At the G7 meeting in Japan, Wally Adeyemo, the deputy Treasury secretary, who has been traveling the world trying to sell American sanctions against Russia to skeptical countries, boasted about the success of the American-designed Russian oil price cap.

As reported in the New York Times, he said: "The Russian price cap is working, and working extremely well. The money that they're spending on building up this ecosystem to support their energy trade is money they can't spend on building missiles or buying tanks. And what we're going to continue to do is force Russia to have these types of hard choices."

The Treasury Department's website describes the rationale for the price cap. "(It) is a novel tool of economic statecraft designed to achieve two seemingly contradictory goals: restricting Russia's oil revenues while maintaining the supply of Russian oil. Meeting these goals would make it harder for Russia to fund its brutal war in Ukraine while keeping energy costs down for consumers and businesses around the world."

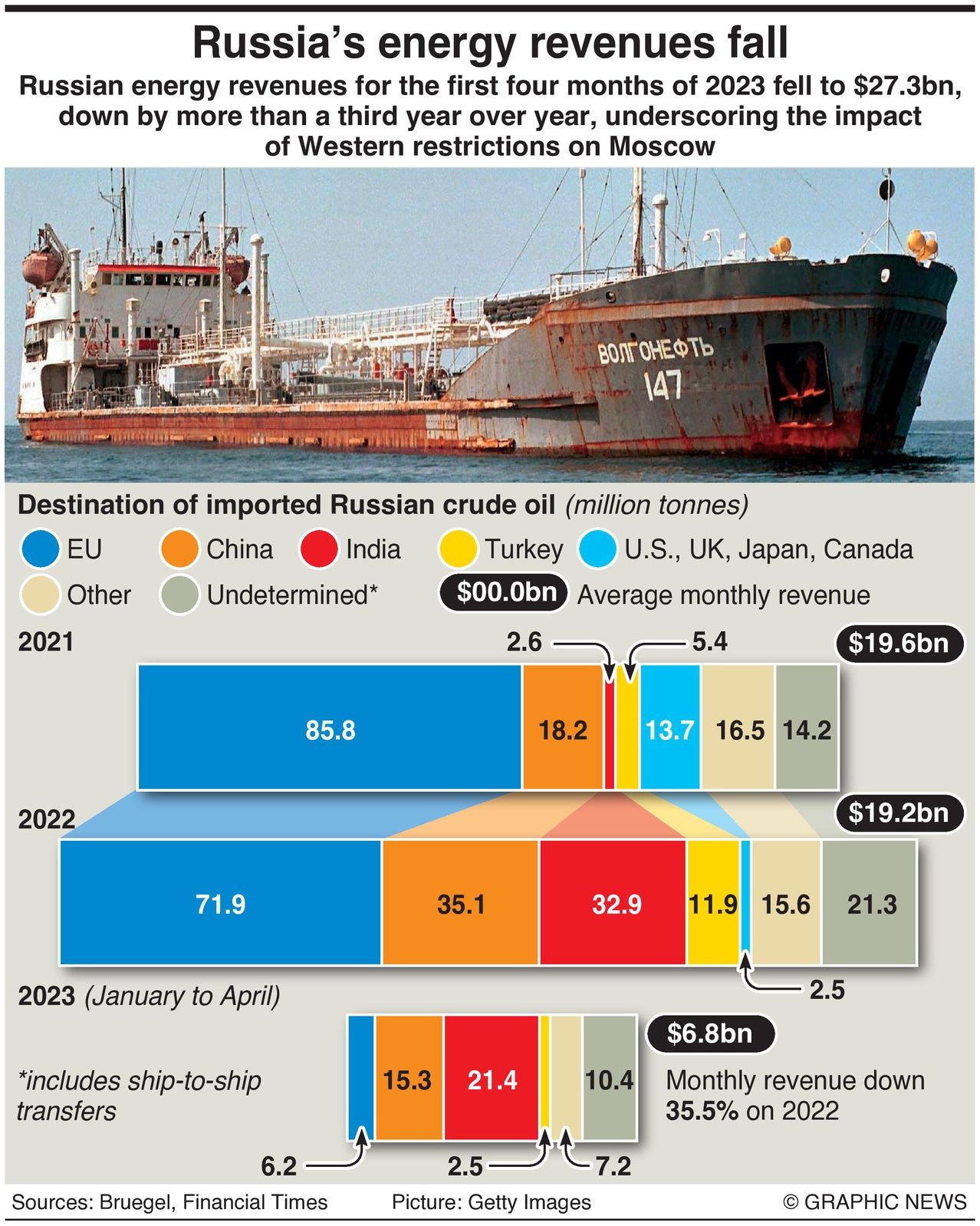

But a look under the hood shows that the administration's claims are more hype than factual. Russian oil revenues are indeed down. Before the war that began in February 2022, oil revenues constituted 30–35 percent of the total Russian budget. In 2023, oil revenues have fallen to just 23 percent of the Russian budget. The administration wants us to believe that the price cap it championed among E.U. nations and implemented on December 5, 2022, has much to do with it. But there are far larger factors at play that are helping the administration meet its price cap goals.

Poor Economic Growth Is The Culprit

The main reason for the decline in Russian oil revenues is that world oil prices have fallen each month since June 1, 2022, primarily because of poor economic growth globally. "Global growth is forecast to slow from 6.0 percent in 2021 to 3.2 percent in 2022 and 2.7 percent in 2023. This is the weakest growth profile since 2001, except for the global financial crisis and the acute phase of the COVID-19 pandemic," said an IMF report in October. Oil consumption is directly related to GDP, and when economies slow down, there's not much oil demand, resulting in falling prices and oil revenues for all producer nations, including Russia.

According to the St. Louis Fed, U.S. economic growth, as measured by real gross domestic product (GDP), downshifted markedly in 2022, slowing from a 5.7% increase in 2021 to a 0.9% increase in 2022. The numbers for 2023 are not flattering either. For the first quarter, GDP increased only slightly, at 1.1%. But professional Fed forecasters expect real GDP growth to fall again in 2023 to less than 1%, with growth slipping below zero (-0.1%) in the third quarter. Two consecutive negative growth numbers would technically mean the U.S. would be in a recession. We will gladly endorse Mr. Adeyemo's views if he wants to take credit for America's terrible economic performance as a reason for falling oil prices rather than the price cap.

The E.U. fared worse. According to Bloomberg, the 20-nation economy expanded by 0.1% in the first quarter of 2023. In 2018, before the pandemic, the bloc grew at a rate of 2.3%.

World Oil Prices Have Been Falling Steadily Since June 1, 2022

In a market where the slightest changes in supply can cause wild price swings, the policies of the 23 members of the Organization of the Oil Exporting Countries (OPEC) Plus carry significant weight. The 13 core members are primarily Middle Eastern and African; the remaining ten, including Russia, have substantial leverage. Russia, which produces about 10 million barrels a day, has a production capacity similar to Saudi Arabia.

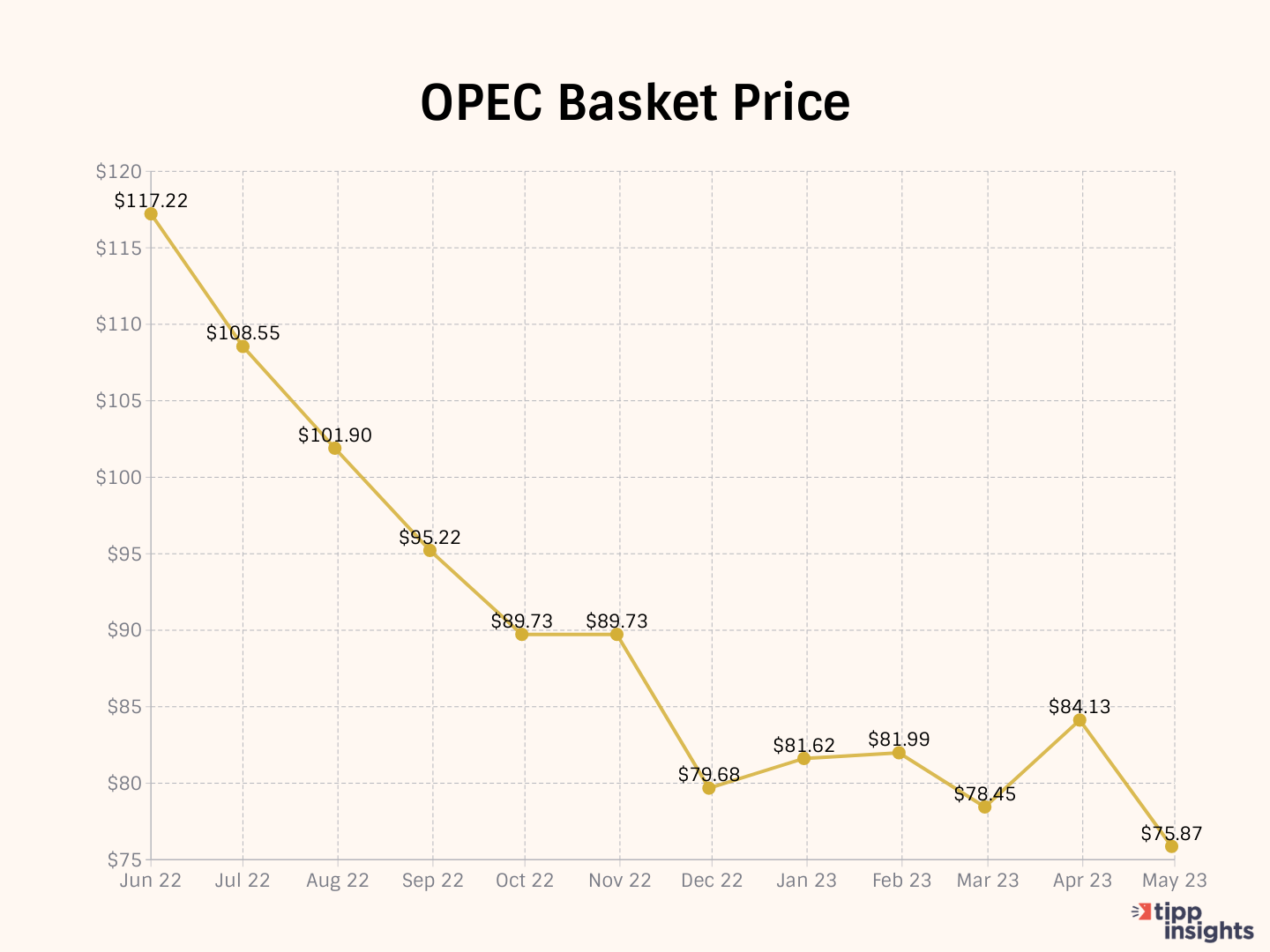

The OPEC Basket is a weighted average of oil prices from the different OPEC members. The chart below shows how world oil prices continued their downward trend from June 1, 2022, which recorded a peak price of $117.22 per barrel.

By November 30, prices had already sunk 32%. The administration's oil price cap was implemented on December 5, five days later. World oil prices have been reasonably steady around the November 30 price. For the administration to claim that the price cap has resulted in lowering prices is dishonest.

A better argument is that OPEC Plus countries carefully monitor prices and keep them in a Goldilocks range of $75-$85 a barrel. OPEC Plus first announced cuts of nearly 2 million barrels per day (mbd) in October. In April, it announced an additional cut of 1.16 mbd. If prices go up too much, the world can tip into a recession, and oil demand could suffer. If prices go down too much, OPEC countries lose revenue even as they pump more and more oil.

Inflation Continues To Bite

On top of the weakening economy in both America and the E.U., the extraordinary pressures on family budgets brought about by non-stop inflation is another driver for lower oil prices. Families are not driving as much, conserving their cash to tide over rainy days that are expected as the Fed is expected to not lower interest rates for some time. As we noted recently, Bidenflation, a TIPP CPI metric that shows how much prices have risen since President Biden took office, hit 15.3% in April. Gasoline prices today are still 43.7% higher compared to Jan 2021.

Other Factors

India and China have continued to buy Russian oil at a discount. India has considerable refinery capacity and is a crucial cog in the oil supply chain. Russian oil today is flowing to India, where it is being refined and shipped to Western economies as petrol and diesel. These flows are happening not because of the price cap but despite it. Besides, evasion, which is rampant for other sanctions, has not yet kicked in for oil because there has been no need to.

Our Summary

It is too early to tell that the administration's price cap is working.

Like our insights? Show your support by becoming a paid subscriber!