With Xi Jinping’s stunning shift back into Maoist totalitarianism, China is destined to become an economic mess once again. China’s opening to the world economy, particularly to the U.S. and Europe, now looks to be over. A new communist dark age will soon descend.

In China’s 20th party congress, which ended last weekend, we saw a very ugly glimpse of the future for the Middle Kingdom.

Not only did Xi cement his position as absolute ruler of the nation of 1.4 billion, but showed he’ll do anything to keep power. The image of an aging former President Hu Jintao apparently forcibly being led out of the congress by security is an ominous statement of what Xi has in store for the entire nation.

Faced with the sudden shock of what’s to come, China’s financial markets crashed on Monday, as investors realized that it’s no longer the promised land but now a prison-house economy in decline.

It was just 2014, a mere 8 years ago, that liberal Nobel Prize-winning economist Joseph Stiglitz heralded the advent of the “Chinese Century.” He and other leftist intellectuals fell in love with the notion of what could be accomplished economically with an authoritarian regime such as Xi’s.

No more saying no! No more dragging your feet! The government can do what it wants, without having to worry about all those pesky free-market naysayers!

The New York Times’ Thomas Friedman summed up this thinking best when he mused on Meet The Press back in 2010:

“I have fantasized — don’t get me wrong — but that what if we could just be China for a day? I mean . . . where we could actually, you know, authorize the right solutions, and I do think there is a sense of that, on, on everything from the economy to environment.”

Elsewhere, he enthused over “one-party autocracy” ruled by “enlightened” people, such as China. This is a classic “progressive” vision.

Since those remarks, China’s “growth miracle,” built largely on trillions of dollars of U.S. trade and investment and greater openness to the world, has come to a grinding halt. From high-altitude GDP growth averaging 10% a year for over 20 years, China’s growth has descended sharply.

The most recent forecast by the IMF sees 3.2% GDP growth this year, well below the Chinese government estimate closer to 5%.

But there are signs of even deeper trouble. Not only is GDP growth falling but, because of its massive debt (290% of GDP, a stunning level), plunging demand for Chinese goods, and a weakening yuan, China’s struggling.

China’s once-torrid real estate market, inflated by Chinese government loans, has crashed. So has the Hang Seng Index, the Hong Kong-based stock market gauge that is off a whopping 35% this year. It fell 8% just this week, as news of the newly-empowered Xi Jinping’s restoration and his signaling that communism isn’t dead scared investors.

In explaining the recent drop in stock prices, even CNN has noticed.

“A number of senior officials who have backed market reforms and opening up the economy were missing from the new top team, stirring concerns about the future direction of the country and its relations with the United States,” CNN reported.

In short, China’s bold experiment with open-markets and capitalism has ended.

As the Finbold financial news site noted: “The Chinese economy is experiencing a near-complete collapse. Nearly half a million customers have lost their deposits as the banks lent indiscriminately to housing developers who are now facing cascading defaults. Here’s the story the Chinese Government doesn’t want you to know.”

With an estimated 70% of Chinese citizens’ wealth tied up in real estate, and a fast-aging population, it’s a very big deal.

Like it or not, U.S. policy, so helpful and accommodating for 40 years as China opened to the world, has now undergone a reversal.

It started under President Trump, who slapped tariffs on many Chinese goods, challenged it on COVID-19, Taiwan’s independence, territorial expansion in the South China Sea, and human rights.

But the new Realpolitik toward China hasn’t ended. Congress’ just-passed Chips and Science Act imposes strict controls that limit China’s ability to “purchase and manufacture certain high-end chips used in military applications”.

Meanwhile, the $52 billion bill heavily subsidizes U.S. chipmakers for avoiding China.

“This is what annihilation looks like: China’s semiconductor manufacturing industry was reduced to zero overnight,” tweeted one Chinese entrepreneur.

U.S. chip and semiconductor equipment makers, fearful of the consequences of breaking the new export control law, are already downsizing to escape possible sanctions. China was counting on its chip industry to lead it into the future; now that looks doubtful.

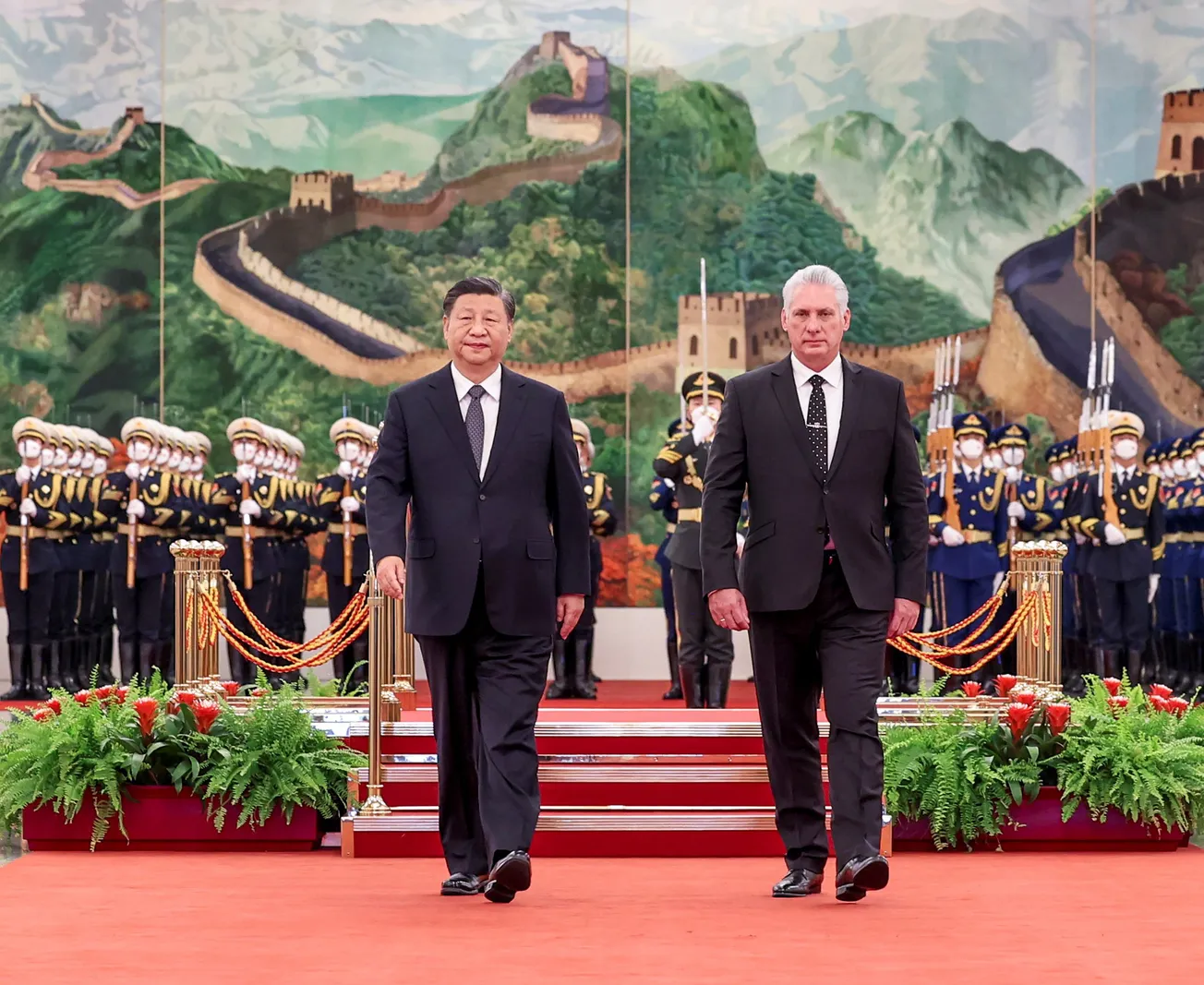

Why is all this happening? China’s ills are a direct result of Xi Jinping’s reversion to stultifying Marxism. Here’s what Xi himself said at the recent party congress, where he won a third five-year term as China’s all-powerful leader.

“Over the past decade, we have stayed committed to Marxism-Leninism, Mao Zedong Thought, Deng Xiaoping Theory, the Theory of Three Represents, and the Scientific Outlook on Development, and we have fully implemented the Thought on Socialism with Chinese Characteristics for a New Era as well as the Party’s basic line and basic policy,” he said.

So, yeah, China’s good times are over.

As China’s population shrinks and it lapses back into its old Communist bad habits, maybe we’ll stop seeing foolish headlines in western publications predicting that China’s economy will soon “leapfrog” the U.S.

Sorry, but even with the U.S.’ many economic problems right now, China will never pass us up.

As we wrote back in 2014: “Not only has China not passed the U.S., but it’s quite possible it never will. China’s population growth is heading for a dramatic Japan-style collapse, which will slash economic growth dramatically in coming years. Growth has already slowed from 10% a year in the 1990s and 2000s to 7% — and it’s likely to fall further from there.”

We’ll stand by our prediction. How many economists will stand by theirs?

— Written by the I&I Editorial Board