By David Ditch for the Daily Signal | May 23, 2023

Following a number of rounds of discussions between House Republican officials and the Biden administration, the two sides still haven’t reached an agreement on increasing the federal debt limit.

House Speaker Kevin McCarthy, R-Calif., described a Monday evening conversation at the White House, however, as “productive.”

An important factor surrounding the issue is McCarthy’s negotiating position. With Republicans holding a relatively narrow majority, there were doubts whether the speaker could find a majority, 218 votes, for a package addressing both the debt limit and the nation’s rapidly deteriorating finances.

Yet McCarthy managed to thread the needle and guide the Limit, Save, Grow Act to passage. The bill would reduce deficits by trillions of dollars and cut red tape that stands in the way of hundreds of thousands of jobs.

Even as McCarthy has invested heavily in attempting to bring a measure of fiscal sanity to the Washington swamp, his public image has improved. There has been a clear upward polling trend this year in both his national approval and net favorable ratings.

Despite that, there’s tremendous pressure on McCarthy and other Republicans in Congress to back down and increase the debt limit without any measures to reduce inflationary deficit spending.

Led by President Joe Biden, Democrats have deployed at least seven false, misleading, or nonsensical claims over the past few weeks to pressure McCarthy into caving in. However, most of those arguments fall apart quickly.

- Claim No. 1: Republicans won’t negotiate and will make America hit the debt ceiling.

This is the most common rhetorical tactic from Biden, essentially contending that if it weren’t for Republicans, there wouldn’t be a problem. However, that ignores the fact that the House passed the Limit, Save, Grow Act, which would immediately increase the debt limit, but with accompanying restrictions on spending.

Rather than start bipartisan negotiations as soon as the Limit, Save, Grow Act passed, Democrats twiddled their thumbs for a week, and the Democrat-controlled Senate has not taken any meaningful action whatsoever.

Biden could have called for staff to start working on a bipartisan debt limit deal last week. This feels like stalling to kill the clock more than good faith negotiation. Second meeting on Friday will be very telling. https://t.co/fCGV7140gy

— David Ditch (@DavidADitch) May 9, 2023

Democrats are fond of saying that the debt ceiling is a dire problem, but their actions suggest they want to drag negotiations out and blame any potential consequences on Republicans.

- Claim No. 2: Biden can raise the debt ceiling unilaterally because of a provision of the 14th Amendment.

In what has become a recurring theme, the Biden administration once again claims to have the unilateral authority to sidestep Congress and do as it pleases. We’ve seen this dictatorial approach on COVID-19-era evictions and student loans, and now, Biden has embraced the notion that the president can increase the debt ceiling without legislative authority.

At issue is the 14th Amendment to the Constitution. Section 4 states that “the validity of the public debt of the United States, authorized by law … shall not be questioned.” That was clearly meant to ensure that if the federal government issues debt, a future president or act of Congress cannot render it void.

Since Article 1, Section 8 of the Constitution gives Congress alone the power to authorize spending, levy taxes and fees, or issue additional debt, the idea that the 14th Amendment provides the president with unstated powers to ignore Congress on this issue is ludicrous.

That Biden is willing to entertain such dangerous radicalism does not speak well of his judgment.

- Claim No. 3: Republicans gave President Donald Trump “clean” debt limit increases and should do the same for Biden.

What Democrats want is a debt limit increase without any other policy provisions included in the legislation, or a “clean” increase. They claim that that’s how Republicans handled the issue during the Trump administration.

However, all three of the debt limit increases under Trump were directly linked to spending actions. While these deals were heavily flawed, they were still subject to bipartisan negotiations.

There are also several instances of bipartisan deals to pair deficit-reduction measures with debt limit increases. In fact, during his time in the Senate, Biden voted for three of them.

It’s unfortunate that Congress has not been consistent on always linking deficit reduction and the debt limit. However, that does not mean House Republicans are out of line in doing so today.

- Claim No. 4: We should save $1 trillion by freezing 2024 appropriated defense and nondefense spending at 2023 levels.

An offer that Democrats supposedly made (but Republicans rejected) would have kept so-called discretionary spending at fiscal year 2023 levels into 2024, rather than the typical practice of increasing spending. The claim is that this would cause a ripple effect on future years and save $1 trillion.

However, there are two major flaws with that line of thinking.

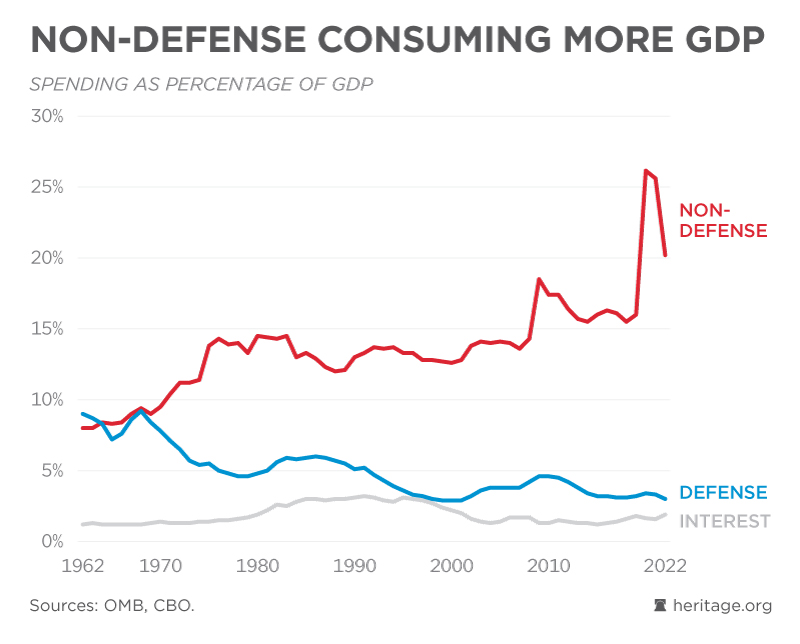

First, Washington used the pandemic as an excuse to go on an epic spending spree, and that extra spending went almost entirely toward nondefense purposes. The idea that there should be an “equal” reduction to defense and nondefense spending in response to the spending spree is absurd.

Second, a one-year spending freeze would have no binding effect on what Congress would approve for future years. Democrats are leery of long-term spending caps, but that would be the only way to reach the promised $1 trillion in savings. In contrast, the Limit, Save, Grow Act would impose caps for a full decade.

- Claim No. 5: Biden reduced deficits by $1.7 trillion.

Biden has made this claim so often that The Washington Post issued a “bottomless Pinocchio” rating.

The deficit shrank as a result of pandemic-related spending coming to an end. In contrast, Biden’s choices have increased short- and near-term deficits by more than $6 trillion, which is especially bad at a time of high inflation and rising interest rates.

- Claim No. 6: We should focus on raising taxes.

There are several variations on this assertion, including an offer from the Biden administration that focuses on trillions in tax hikes and that the 2017 tax cuts were a handout to the wealthy.

On the first point, the simple fact is that tax collections are currently at record levels in absolute terms and are well above historical averages as a share of the economy.

We have a spending problem, not a revenue problem. Unless elected officials get spending under control, the middle class will ultimately pay the price.

On the second point, the 2017 tax cuts provided savings to 80% of households and were followed by strong real wage gains for the bottom 50% due to strong economic growth.

In contrast, poor households are losing ground under Biden due to punishingly high inflation. Raising taxes on businesses won’t help matters, since those taxes would simply be felt through lower wages, higher consumer prices, and slower job growth.

- Claim No. 7: The Limit, Save, Grow Act directly cuts spending on veterans, border security, and more.

It can be hard to tell whether Biden has forgotten how federal budgeting works or is just pretending not to know. Either way, there’s no excuse for claiming that enacting a lower spending cap would immediately reduce spending on veterans, border security, rail safety, and seemingly everything else under the sun.

The way budgeting actually works is that Congress must fit its appropriated spending within an overall limit, and it can prioritize that spending. That means that if the limit is lower, it can focus those cuts on low-priority areas, such as earmark boondoggles and programs that fund the activist Left.

Conclusion

The next few weeks will likely see a flurry of backroom discussions, partisan bickering, and more dubious claims like the ones above.

What matters most is that Republicans, led by McCarthy, must not buckle under pressure from Democrats and their allies in the mainstream media.

America’s fiscal situation is dire, so any debt limit increase must come with strong budgetary reforms.

David Ditch is a policy analyst specializing in budget and transportation policy in the Grover M. Hermann Center for the Federal Budget at The Heritage Foundation.

Original article link