As the tax return deadline approaches, most Americans believe that upper-income earners and corporations are not paying their fair share of taxes. Many believe that low-income and middle-income individuals bear an excessive tax burden.

A majority also favors government policies that tax the rich and redistribute wealth.

However, support for increasing taxes on the wealthy and corporations drops significantly when job losses are considered.

These are the key findings of a Kudlow/TIPP Poll of 1,365 Americans completed in late March. The online survey had a margin of error of +/-2.8 percentage points.

The poll asked a four-part question: Please indicate if you think the following groups are paying their FAIR share in federal taxes, paying too MUCH, or paying too LITTLE.

The four groups were lower-income people, middle-income people, upper-income people, and corporations.

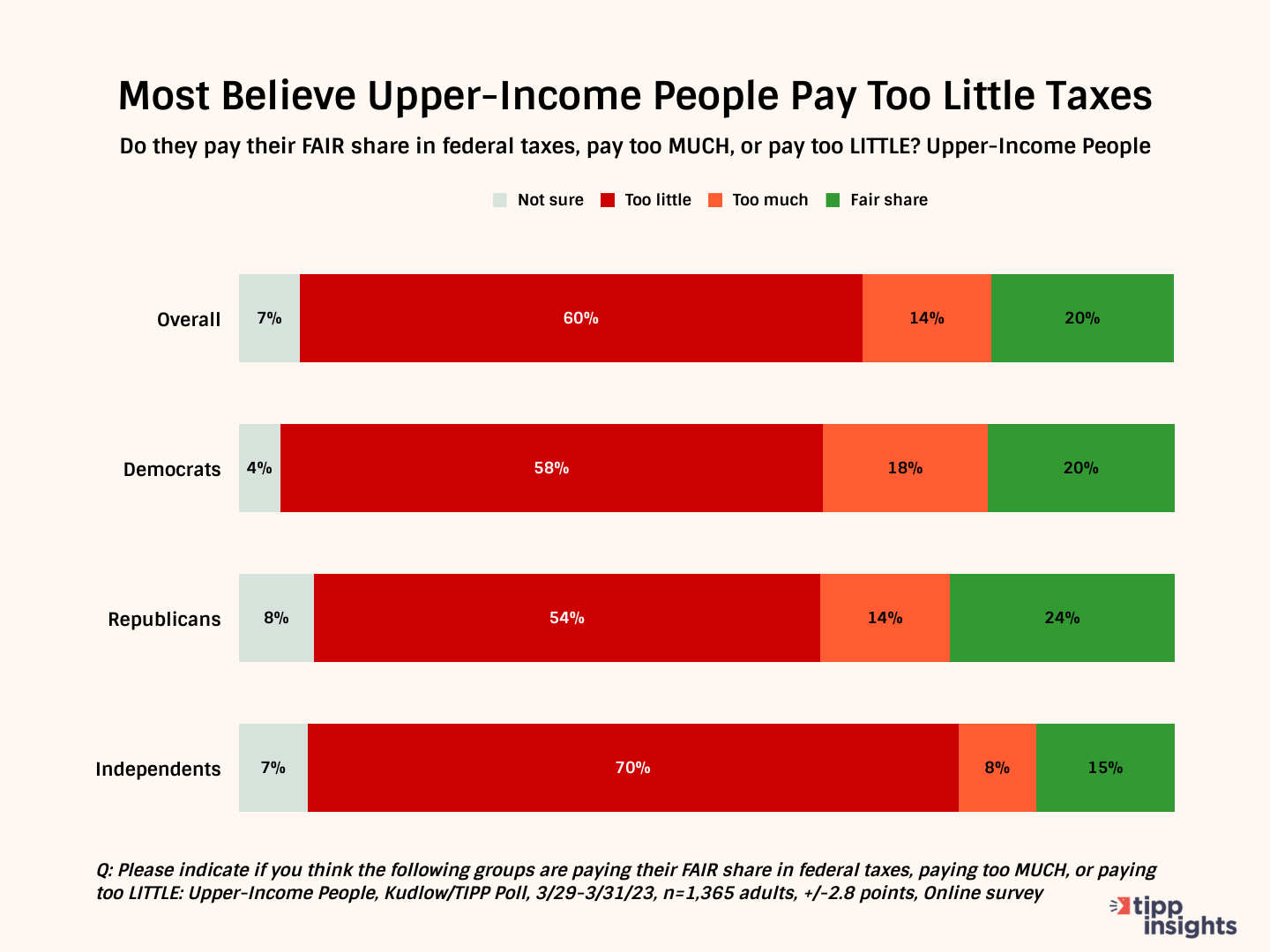

Upper-Income People

Six in ten Americans believe that upper-income individuals are not paying enough taxes; one in five (20%) think they pay their fair share, and another 14% say they are taxed too much.

Interestingly, the highest percentage of those who believe that the wealthy are not paying enough taxes are independents, with 70%, followed by Democrats at 58% and Republicans at 54%.

Meanwhile, nearly one out of four Americans, or 24%, believe the wealthy are paying their fair share.

The percentage of Americans who believe that upper-income earners pay too little in taxes increases with age. The poll found that 54% of those aged 18-24 hold this view, compared to 44% for the 25-44 bracket, 71% for the 45-64 age group, and 73% for those aged 65 and above.

The poll also reveals a gender divide regarding perceptions of upper-income earners' tax contributions. While 54% of men think that the wealthy pay too little in taxes, a significantly higher proportion of women (67%) hold this view.

The results showed that for income brackets below $75K, nearly the same proportion of people believe that upper-income earners pay too little in taxes. Specifically, 68% of those in the under $30K group, 69% of the $30K to $50K bracket, and 68% of the $50K to $75K bracket concur. However, there is a notable shift among those with incomes of $75K or more, where the percentage drops sharply to 44%.

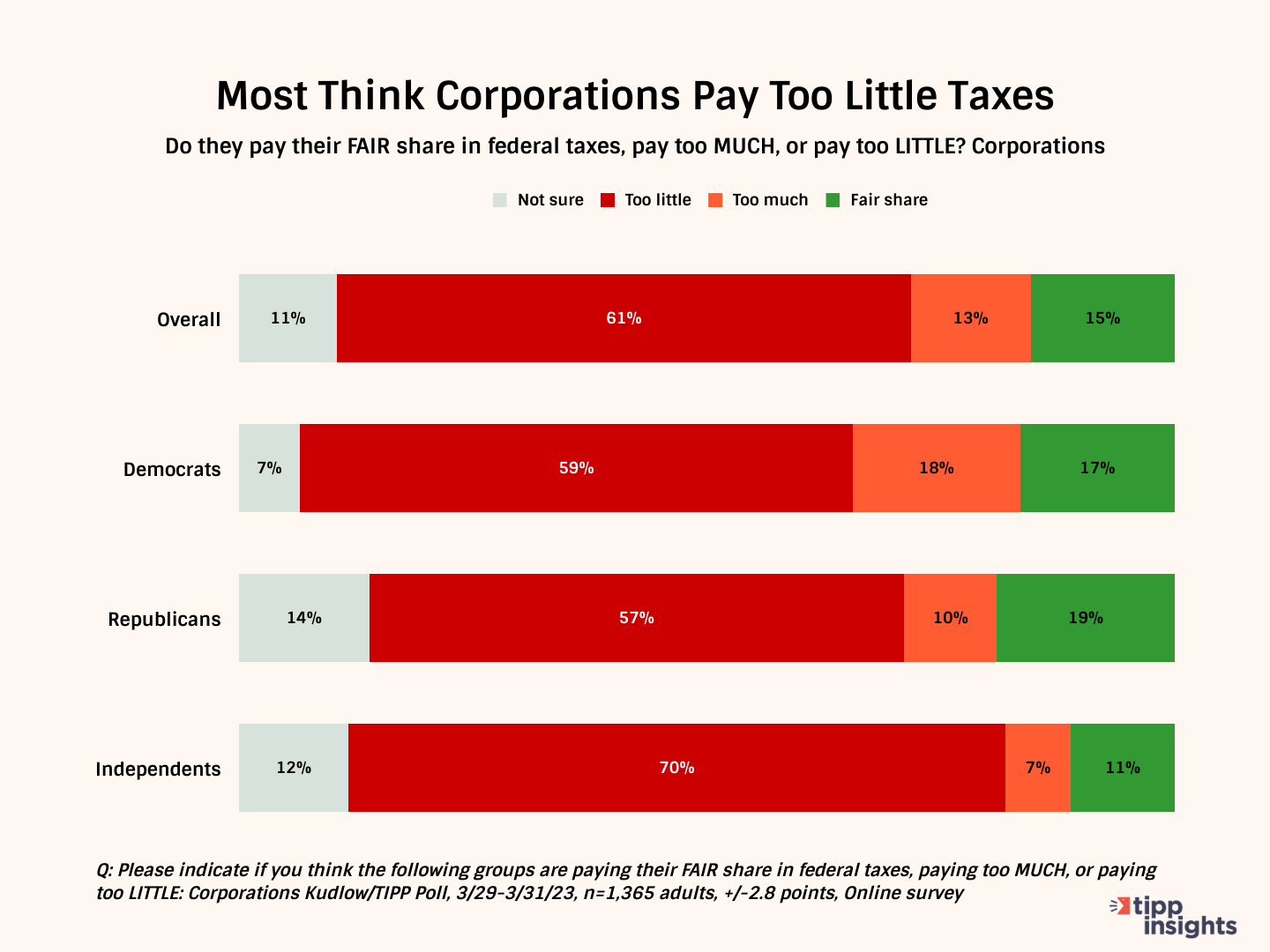

Corporations

The poll shows that the data on corporations' tax contributions has similarities to that of upper-income individuals.

Six in ten Americans, or 61%, believe that corporations pay too little in taxes, with 15% saying they pay their fair share and 13% believe they pay too much.

The poll also found that most independents (70%) think corporations pay too little, while 59% of Democrats and 57% of Republicans share this view.

Redistribution Of Wealth

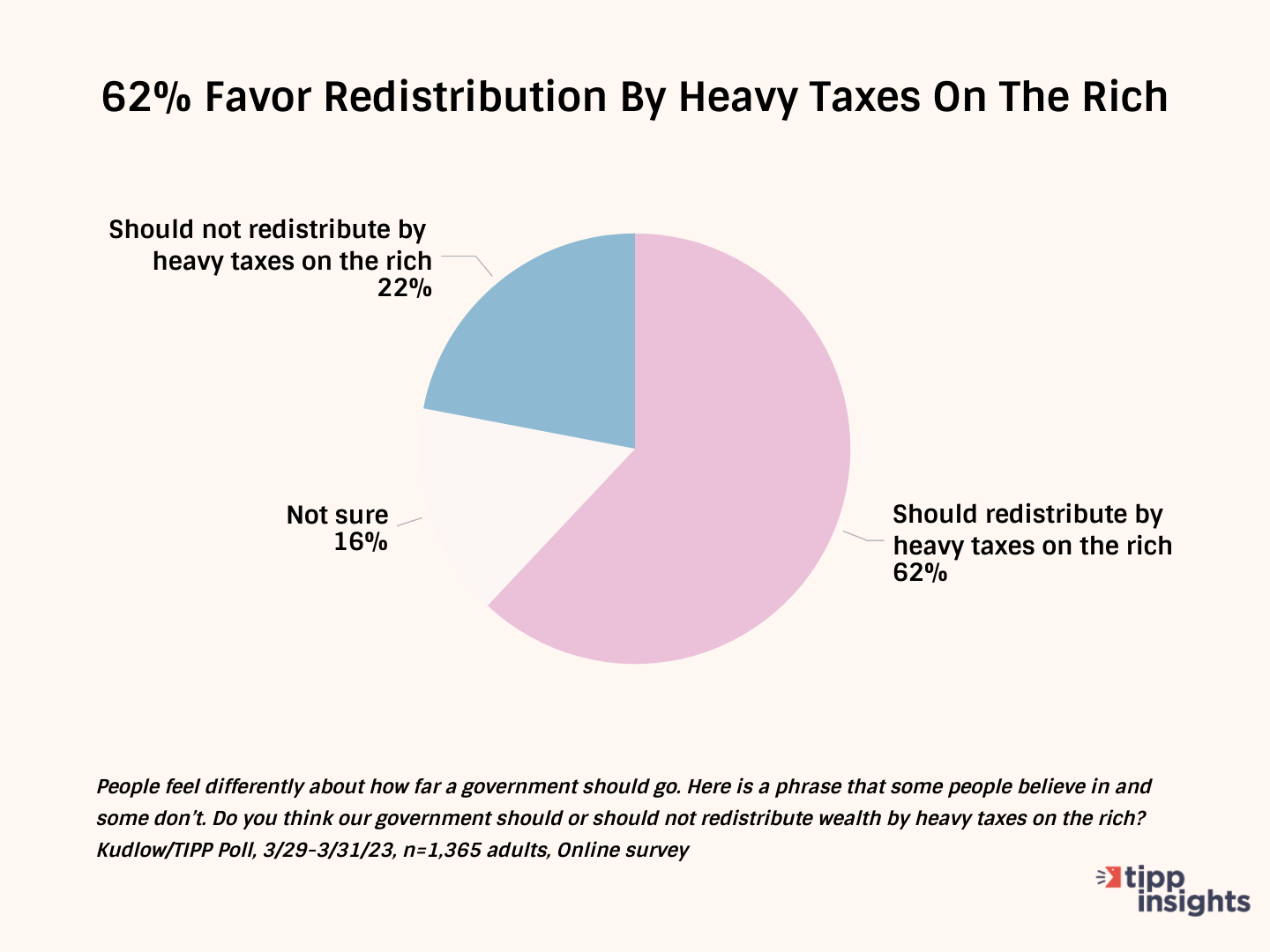

Six in ten Americans, or 62%, believe the government should redistribute wealth by heavily taxing the rich. Meanwhile, 22% think the government should not, and 16% are unsure.

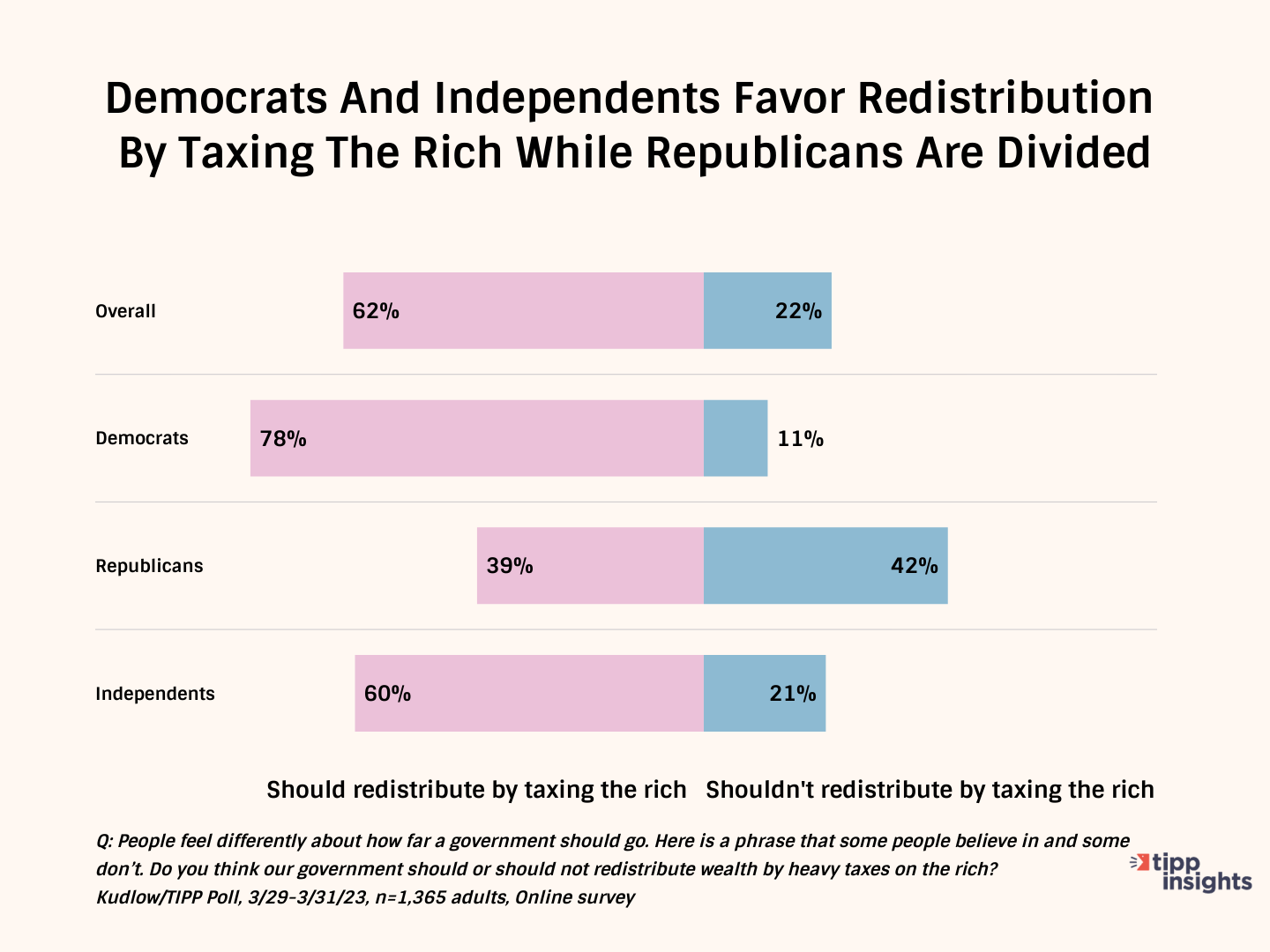

Democrats overwhelmingly support wealth redistribution, with 78% in favor and only 11% opposed. Among independents, 60% favor redistribution, while 21% are opposed. In contrast, Republicans are more divided, with 39% in favor and 42% opposed to wealth redistribution.

A Tale Of Two Tax Questions

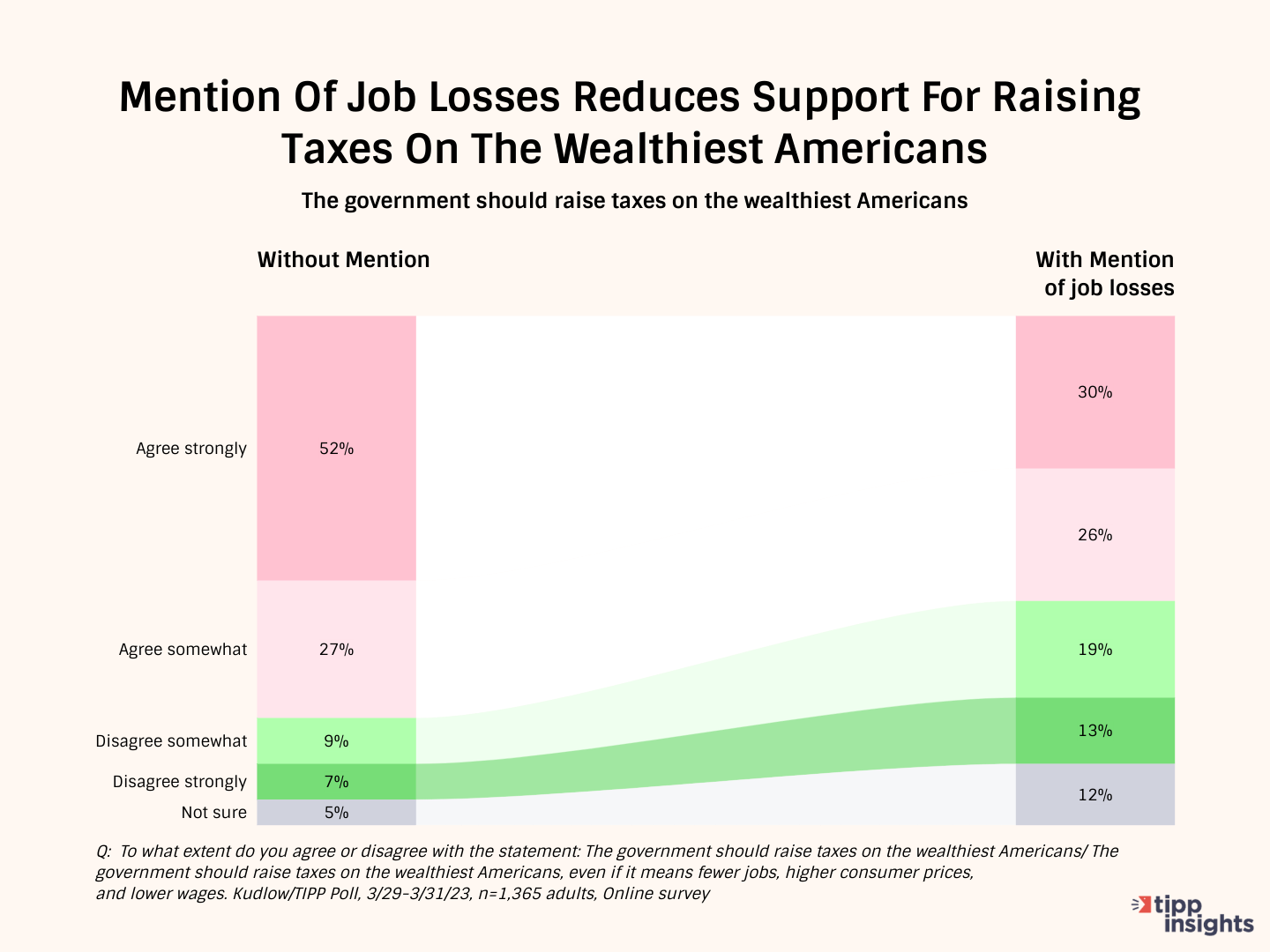

The poll asked two questions regarding support for raising taxes on the wealthiest Americans. The first question did not mention any potential impact. In contrast, the second question asked whether respondents would support raising taxes on the rich if it meant fewer jobs, higher consumer prices, and lower wages.

Nearly eight out of ten Americans, or 79%, supported the idea when no impact was mentioned in the first question. However, when the second question introduced the potential impact of job losses, higher consumer prices, and lower wages, support slumped from 79% to 56%, a whopping 23-point decline.

In the first question, 52% of respondents ‘strongly’ supported raising taxes on the wealthy, and 27% ‘somewhat’ supported it. However, in the second question, those who strongly supported it dropped to 30%, while those who somewhat supported it remained the same at 26%.

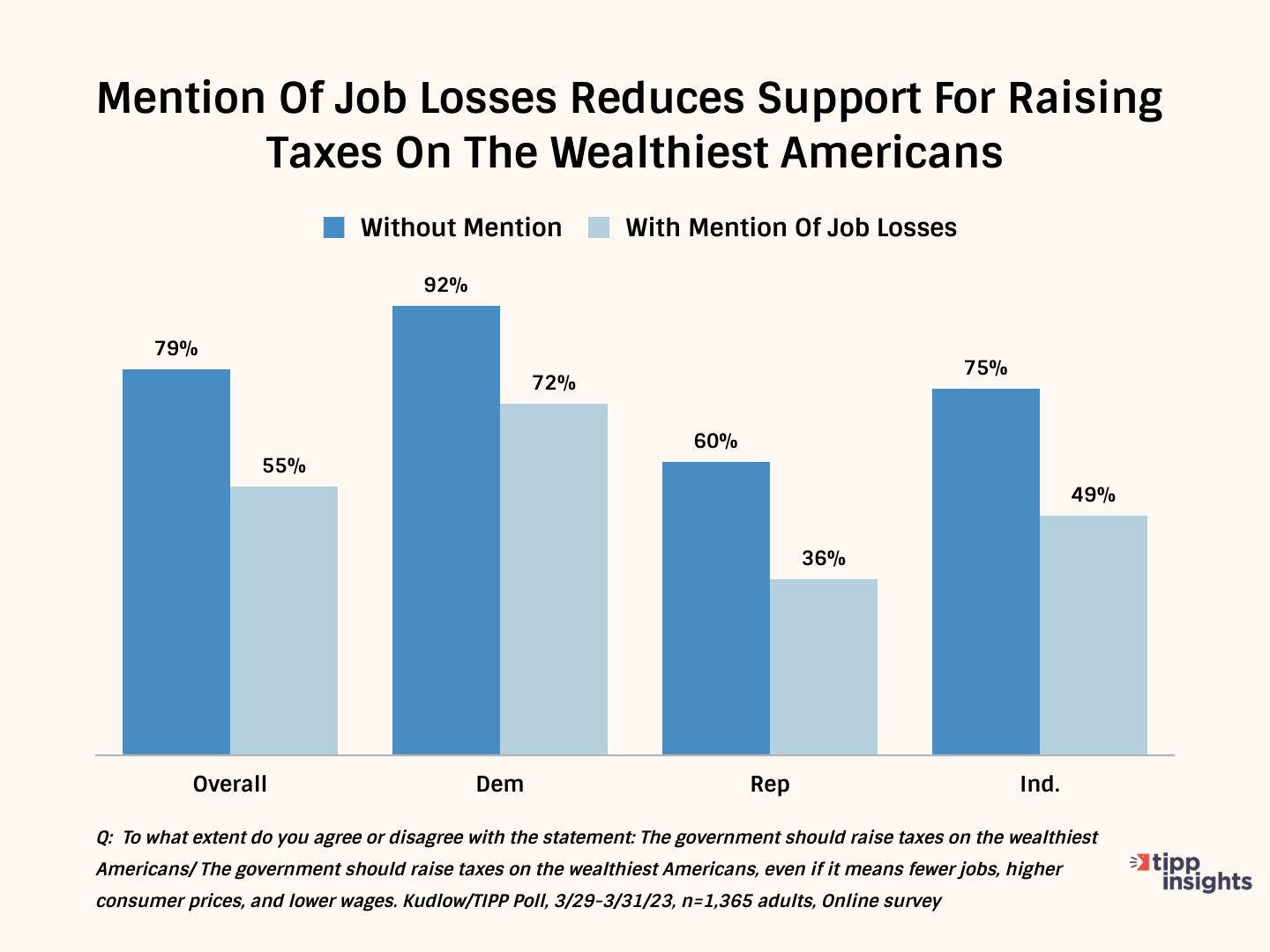

The chart below shows the decline by party affiliation.

When the potential impact was mentioned, independents showed the highest movement in dropping support of raising taxes on the wealthy. They dropped from 75% to 49%, a 26-point decline.

Republicans also saw a significant decline, dropping from 60% to 36%, a 24-point drop, while Democrats slid from 92% to 72%, a 20-point drop.

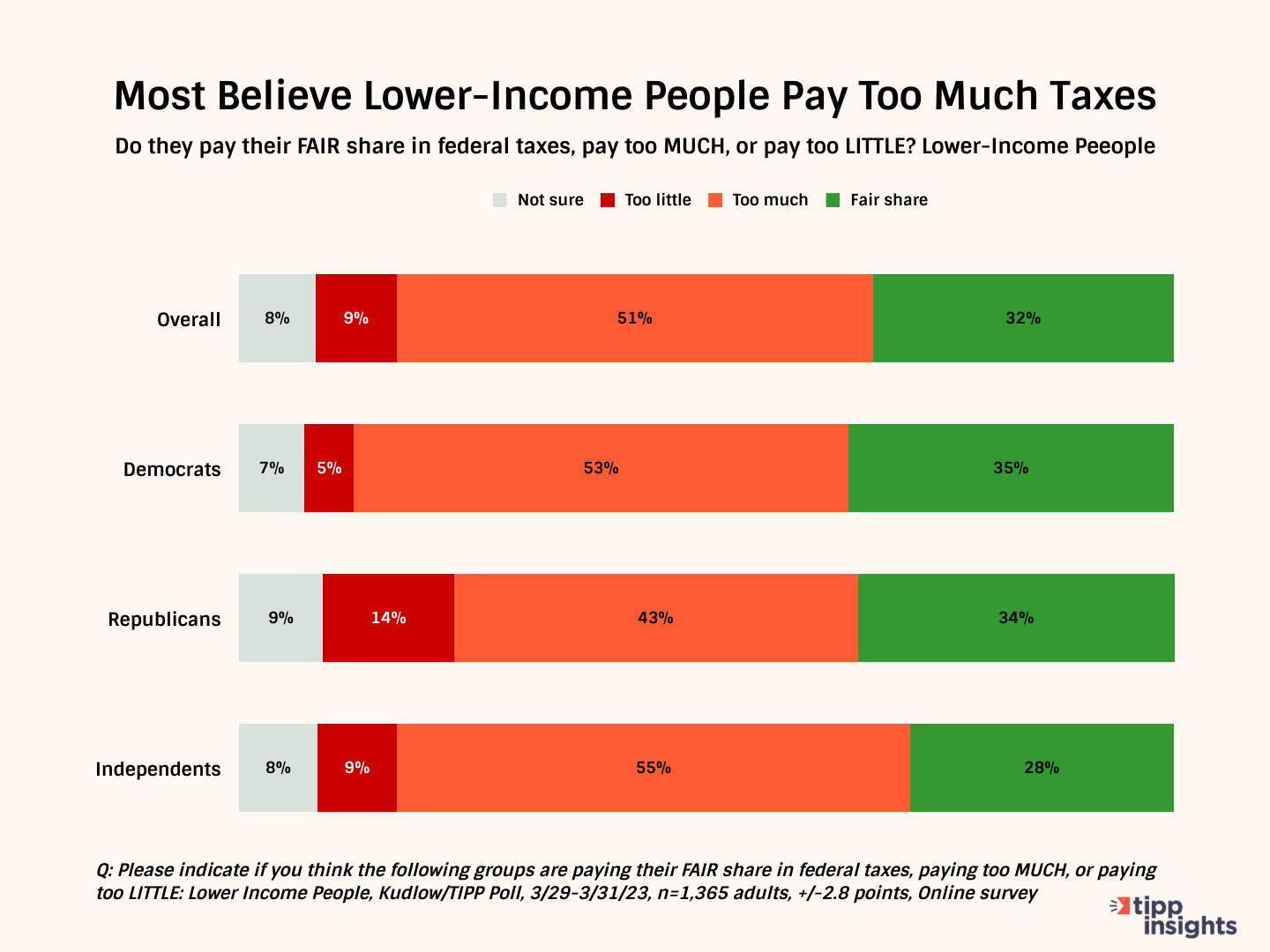

Lower-Income People

Most Americans (51%) believe that lower-income people pay too much in taxes, 32% think they pay their fair share, and 9% say they pay too little.

When analyzed by party affiliation, 53% of Democrats, 43% of Republicans, and 55% of independents believe that lower-income people pay too much taxes.

Interestingly, the percentage of individuals who believe that lower-income people pay too much in taxes decreases as income increases. The poll found that this view is held by 60% of those in the under $30K group, 52% for the $30-$50K group, 49% for the $50K-$75K bracket, and 44% for the $75K+ group.

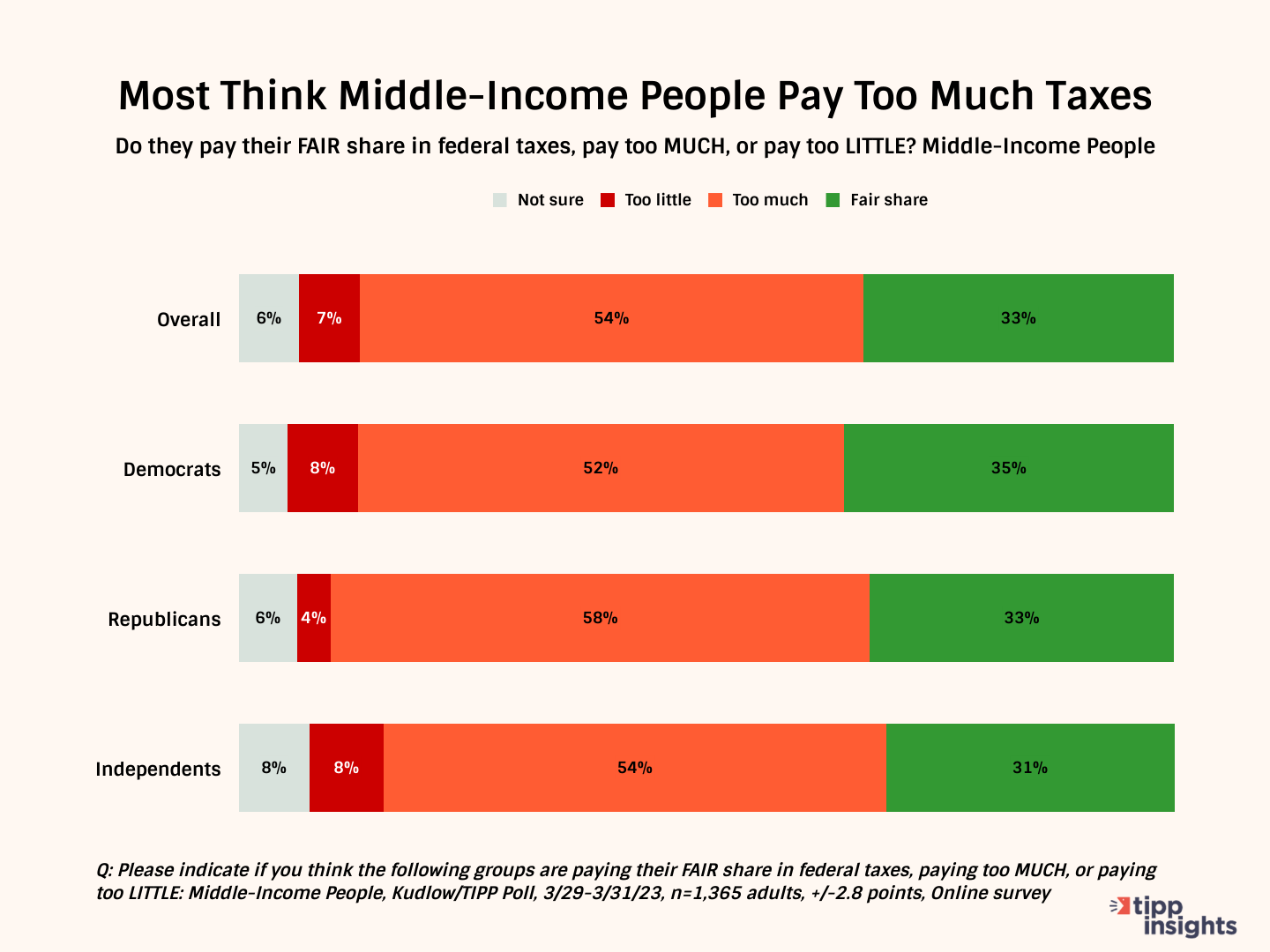

Middle-Income People

The data for middle-income individuals is similar to that of lower-income earners.

Most Americans (54%) think that middle-income people pay too much in taxes, while 33% believe they pay their fair share, and 7% say they pay too little.

By party affiliation, 52% of Democrats, 58% of Republicans, and 54% of independents think middle-income earners pay too much.

Interestingly, a similar share of respondents across different income brackets believes that middle-income earners are taxed too much. Specifically, 52% of those in the under $30K group, 53% of the $30K-$50K group, 57% of the $50K-$75K bracket, and 54% of the $75K+ group say that middle-income earners are taxed too much.

In summary, the poll suggests that there is a divide among Americans when it comes to tax policies and wealth redistribution. While most Americans believe that upper-income earners and corporations are not paying their fair share of taxes, support for increasing taxes on the wealthy decreases significantly when the potential impact of job losses and higher consumer prices is considered.

Additionally, the poll found that most Americans think lower- and middle-income earners pay too much in taxes. The data also suggests that perceptions of tax policies vary by party affiliation, with Democrats generally favoring wealth redistribution and higher taxes on the wealthy, while Republicans oppose such measures.

Hey, want to dig deeper? Download data from our store for a small fee!

Like our insights? Show your support by becoming a paid subscriber!

Want to show your appreciation? Donate