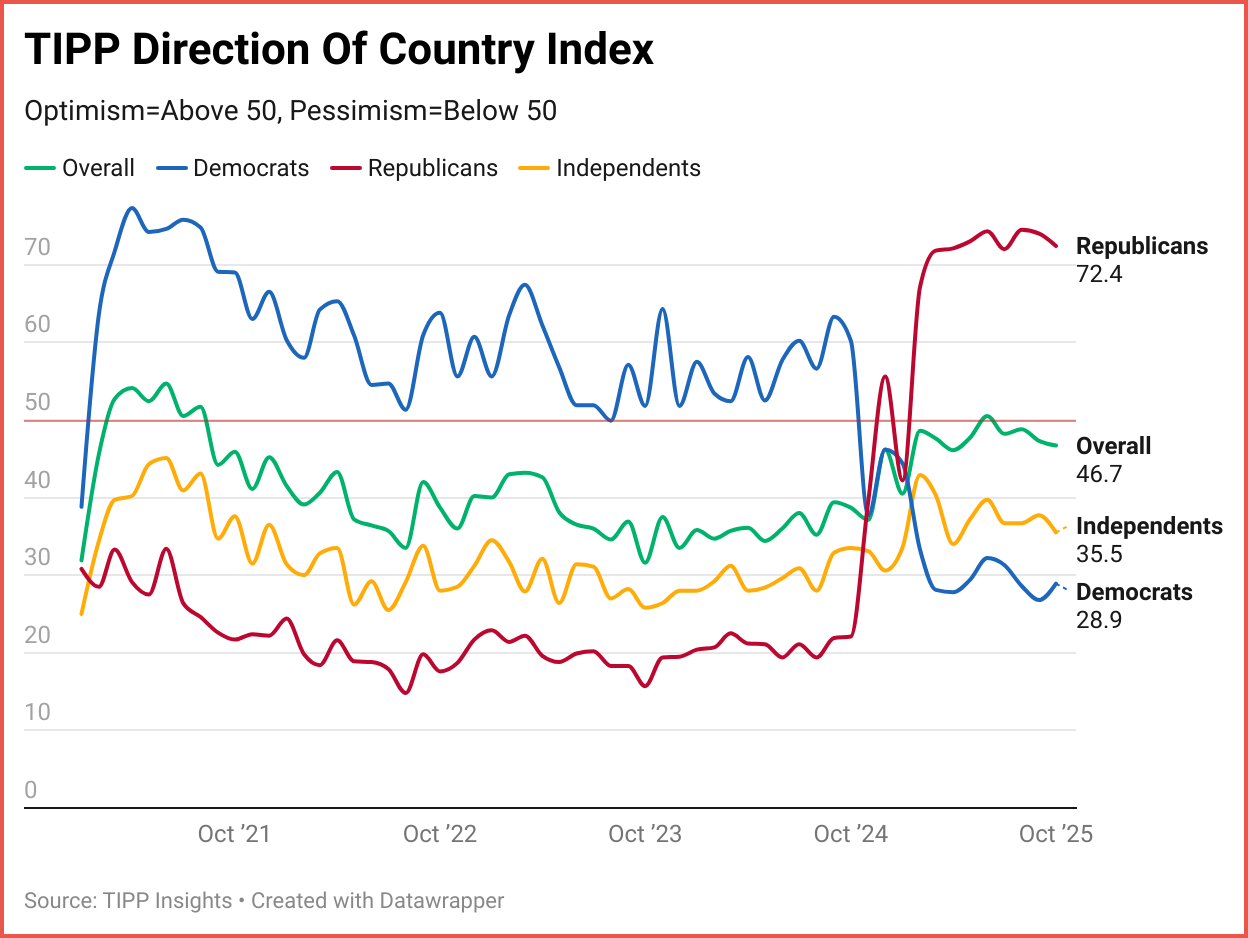

🧭 TIPP Zeitgeist — Direction Of The Country

The Country’s Compass Tilts Toward Hope

Americans grow slightly more optimistic, even as divisions persist

Overall optimism now stands at 46.7. The average during the first nine months of President Trump’s second term is 47.9, notably higher than the Biden-era average of 40.5.

Republicans remain the most upbeat at 72.4, while Democrats register just 28.9. Independents show moderate confidence at 35.5.

The rebound suggests Americans are sensing a modest improvement in national direction even as polarization and an extended government shutdown weigh on confidence.

📊 Table: Comparing Eras

📈 Chart: The Direction of Country Over Time

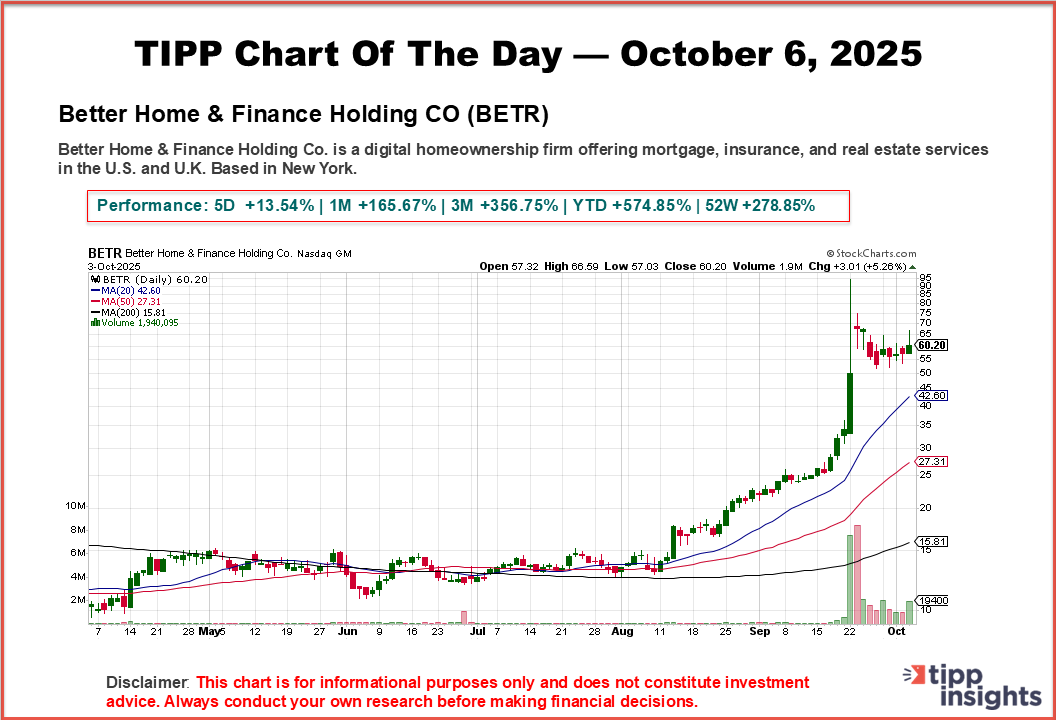

📊 Market Mood — Monday, October 6, 2025

🟢 Futures Edge Higher

U.S. futures rose modestly as investors tracked an extended federal shutdown and looked ahead to the Fed’s upcoming rate decision and the start of earnings season.

🟡 Shutdown Strains Washington

The government shutdown entered a second week, delaying key data releases. A White House official warned mass federal layoffs could begin if talks stall.

🟣 Constellation Brands Reports

The beverage giant is set to announce quarterly results, with investors watching for tariff and demand pressures that have hurt the beer and wine segment.

🟠 Japan’s Takaichi Sparks Rally

Japanese markets surged after Sanae Takaichi’s leadership win raised hopes for stimulus and tax relief, setting her up to become Japan’s first female PM.

⚫ Oil Rebounds

Crude prices jumped after OPEC+ approved a smaller-than-expected November output hike, easing fears of oversupply following last week’s sharp decline.

Market round-up in 5 minutes. We bring you up to speed. Subscribe to TIPP Insights for $99/year.

📅 Key Events Today

🟧 Monday, October 6

No major economic releases scheduled.

Access our Featured Stocks and TIPP Top-20 archives — exclusive to paid subscribers. Subscribe now → $99/year.