By John Hugh DeMastri for Daily Caller News Foundation

As mortgage and interest rates skyrocket, demand for new mortgages hit its lowest level in more than two decades last week, the Mortgage Bankers Association reported Wednesday.

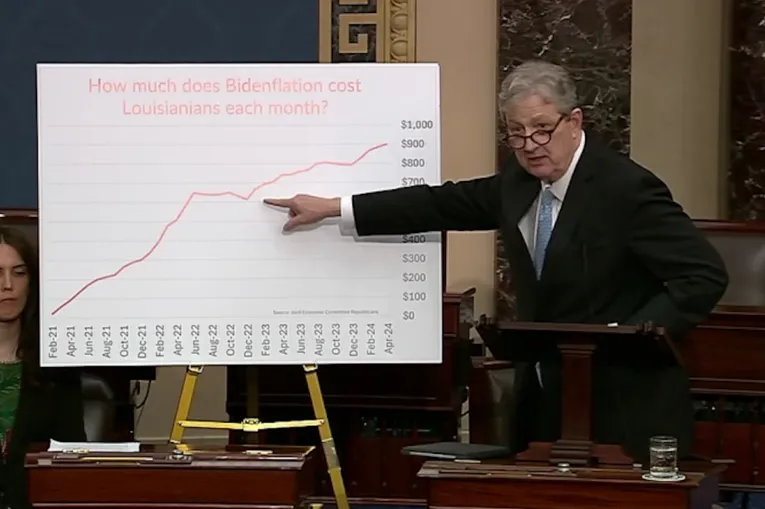

Demand for mortgages fell 4% on a weekly basis and was 38% lower than the same week last year, while demand for refinancing fell 7% on a weekly basis and 86% on an annual basis, according to the Mortgage Bankers Association. During a period of historically low interest rates in 2020 and 2021, partly driven by the economic shock caused by the coronavirus pandemic, most borrowers who previously held high rates have already refinanced, CNBC reported.

“Mortgage applications are now into their fourth month of declines, dropping to the lowest level since 1997, as the 30-year fixed mortgage rate hit 6.94 percent – the highest level since 2002,” Joel Kan, Vice President and Deputy Chief Economist of the Mortgage Bankers Association said in a statement. “The speed and level to which rates have climbed this year have greatly reduced refinance activity and exacerbated existing affordability challenges in the purchase market.”

Mortgage rates are likely to stay high as long as red-hot inflation persists, as foretold in July by Yun. Last week, Yun predicted that rates will stay around the current "resistance point" of 7%, though it's possible to reach a new benchmark of 8.5%. https://t.co/wH7JVtTErB

— NAR Research (@NAR_Research) October 18, 2022

On average, a 30-year fixed-rate mortgage is at 6.92% in October 2022, with the average monthly payment for a median-priced home hitting $2,400, according to Axios. By comparison, mortgage rates in October 2021 were 3%, while typical monthly payments were just $1,500.

These elevated rates are expected to continue to drive down housing demand until the Federal Reserve reverses the course of its aggressive interest rate hikes designed to combat inflation. Investors anticipate that the Fed’s campaign of interest rate hikes will continue at least through the end of the year, amid consistent messaging from Fed officials that rates will not be lowered until substantial progress against inflation is made.

Link to the original article on the Daily Caller website.