Today’s CPI inflation report shocked Wall Street and the nation with a significantly higher than expected print. Pollyannas everywhere are learning painfully that there’s no magic cure. There’s no easy way out.

After several years of excessive federal spending, regulating, taxing, and money-printing, the highest inflation in 40 years is deeply embedded in the economy, and it is spreading. The only significant decline came with gasoline prices.

Overall, the topline CPI came in at 8.3 percent for the year, with food up 11.4 percent and even energy still up 24 percent. Electricity is up 16 percent, natural gas 33 percent, and new cars 10 percent.

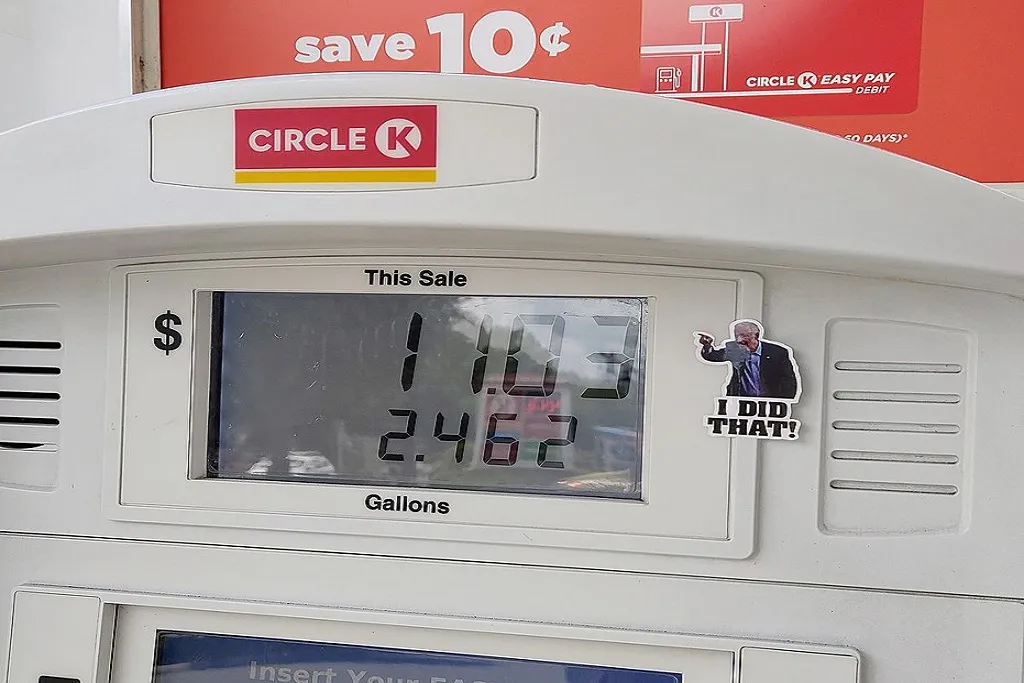

Even with the recent drop, gasoline is still 26 percent above a year ago. Rents are up 6.5 percent. Overall, services are up nearly 7 percent. Core goods prices are up 7 percent. Used cars are up nearly 8 percent.

The so-called core inflation rate, omitting food and energy, has risen 6.5 percent annually over just the past 3 months.

In terms of broader measures, the Cleveland Fed’s median CPI increased to 6.7 percent year-on-year. And the 16 percent trimmed mean, which chops off the highest and lowest 8 percent of outlier prices, is up 7.2 percent.

The Atlanta Fed's wage tracker is up 6.7 percent — but real wages had their 17th straight negative month.

In other words, middle-class working people are getting clobbered. Absolutely clobbered. They’re working more, but buying less.

Around the kitchen table, grocery prices, home heating, air conditioning, electricity, baby formula: All these price hikes are killing the middle class. And then we have the unseemly sight of James Taylor serenading the White House in a bizarre celebration of President Biden’s “Inflation Reduction Act.” You can’t make this stuff up.

Meanwhile, the stock market has fallen nearly 1,300 points. The 10-year treasury rate has jumped over 3.4 percent and the 30-year fixed mortgage rate stands at 6.5 percent. Those are a full percentage point above where they were a month ago. Those are the facts.

What does this all mean?

The Federal Reserve will be much more aggressive in hiking its target rate and draining excess cash in the economy. It ought to raise the Fed funds rate a full percentage point next week, and another percentage point in November, and then a third percentage point in December, in order to stop the inflation tide.

This is a painful wage-price spiral. We haven’t seen one of these for four decades. There is another approach here that would help save America from a truly deep recession.

Move to the supply side. Cut tax rates. Open the fossil fuel spigots. Stop the regulatory stranglehold on business. Start rewarding success instead of punishing it. Implement workfare to bring more than 4 million people back into the labor force.

Unfortunately, the big-government socialists in the Biden administration don't understand any of this. Their woke progressive thinking has done great damage. It’s an utter failure.

The good news is, Americans know this. That’s why the cavalry’s coming.

Larry Kudlow was the Director of the National Economic Council under President Trump 2018-2021. His Fox Business show "Kudlow" airs at 4 p.m &. radio show airs on 770 ABC from 10:00 a.m. to 1:00 p.m.