By Michael Faulkender for the Daily Caller Foundation on April 25, 2023

This summer, the U.S. Treasury will exhaust the money in its checking account. The Congressional Budget Office (CBO) projects that the federal government will run a budget deficit of $1.4 trillion this year, requiring Treasury to engage in additional borrowing to fund spending in excess of receipts.

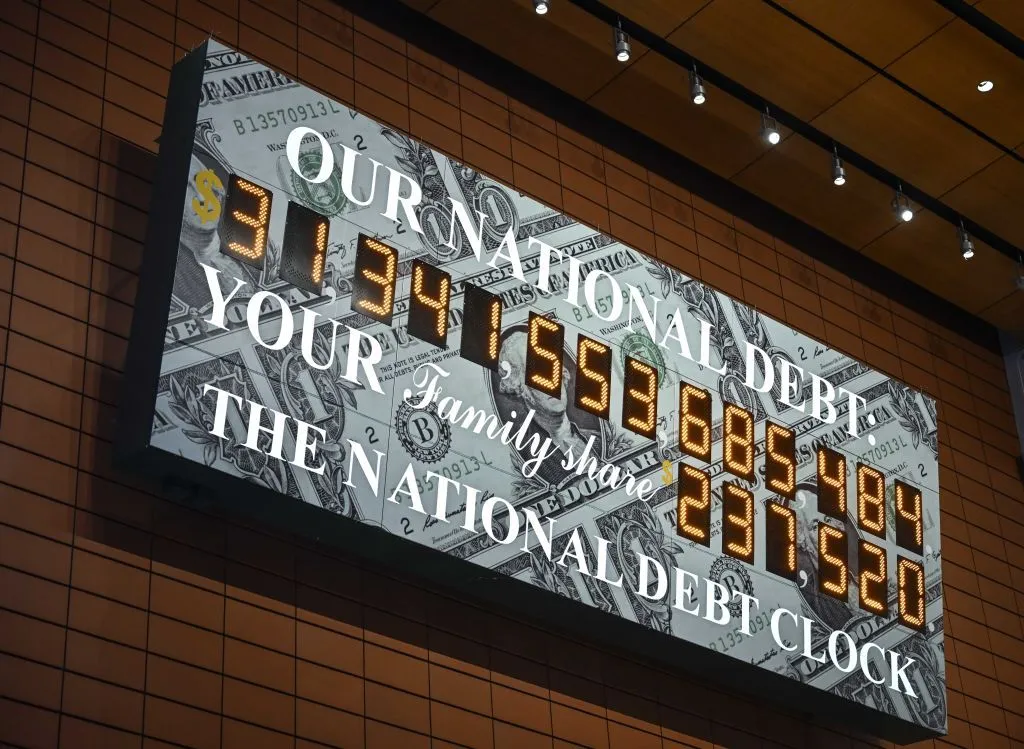

However, under the current debt limit of $31.4 trillion, it is unable to borrow any additional money to cover the deficit. There is no prospect of Congress balancing the budget this year, and a default on the national debt would be both financially catastrophic and a source of national embarrassment. The debt ceiling must be raised.

At the same time, the federal government has a spending problem. As a share of the economy, discretionary spending has grown by nearly 20% from its pre-coronavirus levels while inflation has eaten away at workers’ paychecks. CBO further projects that annual deficits will rise to $2.7 trillion in 2033, with total debt hitting $52 trillion at the end of 2033, an increase of $19.6 trillion over the next 10 years. Even Treasury Secretary Yellen’s department acknowledges that this path is “unsustainable.”

It is a false choice to present the American public with picking between a debt limit crisis now or maintaining the status quo that takes us toward an even bigger debt crisis later. That is why the House of Representatives is poised to extend the debt limit in the short run while making a down payment on fiscal responsibility for the years immediately ahead.

Speaker Kevin McCarthy has introduced a debt ceiling increase bill that charts a new course. The Limit, Save, Grow Act of 2023 builds on the fundamental American principles of individual responsibility, energy independence, economic growth and the rightsizing of the federal government. It raises the debt ceiling by $1.5 trillion and pares back the post-pandemic growth in spending to yield approximately three times that amount in savings.

This approach will steer the country away from its current perilous path and toward one that is sustainable and conducive to economic prosperity.

The package would accomplish these results by requiring federal departments and agencies to spend next fiscal year what they spent in 2022 and then to find efficiencies that will limit their growth to 1% per year over the next 10 years. Just as the American people have had to reduce their spending and find ways to do more with less following the inflation caused by the Biden administration’s blowout spending, it is long past time for government to do the same. By a 69%–24% margin, the American people agree that the pandemic is over. And that means the federal government’s appetite for pandemic spending should be over, too, with any unspent COVID-19 money rescinded.

The package implements commonsense reforms that will return us to energy independence by opening the spigots on our abundant domestic resources, which are extracted in a more environmentally conscious fashion than any other major energy producer. Rather than relying on China for critical minerals that go into renewable energy products and countries like Venezuela and Saudi Arabia for oil, this bill would return us to lower-cost energy abundance that retains American wealth at home. Instead of following the Biden administration’s approach of artificially tilting the scales toward high-cost, unreliable power sources such as wind and solar, this package takes an all-of-the-above approach to ensure that Americans of all income levels can access low-cost, reliable energy.

The bill calls on college graduates, among the highest income earners in our nation, to fully repay their student loans instead of pushing the bill onto taxpayers, which is precisely what “forgiveness” entails. It also strengthens work requirements for federal assistance programs for able-bodied adults up to age 55. At a time of labor shortages, we should again empower more Americans to realize the dignity of work and give back to the community — a position that then-Sen. Joe Biden supported when welfare was reformed in the 1990s. America’s economic prosperity is owed first and foremost to being a nation of producers, not just consumers.

These reform principles are popular with the American people. Recent polling shows that among those Americans who favor raising the debt ceiling by more than a 2:1 margin, they think it should only be done if spending cuts are included.

Similarly, more than 80% of those offering a view on federal spending believe that it should be returned to pre-coronavirus levels. Additionally, according to The Wall Street Journal, a recent ballot initiative in Wisconsin asked voters whether “able-bodied, childless adults [should] be required to look for work in order to receive taxpayer-funded welfare benefits.”

Nearly 80% of those voting on this question approved.

The question confronting Congress is not whether the debt ceiling will be increased or not; it will. The question is whether we are going to use this opportunity to enact the kinds of policies that generate domestic abundance and prosperity or whether we are going to continue the current stagflation path of redistribution and austerity.

It is within our grasp to reign in the excessive spending that is causing massive debt and inflation while once again realizing energy independence, labor force growth and widely shared prosperity.

Members should support the Limit, Save, Grow Act of 2023. Its passage will empower the speaker to negotiate from a position of strength with Senate Democrats and the president to return our nation to its core values while achieving fiscal sanity.

Michael Faulkender is the chief economist at the America First Policy Institute and professor of finance at the University of Maryland. Previously, he served as assistant Treasury Secretary for economic policy (2019–21).

Original article link