With much fanfare, the Indonesian government under President Joko Widodo awarded the coveted Jakarta-Bandung high-speed rail project to China, in 2015, instead of Japan as was expected. But Jakarta was stepping onto a slippery slope of debt and into the ruthless clutches of the dragon.

BRI And Indonesia

Guesstimated to cost around USD 1 trillion, the monstrous BRI project involves around 140 countries spread across Asia, Europe, and Africa.

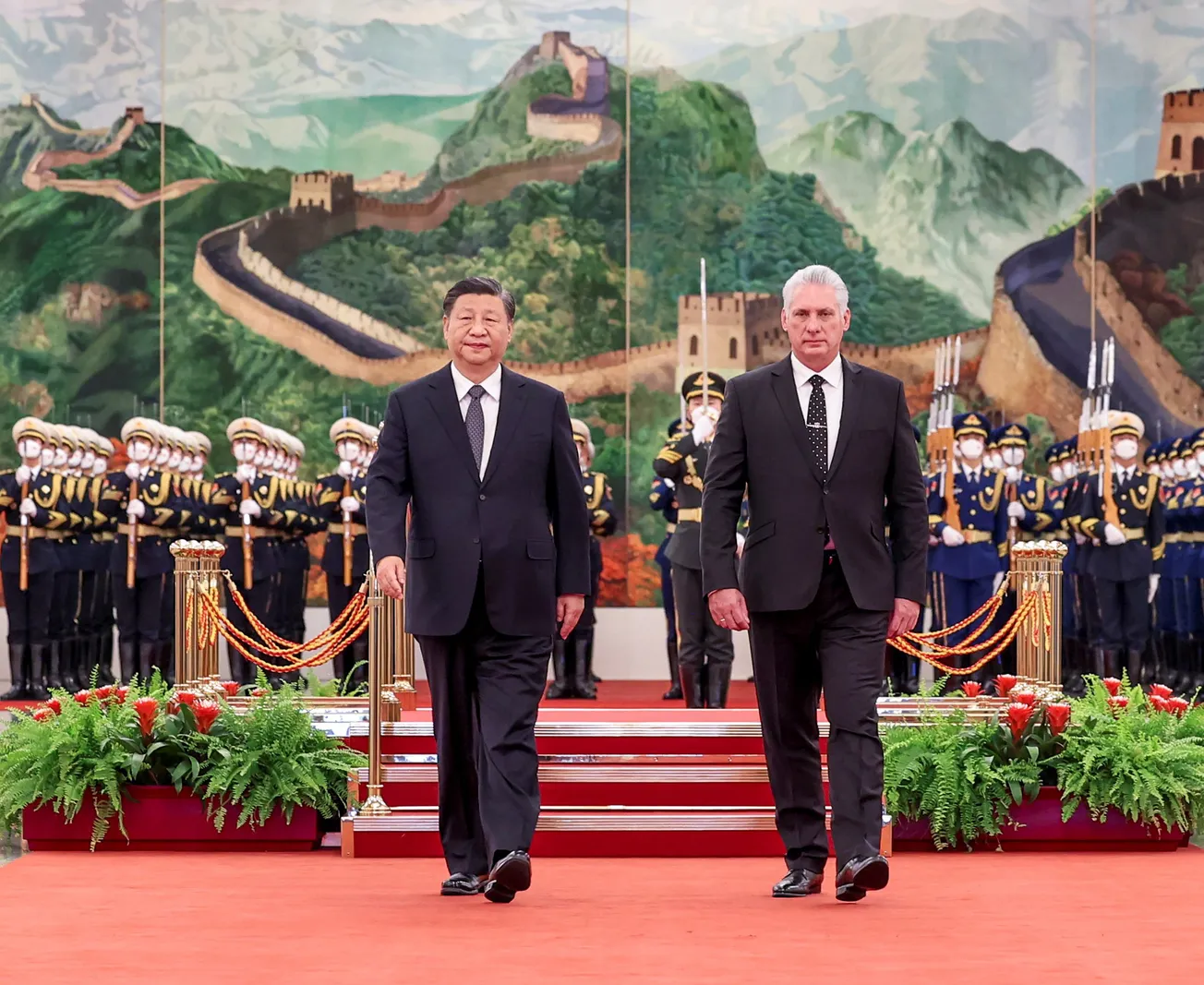

72 Indonesian projects fall under President Xi Jinping's flagship Belt and Road Initiative, totaling a bill of $21 billion. According to AidData, an international development research lab based at the College of William and Mary in Virginia, nine projects under the scheme, worth $5.2 billion, are already riddled with "scandals, controversies or alleged violations," and four were flagged for "financial wrongdoing."

There is nothing rosy about this picture.

The Jakarta-Bandung high-speed rail is one such contract. The 143-kilometer railroad between the capital and Bandung, the country's major technology center, was to be ready by 2022. The project cost of US$6.07 billion was to be funded by a $4.5 billion Chinese loan. According to AidData report, the railway loan is to be paid over ten years and attracts a 2% interest.