Fact: Over the past 80 years, the Federal Reserve has not succeeded in significantly reducing inflation without triggering a recession.

Since March 2022, the Fed has raised interest rates 11 consecutive times, bringing its benchmark interest rate to 5.25%, the highest level in 22 years. Consequently, inflation has decreased from 9.1% in June 2022 to 3.1% in November 2023. Core inflation, which represents the price rise of all items except food and energy, remains at 4.0%.

Applying Aristotelian modes ponens suggests that a recession must follow soon.

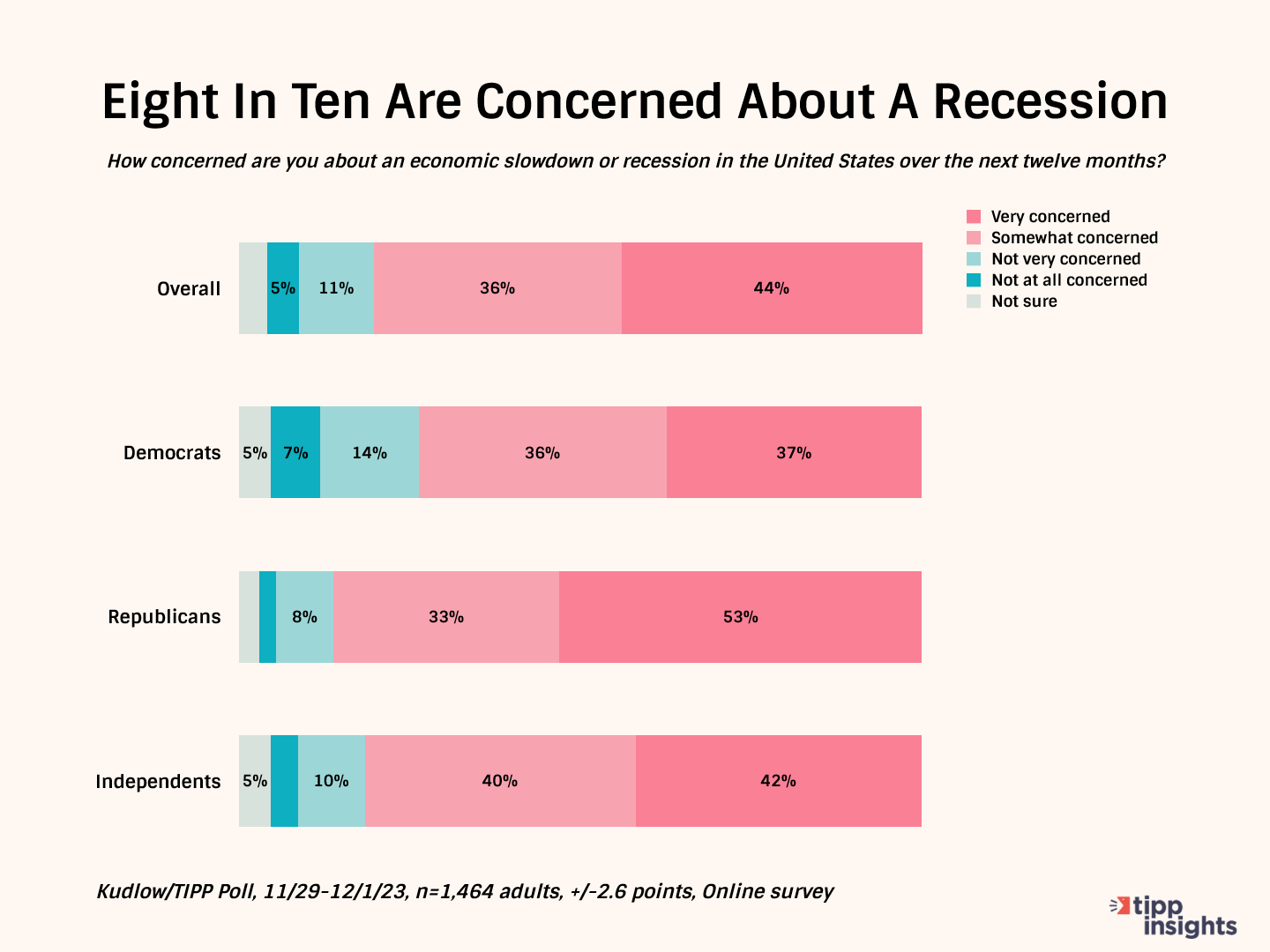

According to the latest Kudlow/TIPP Poll of over 1,400 Americans completed in early December, an overwhelming eighty percent of Americans are concerned about a recession in the next 12 months. While 44% are “very concerned,” another 36% are “somewhat concerned.”

That includes 73% of Democrats, 86% of Republicans, and 82% of independents.

Among the 36 demographic groups we track, the lowest share of concern was recorded by two-thirds of liberals at 67%.

Already In A Recession?

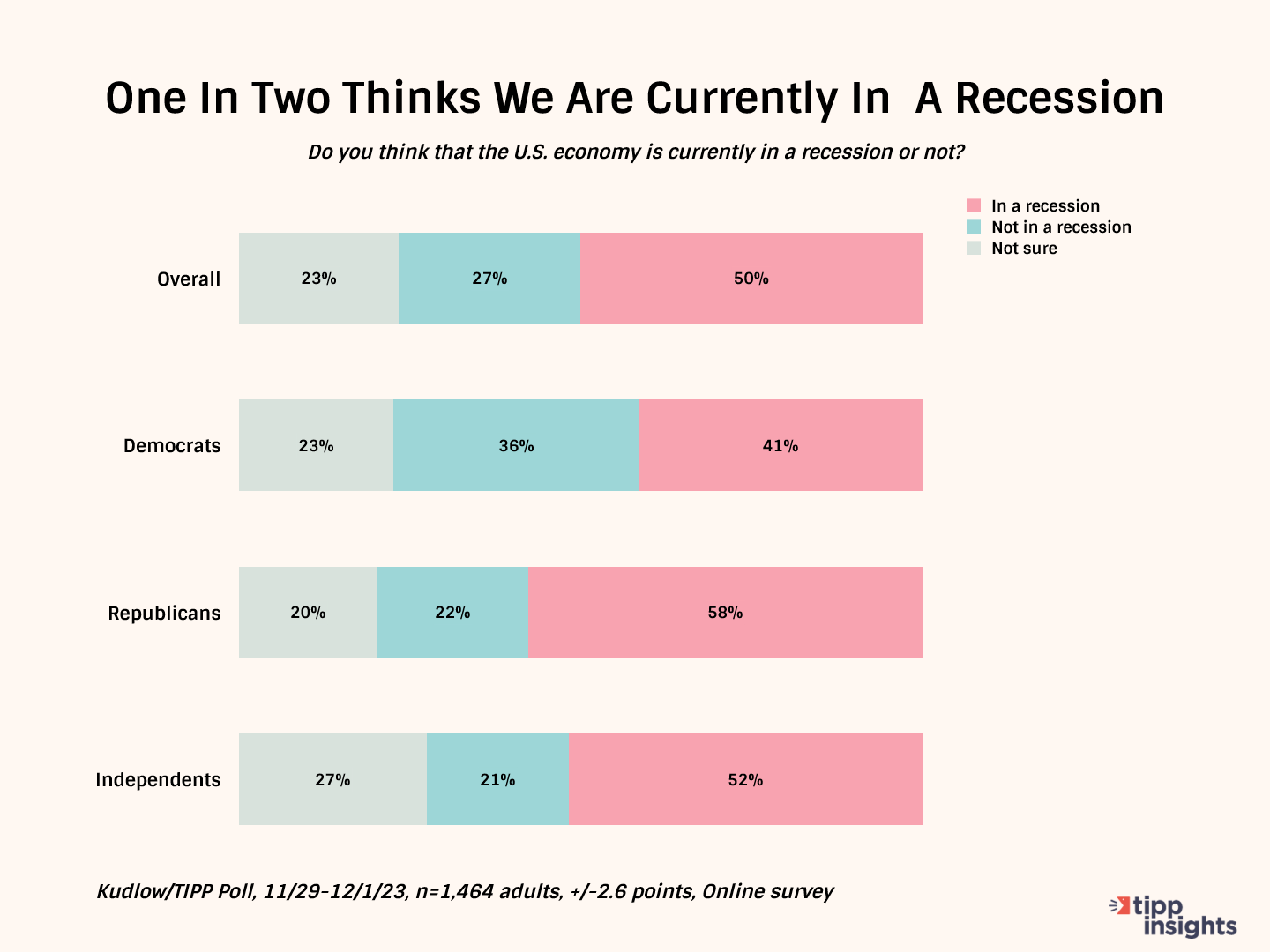

The poll asked respondents if the U.S. economy is currently in a recession. One in two (50%) stated we are in a recession. About a quarter (27%) opined that we are not. And another 23% are not sure.

Most Republicans (58%) and independents (52%) think we are in a recession. On the other hand, only 41% of Democrats believe so. Meanwhile, 20 demographic groups think we are in a recession, while 16 don’t believe the economy is in one.

The pain of Bidenflation and financial worries plague Americans so much that many of them see the economy in a negative light, with recession as a way of describing the gloom.

Recession In 2024?

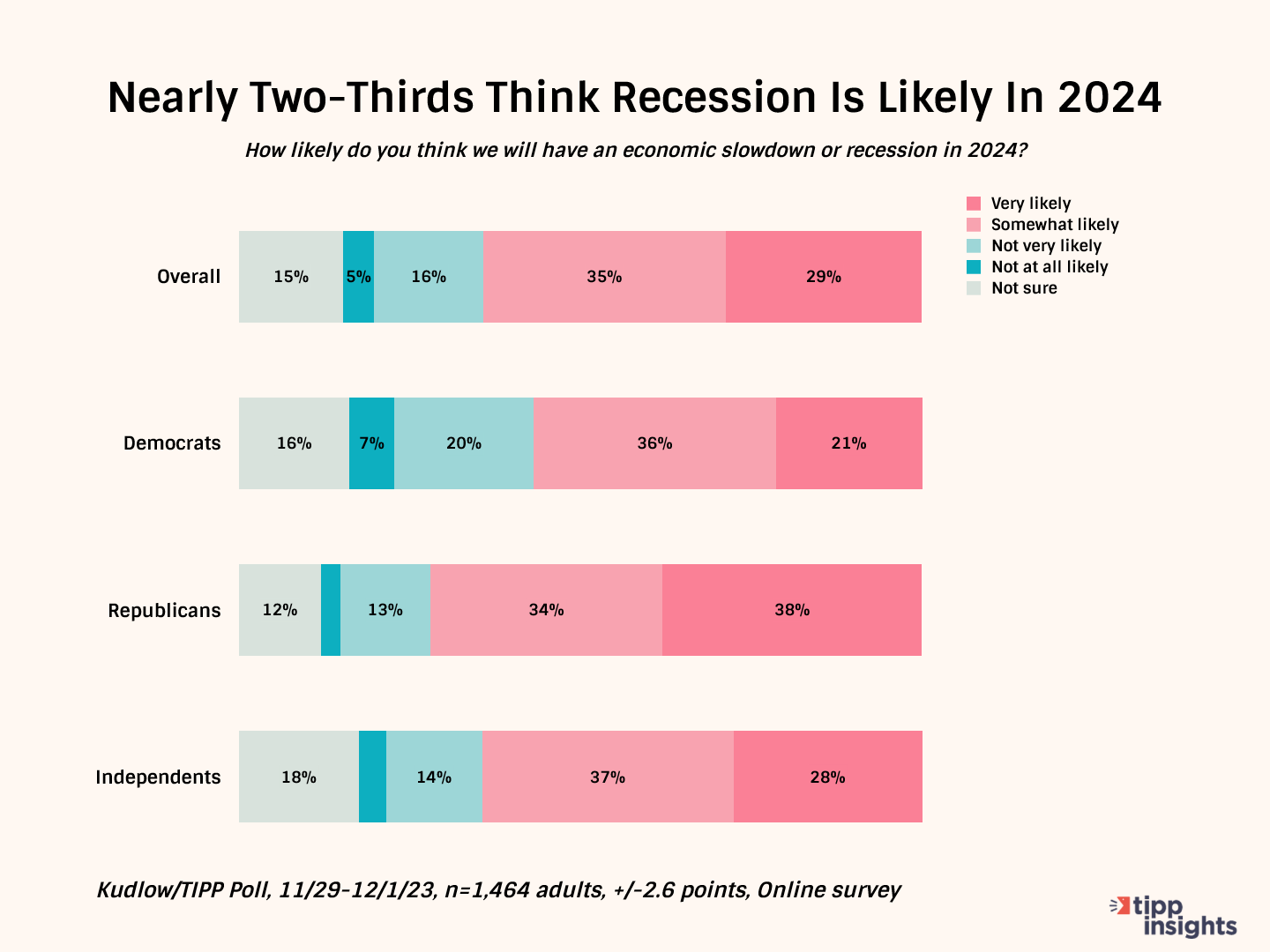

Nearly two-thirds (64%) believe a recession is likely in 2024. That includes 29% who think a recession is “very likely” and another 35% who believe it is “somewhat likely.”

There is an agreement across political lines, with 57% of Democrats, 72% of Republicans, and 65% of independents anticipating a downturn.

Interestingly, there is a consensus, with a majority among all 36 demographic groups believing the economy is headed for a recession in 2024.

Indicators such as weak tax revenue, an inverted yield curve, a declining private-public employment ratio (PPER), increasing credit card debt, rising delinquency rates for mortgages and auto loans, and a sluggish manufacturing sector all point to an economic slowdown.

On the other hand, a strong labor market that added 199,000 jobs in November and a historically low unemployment rate of 3.7% alleviate concerns about a recession.

Bringing down core inflation from its current 4% will be challenging for the Fed. This implies that the Fed is unlikely to ease interest rates soon, despite election-year politics and predictions made by some economists and commentators. Furthermore, due to Biden’s shift away from energy independence, geopolitical tensions on multiple fronts pose additional uncertainties to which the U.S. economy is not immune.

American consumers are still grappling with high interest rates and inflation that, while appearing to have eased on paper, remain stifling without real wage gains. Furthermore, the nation's debt is leaping, set to cross $34 trillion, on an unsustainable trajectory. Consequently, consumers hold a gloomy outlook, and the belief in an impending recession in 2024 is growing, potentially becoming a self-fulfilling prophecy.

We could use your help. Support our independent journalism with your paid subscription to keep our mission going.