Politicians who lose two consecutive attempts to win their party's presidential nomination tend to recede from the public eye. But not Sen. Bernie Sanders, the icon of the Left, who loves to get on TV at every possible moment. He likes to inject himself into the most pressing debates of the day, even if it means he can mislead the audience. When Silicon Valley Bank (SVB) failed last week, Sanders floated a theory that weak deregulation rules under former President Trump triggered the collapse:

"Let's be clear. The failure of Silicon Valley Bank is a direct result of an absurd 2018 bank deregulation bill signed by Donald Trump that I strongly opposed. Five years ago, the Republican Director of the Congressional Budget Office released a report finding that this legislation would 'increase the likelihood that a large financial firm with assets of between $100 billion and $250 billion would fail."

Skilled at using Republican statements to drive wedges and appear bipartisan when it suits him, Sanders was playing the usual blame game.

But Sanders was also dishonest about the underlying facts and showed that he didn't grasp the technical details of "duration risk," which we shall illustrate below.

Even small banks are required to operate an office of Risk and Compliance whose only job is to evaluate the bank's positions on loans and investments (assets); and deposits (liabilities) so that it can assess risk. Maintaining a balance sheet and alerting senior executives to abnormalities is the most foundational function of risk management.

Also, by existing law, banks must hold periodic internal audits conducted by Risk and Compliance - and present results to the bank's board. Banks usually employ external audit services (KPMG was SVB's accountant) to help conduct these audits. Risk evaluations must be published in the bank's annual statements so that shareholders and investors can consider their exposure.

SVB's Risk office was relatively large for a regional bank with nearly $250 billion in assets. Even SVB's London branch had its own Risk and Compliance division. SVB was also under supervision by the San Francisco Fed. SVB's former CEO, Greg Becker, was a San Francisco Fed board member. Mr. Becker knew that his bank was hopelessly exposed to duration risk, but he did nothing about it, either willingly or knowing that the Feds would bail the bank out.

Sen. Sanders's complaint centered on the so-called stress test that banking regulators have been conducting since the 2008 financial crisis on banks deemed too big to fail. The Dodd-Frank bill passed quickly after that global banking failure. The 2018 bill's co-author, Rep. Barney Frank, an expert in banking regulation, had studied how his bill was strangling smaller banks with stress test rules that were too burdensome. He led the change to make things easier for smaller banks that were not too big to fail. Numerous existing regulations, he concluded, were adequate to catch something as fundamental as duration risk that can directly impact a bank's balance sheet.

Duration Risk

The first rule of finance is that a dollar today is worth more than a dollar tomorrow because of the time value of money. If one were to loan someone $100 for one year, the interest rate one would demand would be lower than if one were to lend to that person for ten years.

The US Treasury bond is the world's most risk-free investment. It is considered to have a beta of zero, which means that no matter what happens to market volatility, a Treasury bond retains its value — both principal and interest. Gold and silver also approach zero beta levels, but the world accepts Treasurys as the only reliable zero beta asset.

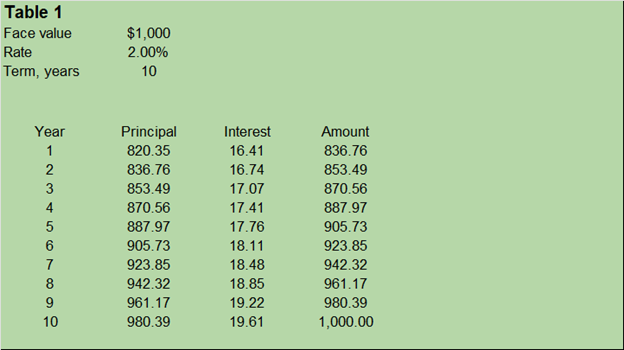

When first issued at an auction, US Treasury bonds are priced and sold on a discount basis. A $1,000 bond with a maturity period of 10 years and a 2 percent rate is sold at auction for $820.35. If you bought this paper, you could do one of two things: hold on to the bond for ten years and walk into a bank to exchange your bond for the full $1,000. (You would have earned a compound interest rate of 2 percent). Or you could take your bond to the secondary market in a few months and sell it to someone else.

It is the secondary market for bonds that is a vital piece of the global economy. When SVB customers deposited cash at SVB branches, SVB disbursed loans to other customers. The spread between interest given out to depositors and interest earned from borrowers is how banks profit.

When SVB couldn't find customers to whom to loan, it began investing the excess cash from deposits by buying Treasury Bonds in the secondary market.

Assume that SVB bought ten-year bonds. Barron's reported that SVB invested in longer-term mortgage securities with more than ten years to maturity rather than shorter-maturity Treasuries or mortgage issues maturing in less than five years, which made SVB's bets worse, but for our illustration, let's stick with ten-year bonds.

Table 1 represents the bond when it was first sold at a Treasury auction. Assume that the market interest rate was 2%.

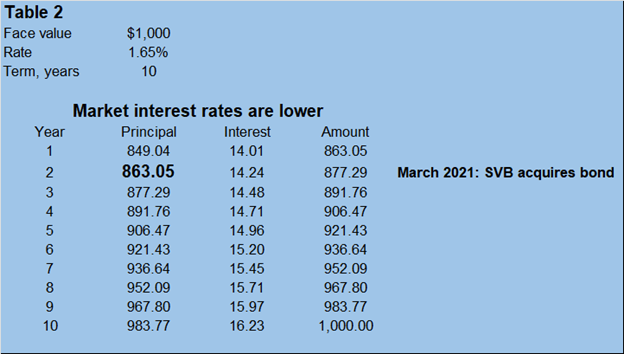

SVB took to the secondary bond market to buy its securities about a year after the initial treasury auction. Assume this was in March 2021, and the average yield on the bond market was 1.65% because interest rates had fallen. SVB paid $863.05, as indicated in Table 2. Had SVB held the bonds to full maturity, SVB could have collected the face value of the bond, $1,000.

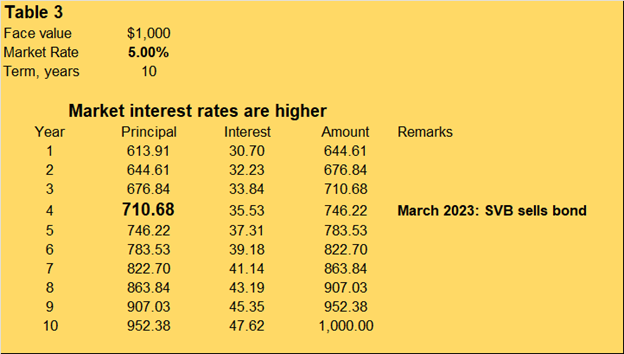

The Fed steadily began increasing interest rates starting in March 2022 and kept this up for nearly a year. SVB, having held its bonds for two years, decided to sell on the advice of Goldman Sachs, as seen in Table 3, when the market interest rate was much higher, at 5%. The only price acceptable to a buyer is $710.68 because they can take this up to maturity in the remaining six years and collect the full market interest value.

SVB incurred a material loss of $152.36 ($863.05 - $710.68) for every $1,000 in bonds. Barrons reported that the total loss was a whopping $15 billion. Accounting rules require banks to report these only when an asset is liquidated. According to the FDIC, America's financial institutions have $620 billion in unrealized mark-to-market losses - the difference between asset values when they were first acquired to their value under current market conditions. SVB tried to shore up its $15 billion loss with new equity, but that plan did not materialize.

The above scenarios underline the most important rule of bond markets, something a first-year finance student knows. When interest rates rise, bond prices fall. When interest rates fall, bond prices rise.

SVB had thrived since 1982, making everyday bets about where to invest its excess cash and how to manage mark-to-market losses or gains for 41 years. SVB failed not because the 2008 banking rules were relaxed, as Sen. Sanders charged. No amount of regulation is sufficient if SVB employees and SVB's auditor do not do their jobs adequately.

It is little wonder that the Department of Justice is looking into why SVB went under.