- Small business owners are concerned about future economic conditions, particularly inflation, and are actively preparing for a potential recession

- Inflation and economic uncertainty are challenging small businesses, affecting their ability to invest capital confidently

- The Federal Reserve's proposed Basel III changes raise significant concerns among small business owners regarding capital availability and access

- Policymakers should prioritize pro-growth policies, including tax and regulatory reforms, to support small businesses and mitigate economic challenges

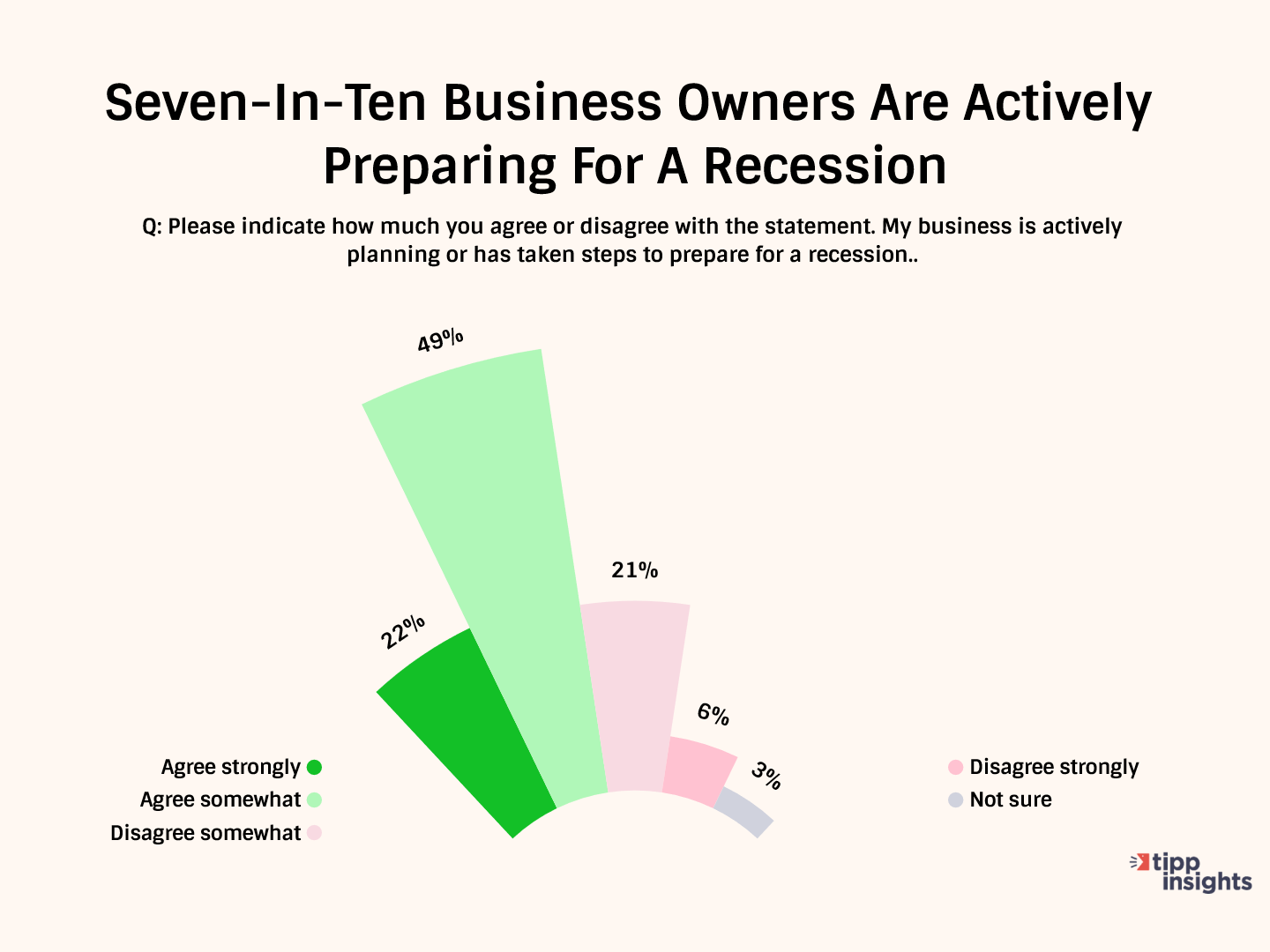

The Small Business Check-Up Survey Q4 2023 by the Small Business & Entrepreneurship Council (SBE Council) reveals that inflation and economic uncertainty make it challenging for business owners to confidently re-invest the limited capital they may have. Moreover, high interest rates and uncertainty are restricting the availability of capital, impacting business competitiveness and growth. The threat of recession also weighs heavily on business investment decisions, with 71% of business owners saying they are actively planning or have already taken steps to prepare for a recession. The lack of confidence in future conditions does not bode well for the broader economy.

More than 500 small businesses from across the nation took part in the survey conducted by TechnoMetrica at the end of 2023. These enterprises drive local economies, create jobs, and reflect the entrepreneurial spirit of America. The in-depth assessment of the data reveals how the mainstay of communities – small businesses -fared in the past year and the challenges they face in the months ahead.

Small Business Check-Up Survey Q4 2023 found that half (50%) of small business owners say their firms will turn a profit for the year, 25% expect to be in the red, and 25% are uncertain. While most (61%) have a positive outlook for their business in 2024, 71% hold a bleak view of future economic conditions.

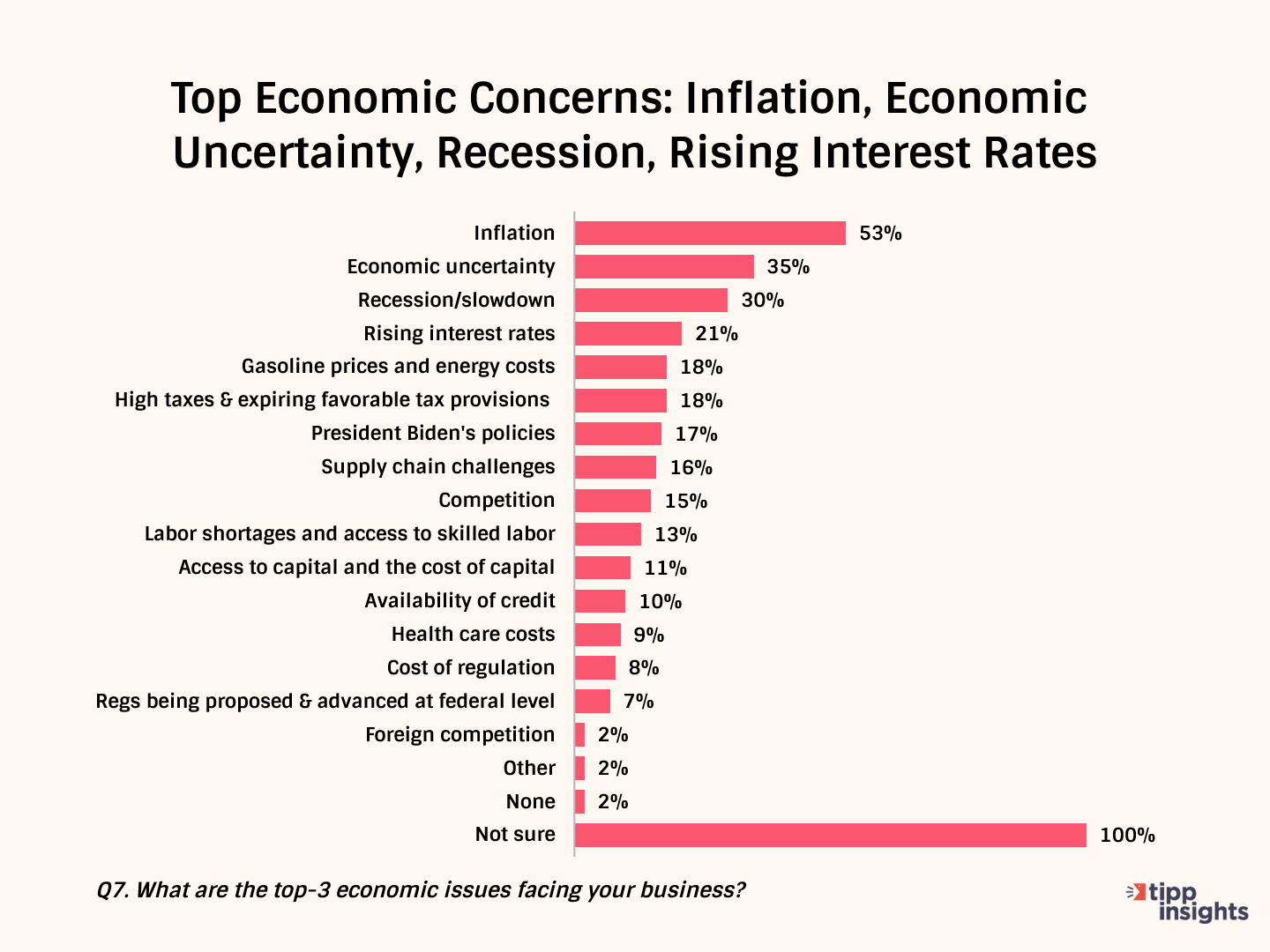

Small business owners' top concerns have remained consistent over the past three quarterly check-up surveys, with inflation topping the list. Looking ahead, 87% of small business owners are concerned that inflationary pressures will persist over the next twelve months. The top four economic concerns for small businesses include inflation (53%), economic uncertainty (35%), recession/slowdown (30%), rising interest rates (21%). Gasoline and energy costs (18%) and high taxes or expiring tax provisions favorable to small businesses (18%) shared the fifth spot.

In the survey, just over a third of the small businesses, 34%, report growth in sales. While for 32% of businesses, sales have merely held steady, for another 32%, they have declined. Profitability in the past year follows a similar pattern, with 31% reporting growth, 30% remaining steady, and 39% seeing a decline. For a majority, 55%, revenues have not kept pace with inflation, creating a challenging business environment. Despite the less-than-stellar circumstances, one-third (32%) plan to hire more in the next six months, 50% plan to maintain current employment levels, and 13% plan to downsize.

SBE Council chief economist Raymond J. Keating opines:

Small business owners are generally positive on the current economic environment, and that's great. But clearly, entrepreneurs are worried about the economy over the coming year, with a rather astounding 87% concerned about inflation and 81% concerned about a slowdown or recession. Policymakers and elected officials need to take note. They need to focus on a robust pro-growth policy agenda featuring substantive and broad-based tax and regulatory reform and relief, and reining in government spending.

Policy Concerns

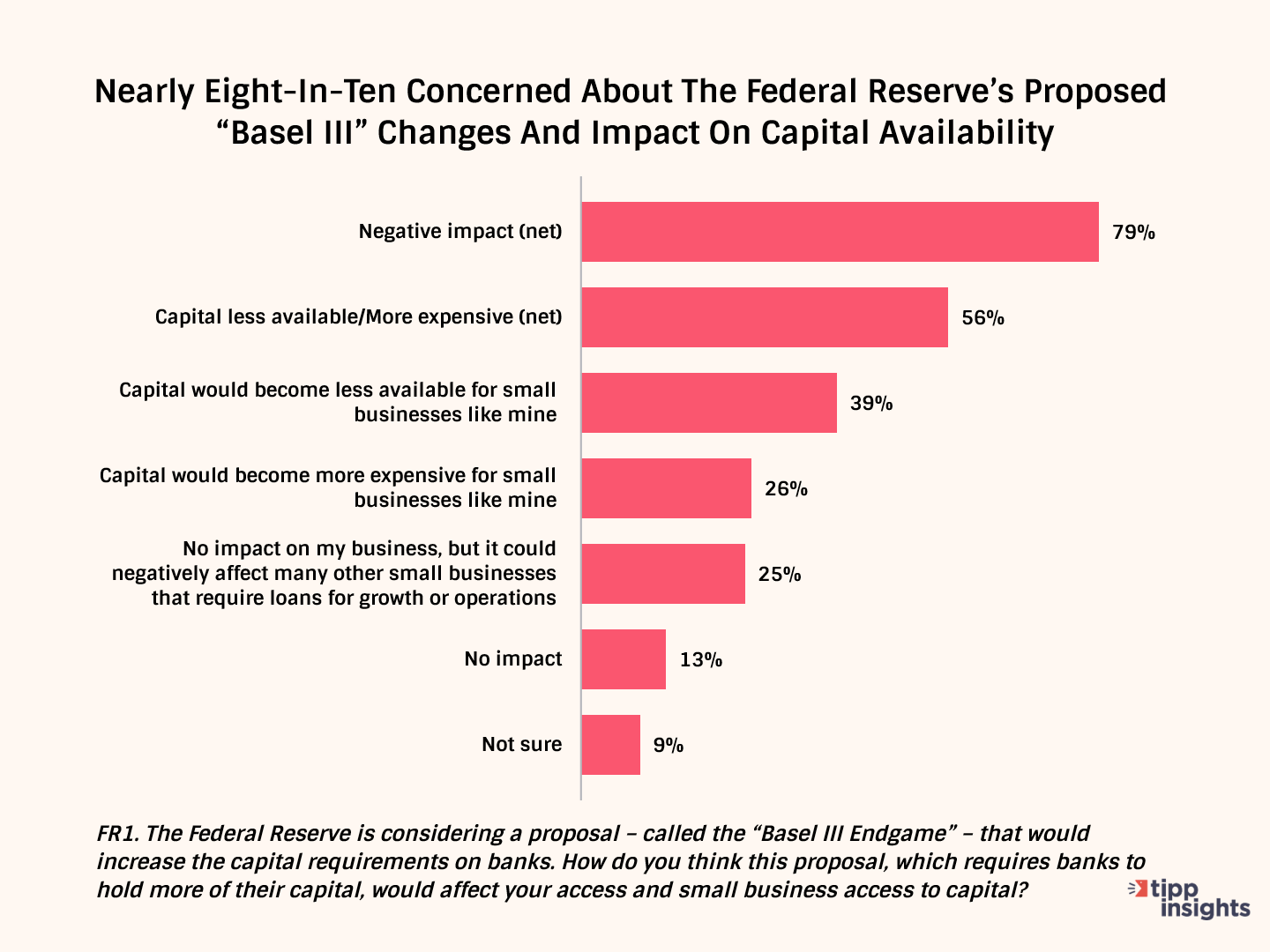

However, some of President Biden's policy proposals have created apprehension among small business owners, particularly the Federal Reserve's Basel III Endgame proposal to increase the capital requirements for banks. 79% of small business owners expressed concern about the policy's potential impact on capital availability and access. Over half anticipate reduced capital availability or increased costs as a result of the proposed changes.

Specifically, due to constraints they expect from Basel III, 35% of business owners fear that expansion plans would need to be postponed, 30% expect reduced investments in equipment and technology, and 27% express worry about the survivability of their businesses.

Keating noted:

Small business owners know better than most that increased regulation, no matter who it is said to be targeted at, always ends up hurting small businesses. It's not surprising, therefore, that the Fed's proposed Basel III changes raise real concerns among small business owners.

Small businesses reflect the pulse of the economy at the ground level. Optimism or pessimism among these grassroots firms is a good indicator of the general mood of the community. Unfavorable policy changes on top of revenue-eroding inflation and a threat of recession may dampen the small business environment in the coming months.

Karen Kerrigan is president & CEO of the Small Business & Entrepreneurship Council.